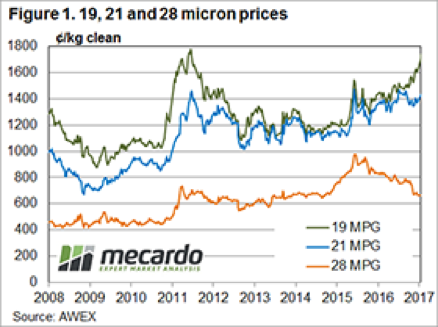

AWEX report a “good solid market over three selling days”; again it was the fine wool leading higher while the rest of the market held firm. Crossbreds also finally found some support and reversed their long downward spiral to see the 28 MPG improve by 19 cents.

AWEX report a “good solid market over three selling days”; again it was the fine wool leading higher while the rest of the market held firm. Crossbreds also finally found some support and reversed their long downward spiral to see the 28 MPG improve by 19 cents.

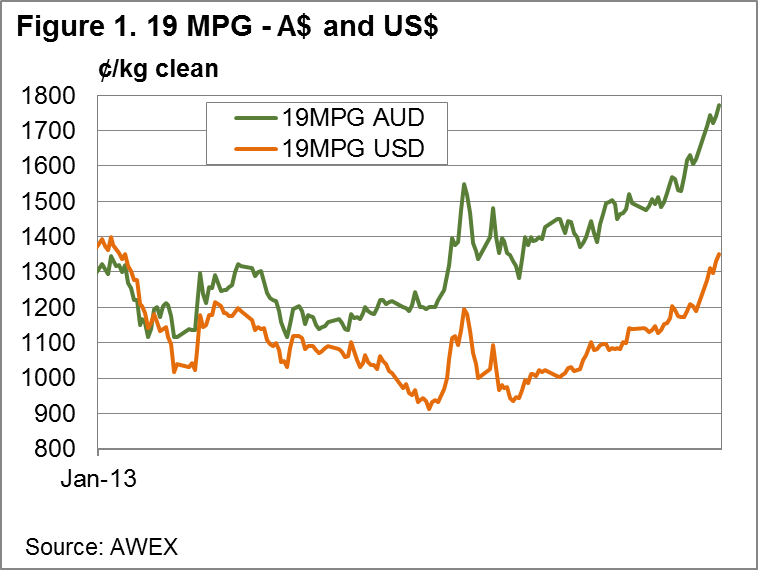

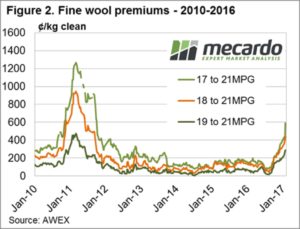

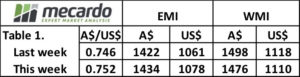

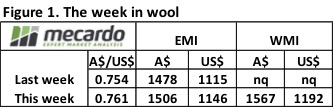

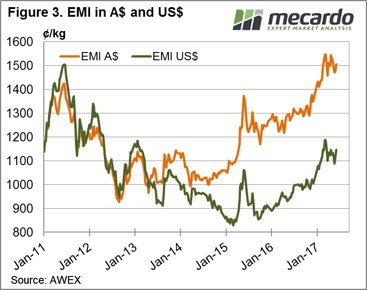

The EMI was up A$0.03, while in US$ terms it improved 16 cents on the back of the Au$ increasing by almost US$0.01 over the week.

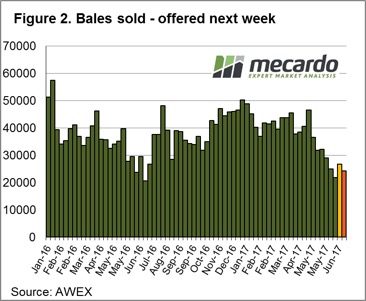

While 47,000 bales were originally listed, only 45,400 bales were eventually offered with 41,500 sold into a market resulting in a 7.6% Passed In rate. The PI rate was skewed somewhat with growers in Fremantle passing 13.5%.

While 47,000 bales were originally listed, only 45,400 bales were eventually offered with 41,500 sold into a market resulting in a 7.6% Passed In rate. The PI rate was skewed somewhat with growers in Fremantle passing 13.5%.

