Wheat and Bitcoin.

The markets have been very quiet over the past week, with little in the way of new information to get the trade excited. Usually in our Friday comments, we would take a look at the past week. This week, I thought I would take a quick review of the past two years.

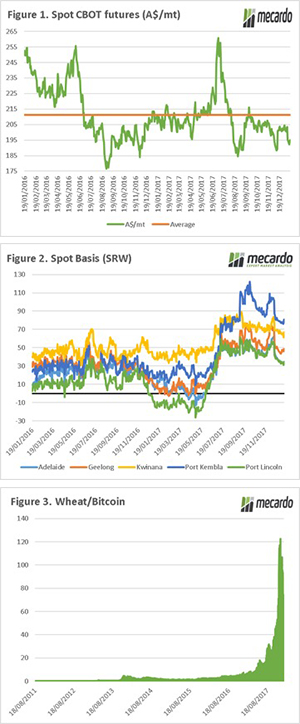

In figure 1, the Chicago spot wheat futures, converted to A$ has been plotted. The past two years has not been pretty, the average price in this period has been a meagre A$211/mt. The futures price makes up the bulk of our price in Australia, we have a very low floor with which our local premiums can contribute to.

The basis is our premium or discount between the physical and futures market, and typically we compare Australian prices to Chicago futures, but it can be against any other pricing point. Basis is important as it can help substantially to increase the prices that we receive locally.

In figure 2, we can see the basis between APW1 and Chicago futures. As we can see, for the bulk of the past two years levels have been at a premium, with a short period of time where SA has experienced negative levels.

This season we can see that basis levels have been extremely strong since seeding. This is due to the weather risk, and then the realization that the Australian crop was going to end up below average. This basis has helped push up localphysical prices to provide a much stronger return for growers.

What is important to remember is that basis levels are largely driven by supply (or lack of), and if Australia had produced an ample harvest, then our basis levels would have been much lower, in combination with a period of low futures prices.

You would have to be living under a rock, if you hadn’t heard about the stratospheric rise of bitcoin. Although of little analytical benefit, I thought this was quite interesting to look over time at how many tonnes of wheat that you can buy for 1 bitcoin. This is displayed in figure 3, in mid-December a bitcoin could get you 122mt on the Chicago futures market, today it will get you 73mt.

What does it mean/next week?:

The market is likely to be quite dull in the coming weeks. There now seems to be less concern about the northern hemisphere crop, and every week that flows without an issue removes risk.

It sounds bad, but we need a supply issue to our fellow farmers in the north. We can’t rely too heavily on basis to make us profitable.