The three-week recess seemed to create pent up demand from the processors, with the larger offering and stronger A$ unable to dampen competition – the wool market had a good week. AWEX reported that buyers were bidding strongly from the outset to fill orders secured over the break.

The three-week recess seemed to create pent up demand from the processors, with the larger offering and stronger A$ unable to dampen competition – the wool market had a good week. AWEX reported that buyers were bidding strongly from the outset to fill orders secured over the break.

As Mecardo reported in the last sale report prior to the market recess, demand is good and with growers seemingly selling as soon as wool hits the stores any improving demand will construe to create increased competition on the auction floor. This theme certainly continued this week.

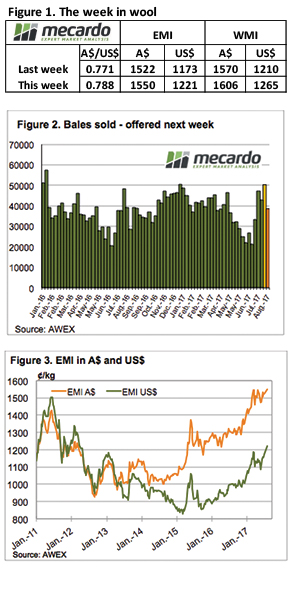

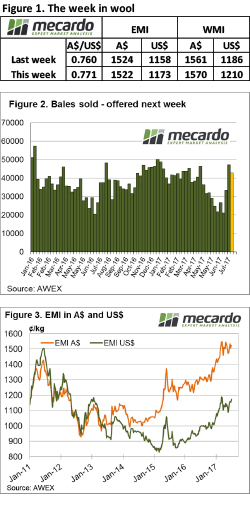

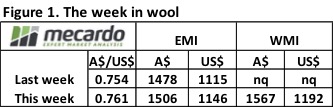

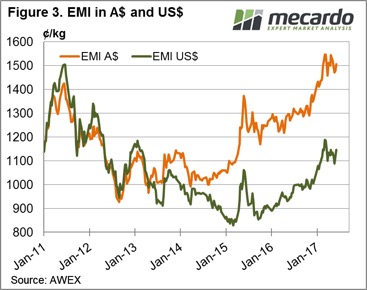

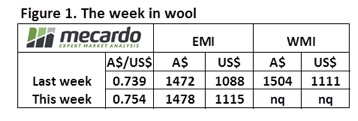

The EMI rallied A$0.28, the WMI improved A$0.36 while in US$ terms the EMI increase of US$0.48 was significant.

While all MPG’s improved, it was the 19.5 MPG and broader that performed strongest including X Bred types. The 28 MPG is back above 800 cents for the first time in 12 months while it was September last year when the 30 MPG closed above the current 614 cents.

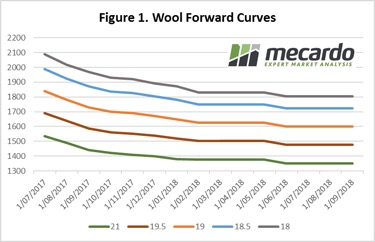

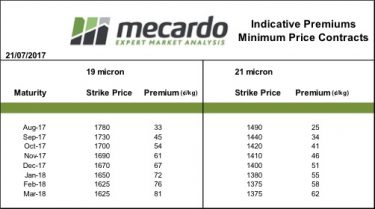

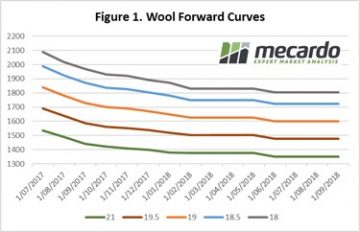

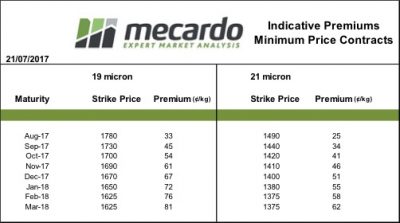

This strong auction market translated into strong bidding on the Wool Forward market with growers stepping in to secure good forward cover for the remainder of 2017, and trades secured into 2018.

