Recently we published an article reviewing the trends in ewe numbers and breeds. An interesting stat in the article was that Merinos still make up 69% of the national ewe flock. A common question after the article was ‘where are all these Merinos? We delve deeper into the data to find out.

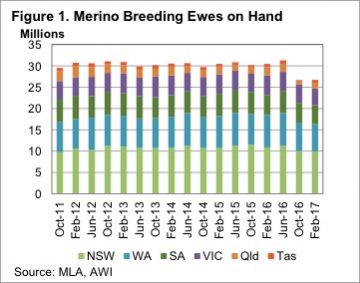

Living in Western Victoria, which is one of the hotspots for the swing to meat breeds, it’s hard to imagine that 69% of the ewe flock is made up of Merinos. Figure 1 in part explains this, with 61% of the nation’s Merinos being in NSW and WA. Just 15% of Australia’s Merino Ewes are now in Victoria.

Living in Western Victoria, which is one of the hotspots for the swing to meat breeds, it’s hard to imagine that 69% of the ewe flock is made up of Merinos. Figure 1 in part explains this, with 61% of the nation’s Merinos being in NSW and WA. Just 15% of Australia’s Merino Ewes are now in Victoria.

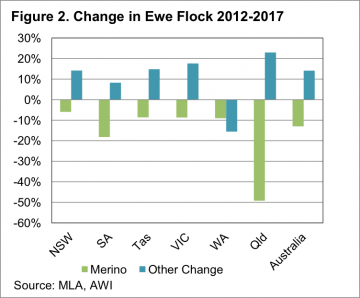

The numbers of Merino ewes in NSW has remained relatively steady since the start of 2012, falling 6% compared to the national fall of 13% (figure 2). The big movers have been South Australia, where Merino numbers have fallen 18% in five years, and Queensland, which has lost 49%, just under 1 million head to 1.35 million head.

Figure 2 also shows every state except WA has increased their number of ‘other’ breeds since 2012. On a national scale, the decline in Merinos hasn’t been matched by increases in other ewes. However, in NSW and Victoria Merinos have been displaced by other ewes. In WA, SA and Queensland total sheep numbers have fallen.

Figure 2 also shows every state except WA has increased their number of ‘other’ breeds since 2012. On a national scale, the decline in Merinos hasn’t been matched by increases in other ewes. However, in NSW and Victoria Merinos have been displaced by other ewes. In WA, SA and Queensland total sheep numbers have fallen.

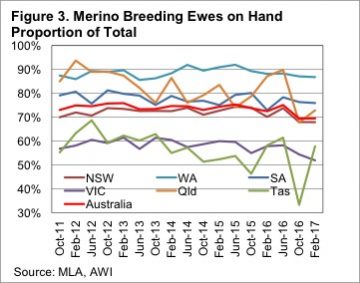

Figure 3 shows how the proportion of Merino ewes has changed in each state over the past five years. Victoria has had the lowest proportion of Merino ewes, apart from Tasmania, for the past five years, with much of the decline happening in the last two years. With just 52% of sheep in Victoria being Merinos, having fallen from 60% two years ago, it’s little wonder those in the south are wondering where the Merinos are.

Perhaps it is due to climatic conditions, or it might be due to the fact that Merino’s are bigger and more suited to lamb production in WA, but the West remains a stronghold of the Merino. The proportion of Merino’s in the west hasn’t really changed over the last five years, fluctuating between 86 and 92% and currently sitting at 87%.

Perhaps it is due to climatic conditions, or it might be due to the fact that Merino’s are bigger and more suited to lamb production in WA, but the West remains a stronghold of the Merino. The proportion of Merino’s in the west hasn’t really changed over the last five years, fluctuating between 86 and 92% and currently sitting at 87%.

Key points:

- Most of Australia’s Merino ewes are currently in NSW and WA, although numbers have declined in all states.

- Other breed have replaced Merinos in NSW and Victoria, but total ewe numbers are down in WA and SA.

- The decline in Merino’s is in part being borne out in higher wool and merino sheep prices.

What does this mean?

