After multiple years of drought conditions, the current La Nina weather system has given Australian sheep owners a much-needed reprieve.

As the country comes out of drought, farmers – particularly across Australia’s east coast – find themselves coming into a much more favourable season, with plenty of grass available for livestock to utilise. This in turn has led to a very competitive re-stocker market, resulting in high female sheep prices – and producers are now faced with the challenging decision of when or if to buy.

But with these favourable conditions comes the problematic issue of affordability and cashflow management. A lot of drought-hit producers had to reduce their sheep numbers in order to remain viable, and many now find themselves with limited capital on hand to reinvest. Additionally, many producers had money tied up in purchasing fodder to help their existing animals survive the drought – a situation that now further compounds the issue. In what’s currently a hugely competitive market, with large numbers of farmers wanting to rebuild their flock, many are struggling to find the initial outlay that lets them invest whilst the outlook is promising.

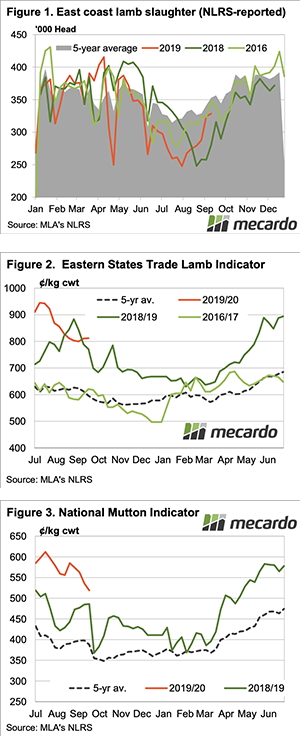

With replacement ewe prices varying anywhere from $350-$400+/hd, the thought of spending that amount can be a daunting one – particularly when, over the past 12 months, the lamb and mutton market has seen a considerable amount of volatility that casts doubt on whether these prices are justifiable. A productive ewe has to raise a lamb or twins to compensate for those that don’t, and a sudden shift in carcass values could mean the difference between making the right call or owning some very expensive animals.

It’s this situation that’s led to many farmers approaching StockCo about our breeder finance offering – a product that means they can avoid having to outlay a large sum of money to get themselves into a line of ewes. Instead, breeder finance enables them to spread the cost of the sheep – or cattle, where relevant – over a number of years, as well as offering a chance to free up additional funds to spend elsewhere in business, such as on infrastructure expansion or other farm improvements. After what’s been a challenging period for producers across the country, the signs ahead are finally promising – as long as the finance is in place to help farmers take full advantage of the conditions.