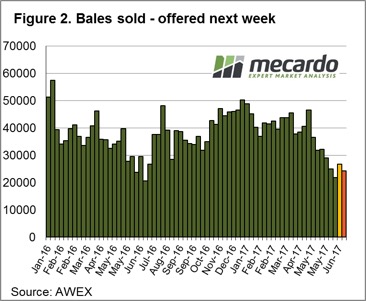

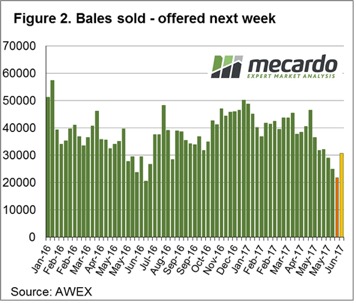

With a larger offering (on top of a big offering pre-recess) and a season low pass-in rate of 3.9% (season average 6.3%), 50,300 bales were cleared to the trade. This is an outstanding result compared to recent sales patterns; the last time 50k bales were sold was in December 2016, and then you need to go back to January 2016 to see more than this number sold.

There was one negative in the market; the cardings indicators in all centres retreated against the general market trend to post. A small offering in Fremantle held the market steady, however in Sydney & Melbourne the Carding indicator lost 40 & 23 cents respectively.

The week ahead

The result this week gives confidence for the week ahead, and with the A$ seemingly having peaked we should see another strong result with all centres selling.

The smaller offering is a portent of things to come with less than 40k bales rostered per week over the next three weeks; this should assist the market to at least retain current levels.

Considering the finale is always the main event, we’ve focused this market review on the last week of the season (July 10th 2017). Table 1 compares the average market price for the last week of the 2016-17 year for Northern, Southern and Western market regions to that of the previous year. The closing market clearly favoured the fine microns this year with a price jump at an average of 34% across the 16.5 to 19 micron range for the Eastern markets and 24% for the West.

Considering the finale is always the main event, we’ve focused this market review on the last week of the season (July 10th 2017). Table 1 compares the average market price for the last week of the 2016-17 year for Northern, Southern and Western market regions to that of the previous year. The closing market clearly favoured the fine microns this year with a price jump at an average of 34% across the 16.5 to 19 micron range for the Eastern markets and 24% for the West. By comparison, the mid and coarse fibre market on the West Coast remained fairly stagnant, landing nearly right back where it ended 12 months ago. The market price was on average just 10c higher than last year for fibres above 19.5 micron.

By comparison, the mid and coarse fibre market on the West Coast remained fairly stagnant, landing nearly right back where it ended 12 months ago. The market price was on average just 10c higher than last year for fibres above 19.5 micron.

It seems wool growers are selling as soon as the wool is shorn, with another large offering coming forward. Despite this, the market performed well despite receiving no help from a rising A$. AWEX report that W.A.’s unseasonaly dry weather has seen growers bringing forward shearing causing the increase in supply this week.

It seems wool growers are selling as soon as the wool is shorn, with another large offering coming forward. Despite this, the market performed well despite receiving no help from a rising A$. AWEX report that W.A.’s unseasonaly dry weather has seen growers bringing forward shearing causing the increase in supply this week.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

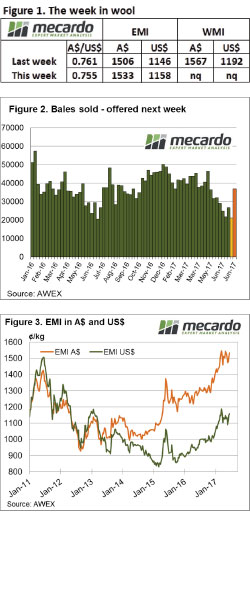

The fragility of the wool market was evident this week in what was the final sale for the financial year where increased supply (Fremantle back selling again) and a rising A$ pushed all types lower however, the strong Crossbred types showed some resilience. The EMI shed some weight nearing 1500¢, down 26¢ to 1507¢ and also falling a more modest 4US¢ to 1154US¢.

