To feed or not to feed

That is the question – A look at gross margins on a lamb feedlot trade.

As a specialist livestock funder, we are fortunate to work closely with our clients to understand the fundamentals of what drives weight gain performance. Taking it a step further, the data on performance we capture helps us and our clients make timely and strategic decisions.

We have seen a significant shift toward lamb feedlotting. The investment of time, education and technology in this space has evolved from a drought management mechanism, to first class outfits delivering on-spec product with confidence.

The attached article from TEM talks to the performance of lamb feedlotting over time, with a retrospective outlook. As a precursor to the article, we’ve provided the following observations from our Regional Livestock Managers who are on the ground, working closely with their customers.

- Be across your ration and what’s in it. Margins can be skinny therefore mortalities due to a ration which is too hot can quickly eat into profits. Get the right nutritional advice.

- Consider the use of pellets. More and more pellet manufacturers are entering the market. They often include necessary buffers and reduce risk of mortalities through acidosis.

- Weigh consistently and pen lambs accordingly. Shy feeders can go downhill quickly if they are not getting an opportunity to feed and being bullied out by heavier lambs.

- StockCo trends being observed – Store lambs are being purchased at heavier weights (approx. 40kg), with the view of getting them onto a ration faster and turning the trade around within 60-80 days. Some mixed farming operations are achieving 2 or 3 trades over the Spring and Summer months using this method, running lambs on post-hay paddocks and post-harvest stubbles before finishing on farm in containment pens.

Author- Matt Dalgleish, Thomas Elder Markets

The Snapshot

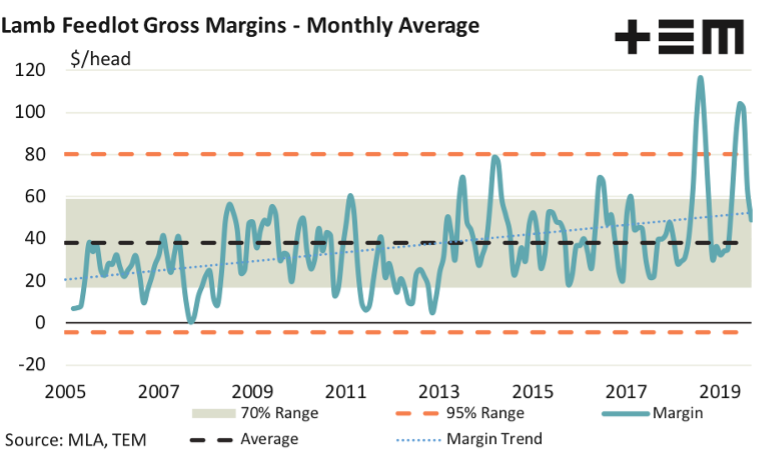

- Since 2005 the long-term average gross margin has been a $38 profit per head of lambs in the feedlot.

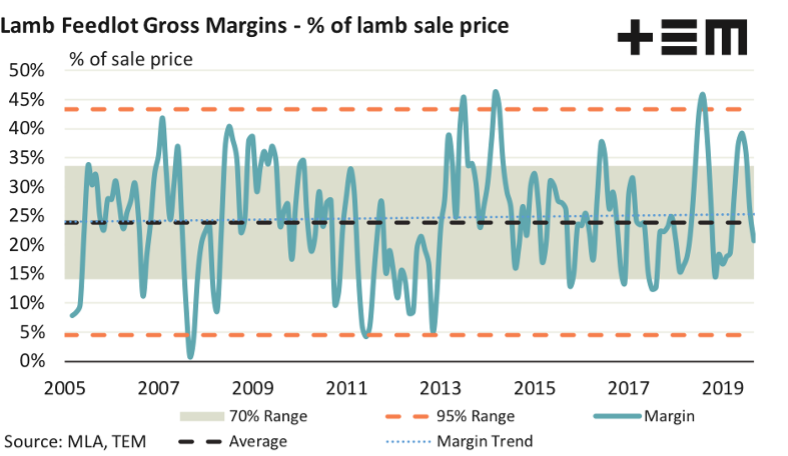

- Bearing in mind that since 2005 the lamb price has tripled it is probably a more accurate to measure the lamb feedlot margin in percentage terms relative to the prevailing lamb price.