Where are all the Merinos? In NSW and WA, and to a lesser extent SA. There remain some in Victoria but the trend towards meat breeds continues, albeit at a slower pace than anecdotal evidence would suggest. Lower merino ewe numbers are obviously contributing to current strong wool prices, along with merino lambs and sheep, which are currently sought after, and priced well relative prime lambs.

nal OTH prices to see it probe toward the $5 mark, closing just shy at 490¢/kg. WA Trade lamb mirroring the ESTLI percentage gains to see it up 1.1% to 664¢/kg cwt, while WA mutton recovering strongly to see an 8.6% rise to 453¢.

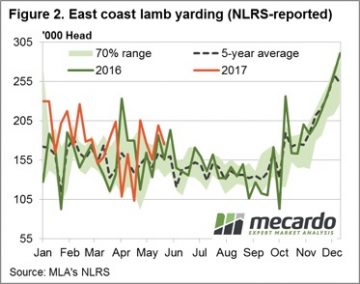

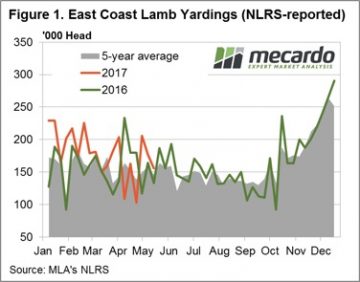

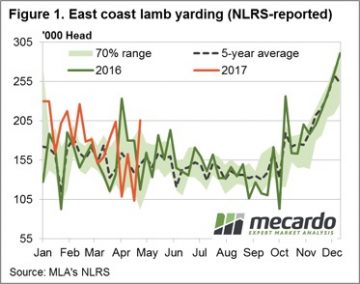

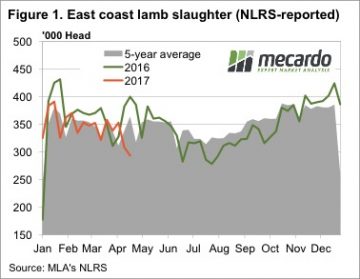

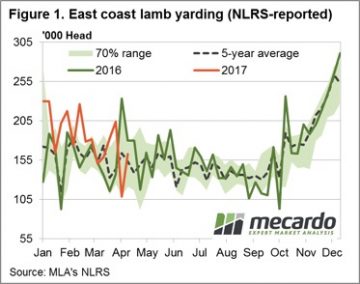

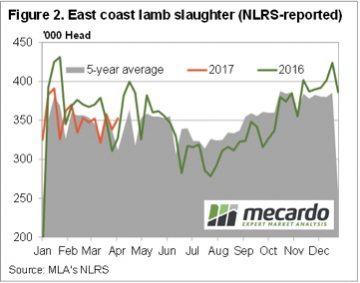

nal OTH prices to see it probe toward the $5 mark, closing just shy at 490¢/kg. WA Trade lamb mirroring the ESTLI percentage gains to see it up 1.1% to 664¢/kg cwt, while WA mutton recovering strongly to see an 8.6% rise to 453¢. East coast lamb throughput retraced 12% this week to see just over 175,000 head reported through the saleyards. The softer offering broadly supportive of prices, although SA lamb numbers were up 18.7% in contrast to the other East coast states – perhaps another reason for the SA price weakness displayed. Despite the softer week on week East coast lamb throughput the trend is still tracking above the five-year average and higher than this time last year – figure 2. This suggest the current solid prices are drawing out a bit of supply but not enough to curb the recent price gains.

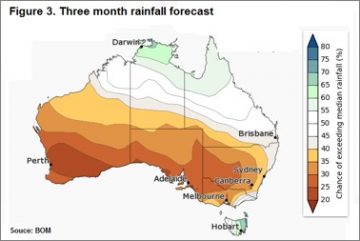

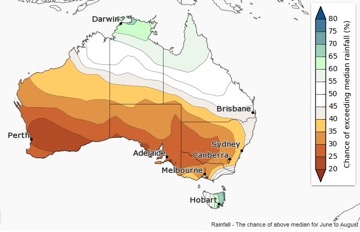

East coast lamb throughput retraced 12% this week to see just over 175,000 head reported through the saleyards. The softer offering broadly supportive of prices, although SA lamb numbers were up 18.7% in contrast to the other East coast states – perhaps another reason for the SA price weakness displayed. Despite the softer week on week East coast lamb throughput the trend is still tracking above the five-year average and higher than this time last year – figure 2. This suggest the current solid prices are drawing out a bit of supply but not enough to curb the recent price gains. A good sign for robust offshore demand noted with live export wethers up 26% on the week to hit $136 per head out of Muchea. Finally, in weather news of a different kind the Bureau of Meteorology released their next instalment of the three-month outlook showing a drier than normal Winter for much of the sheep rearing regions of the country.

