WASDE the matter now?

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

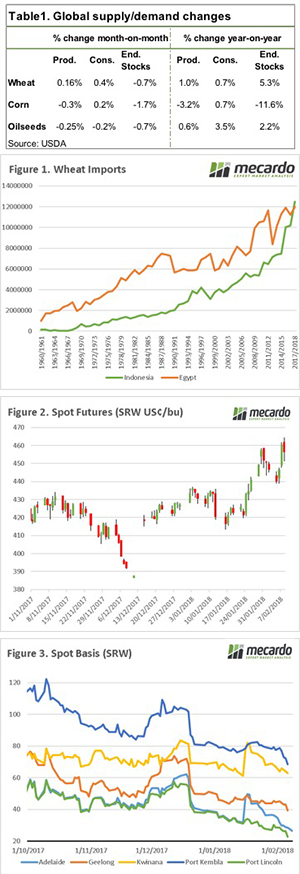

The WASDE report was released overnight. The report was largely bereft of much in the way of surprises, with tinkering around the edges. The summary of the report is provided in table 1. On a month on month basis, the end stocks for wheat, corn and oilseeds were all reduced. This has to be tempered by the fact that season on season, end stocks are still strongly up, with the exception of corn.

An interesting piece of data in the report, was the imports of wheat. Egypt has traditionally been the largest importer of wheat; this year Indonesia is expected to take the crown. As we can see in figure 1, there has been a rapid increase in imports in the past five years. Increased Indonesian imports are of benefit to Australian farmers, as we have a geographic advantage into this destination. The question remains on whether imports have been higher due to low pricing, or whether this will continue to be a long-term trend when prices rise.

The futures market overnight took a tumble (figure 2), nonetheless futures when converted into A$ remain $15 higher than the same time last week. At a local level the full benefit of the futures rally has not been passed onto local growers, with basis levels (figure 3) falling between $5 and $11 dependent upon zone.

One thing to keep in mind is that although basis levels have fallen since harvest, they have fallen from close to record levels. In our articles prior to harvest, we recommended selling basis, as it was very top heavy.

I recommend re-reading the article ‘3 elements that need to be considered when selling grain’, this will gives some indication on how we can improve our risk management strategies.

What does it mean/next week?:

The A$ is currently falling, which if it continues this trend will add additional value to export pricing, and make it more attractive to buy in Australia.

The key focus will be on the US weather, with drought seemingly spreading further their productive potential will be constrained, if no rain is received in the next six weeks.