Will African Swine Fever impact upon grain prices?

The biggest issue in the protein markets at present is the African Swine Fever outbreak hitting hard in China. Clearly, there is a direct relationship between different meat products – but what about grains?

At Mecardo we examine a wide range of markets to provide insights into possible disruptions within the marketplace. This allows the team to cover a wide range of markets and commodities, and not solely examine one restrictive area. In the coming weeks, the Mecardo team will be working on various analysis related to the potential impact of this black swan event.

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m.

African Swine Fever is one of the worst ailments to hit pigs, and it is currently flowing its way throughout China. There are a wide range of estimates of the potential damage, ranging from very low government estimates (1m head) through to industry estimates of >200m.

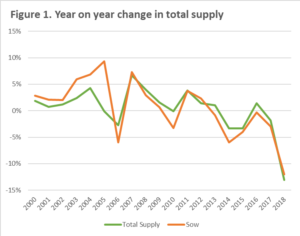

In figure 1 the year on year change (as %) is shown for total supply of pigs and sows. As we can see This season is expected to experience an extremely sharp decline in numbers (13%), which is the highest decline since 1996. There is potential of further downward revisions if the worst projections are realized.

Why or how could this impact upon grain markets? In China, like most countries around the world pigs are fed on a grain-rich diet in sheds. If the worst projections are realized then feed demand for a large proportion of the worlds protein will be taken off the balance sheet.

The main ingredients in Chinese pig feed are Soybean meal and corn. In order to meet the demand for feed, imports have increased in recent years. The biggest import program is soybeans, which are then crushed to produce meal and oil.

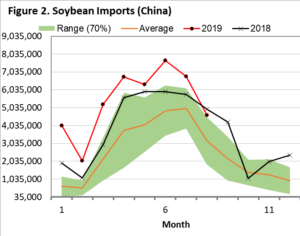

In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

In figure 2, the seasonality of soybean imports into China are shown from 2012 to present. Interestingly when I ran these numbers, I was expecting soybean imports to trending downwards. At present this is not the case with soybean imports appearing to be well above the range expected.

If as expected demand does finally drop, then we would expect that soybean prices will decline, which feasibly could have a flow-on effect onto other oilseeds (palm/canola).

Remember to listen to our podcast

What does it mean/next week?:

At the moment the estimates of the losses are all ‘Chinese whispers’. I expect that over time import volumes will be a strong indicator of the losses felt throughout the Chinese pork supply chain.

On Thursday I will be looking at other indicators including corn and local grain prices in China.