A good sign for robust offshore demand noted with live export wethers up 26% on the week to hit $136 per head out of Muchea. Finally, in weather news of a different kind the Bureau of Meteorology released their next instalment of the three-month outlook showing a drier than normal Winter for much of the sheep rearing regions of the country.

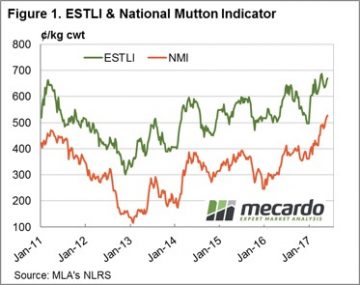

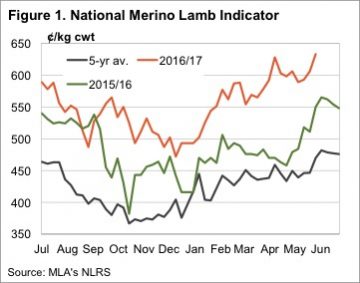

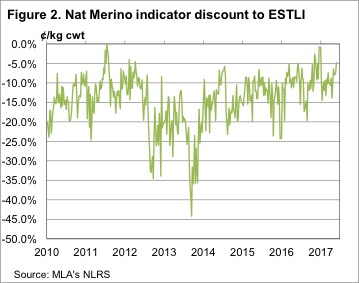

If ever there was a year to have held onto sheep and lambs, this was it. We are only in May and Merino lambs have moved further into uncharted territory, the National Merino Lamb Indicator this week hitting 633¢/kg cwt (figure 1).

If ever there was a year to have held onto sheep and lambs, this was it. We are only in May and Merino lambs have moved further into uncharted territory, the National Merino Lamb Indicator this week hitting 633¢/kg cwt (figure 1). It looks like restocker demand is pushing mutton prices along, they are 40% stronger than this time last year. The ESTLI is ‘just’ 16% higher than last year.

It looks like restocker demand is pushing mutton prices along, they are 40% stronger than this time last year. The ESTLI is ‘just’ 16% higher than last year. If we do see drier than normal conditions, it should mean lighter lambs, sold earlier, and weaker prices. Rainfall could continue to defy the forecasts, but there is some significant downside price risk come late winter.

If we do see drier than normal conditions, it should mean lighter lambs, sold earlier, and weaker prices. Rainfall could continue to defy the forecasts, but there is some significant downside price risk come late winter.

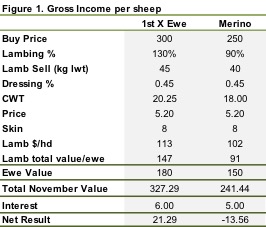

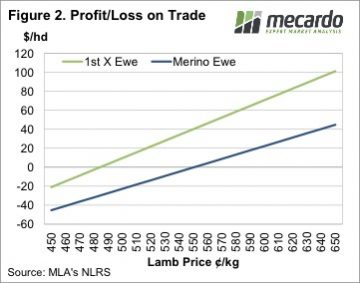

There is plenty of talk about store sheep being expensive, but are they overpriced? It depends on your definition, but one way to look at it is to look at whether ewes bought now are going to be worth more in six months’ time, or worth less.

There is plenty of talk about store sheep being expensive, but are they overpriced? It depends on your definition, but one way to look at it is to look at whether ewes bought now are going to be worth more in six months’ time, or worth less. For those looking to buy or sell scanned in lamb sheep the question is whether the cost of running the sheep through to November is higher than the net result. For merinos all businesses would incur more than in costs in lambing down and marking lambs. For the first cross ewes cost or running may not outweigh the profit on the trade so they might be a better purchase.

