This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market.

This time of year, has typically been one of great volatility as the northern hemisphere commences harvest. This can easily be seen in the current market, where the weather is the major driver. The market stays on a knife edge, where every new piece of information is propelling the market.

The past week has been quite exciting in the grain market. The USDA release weekly crop condition reports, which has shown the lowest good/excellent condition since 2006 at 45%. This in combination with continued poor weather across the US has led to all futures contracts experiencing strong rallies of around 2-4% (figure 1).

The fear in the marketplace is largely centred around high protein wheats, due to deteriorating crop condition of spring wheat. This can be seen clearly in the ascent of the spread between the CME soft red winter wheat (SRW) and MGEX hard red winter wheat (HRW). The HRW contract is high protein with protein specs of 13%. In the past two months, the spread has increased dramatically (figure 2) to 180¢/bu on the spot contract. If there is a shortage of protein around the world, this could be some stronger local premiums for export protein.

In the past week, the WASDE and ABARES crop reports were released, however had little in the way of surprises. They do however each contain positive insights, and are discussed in more details on the following links:

Global wheat stocks have fallen and risen

The average ABARES

At a local level, the dry weather continues to paint a bleak picture for much of the country especially SA/WA. This has resulted in continued strength of APW basis levels in Adelaide & Port Lincoln (figure 3), which since harvest have remained quite stagnant.

Next Week

The US crop condition report is released this weekend. I wouldn’t be surprised to see spring crop conditions deteriorate further.

The recent rally has provided some good pricing opportunities to capture some strong basis around the country. It is worthwhile to consider your marketing options, one of which could be the sale of physical and the purchase of call options to continue to have exposure to the futures market.

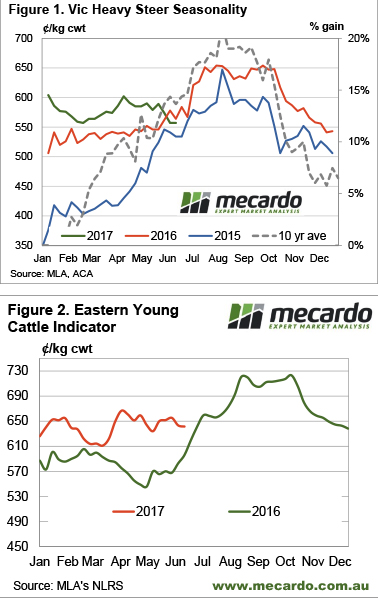

It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices.

It doesn’t matter how tight cattle supply is, beef still lies on a demand curve, where consumers will eat less beef as prices rise. While Australian beef prices are largely governed by export markets, the domestic consumer is still our largest single market for beef. This week we take a look at the latest retail meat values, and what this might mean for cattle prices. It hasn’t happened to the Eastern Young Cattle Indicator (EYCI) yet, but we have a few slaughter categories which have moved below year ago levels. It’s been a while since producers were getting less money than the year before, in fact it’s been three years, but is anyone complaining?

It hasn’t happened to the Eastern Young Cattle Indicator (EYCI) yet, but we have a few slaughter categories which have moved below year ago levels. It’s been a while since producers were getting less money than the year before, in fact it’s been three years, but is anyone complaining?

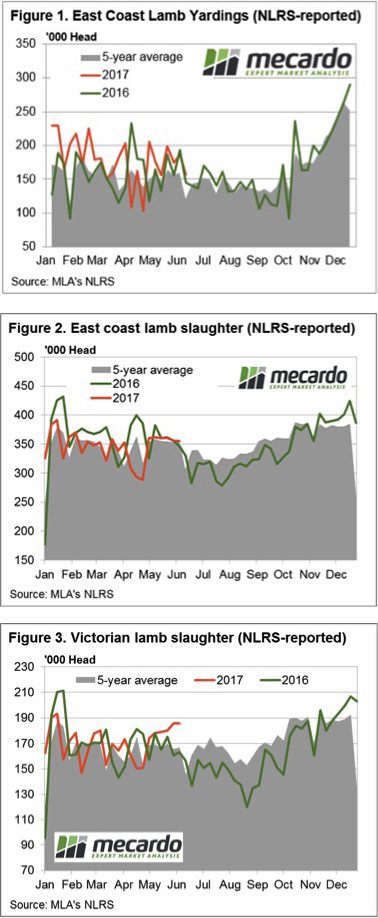

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

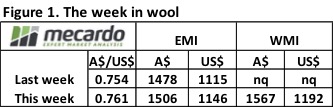

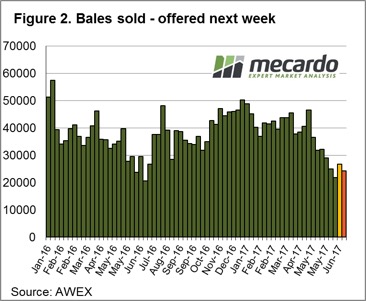

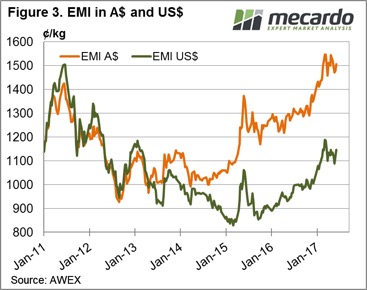

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢. Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level. The week ahead

The week ahead