The price received in Australia is composed of futures & basis*. It is possible to lock in the futures component through using derivatives (swap/futures etc).

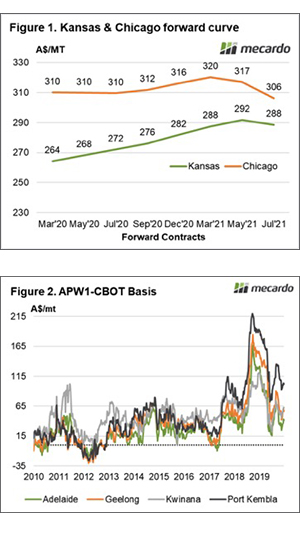

In figure 1 the forward curve is displayed in A$/mt. The forward curve shows the futures price for forward contract months.

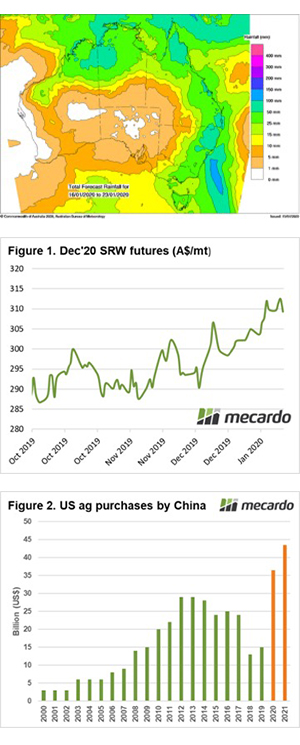

The December 2020 contract which aligns with the Australian harvest is currently trading at A$316/mt. This is the highest level in five years, and provides a strong starting point for marketing grain.

As mentioned before the futures price is one component albeit one which makes up the majority of price (even in drought years – see here).

If using swaps/futures, the final price you receive will effectively be your futures price (A$316) plus basis at the point of physical sale.

In figure 2 the weekly average basis is displayed since 2010. As we can see the past year and a half is probably not a reliable indicator due to the drought led basis. However, the average across the country is:

- Adelaide A$28

- Geelong A$37

- Kwinana A$49

- Port Kembla A$51

- Port Lincoln A$24

On the law of averages locking in futures and selling on average basis would return between A$340 & A$366. A price that is historically attractive.

*For the purpose of this analysis we are not including FX, and basing on a converted futures price.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

The futures market is currently offering strong levels for December 2020. A large proportion of the rise in recent weeks has been due to geopolitical factors – which could lead to volatility.

At present these are high levels compared to the last five years. If you lock in a little at these levels, and it turns out to be the worst trade you do – it is still likely to be profitable.

Little and often wins the day.

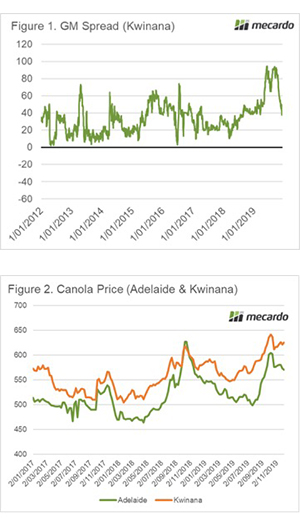

The South Australian government is debating a bill to end the moratorium on GM crop cultivation. I received information from a contact related to claims from anti-gm activists. I thought it was time to dispel some of the activist’s misunderstandings.

The South Australian government is debating a bill to end the moratorium on GM crop cultivation. I received information from a contact related to claims from anti-gm activists. I thought it was time to dispel some of the activist’s misunderstandings.