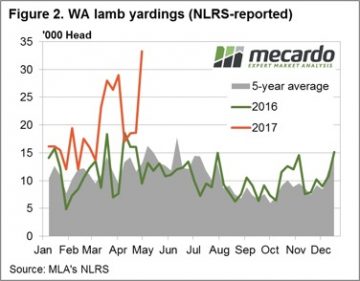

For those looking to buy or sell scanned in lamb sheep the question is whether the cost of running the sheep through to November is higher than the net result. For merinos all businesses would incur more than in costs in lambing down and marking lambs. For the first cross ewes cost or running may not outweigh the profit on the trade so they might be a better purchase. All states, except Tasmania, saw a decline in lamb throughput this week evident in the yarding figures for the East coast (Figure 1) and in Western Australia (Figure 2). East coast lamb yarding down 12% to just under 156,000 head reported through the saleyards, while WA lamb throughput saw a decline of 13.8%.

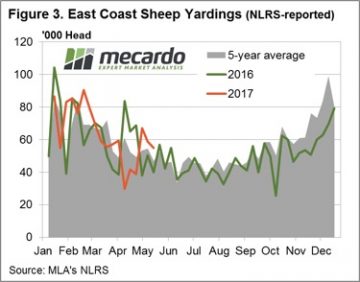

All states, except Tasmania, saw a decline in lamb throughput this week evident in the yarding figures for the East coast (Figure 1) and in Western Australia (Figure 2). East coast lamb yarding down 12% to just under 156,000 head reported through the saleyards, while WA lamb throughput saw a decline of 13.8%. East coast Mutton throughput impacted by soft NSW figures where an 11% fall in NSW flowed through to a price gain of 1.6% for sheep in that state and a broader drop in the East coast throughput for the week – figure 3. Not the case in WA and SA, where increased mutton yardings translated into double digit percentage price falls to see both state mutton prices back below 500¢.

East coast Mutton throughput impacted by soft NSW figures where an 11% fall in NSW flowed through to a price gain of 1.6% for sheep in that state and a broader drop in the East coast throughput for the week – figure 3. Not the case in WA and SA, where increased mutton yardings translated into double digit percentage price falls to see both state mutton prices back below 500¢. A forecast of steady rain for the weekend and early part of next week to much of the sheep producing regions of the country and the prospect of tightening of supply, as the weather cools further, should continue to provide support to lamb and sheep prices.

A forecast of steady rain for the weekend and early part of next week to much of the sheep producing regions of the country and the prospect of tightening of supply, as the weather cools further, should continue to provide support to lamb and sheep prices. If you told a sheep grower back in November you’d give them 530¢ for lambs in May, they would have considered it. If you told them you’d give them that for mutton, they’d have laughed at you. But here we are, with the Victorian Mutton Indicator at 530¢/kg cwt.

If you told a sheep grower back in November you’d give them 530¢ for lambs in May, they would have considered it. If you told them you’d give them that for mutton, they’d have laughed at you. But here we are, with the Victorian Mutton Indicator at 530¢/kg cwt. Mutton yardings were also strong relative to last year, but down on last week. The National Mutton Indicator (NMI) reacted by gaining 22¢ to hit a new record of 503¢/kg cwt. This is the first time the NMI has broken 500¢ (figure 2).

Mutton yardings were also strong relative to last year, but down on last week. The National Mutton Indicator (NMI) reacted by gaining 22¢ to hit a new record of 503¢/kg cwt. This is the first time the NMI has broken 500¢ (figure 2). It seems unlikely lamb or sheep supply is going to improve in the short term, with the tap to turn on sometime in August. What happens from there depends on the season, but we can expect to see price decline fairly rapidly once lambs start to hit the market.

It seems unlikely lamb or sheep supply is going to improve in the short term, with the tap to turn on sometime in August. What happens from there depends on the season, but we can expect to see price decline fairly rapidly once lambs start to hit the market.

