What’s left for lamb and sheep slaughter volumes into spring and summer?

Author- Matt Dalgleish, Thomas Elder Markets

The Snapshot

- Approximately 10 million lamb need to be turned off in the second half of 2021 in order to reach the MLA target of 20.3 million head of lamb processed by the end of the year.

- Lamb slaughter volumes need to replicate the pattern set in the second half of 2020 in order to reach this target, which seem achievable.

- However, sheep slaughter volumes need to increase 40%-45% above the levels set in the second half of 2020 to reach the MLA target of 6.1 million head of sheep processed, which appears to be a tough ask given the favourable season expected.

The Detail

As we enter spring, we can calculate what is left for lamb and sheep slaughter if we are to hit the Meat and Livestock Australia (MLA) annual slaughter targets for 2021. We know the season will help dictate how many lambs or sheep are slaughtered in the remainder of the year, but it’s still worth taking a look at the forecast annual projections from the MLA June sheep industry update and assessing what they mean for upcoming supply.

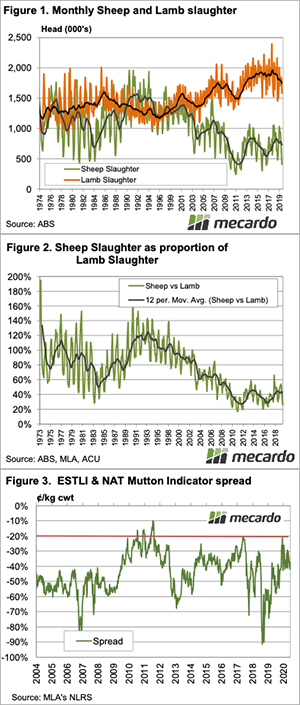

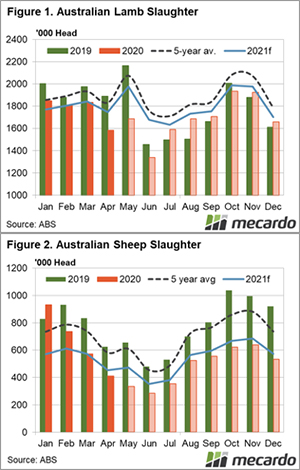

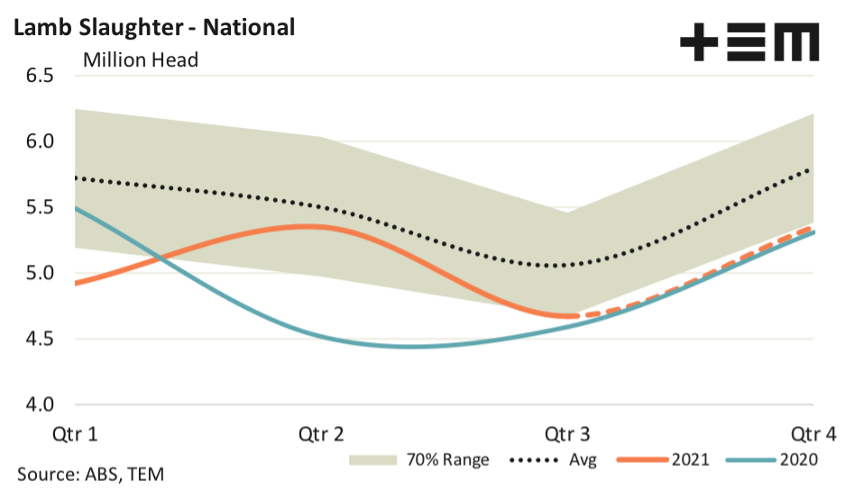

MLA are anticipating annual lamb slaughter of 20.3 million head by the end of the year. The Australian Bureau of Statistics (ABS) quarterly slaughter data demonstrates that as of the June quarter there have been 10.3 million head of lamb slaughtered so far this season. This leaves 10 million head for the remainder of the season if we are to reach the MLA forecast.

Normally we see a lull in lamb slaughter volumes in quarter three, as the average seasonal pattern demonstrates. If we assume a similar pattern to lamb slaughter flows as outlined by the average trend for the remainder of this season, we can expect around 4.7 million head of lamb processed in the September quarter and 5.3 million head in the December quarter to meet the MLA annual target of 20.3 million head. This would replicate the volumes seen in the second half of 2020.

