You don’t know what you’ve got til it’s gone

Key Points

As we head into June, a period of uncertainty looms. Do we see price rises as weather concerns mount, or does a large global crop hamper upside? One thing for sure is that the next two months will be volatile.

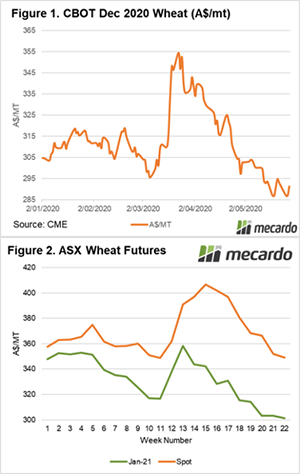

CBOT wheat futures lost steam this week but have tried to regain ground overnight. There are concerns that poor weather in Europe has hampered crop production. The December wheat futures in US$/mt have returned to the same level as last Thursday. The Australian dollar has gained ground however and is currently trading A$4 below last Thursday.

Risk management and examining prices are some of the most important factors in running a grain growing enterprise. There were fantastic opportunities to lock in high futures levels in March. The market since then has fallen from A$355 to A$291 (Figure 1).

There is always a potential for the market to rise back to those levels, but it’s always advisable to take some cover when it is available – at least for a small portion.

As a tip, it is important to ensure that you have the correct facilities available and open to use the market to your advantage. It takes time to set up the correct facilities and by the time they are in place, the opportunity may have passed. You don’t know what you’ve got til its gone.

At a local level, the ASX futures market has slightly declined, with both old and new crop pricing down around A$2/mt (Figure 2). As we draw ever closer to harvest we are likely to see the spread between new crop and old crop trend lower. There may be times when the market jumps up as domestic buyers hit the market, however, the trendline will be for that spread to narrow.

If you are holding old crop, it might be time to sell and take advantage of the remaining drought premium.

The three-month outlook for Australia looks positive (see here).

What does it mean/next week?

Next week we will be moving into June. If previous years are any indicator, we are likely to see some volatility. This could provide opportunities for farmers to increase their hedge positions, especially as good rainfall reduces potential production risk.