Key Points

- Sheep slaughter is expected to get tight, both in absolute terms and relative to lamb.

- MLA’s forecast is for sheep slaughter to move back towards the levels of 2016-17.

- There is less downside for sheep prices than lamb values as we move towards the spring.

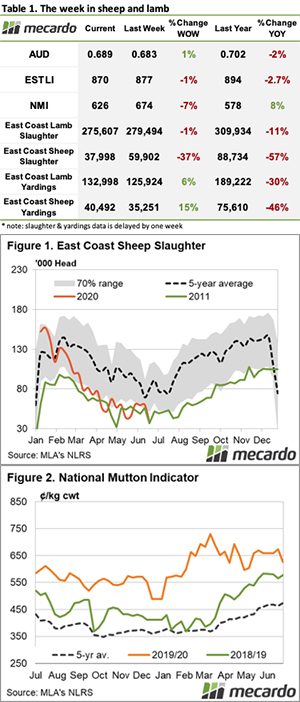

As we come out of the winter lull evidence is starting to point towards a recovery in lamb supplies, and a continuing dearth in sheep. We have seen this before, but maybe not to the extent that is expected, though we can still look for clues as to how prices might react.

Lamb supplies are bottoming out, and on the way up, and sheep supplies are heading lower as the flock rebuilds. The difference in supply trajectories as we move into spring will see mutton supplies heading back towards the lows of 2016-17, and possibly even lower.

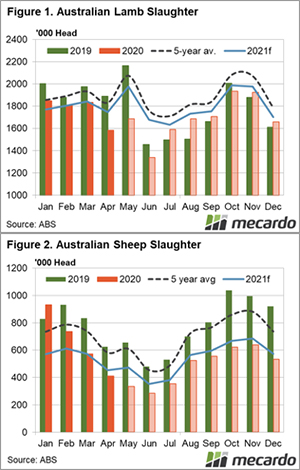

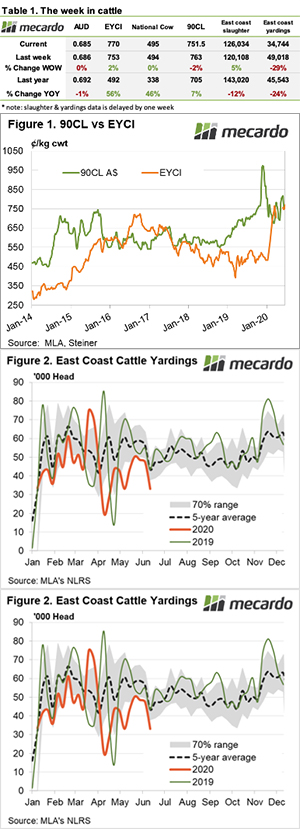

Figure 1 shows how lamb and sheep slaughter has behaved over the long term, with a 12 month moving average over the top to smooth out the chart. Since 2000, we have seen a divergence of lamb and sheep slaughter. The move towards meat and dual purpose sheep seeing more lambs being produced, along with more Merino wethers being slaughtered as lambs, has increased lamb supplies and decreased sheep.

We can see that in the last year, lamb slaughter has trended down more quickly than sheep. However, we expect the rolling average to turn upwards for lambs and continue down for sheep. With lamb and sheep supplies both falling, relative supplies have remained steady since late 2018.

Figure 2 shows sheep slaughter as a proportion of lamb slaughter which highlights that in relative terms, we only just saw a move in tightening sheep supplies in April. The average sheep slaughter as a proportion of lamb has been tracking at 43% for the last two years. Meat & Livestock Australia’s (MLA) industry projections suggest that sheep slaughter will be 35% in 2020 and 33% in 2021.

In 2016 and 2017 sheep slaughter was 30% and 33% of lamb slaughter, so while sheep supply is set to be lower than those years, lamb slaughter will be lower as well.

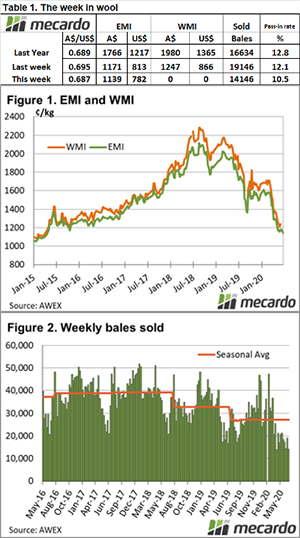

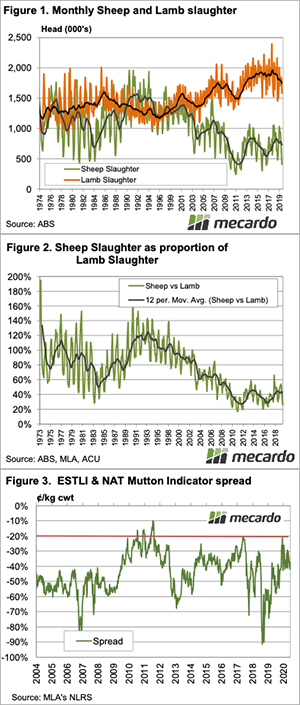

The last two times sheep slaughter was below 35% of lamb slaughter, mutton prices narrowed their discount to lamb prices. Figure 3 shows the National Mutton Indicator (NMI) spread to the Eastern States Trade Lamb Indicator (ESTLI).

From 2010 to 2012, when sheep slaughter was at its tightest, the NMI ranged between a 20 and 30% discount to the ESTLI. In 2016 and 2017, mutton values were not as strong relative to the ESTLI, but they did sit in the 20-30% range for the first half of 2017.

What does this mean?

For most of the last year the NMI sat between a 30-40% discount to the ESTLI. With sheep slaughter falling relative to lamb slaughter, we can expect the NMI discount to shrink over the coming months, as it is likely to return to the 20-30% discount level.

Moving toward spring, the mutton discount is likely to shrink due to falling lamb prices rather than rising mutton prices. If mutton remains around 650¢, the ESTLI will be 800-850¢. Looking from the other angle, if the ESTLI falls back to 750¢, mutton will be 550-620¢. There is less downside for mutton than lamb over the coming year.