- As the percentage margin trend identifies this has not changed much over the last fifteen years, sitting at about 24% of the lamb sale price.

- Margins below a 4% gain or above a 43% profit would be considered extreme, based on the historic variation in the percentage margin.

The Detail

There is growing interest in the idea of feedlot feeding for lamb fattening, not just to accommodate times when pasture is tight during drought, but as an ongoing dedicated feed regime as we see in cattle feedlot systems.

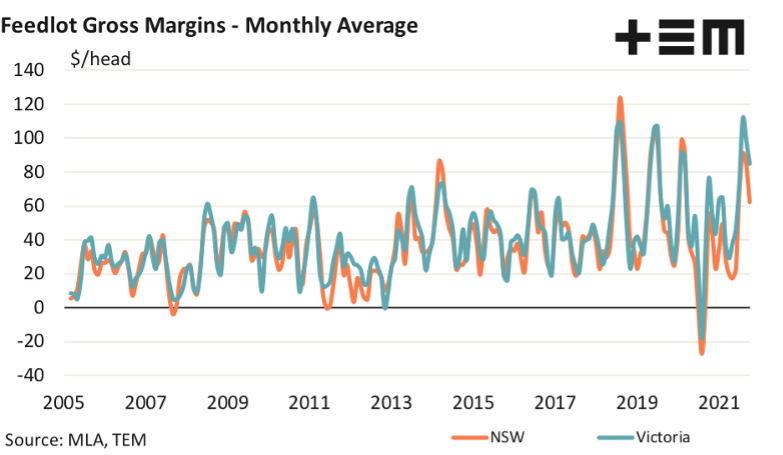

Victoria and NSW are the nation’s largest lamb rearing states, so two gross margin models were created for each state to assess the monthly margin achievable, based on average monthly feed and lamb pricing opportunities in each region. Given that lamb and feed grain markets in each region often follow closely there are subtle differences between gross margins in NSW and Victoria, but the general trend shows both margins are usually within $5-$10 of each other.

The following trade scenario was established for each state:

- Buy 40 kg liveweight feeder lamb based on average monthly price levels in each state

- Feed for two months assuming a ration of 75% barley, 15% oats and 10% roughage with respective pricing relevant to each region. It is understood that oats are being replaced with lupins/beans, unfortunately there is limited historic price series data for this feed input, so the ration has retained oats.

- 75 kg of feed purchased per lamb at the time the feeder lambs are purchased, locking in the feed cost.

- 25 kg consumed by lambs on average per day with a daily weight gain estimate of 330 grams (feed conversion ratio of 3.75 to 1). A two-week ration induction phase is included in the feed regime, however total feed consumed/weight gain is averaged over the time the lamb spends in the feedlot.

- Lambs to be sold at 60kg liveweight, after a 20 kg weight gain, at the prevailing average monthly heavy lamb price in each state

Combining the gross margin of both NSW and Victoria we can analyse the average feedlot margin achievable within the south eastern mainland of Australia. Since 2005 the long-term average gross margin has been a $38 profit per head of lamb in the feedlot, with a normal fluctuation between $17 to $59 as demonstrated by the 70% range boundary. The historic trend in the gross margin shows that movements under a loss of $4 per head or above a profit of $80 per head would be considered extreme.

Bearing in mind that since 2005 the lamb price has tripled it is probably a more accurate to express the lamb feedlot margin in percentage terms relative to the prevailing lamb price. This way we can see if margins have increased over the last decade and a half or if the higher margins achieved since 2013 are proportional to the increase in the lamb price. As we can see by the margin trend the gross margin has increased by around $25 profit in 2005 to $55 by 2021.

Gross margins as a percentage of the lamb sale price highlights that long term average margins sit at 24% of the lamb sale price. As the percentage margin trend identifies this has not changed much over the last fifteen years. In percentage terms margins have usually fluctuated between 14% to 34%, as highlighted by the 70% range boundary. Margins below a 4% gain or above a 43% profit would be considered extreme, based on the historic variation in the percentage margin.

