The curious case of rising slaughter and prices.

Regular readers will no doubt be aware that we like to base our analysis in basic economic theory. Supply, demand, price, that sort of thing. It also piques the interest when a market behaves in a way contrary to the normal rules, and we’ve seen a bit of that this week.

Rain in South East South Australia and Victoria has seen lamb and sheep markets rally this week on the east coast. So we went looking for the ‘smoking gun’, which is usually declining supply. But we couldn’t find it.

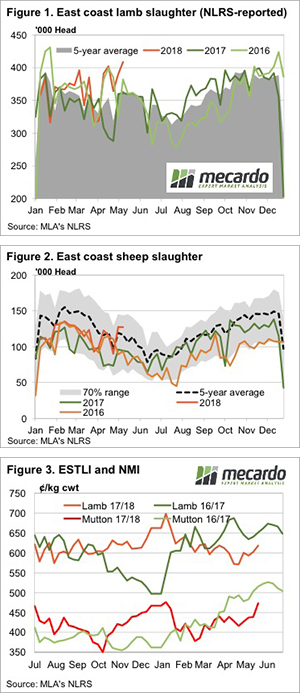

Admittedly we were frustrated by the week old yarding data, so we turned to slaughter. Also a week old but usually less volatile. Wheat we found was that rather than seeing a declining trend in lamb and sheep slaughter, we found lamb slaughter parked at an all-time high for May. In fact, there have only been 3 weeks in history when lamb slaughter has been higher, all of them in 2006 (figure 1).

So it must be sheep which are in tight supply, opening up space for more lambs. Where is that sheep with the smoking gun? Nowhere to be found. While sheep slaughter (figure 2) is within the historical range, it was 35% higher than 2016 and 2017 last week, and the week before.

It was demand. Despite producing very large amounts of sheepmeat, demand continues to push prices higher especially for mutton (figure 3), which is nearing a 12 month high in Victoria and NSW.

The week ahead

There is no real rain on the 8 day forecast, so we might expect the flow of sheep and lambs out of NSW to continue. At least they are getting good prices for them. Well finished lamb supply is likely to wane, however, which might help push the ESTLI back toward the highs of last year. If it does ever rain it’s going to be interesting. It might be a case of the irresistible force (demand) meeting the immovable object (growers trying to maintain flocks).