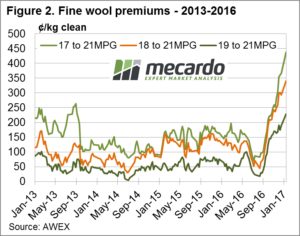

The question around at the moment is can fine wool continue to rally; will we see an increase in the premium (Basis) for fine wool over medium wool as the clip shifts broader as a result of the improved seasonal conditions? What is the nett effect of recent decisions by Merino sheep producers to re-focus on meat production alongside their traditional wool focus? Historically a push to bigger sheep and more lambs meant a broader micron from these sheep; but has the advances in breeding for wool quality evident over the past 20 years negated this usual outcome?

As Mecardo reported, 21 MPG types were up 34% in volume for the 3 month period, continuing the trend of moving wool across the micron spectrum. The bottom line is that increases in the 20 – 22 micron types are at the direct expense of volume in the 17 – 19 micron categories. Even if the Autumn break is poor, cheap grain prices should mean that sheep are maintained in peak condition again maximising performance but also continuing the pressure on the clip to move broader.

As Mecardo reported, 21 MPG types were up 34% in volume for the 3 month period, continuing the trend of moving wool across the micron spectrum. The bottom line is that increases in the 20 – 22 micron types are at the direct expense of volume in the 17 – 19 micron categories. Even if the Autumn break is poor, cheap grain prices should mean that sheep are maintained in peak condition again maximising performance but also continuing the pressure on the clip to move broader.

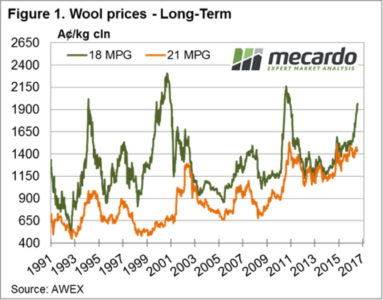

While we can speculate that the long-awaited rally for fine wool will be the saviour of the industry and reverse the trend away from Merino sheep, the reality is that the market will need some time to adjust after a long period of relatively cheap fine wool. Countering this though is the fact that the world wool processing industry has as a result of cheaper fine wool prices become accustomed to using the finer types; cheap basis and plenty of volume over the past 4-5 years has encouraged greater demand.

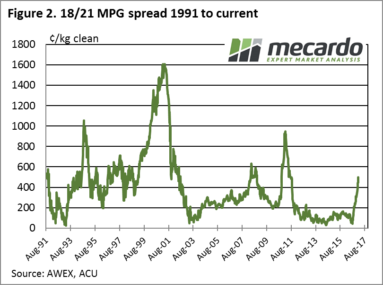

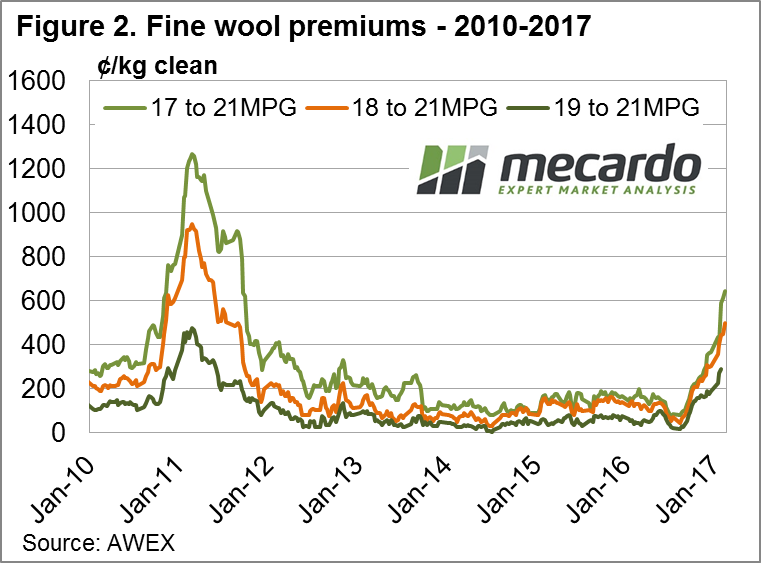

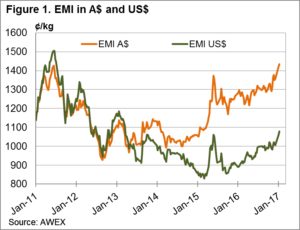

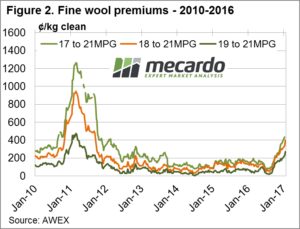

We also know that fine wool rallies can become price spikes; the problem is that price spikes in the past have been short-lived. Figure 2 shows that the spikes in September 1994, June 2001 and March 2011 were followed by severe corrections. Could this time be different?

