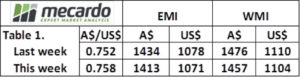

The good news for the wool market continued; again, it was the fine wool that was the stand-out and led the market. Sydney had a designated fine wool sale; this came at the perfect time for NSW fine wool growers resulting in the Merino fleece and skirtings component having an almost total clearance with only 1.6% Passed In, compared to the national PI rate of 6.7%. The EMI was up A$0.15, while in US$ terms it was 9 cents better.

The good news for the wool market continued; again, it was the fine wool that was the stand-out and led the market. Sydney had a designated fine wool sale; this came at the perfect time for NSW fine wool growers resulting in the Merino fleece and skirtings component having an almost total clearance with only 1.6% Passed In, compared to the national PI rate of 6.7%. The EMI was up A$0.15, while in US$ terms it was 9 cents better.

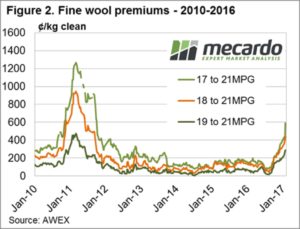

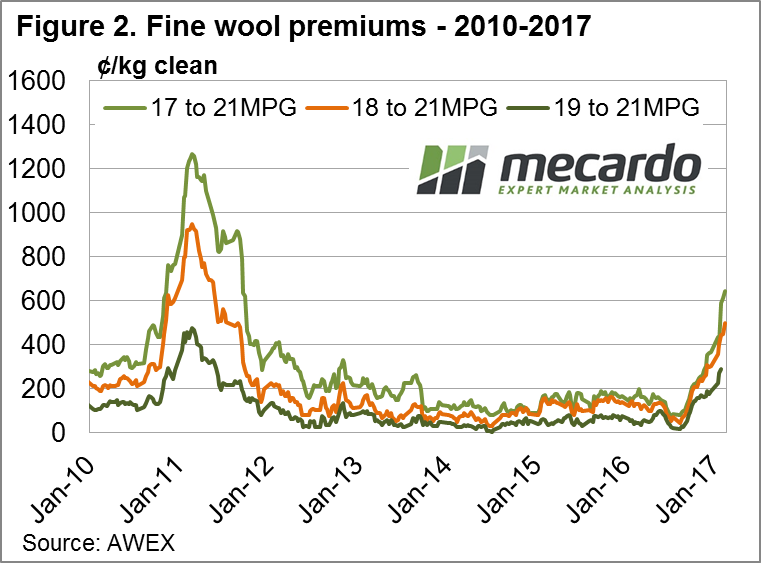

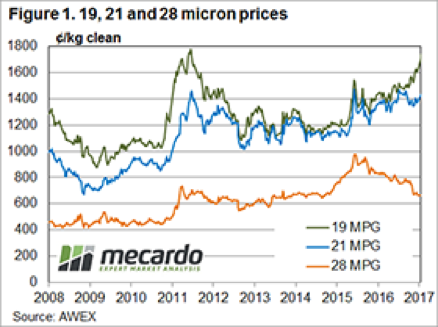

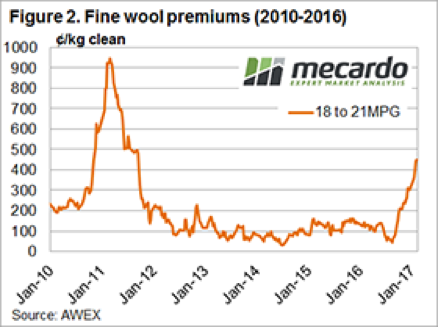

The premium for fine wool continues to grow, in Melbourne 18 MPG is 500 cents over the 21 MPG, while the Sydney catalogue reported a 550-cent premium due to a generally sounder offering.

The last time 18MPG basis was at this level was July 2011 (Fig 2). Of further note is that in July 2016 (last year) it was quoted in Melbourne at 52 cents. Is that a 900% increase in less than 12 months?

The last time 18MPG basis was at this level was July 2011 (Fig 2). Of further note is that in July 2016 (last year) it was quoted in Melbourne at 52 cents. Is that a 900% increase in less than 12 months?

Of the 44,400 bales offered, 41,500 were sold into a market where all but the coarse X Bred types improved on last week’s price levels.