As pointed out in

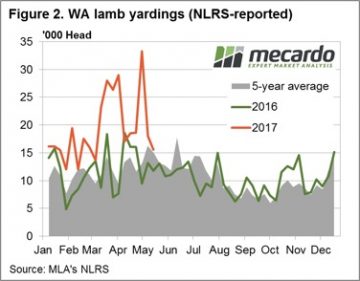

As pointed out in  A different story in the West though with solid prices enough to draw out supply as the pattern of lamb yarding in WA shows so far this season tracking well above the five-year average pattern and the 2016 trend – figure 2. Prices in the West responding in an anticipated to the 78% jump in lamb yardings on the week, fashion according to the laws of economics, with the WA Trade Lamb Indicator (WATLI) down 7.5% to 596¢/kg cwt. The elevated east coast lamb yardings having an impact on the Eastern States Trade Lamb Indicator (ESTLI) too, albeit to a lesser degree than out West, with a slight fall of 1.7% recorded on the week to see it close yesterday at 634¢/kg cwt.

A different story in the West though with solid prices enough to draw out supply as the pattern of lamb yarding in WA shows so far this season tracking well above the five-year average pattern and the 2016 trend – figure 2. Prices in the West responding in an anticipated to the 78% jump in lamb yardings on the week, fashion according to the laws of economics, with the WA Trade Lamb Indicator (WATLI) down 7.5% to 596¢/kg cwt. The elevated east coast lamb yardings having an impact on the Eastern States Trade Lamb Indicator (ESTLI) too, albeit to a lesser degree than out West, with a slight fall of 1.7% recorded on the week to see it close yesterday at 634¢/kg cwt.

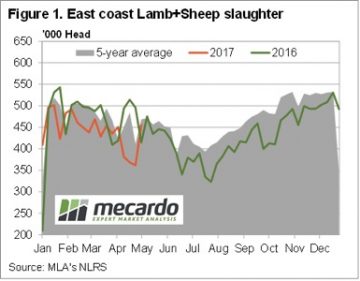

One of the most interesting numbers found this week was MLA’s weekly lamb slaughter for the week ending the 21st of April. Lamb slaughter came in at just 293,342 head, the lowest level since July last year. In the week ending the 21st Lamb slaughter fell 5%, and also sat 5% below the Easter levels of 2016.

One of the most interesting numbers found this week was MLA’s weekly lamb slaughter for the week ending the 21st of April. Lamb slaughter came in at just 293,342 head, the lowest level since July last year. In the week ending the 21st Lamb slaughter fell 5%, and also sat 5% below the Easter levels of 2016. Not all lamb prices fell this week, Merino lambs gained 19¢ on the east coast, while light lambs were up 12¢. Neither quite managed to hit record highs, but are not far off at 611¢ and 673¢/kg cwt for Merino and Light lambs respectively.

Not all lamb prices fell this week, Merino lambs gained 19¢ on the east coast, while light lambs were up 12¢. Neither quite managed to hit record highs, but are not far off at 611¢ and 673¢/kg cwt for Merino and Light lambs respectively.

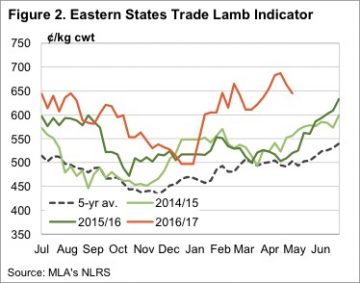

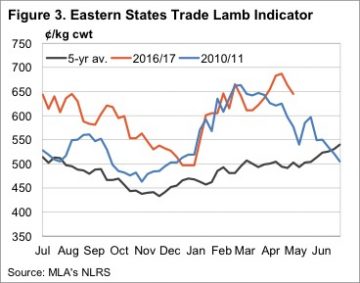

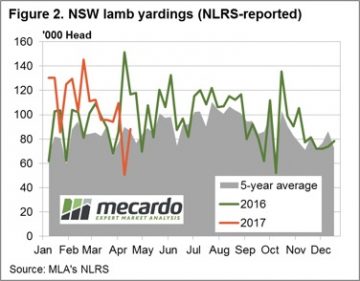

A rebound in East coast yardings post the Easter break, particularly out of NSW, sees the Eastern States Trade Lamb Indicator (ESTLI) take a breather this week. The ESTLI posting a 2.9% drop to 667¢/kg cwt. Not so for National Mutton, bucking the trend with a 1.9% gain to 495¢ – dragged higher by gains to Western Australian sheep.

