The bears are out for barley

It’s been a tough month for grain producers both locally and globally, with prices falling dramatically. In this weeks update, we take a look at the December futures contract, basis and potential issues with barley into China.

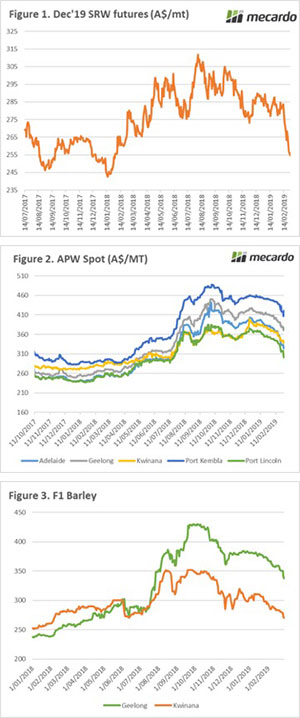

The futures market has another tough week, with spot futures falling 6% since last Friday to end the month down 13%. In A$ terms wheat futures have retreated A$30/mt. The December wheat contract which coincides with our harvest has fallen to A$254 (figure 1), the lowest since early February last year.

The futures market has another tough week, with spot futures falling 6% since last Friday to end the month down 13%. In A$ terms wheat futures have retreated A$30/mt. The December wheat contract which coincides with our harvest has fallen to A$254 (figure 1), the lowest since early February last year.

The highest price since the contract commenced was achieved in August at A$311, this would have provided a strong base for marketing the coming crop, with basis yet to be added to your overall price. The current market structure is starting to provide improved opportunities for consumers to hedge their requirements for the coming year.

At present basis is largely unchanged since the start of the month, which has meant that most port prices have followed the futures fall by A$30. The exception seems to be in South Australia, with basis falling A$24 in Adelaide and A$19 in Port Lincoln. This has resulted in price falls across the board (figure 2), obviously exacerbated in South Australia due to substantial difference in basis.

The barley market is in a precarious situation at present, with prices falling (figure 3) due to risk concerns related to China. It is likely that the conclusion of the anti-competitive dumping investigation will be released imminently.

Through conversations with a number of industry contacts, the general consensus is that it will be negative towards Australia. The expectations are that a deposit of 55-60% of the value of any vessel importing barley ex Australia into China. The Chinese government will review the import and then return the deposit, provided there are no issues.

At present this is merely rumors and the result could feasibly go the other way, however at present the risk in selling barley into China is high, which limits the appetite of exporters.

As a side note, it was reported that China has bought eight cargoes of barley ex Ukraine in the past week. Is this a portent of things to come, with them buying barley ahead of an announcement?

What does it mean/next week?:

The wheat market has fallen substantially in the past month, will we see short speculator start to profit take? The commitment of traders report is only just starting to get back up to date and it will be interesting to see how far short the market is.

China is going to be the big story over the next few days, not just for Australia but also the long-awaited results of discussions re US trade tariffs.