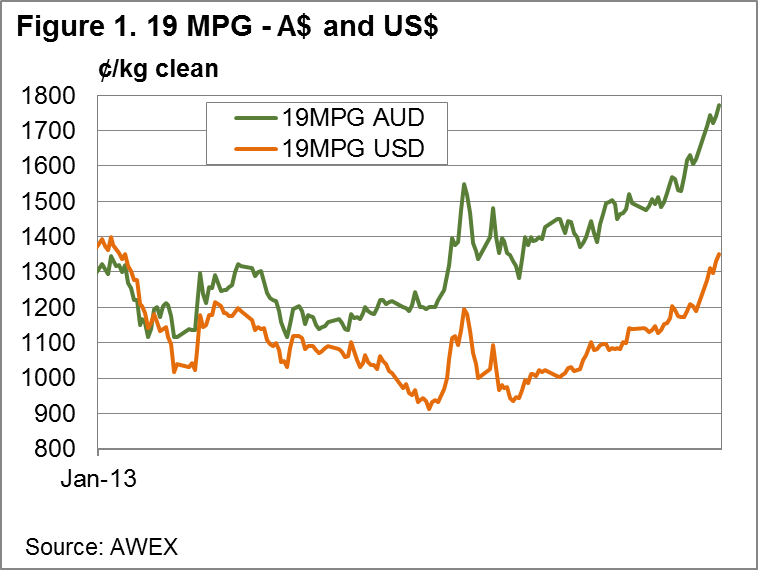

were also good traded levels on Riemann concentrating on the 19 MPG contract with 1700 cents for the winter maturity and 1640 out to September. As one grower noted, “Sales above $2,000 per bale are now available out to December and we have sold plenty below this level in the past 5 years, so hedging a percentage of the next clip makes sense even if we think the market outlook is bullish!”.

This week Mecardo had a look at wool volumes, with the “Some up, some down” article reporting Auction data for merino combing wool showing a continued swing to the broader half of the merino distribution with 21 micron auction volumes up by 34% for the past three months.

Understanding what this observation means to the future for wool was helped when the subsequent article was published looking at how the main competitors to wool were placed regarding price.

The average merino micron price in US dollar terms continues to outperform the major apparel fibres. However, price forecasts for cotton and manmade fibres in 2017 point to their rolling five year ranks easing. It is easy enough to envisage finer micron merino prices continuing to outperform due to lower supply but broader merino categories will have increased supplies coming onto the market which will make continued outperformance difficult.

The week ahead

The combination of a stronger market both in US$ and A$ terms alongside lower Pass-In rates points to a growing demand from processors. This is also fuelled by the expectation of tighter supply for fine wool going forward; all this leads to a strong level of confidence for the near term.

Next week Melbourne is selling over three days with Fremantle and Sydney on Wednesday & Thursday. The strong market has enticed some additional volume to the market with 47,500 bales listed for next week, however forward projections for the following weeks trail off to 43,000 and 40,000.

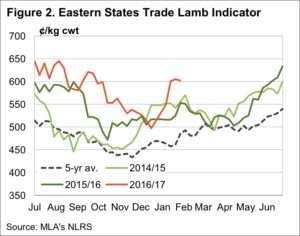

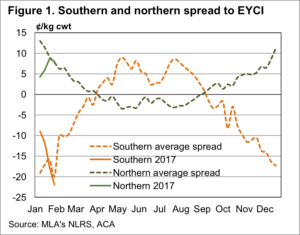

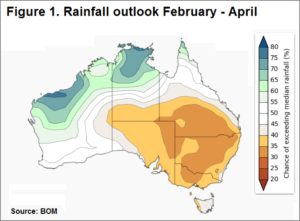

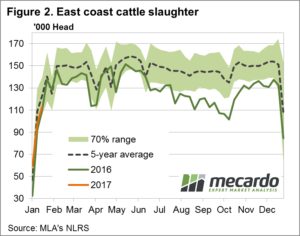

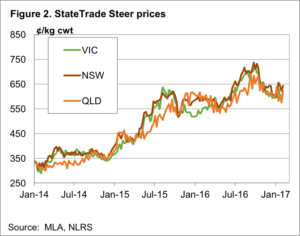

ements suggest this will again be the case, so what does this mean for pricing over the coming months.