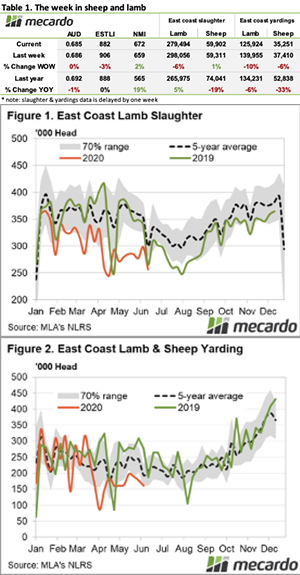

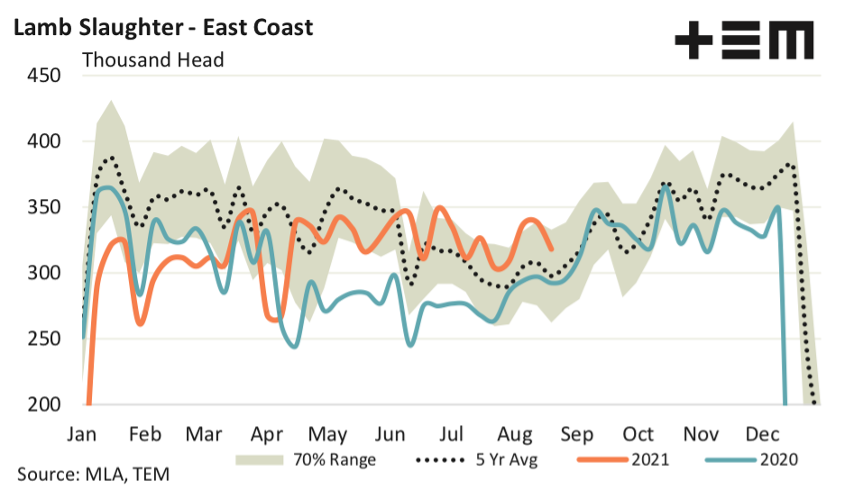

A look at weekly east coast lamb slaughter volumes as reported by MLA demonstrate that we would need to see weekly slaughter volumes between 330,000 to 350,000 head per week to match the level of lamb slaughter we saw in 2020. As the current season trend outlines, we have been managing weekly levels of this magnitude since returning from the Easter break in April, so it certainly seems achievable.

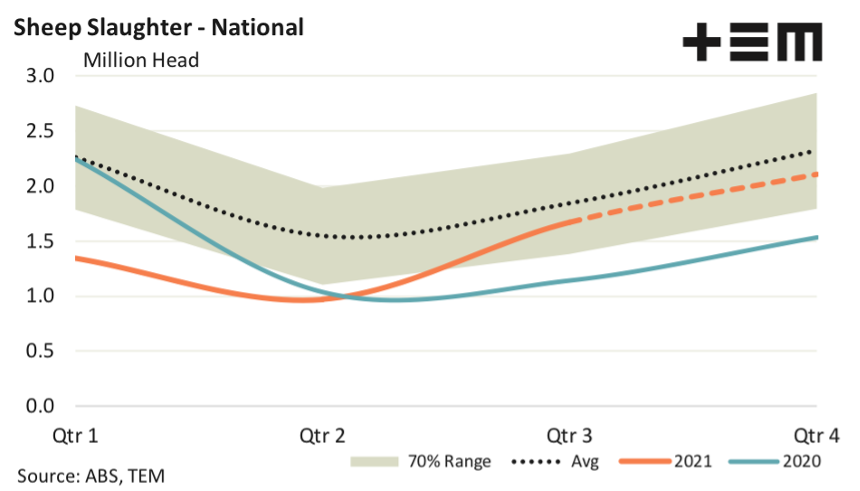

The picture for sheep slaughter is somewhat different. MLA are expecting to see 6.1 million head of sheep processed for the 2021 season. However, as of the middle of the year there have only been 2.3 million head of sheep sent to meat works according to the ABS June data release. This leaves approximately 3.8 million head of sheep required to be processed for the second half of the year to meet the MLA target.

As the average pattern for sheep slaughter demonstrates it is not uncommon to see a seasonal lull in processing volumes in the June quarter, with volumes often gaining momentum into quarter three and four. Assuming a similar pattern of sheep slaughter as the average trend we would need to see a 40%-45% lift in slaughter on the volumes seen during the second half of 2020 to meet the MLA target of 6 .1 million head of sheep processed by the end of 2021. This would equate to around 1.7 million head of sheep processed in quarter three and 2.1 million head for quarter four, if volumes were to mirror the average seasonal pattern.

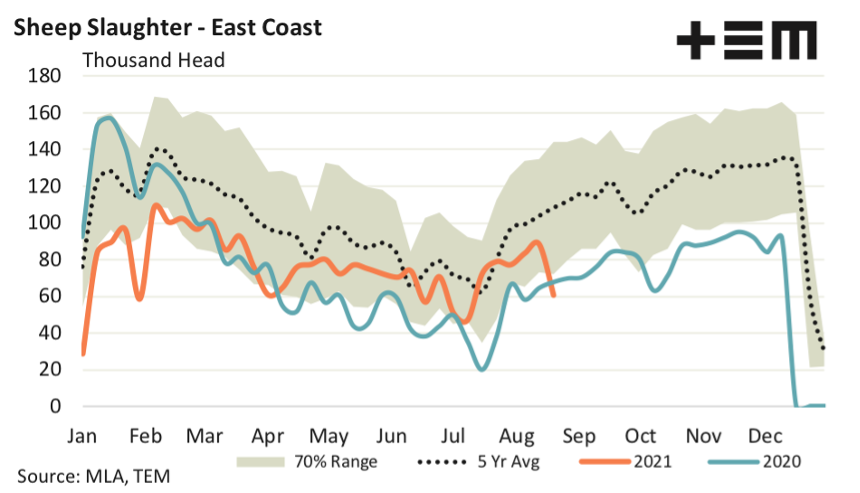

The favourable season, low supply and strong intent to rebuild the flock has seen weekly sheep slaughter volumes persist at the lower end of the normal range for much of 2020 and 2021, as highlighted by the east coast weekly slaughter figures reported by MLA. In order to reach the MLA target of 6.1 million head of sheep slaughter by the end of 2021 we are going to need to see weekly slaughter volumes average around 100,000 head to the end of the year.

With the forecast for a wetter than normal spring and the prospect of a heap of green pasture available into summer it seems unlikely there will be much incentive for producers to turn off sheep at this magnitude to reach the MLA target of 6.1 million head.