What in the ag markets changed 254.7% overnight?

Recently there have been releases from both the US Department of Agriculture (USDA) and the National Statistics Bureau (China). There were some very, very big changes to headline numbers.

I have rightly or wrongly always been dubious of supply and demand numbers originating from China. The data reporting does not appear to be as rigorous as other nations and it can be very difficult to obtain a strong handle on what is happening on the ground.

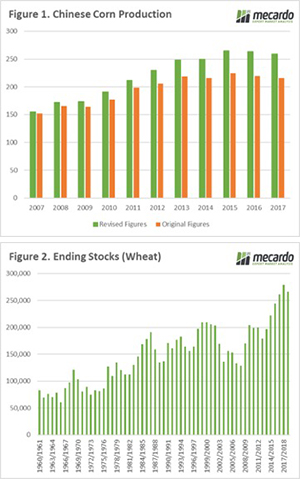

The National Statistics Bureau has revised Chinese corn production from 2007 to 2017 based on census data. This has resulted in large amendments, with production over the period increased by 259mmt (Figure 1). To put this in perspective, China has found 23.6mmt on average over the past decade. Coincidentally, this is the average Australian wheat production for the same period.

The USDA released their November World Agricultural Supply and Demand Estimates (WASDE) overnight. The USDA reflected the change and increased Chinese corn ending stocks by 254.7% between the October and November update. The overall global picture for corn stocks is 307mmt, versus 159mmt one month ago.

If these numbers are truly reflective, then this will reduce China’s need to import corn during this season, or at least until the mandated 10% ethanol in fuel regulation is implemented.

Wheat was also given the bearish treatment, with global end stocks increased by 6.5mmt. This would place world ending stocks at the second highest on record (Figure 2). As ever, we must be cognizant of the fact that 53% of world stocks are held in China and are unlikely to be available to the world market.

The Australian crop was reduced from 18.5mmt to 17.5mmt, which remains above trade estimates. There tends to be a two-month delay in the USDA expressing a change in Australian wheat production from what is happening on the ground. In the December update, it would be unsurprising to see a further reduction to 16.3-16.8mmt. However, this will already be taken into account by the market.

What does it mean/next week?:

As harvest rolls will we get more surprises or will harvest selling pressure bring some downside to pricing?

There is some light rainfall expected for most of the east coast in the next 8 days, which will be positive for the sorghum crop.