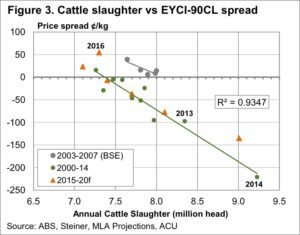

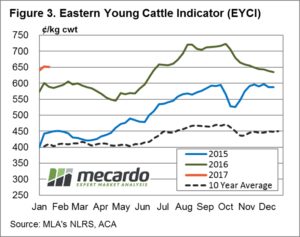

ements suggest this will again be the case, so what does this mean for pricing over the coming months. More interesting is what happens from there with the southern spread to the EYCI. Over February, March and April, the southern discount becomes a premium, as the supply of grass finished cattle tightens, as grass supply wanes.

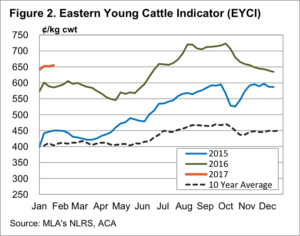

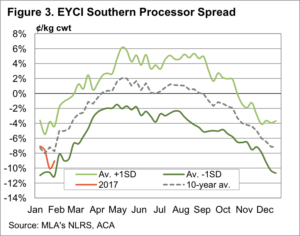

More interesting is what happens from there with the southern spread to the EYCI. Over February, March and April, the southern discount becomes a premium, as the supply of grass finished cattle tightens, as grass supply wanes. It young cattle destined for slaughter, or trade steers and heifers, which are set to benefit the most over the coming months. Figure 3 shows that young cattle sold to processors improve 8% over the late summer and autumn. From the current level of 595¢/kg cwt, a narrowing of the discount to parity, would see the price reach 630-640¢/kg cwt. Prices haven’t been this good since October.

It young cattle destined for slaughter, or trade steers and heifers, which are set to benefit the most over the coming months. Figure 3 shows that young cattle sold to processors improve 8% over the late summer and autumn. From the current level of 595¢/kg cwt, a narrowing of the discount to parity, would see the price reach 630-640¢/kg cwt. Prices haven’t been this good since October.

The response from three wool brokers this week when asked about the wool market was unanimous – it’s extremely good if you have wool 19 micron and finer, its good if you are in the “bread and butter” 20 to 22 micron range, and it’s terrible if you have crossbred types. This reinforces the concept that the wool market is not homogenous, it’s made up of a variety different markets.

The response from three wool brokers this week when asked about the wool market was unanimous – it’s extremely good if you have wool 19 micron and finer, its good if you are in the “bread and butter” 20 to 22 micron range, and it’s terrible if you have crossbred types. This reinforces the concept that the wool market is not homogenous, it’s made up of a variety different markets. Fine wool has finally come out of the shadows and remerged to show good premiums over the mainstream types, the concern with the trade now is that this incentive for fine wool producers to continue with this specialty product has come too late for some. The fine wool premium as shown in Fig 2, identifies that the 18 premium over 21 MPG is now at a record not seen since September 2011

Fine wool has finally come out of the shadows and remerged to show good premiums over the mainstream types, the concern with the trade now is that this incentive for fine wool producers to continue with this specialty product has come too late for some. The fine wool premium as shown in Fig 2, identifies that the 18 premium over 21 MPG is now at a record not seen since September 2011

