The wheat market is trying to have a rally, at least in international

markets, while locally the sheer volumes of wheat in store, and

seeping out into the market appears to be depressing basis.

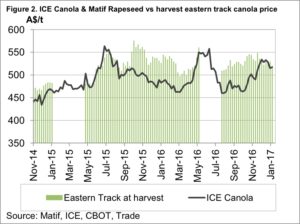

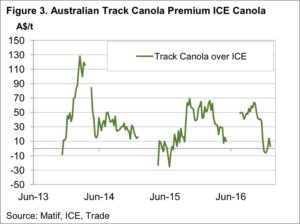

Canola basis has improved, but unfortunately it’s been due to futures

falling, not physical rising.

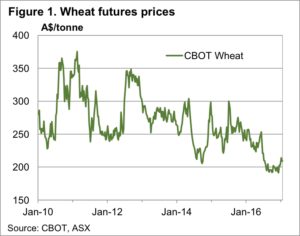

You wouldn’t know it looking at cash prices, but CBOT wheat has

gained $18/t, or 9%, since the start of December. Figure 1 shows

that the spot contract, which is now March, is sitting at a 6 month

high in our terms, but it’s still just $209/t.

Locally some of the price increase was seen, with track APW moving

from around $212 to $223/t, although late this week it dropped

back to $215/t. APW Basis to CBOT is now just $5/t, and it’s safe

to say we are now sitting at export parity. The good news is that

basis is unlikely to weaken further, and price movement will be largely

dependent on what happens in the international market.

Canola prices have eased in the last week, now sitting at around $520/t

on a port level (figure 2). The fall has been due to easing ICE canola

prices, with local basis improving marginally (figure 3). It appears

there is still plenty of Canola finding its way into the market, hence

basis being $50 lower than in October. There remains some potential

for basis upside.

Barley prices are ok at Port terminals at $170/t, but up country values

have fallen to around $152/t on a Port equivalent. Feed Barley prices

are now likely to be below export parity, and as such there is no hurry

to sell at these levels.

The Week Ahead

With the decline in wheat basis, it is now only the H2 wheats and better which look like reasonable selling, everything else looks like a hold, as there is very little downside to be concerned about. Unless, of course,

the international market returns to December lows, but this is unlikely

at this time of year.

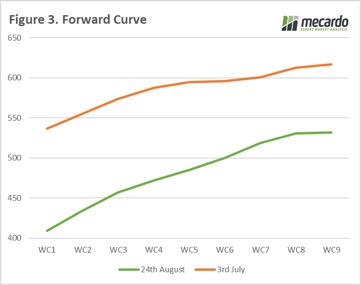

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this.

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this. In early July we recommended the use of a Dec’18 Chicago swap in our article ‘

In early July we recommended the use of a Dec’18 Chicago swap in our article ‘ The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.

The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.