Volatility and uncertainty but supply remains the driver.

Easter usually leads to plenty of variation in saleyard indicators. With some sales not running due to the break and processors closing for some extra days, it is hard to get a handle on pricing. This week we saw some falls for slaughter cattle, but feeders found some support.

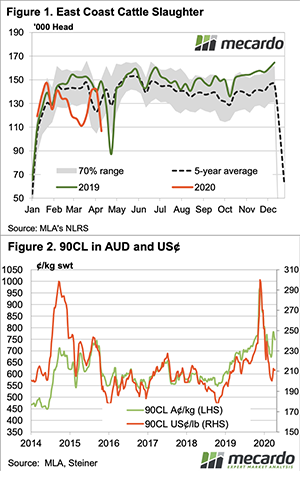

Figure 1 shows cattle slaughter took a dive last week and is likely to have spent this week at similar levels. Cattle slaughter is not as low as Easter last year but did see its lowest week for 2020. It is probably not bad timing for processors, who are likely still seeing some pretty significant demand swings.

This week the improving Aussie dollar saw export prices in our terms weaken. The 90CL Frozen Cow Indicator was steady in US terms, but 16¢ lower in our terms at 748¢/kg swt. Figure 2 shows the 90CL is still well above the lows hit back in March and apart from the spike late last year, it has never been better.

There are positive signs for export beef demand from the US. According to The Steiner Consulting Group, cattle slaughter in the US has fallen heavily with a COVID-19 outbreak at two plants putting production on hold. Closures are expected to be short term, but they will put pressure on beef supplies while seeing cattle prices fall.

Locally, feeder cattle prices rallied this week, with the National Indicator up 12¢ to 368¢/kg lwt. Tight supply remains the driver of the store cattle market.

Heavy Steers and Cows were down, according to National Indicators, but this might have been due to intermittent sales. We will know more next week.

Next Week

There are plenty of reasons for cattle prices to fall, with shifting demand, a volatile currency and rising wheat prices all applying pressure. However, the main driver, for the time being, remains supply, which is unlikely to improve until the spring.