A rebound in East coast yardings post the Easter break, particularly out of NSW, sees the Eastern States Trade Lamb Indicator (ESTLI) take a breather this week. The ESTLI posting a 2.9% drop to 667¢/kg cwt. Not so for National Mutton, bucking the trend with a 1.9% gain to 495¢ – dragged higher by gains to Western Australian sheep. Despite the higher supply, restocker lambs in NSW and Victoria gaining some ground up 10.4% and 6.6%, respectively. NSW restockers now fetching $119 per head, while Victorian restockers are enjoying a $126 per head level. The higher NSW yardings having most impact on Heavy and Trade lambs in that state down 4.2% (641¢/kg) and 1.4% (656¢/kg), correspondingly. The two softest categories of Victorian lamb for the week were Merino, falling 5.2% to 616¢, and Light lambs, down 3.5% to 660¢. Trade lambs the star performer in SA, the only category of sheep in that state to post a gain this week, up 4.2% to 614¢.

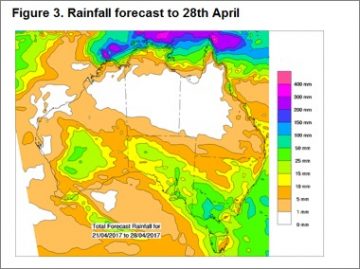

Despite the higher supply, restocker lambs in NSW and Victoria gaining some ground up 10.4% and 6.6%, respectively. NSW restockers now fetching $119 per head, while Victorian restockers are enjoying a $126 per head level. The higher NSW yardings having most impact on Heavy and Trade lambs in that state down 4.2% (641¢/kg) and 1.4% (656¢/kg), correspondingly. The two softest categories of Victorian lamb for the week were Merino, falling 5.2% to 616¢, and Light lambs, down 3.5% to 660¢. Trade lambs the star performer in SA, the only category of sheep in that state to post a gain this week, up 4.2% to 614¢. Another short week ahead with the ANZAC break and some decent rainfall to much of the sheep regions of the nation (figure 3) should see prices hold, or perhaps firm slightly. As outlined in the sheep/lamb analysis piece this week longer term fundamentals will continue to support any price dips seen in sheep and lamb markets for much of the current season.

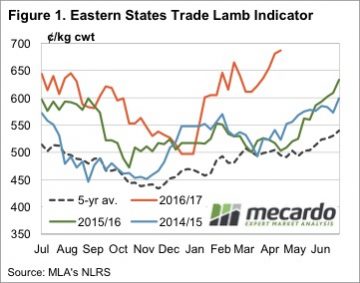

Another short week ahead with the ANZAC break and some decent rainfall to much of the sheep regions of the nation (figure 3) should see prices hold, or perhaps firm slightly. As outlined in the sheep/lamb analysis piece this week longer term fundamentals will continue to support any price dips seen in sheep and lamb markets for much of the current season. The pace of the rally in the Eastern States Trade Lamb Indicator (ESTLI) slowed this week, but it still went up. The ESTLI finished Wednesday at 687¢/kg cwt (figure 1). While the stronger prices of the last month might have something to do with a demand spike, it’s more likely to be underlying tight supply supporting values.

The pace of the rally in the Eastern States Trade Lamb Indicator (ESTLI) slowed this week, but it still went up. The ESTLI finished Wednesday at 687¢/kg cwt (figure 1). While the stronger prices of the last month might have something to do with a demand spike, it’s more likely to be underlying tight supply supporting values. Driving MLA’s figures were results from the February MLA/AWI survey with the key figures being 34% of producers intending to increase flocks, and 59% intending to maintain. Of those intending to increase the flock, 56% are going to retain more replacement ewes. This basically means that of the fewer lambs born in 2016 and 2017, fewer are going to be available for slaughter.

Driving MLA’s figures were results from the February MLA/AWI survey with the key figures being 34% of producers intending to increase flocks, and 59% intending to maintain. Of those intending to increase the flock, 56% are going to retain more replacement ewes. This basically means that of the fewer lambs born in 2016 and 2017, fewer are going to be available for slaughter.