Sheep meat demand forecasts

Key points:

- Forecast global market share for Australian sheep meat exports are anticipated to increase into the next decade and outperform NZ exports.

- Global sheepmeat consumption is forecast to increase, particularly from developing nations.

- Increased demand for sheepmeat imports is anticipated from some of Australia’s key red meat importing nations over the next five years.

In our analysis piece earlier this week Angus pointed out that the recent period of high supply and firm prices point to stronger demand for Australian sheepmeat. This article takes a look at the OECD forecast for global sheepmeat consumption and demand out to 2026 to see where the opportunities exist for continued growth in demand for sheepmeat.

Read the earlier analysis here.

Read the earlier analysis here.

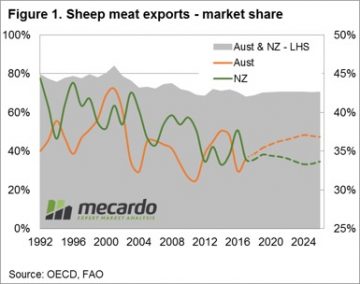

It is important to not that the OECD data provided by the United Nations Food and Agriculture Organization (FAO) includes goat as part of the global sheepmeat trade. Nevertheless, figure 1 highlights how large a share the combined New Zealand and Australian sheepmeat exports make up of total global exports, sitting reasonably stable at around 70% for much of the last decade.

The decline in the market share of NZ exports as a proportion of the total world exports since the early 1990s is reasonably evident, moving from 45% to 35% over the last three decades. Importantly, anticipated increases in production and exports in Australia over the next decade will see us wrestle a greater degree of market share away from NZ, such that by 2026 Australia will hold 36.9% of the global trade compared to New Zealand’s 33.6%.

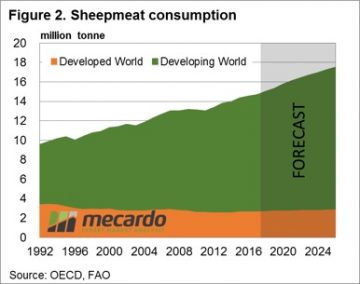

Turning to global consumption levels we can see that the majority of growth has been, and is expected to continue, coming predominantly from the developing world – figure 2. While sheepmeat consumption levels can be satisfied partially by domestic production the fact remains that for many countries their consumption will outweigh their production and the need to import sheepmeat will be required to satisfy the demand. This is important, particularly in relation to non-goat sheepmeat as the only two significant global exporters of sheep and lamb product are NZ and Australia.

Turning to global consumption levels we can see that the majority of growth has been, and is expected to continue, coming predominantly from the developing world – figure 2. While sheepmeat consumption levels can be satisfied partially by domestic production the fact remains that for many countries their consumption will outweigh their production and the need to import sheepmeat will be required to satisfy the demand. This is important, particularly in relation to non-goat sheepmeat as the only two significant global exporters of sheep and lamb product are NZ and Australia.

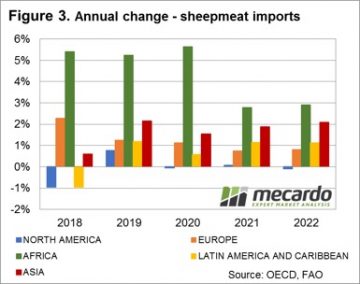

Figure 3 outlines the FAO forecast annual growth in sheepmeat imports by geographic region for the next five years and it shows significant growth in demand forecast for Africa, although from an Australian and NZ sheepmeat producer perspective this isn’t the key focus as much of this will be for goat. What is significant is the growth levels forecast for the Asian region. Although the year on year increases in growth are lower than Africa, Asia accounts for around 65% of the total global sheepmeat imports each year so the volumes going there are significant.

What does this mean?

Further analysis of the breakdown of the forecast Asian sheepmeat import flows shows that much of the growth is anticipated to come from China, Malaysia, Saudi Arabia, Indonesia, and Vietnam. These are already key export destinations for our red meat products and strong trade ties already exist between Australia and these nations.

Further analysis of the breakdown of the forecast Asian sheepmeat import flows shows that much of the growth is anticipated to come from China, Malaysia, Saudi Arabia, Indonesia, and Vietnam. These are already key export destinations for our red meat products and strong trade ties already exist between Australia and these nations.

Given the forecast decline in market share for NZ sheepmeat exports, it places Australia in the prime position to capitalise on a growing population and burgeoning middle class in these nations and points to robust demand and relatively firm sheepmeat prices for years to come.