This week Riemann traded solid volumes, however most of the action was in the 19 MPG tenor, a big change from volume traded over the past 4 – 5 years which has been 21 MPG focused. This is reflecting where buyers now have their concern; so perhaps it would be prudent for wool growers to take a contrarian approach and focus on 21 MPG contracts to protect future production. This is a good time to discuss with either your broker or Mecardo the type and tenor of forward contracts; high prices and potential further upside for fine wool making an interesting case for trading Basis, something the good grain traders regularly exploit to advantage and worth considering for the next wool clip.

The week ahead

Next week Melbourne is selling over three days with Fremantle and Sydney on Wednesday & Thursday. The strong market has again enticed 47,500 bales to be listed for next week, however forward projections for the following weeks trail off to 40,000 and 43,000.

The good news for the wool market continued; again, it was the fine wool that was the stand-out and led the market. Sydney had a designated fine wool sale; this came at the perfect time for NSW fine wool growers resulting in the Merino fleece and skirtings component having an almost total clearance with only 1.6% Passed In, compared to the national PI rate of 6.7%. The EMI was up A$0.15, while in US$ terms it was 9 cents better.

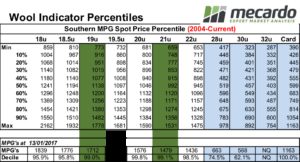

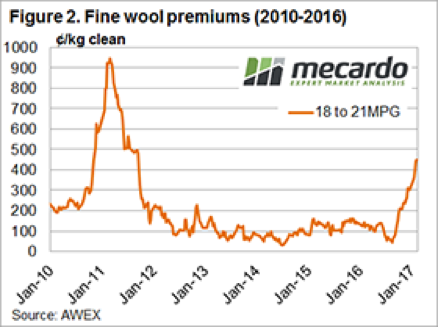

The good news for the wool market continued; again, it was the fine wool that was the stand-out and led the market. Sydney had a designated fine wool sale; this came at the perfect time for NSW fine wool growers resulting in the Merino fleece and skirtings component having an almost total clearance with only 1.6% Passed In, compared to the national PI rate of 6.7%. The EMI was up A$0.15, while in US$ terms it was 9 cents better. The last time 18MPG basis was at this level was July 2011 (Fig 2). Of further note is that in July 2016 (last year) it was quoted in Melbourne at 52 cents. Is that a 900% increase in less than 12 months?

The last time 18MPG basis was at this level was July 2011 (Fig 2). Of further note is that in July 2016 (last year) it was quoted in Melbourne at 52 cents. Is that a 900% increase in less than 12 months? The response from three wool brokers this week when asked about the wool market was unanimous – it’s extremely good if you have wool 19 micron and finer, its good if you are in the “bread and butter” 20 to 22 micron range, and it’s terrible if you have crossbred types. This reinforces the concept that the wool market is not homogenous, it’s made up of a variety different markets.

The response from three wool brokers this week when asked about the wool market was unanimous – it’s extremely good if you have wool 19 micron and finer, its good if you are in the “bread and butter” 20 to 22 micron range, and it’s terrible if you have crossbred types. This reinforces the concept that the wool market is not homogenous, it’s made up of a variety different markets. Fine wool has finally come out of the shadows and remerged to show good premiums over the mainstream types, the concern with the trade now is that this incentive for fine wool producers to continue with this specialty product has come too late for some. The fine wool premium as shown in Fig 2, identifies that the 18 premium over 21 MPG is now at a record not seen since September 2011

Fine wool has finally come out of the shadows and remerged to show good premiums over the mainstream types, the concern with the trade now is that this incentive for fine wool producers to continue with this specialty product has come too late for some. The fine wool premium as shown in Fig 2, identifies that the 18 premium over 21 MPG is now at a record not seen since September 2011

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢. Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

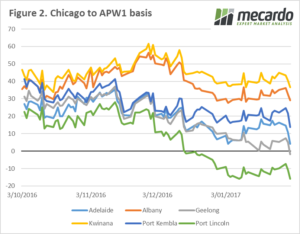

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.