Supply low, AUD strong & market positive

While the Wednesday opening to the market was positive, Thursday saw a retracement to produce an overall cheaper market.

The AUD was strong, hurting buyers buying capacity, while a concerning report was that there was insufficient supply of good yielding wool to fill orders. The flip side to this was that the large offering of low yielding wool weighed on the market with buyers struggling to fit it into orders.

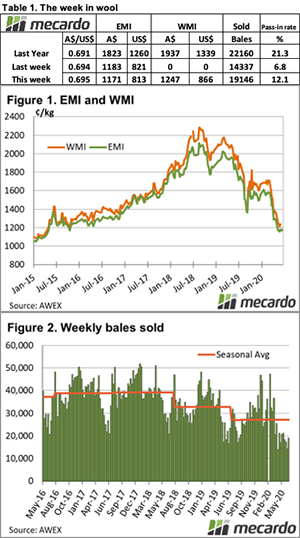

The Eastern Market Indicator (EMI) gave back 12¢ this week to close at 1,171¢. The Australian dollar was quite strong hovering around US$0.70, with the EMI in USD terms falling by 8¢ to 813¢. With Fremantle back selling this week, the Western Market Indicator played a bit of “catch-up” finding an 8 cent lift to settle at 1,247¢.

Turnover increased to $25.02 million this week with all centres involved, however, the average bale value of $1,150 was $200 per bale back on last week, taking the season to date value to $1,922 million.

The softer market influenced a lift in the pass-in rate to 12.1% nationally, 5.4% higher than last week’s level. This resulted in 19,146 bales clearing, almost 5,000 more than last week.

This week on Mecardo, Andrew Woods looked at the sheep flock and noted “The Australian sheep flock has moved into an expansionary phase, based on early 2020 rainfall.” Of course, any continued expansion from here (and consequently changes on the sheep flock) will depend on winter/spring rainfall in the key sheep regions.

While Fremantle played catchup on last week’s sales, overall the market was cheaper, ending its two-week positive run. The Crossbred sector was the shining light rising against the general trend and supporting the EMI to some degree.

Cardings continued to improve also and posted on average a 14¢ lift average across the all centres.

The week ahead

Next week’s national offering declines to just 16,800 bales with Fremantle not offering. Sydney & Melbourne will sell on Tuesday & Wednesday only.