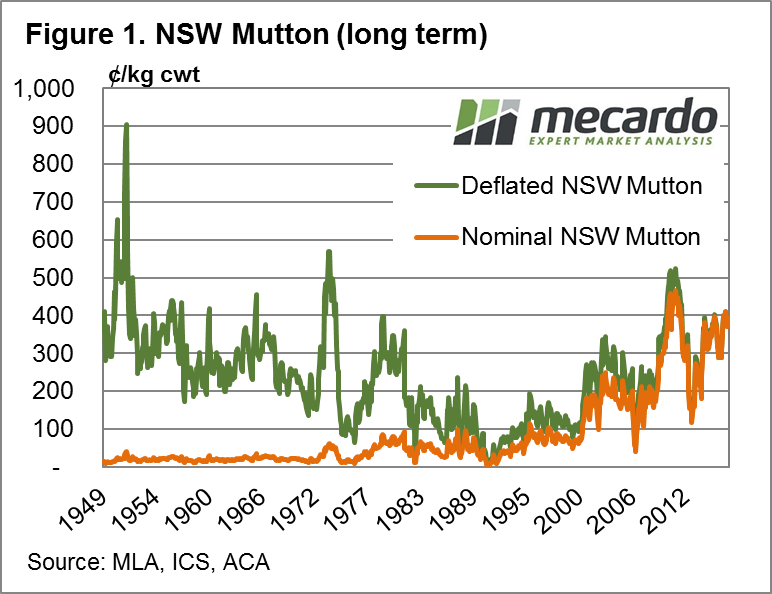

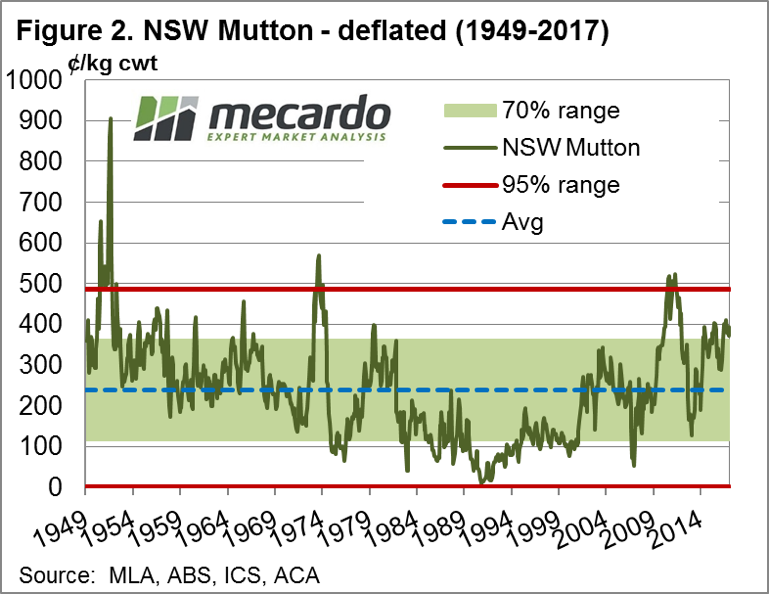

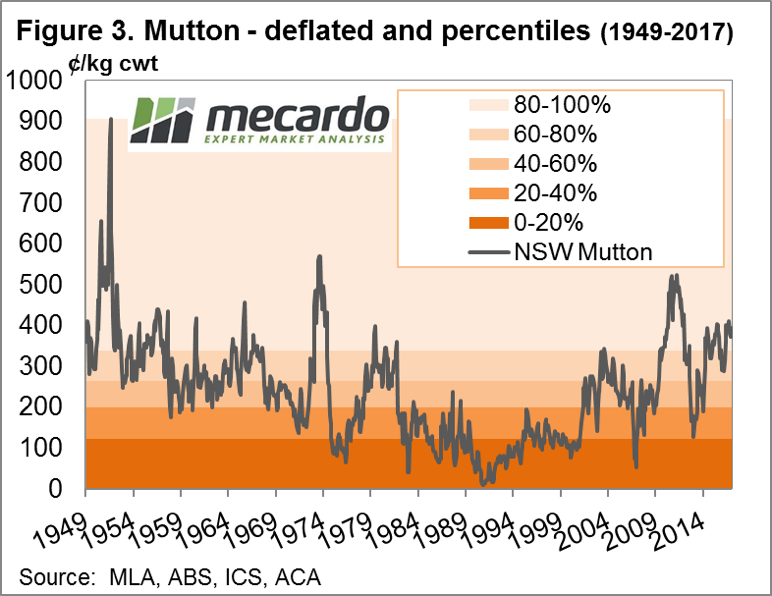

in deflated terms (current day dollars) occurred during April 2011 at 523¢/kg cwt

in deflated terms (current day dollars) occurred during April 2011 at 523¢/kg cwt

price series overlaid with percentile ranges which shows that the current average monthly NSW mutton price has remained in the 80-100th percentile range since April 2016. Unquestionably, mutton prices are holding firm with the January average of 394¢ sitting at the 90th percentile when compared to the deflated price data series since 1949.

price series overlaid with percentile ranges which shows that the current average monthly NSW mutton price has remained in the 80-100th percentile range since April 2016. Unquestionably, mutton prices are holding firm with the January average of 394¢ sitting at the 90th percentile when compared to the deflated price data series since 1949.

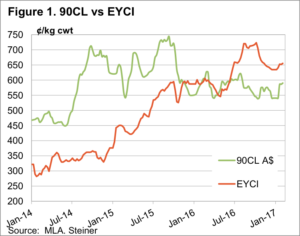

ood for us if McDonalds sell more burgers in the US.

ood for us if McDonalds sell more burgers in the US.