The fragility of the wool market was evident this week in what was the final sale for the financial year where increased supply (Fremantle back selling again) and a rising A$ pushed all types lower however, the strong Crossbred types showed some resilience. The EMI shed some weight nearing 1500¢, down 26¢ to 1507¢ and also falling a more modest 4US¢ to 1154US¢.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

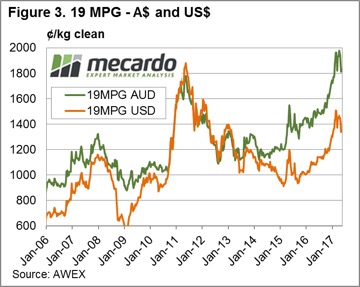

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢. Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level. The week ahead

The week ahead Australian Wool Innovation has stated it will progress with its Wool Exchange Portal (WEP) beyond the scoping stage and is now moving to the “discovery stage” where the portal is built. Expected industry benefits are $38 million over the first 15 years. In this article Mecardo puts this expected benefit into perspective.

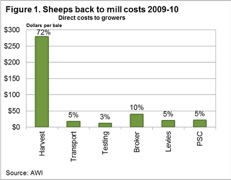

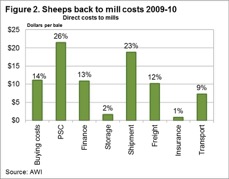

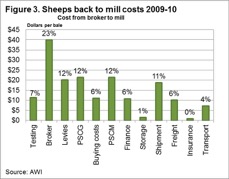

Australian Wool Innovation has stated it will progress with its Wool Exchange Portal (WEP) beyond the scoping stage and is now moving to the “discovery stage” where the portal is built. Expected industry benefits are $38 million over the first 15 years. In this article Mecardo puts this expected benefit into perspective. Costs incurred by growers after the wool has been delivered to store (excluding shearing and delivery to store costs) were $72 per farm bale in 2009-10. Figure 2 shows a breakup of the costs associated with purchasing wool (direct costs to mill) in Australia which totalled $75 per farm bale in 2009-10. In total it cost $175 per farm bale to sell wool in 2009-10, through a system with no counterparty risk.

Costs incurred by growers after the wool has been delivered to store (excluding shearing and delivery to store costs) were $72 per farm bale in 2009-10. Figure 2 shows a breakup of the costs associated with purchasing wool (direct costs to mill) in Australia which totalled $75 per farm bale in 2009-10. In total it cost $175 per farm bale to sell wool in 2009-10, through a system with no counterparty risk. In Australia in 2017, around 1.5 to 1.6 million farm bales will be sold annually through the auction system. In May the average gross value per bale was $1670. For the past three years the average gross value per bale sold has been $1411.

In Australia in 2017, around 1.5 to 1.6 million farm bales will be sold annually through the auction system. In May the average gross value per bale was $1670. For the past three years the average gross value per bale sold has been $1411.

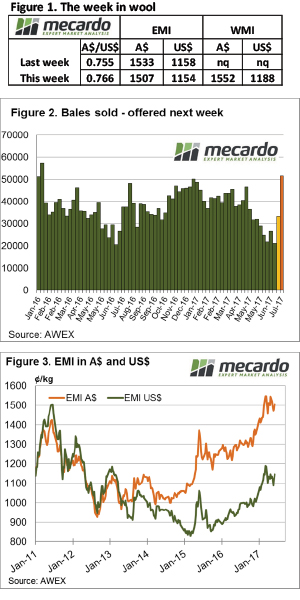

Normal market drivers and influences were turned on their head this week. On Wednesday, the A$ fell and so did the market, while on Thursday the market rallied with the A$ ending the week up by almost US$0.015 cents.

Normal market drivers and influences were turned on their head this week. On Wednesday, the A$ fell and so did the market, while on Thursday the market rallied with the A$ ending the week up by almost US$0.015 cents.  To compare with the same period last year, wool sales; more specifically “clearance to the trade”, are on average 4,000 bales per week lower.

To compare with the same period last year, wool sales; more specifically “clearance to the trade”, are on average 4,000 bales per week lower. The opportunity for wool growers is to apply a strategic approach to sales; that is use the wool broker to identify types that are selling well as well as types that are over supplied or lacking demand; and then sell or hold back as your situation allows. The recent market activity shows that a weak market one week is quickly replaced by a rally. It is also a time to have any unsold wool listed on Wool Trade where buyers can access if required.

The opportunity for wool growers is to apply a strategic approach to sales; that is use the wool broker to identify types that are selling well as well as types that are over supplied or lacking demand; and then sell or hold back as your situation allows. The recent market activity shows that a weak market one week is quickly replaced by a rally. It is also a time to have any unsold wool listed on Wool Trade where buyers can access if required.