Strong supply meets rampant demand

Cattle supply has shown no signs of slowing in recent weeks, with slaughter still running hot, but prices continued to rise. As outlined earlier in the week, supply is outstripping demand at the moment, forcing counter-seasonal price rises.

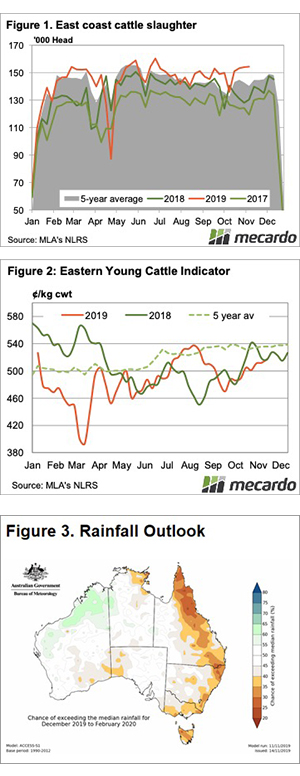

Cattle slaughter has been steadily rising over the last month, and last week hit a four month high (figure 1). It was no surprise to see NSW driving slaughter, recording its second highest week since 2015.

Despite the stronger slaughter, the market keeps on rising. Even the Eastern Young Cattle Indicator (EYCI) has been rising, without any real rain. Processors might move into the young cattle space to get beef to supply export markets. Yesterday the EYCI moved to 517¢/kg cwt, the highest level since August.

The headline cattle indicator this week was the Medium Cow, which on the east coast made a 3 year high of 251¢/kg lwt. A very tidy 23.5% increase on the same time last year.

It was export beef prices driving cattle prices again this week. A further 21¢ rise in the 90CL took it to 840¢/kg cwt. It’s not just lean trim which has found some strength. The 75CL price has gained 28% on the same time last year. In the coming week, we’ll see if we can find some prices for higher value beef cuts.

In the West young cattle are priced better, with the WYCI at 547¢/kg cwt, but cows are well behind at 197¢/kg lwt. Supply is usually good at this time of year, but when it tightens cow values in the west should at least match those in the east.

Next week.

There is no rain on the short term forecast, and a largely dry outlook for the summer (figure 3), so further price rises are dependent on processor and feeder demand. This week’s processor margin article showed there is still some room for cattle prices to move higher, but while supply continues to flow upside will be limited.