There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

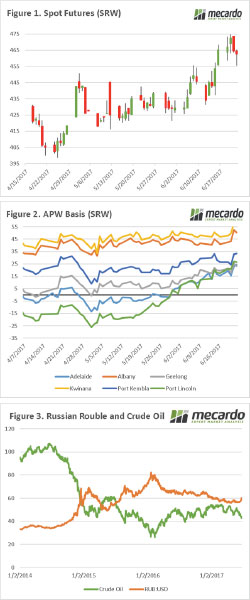

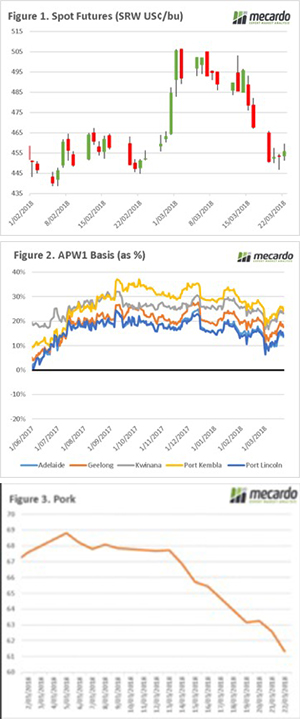

There has been a welcome (for sellers) rally in the wheat futures over the past fortnight (figure 1), as a result of weather woes in the US. Overnight however the market performed a partial flip and dropped around 2%. The trade will be watching the weather with close eyes, especially as Russian crops look to again be in good condition. This factor, combined with a depreciating rouble (more on that later), is likely be putting some caps on futures for the next few days.

At a local level, there are still major concerns about the coming harvest which has led to a substantial rise in pricing. This has especially been seen with continuing strengthening in basis in Adelaide & Port Lincoln (figure 2).

In addition to supply concerns for the coming season, the growers are not surprisingly reluctant sellers. This has led to the market paying up to acquire some cover, however we need to be aware that if the concerns start to be alleviated, then the interest from the trade may diminish. There is still a long way to go until harvest, and we shouldn’t write off the crop at the end of June.

As we all know, foreign exchange plays a factor in commodity trading. The Russian economy is largely dependent on oil revenues, and is also a major competitor for Australian wheat. In figure 3, we have charted the Rouble against the US$, and the price of crude oil since early 2014. This period has seen a reduction in crude oil prices, which has led to a weakening of the Rouble, the correlation between the two is almost perfect at -0.96.

The oil price in recent weeks has started to slide again, and the market remains bearish which has resulted in a further deterioration in the Rouble. If the fall in oil continues, then by proxy Russian wheat will become more competitive on the market.

Next Week

Like a broken record, the trade will largely be concerned with weather events in the northern hemisphere. As the days flow, any weather risk premium in the market will lessen unless we see some major production failures.

We still have to keep into account that even when excluding Chinese wheat stocks, the world still has considerable supplies.

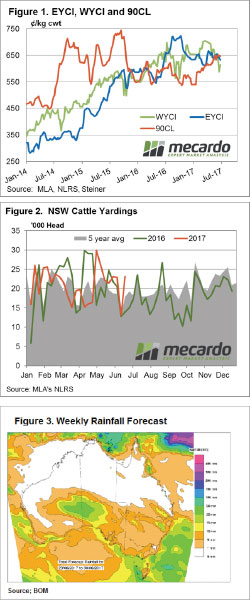

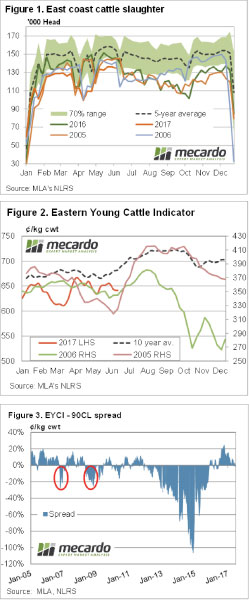

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.

A good recovery staged by Queensland across the board, while NSW disappoints… no I’m not talking about the State of Origin – although the phrase fits there too! Actually, it’s the cattle market this week. Despite the national market indicators posting largely flat results, with weekly moves of less than 2% either way some state based indicators saw more substantial action.  Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

Whether or not you believe the Bureau of Meteorology (BOM) three month forecast, there is always the chance the current dry spell could continue. Dry winter’s and springs are not great for cattle prices, but given the current historically strong values, how bad could it get?

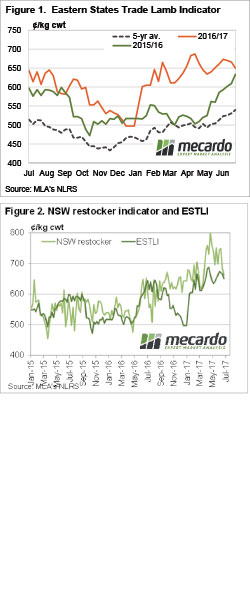

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Again, the occasional, yet extreme demand for wool with good measurements (low mid breaks & good tensile strength) contributed to a mixed message out of this week’s wool market. The better types pushed the overall market to new levels while lower style wool battled to keep pace.

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this.

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this. In early July we recommended the use of a Dec’18 Chicago swap in our article ‘

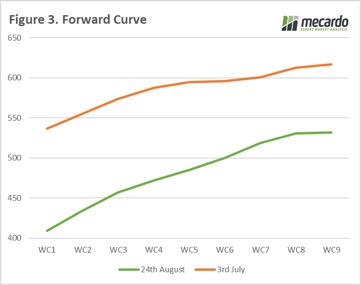

In early July we recommended the use of a Dec’18 Chicago swap in our article ‘ The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.

The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.