The big changes in wool supply continue

Low supply remains a key issue in the greasy wool market, with the uncertainty of projected production for 2019 easily leading to various views on what is likely to happen. For the supply chain this uncertainty is magnified by language and cultural differences. This article takes a look at the latest AWTA core test volumes for February.

To illustrate the uncertainty of greasy wool production, search the internet for good merino wool supply data for Russia, China and South America. You will be hard put to find up to date historical production data, let alone reliable production projections. In Australia our historical production data is excellent (https://www.awtawooltesting.com.au/index.php/en/statistics/awta-analytics ) and while production projections are better than in other parts of the world there is plenty of room for improvement.

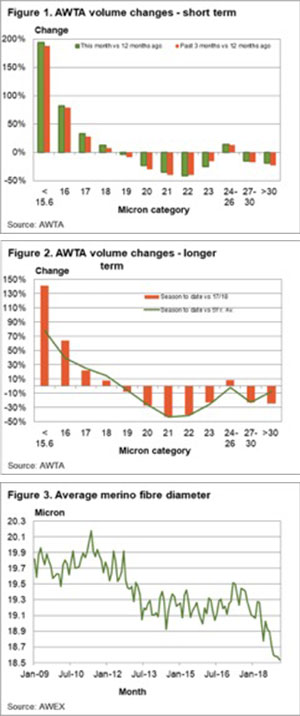

In Figure 1 the year on year change in volume for the past month and past three months by micron category for AWTA core test volumes (farm bales) is shown. The changes are in line with those seen since the early spring; more fine merino wool and less broad merino wool, with similar changes in the crossbred categories.

Figure 2 repeats the analysis of Figure 1 but for longer time frames. The season to date volumes for a range of micron categories is compared to the previous season and for the average of the past five seasons (all data used is July to February). The fall in broad merino volumes shown in Figure 2 is looking like it is becoming a structural change with 21 micron volumes down by 40% on the 2017-18 season and also compared to the five season average.

To summarise these changes in supply Figure 3 shows the average merino fiber diameter sold at auction for the past decade. The fiber diameter stepped down in 2012-2013 then stabilised through to 2017 roughly in the range of 19.1-19.3 micron before stepping down again in the past year. The average merino fiber diameter in February was a low 18.5 micron.

Now back to the wool supply chain. Put yourself in charge of mills which use various micron categories of wool, especially the 20-22 micron categories. What do you plan for in terms of purchases in the coming 6-12 months? Do you punt that supply will partially recover or do you assume broad merino volumes will remain at low levels? This is why uncertainty about production in 2019 is unsettling.

Key points:

- While February AWTA volumes were “only” down by 6% the trends evident since the spring continued.

- 20-23 micron volumes continue to be well below earlier period volumes.

- The average merino fibre diameter reached a low of 18.5 micron in February.

- The supply chain faces some difficult decisions in the coming year with regards to broader merino supplies.

What does this mean?

AWTA data shows a continuation of trends seen since the early spring. In many seasons volumes vary by relatively small amounts, but 2018-2019 is a season when there has been a big shift in production which will require the supply chain to think hard about supply in the coming year and seasons. The drop in the average merino fibre diameter is a good illustration of the marked change in production.