Surety in sorghum?

When it rains, it pours. It’s been a dry year, and to end the month the east coast has received a deluge, with many areas receiving more rainfall over the past week, than they had received for the entire year. What does this mean for sorghum?

The rainfall in Queensland and Northern New South Wales was welcomed by summer croppers, with reports of 100-300mm. This rainfall will provide surety to the sorghum crop, as there should now be sufficient moisture to get the crop through to harvest.

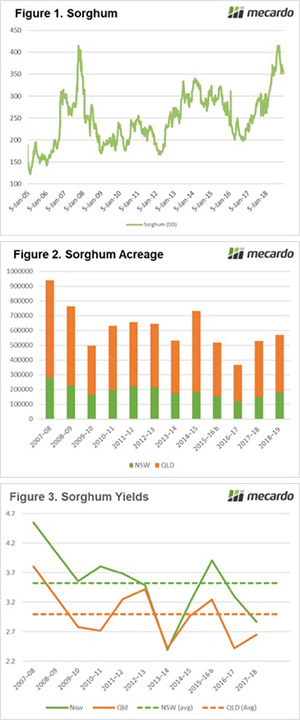

The Sorghum price has been very strong in recent months due to a combination of drought and record numbers of cattle on feed. The peak of the year was reached in September, however has fallen 15% since this time (Figure 1). This peak was at similar levels to the previous record held in the drought year of 2007/08. Nonetheless, even with the sharp fall in pricing levels, Sorghum is still priced well above average.

The question now remains, what size will this crop be? The crop production is made up of two factors; acreage & yield.

The December ABARES report forecast the total sorghum crop acreage at 570kmt, shy of the decade average of 615kmt (Figure 2). However, these forecasts were produced before the December rains, and there is still ample time for producers to seed recently moistened paddocks. I would expect acreage to increase in following updates to levels above average.

The bumper sorghum crop in 2007/08 was due to a combination of both yield (figure 3) and acreage. This resulted in a sorghum crop of 3.7mmt. At present we would like to consider that yields will be at or above average for the coming crop due to the recent deluge. This would place the crop at approximately 1.8mmt, based on the ABARES most recent acreage forecasts. However, with acreage likely to be increased above their forecasts, a 2mmt (or above) production year is not unfeasible.

What does it mean/next week?:

The ABARES forecasts are likely to be ratcheted up as both yield and acreage projections are revised.

The bigger the sorghum crop becomes, the larger the impact will be on pricing of both Sorghum and other feed crops. This will be a relief for grain consumers up and down the east coast as the flow on effect reduces input prices.

However, with record cattle on feed and a poor northern winter crop the pricing scenarios are still expected to attractive for producers.

As always it is a good idea to consider selling in small chunks, especially as production becomes more assured. This will help average up pricing if the market does fall.

Key Points

- The recent rainfall in NNSW and QLD will provide an element of surety to the sorghum crop.

- The sorghum market has fallen 15% since its peak in September, however remains at historically attractive levels (for producers).

- The acreage & yield for sorghum will increase due to positive moisture levels.