The country sits on tender hooks, as we come to the end of September. The forecasts for the crop from ABARES and USDA seem to be wholly optimistic, and will see severe downward revisions after a terrible month for much of the growing regions.

The country sits on tender hooks, as we come to the end of September. The forecasts for the crop from ABARES and USDA seem to be wholly optimistic, and will see severe downward revisions after a terrible month for much of the growing regions.

The futures market had a strong rally mid-week, rising A$8/mt (figure 1) from last week, before shedding A$4 overnight. The market is largely directionless with a lack of fresh information. This evening the USDA will release their September stocks report, which the trade awaiting this to find new grounding.

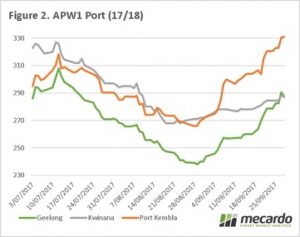

The poor September on the east coast, has seen the market rally considerably. In figure 2, the flat price of APW1 in Geelong, Port Kembla and Kwinana has been plotted. As we can see Kwinana pricing has remained somewhat flat, and Geelong/Port Kembla has risen in line with one another due to the domestic demand in the north. Albeit still with a substantial premium of $40-45p/t in Port Kembla over Geelong.

The A$, although still high compared to the last year has dropped back below 79¢, helping the local price. In the past month we have seen iron ore futures (figure 3), start to slip which put pressure on the A$. As China drops demand after an intensive import program over the past few months will we see a further slide back down to 75¢

The A$, although still high compared to the last year has dropped back below 79¢, helping the local price. In the past month we have seen iron ore futures (figure 3), start to slip which put pressure on the A$. As China drops demand after an intensive import program over the past few months will we see a further slide back down to 75¢

What does this mean?

This week we have basis, futures and currency all doing their bit to help returns for farmers.

The question remains how long these premiums will remain in the market. At present basis in Port Kembla is at +A$118, however the grower is largely holding back from selling. There will still be ample supply in the coming months to meet domestic demand, and this could result in a paring back of basis premiums albeit prices locally are expected to remain strong.

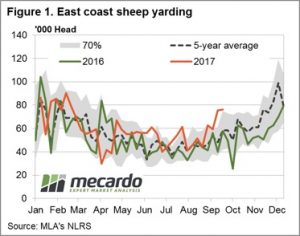

Fairly erratic moves to the state mutton prices this week but they all evened each other out to see the National Mutton Indicator just 3¢ softer to 370¢/kg cwt. Marginal prices changes the order of the week it seems with the Eastern States Trade Lamb Indicator continuing to dance around the $6 area, posting a 5¢ gain to close at 603¢/kg cwt.

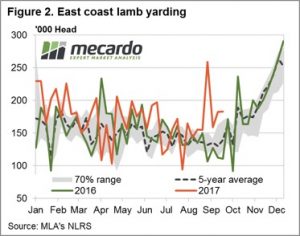

Fairly erratic moves to the state mutton prices this week but they all evened each other out to see the National Mutton Indicator just 3¢ softer to 370¢/kg cwt. Marginal prices changes the order of the week it seems with the Eastern States Trade Lamb Indicator continuing to dance around the $6 area, posting a 5¢ gain to close at 603¢/kg cwt. East coast lamb throughput showing a similar story to sheep throughput with yardings remaining above the 70% range and quite elevated for this time of the year – figure 2. The high sheep throughput being held up by above average numbers at saleyards mainly centred in NSW. The lamb throughput supported by NSW and Victorian flows, the only two states with yarding figures trekking above average for this time of the season.

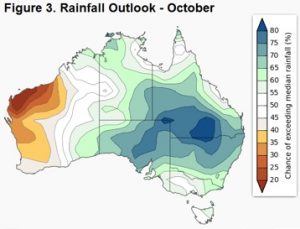

East coast lamb throughput showing a similar story to sheep throughput with yardings remaining above the 70% range and quite elevated for this time of the year – figure 2. The high sheep throughput being held up by above average numbers at saleyards mainly centred in NSW. The lamb throughput supported by NSW and Victorian flows, the only two states with yarding figures trekking above average for this time of the season. The recent Victorian lamb yarding pattern suggest the beginning of the Spring flush is underway which is likely to start to see some price pressures for the ESTLI in the coming weeks. Although, the updated Bureau of Meteorology rainfall outlook for October (figure 3) signals a move to a much wetter NSW which will provide some welcome relief to producers there and price support on dips.

The recent Victorian lamb yarding pattern suggest the beginning of the Spring flush is underway which is likely to start to see some price pressures for the ESTLI in the coming weeks. Although, the updated Bureau of Meteorology rainfall outlook for October (figure 3) signals a move to a much wetter NSW which will provide some welcome relief to producers there and price support on dips. An overall satisfactory wool sale result this week, however we need to acknowledge that the weaker A$ played a part. Last week the A$ touched out at US$0.80, whereas this week it closed at US$0.782. Causes for currency moves are varied and debatable, and we can’t be sure if the weakness in the A$ is anticipating a Tigers/Crows win or loss in the AFL; or perhaps it is due to the struggle NSW NRL fans are having coming to terms with a Cowboys/Storm final?

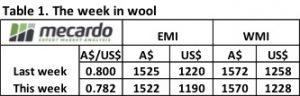

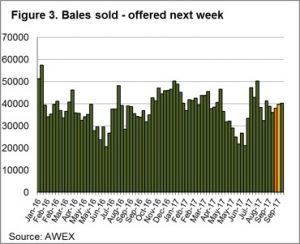

An overall satisfactory wool sale result this week, however we need to acknowledge that the weaker A$ played a part. Last week the A$ touched out at US$0.80, whereas this week it closed at US$0.782. Causes for currency moves are varied and debatable, and we can’t be sure if the weakness in the A$ is anticipating a Tigers/Crows win or loss in the AFL; or perhaps it is due to the struggle NSW NRL fans are having coming to terms with a Cowboys/Storm final? A key point of interest in the wool market is the fine wool price, including the fine wool price relative to medium wool.

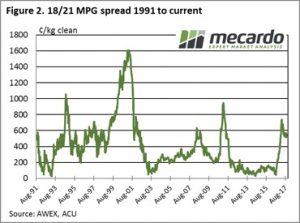

A key point of interest in the wool market is the fine wool price, including the fine wool price relative to medium wool. Of course, this leads to comparisons of relative price levels. Figure 2 shows the basis or spread between the 18 & 21 MPG’s for the Southern selling region. Currently the 18 over 21 MPG premium is sitting nicely at 554, having briefly touched the high level of over 700 cents in March this year.

Of course, this leads to comparisons of relative price levels. Figure 2 shows the basis or spread between the 18 & 21 MPG’s for the Southern selling region. Currently the 18 over 21 MPG premium is sitting nicely at 554, having briefly touched the high level of over 700 cents in March this year. The market looks remarkably stable at present, and providing we don’t see a sudden surge in the A$ this should translate into another good week to be selling (that is providing the footy community can cope with an all Victorian result!!!)

The market looks remarkably stable at present, and providing we don’t see a sudden surge in the A$ this should translate into another good week to be selling (that is providing the footy community can cope with an all Victorian result!!!)