Gross Margin Seasonality

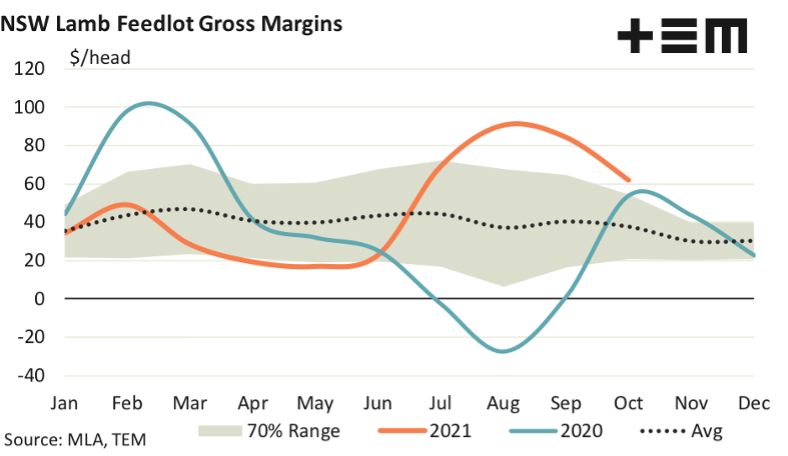

A seasonal perspective of the NSW lamb feedlot trade shows that the margin tends to fluctuate between a $10 to $70 gross margin profit throughout the season with the margin tending to narrow towards the last quarter of the season.

The NSW average seasonal margin shows an increased level of stability during the first half of the year and higher potential volatility toward the end of winter. Often the northern hemisphere grain markets see turbulence during the middle of the year as the northern hemisphere harvest draws closer. The higher global price volatility in grain prices can have an impact on Australia feed grain prices at this time leading to uncharacteristically higher or lower gross margins on the NSW lamb feedlot trade.

The 2020 and 2021 trend has demonstrated the potential for volatility in NSW margins in August with 2020 registering a loss in excess of $25 per head. As a direct result of COVID19, the heavy lamb price took a hit at this time due to lower export demand and a capacity issue in Victorian abattoirs sweeping through to the northern markets. Meanwhile August 2021 has recorded a $90 gross margin profit. October 2021 saw the NSW lamb feedlot margin achieve $62 profit per head, nearly 70% higher than the average October margin of $37 per head, according to the ten-year average trend for October.

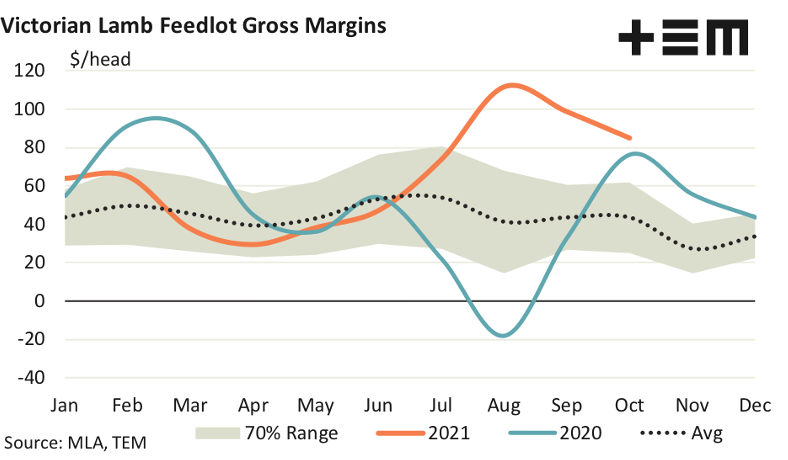

The seasonal pattern for the Victorian lamb feedlot trade shows a higher degree of variation throughout the year, compared to the NSW pattern with fluctuations between $15 to $80 profit per head. As was the case in NSW, the Victorian experience is also for higher margin volatility during late winter with a similar wide disparity in margins seen during August 2020 and 2021. August 2021 saw Victorian gross margins extending over $110 per head profit, meanwhile the 2020 August period saw losses nearing $18 per head, again drawing reference to the impacts of COVID19 mentioned above.

Margins in Victoria have eased since the August 2021 peak to see a gross margin of $85 profit recorded for October. Despite this recent decline the current Victorian margin sits at levels that are nearly double the October ten-year average of $43 per head gross margin profit.