At the end of sales for 2016, we noted that the wool market had

finished in line with its performance over the year, solid, firm and

resilient. There was generally a feeling of confidence, but the open

to 2017 was well above expectation. The market this week opened

strongly and then just got better.

The week started in Melbourne on Tuesday where the initial price

rises were led by the fine wool, and when Sydney joined in it had to

catch up with the early market quote reporting 18 MPG up 100 cents

compared to the last sale in Sydney of 2016.

This was a large offering, the 48,808 bales sold was 10,000 above

the average weekly clearance for 2016.

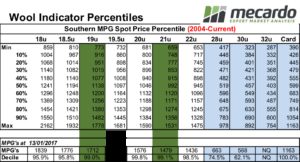

By the end of the week, the EMI had jumped 67 cents to be at its

highest level for 5 years and within 3 cents of its all-time high in

2011 (Fig 1). In A$ terms it sat at 1422, exactly 140 cents above the

level for the first sale in 2016. In US$ terms it’s at 1061, well above

the comparative year ago, level of 890. These are strong signals that

demand is improving. Percentiles are telling the story, with all types

except Crossbreds at the 95% level or better. (Table 1)

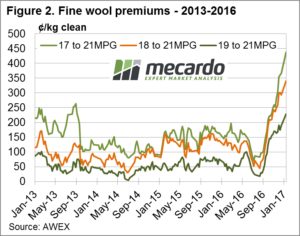

In the Mecardo report this week by Andrew Woods, Wool supply

update, the seasonal effect is starting to become obvious with the

good general spring conditions translating into the clip moving

broader. This is taking pressure off fine wool prices, in fact there

is now evidence of buyers

concern with this end of the market keenly sought out this week.

The micron movement of the clip will be most keenly felt in the sub 19

MPG which is reducing in volume, and the 20 microns and broader

which is increasing. This trend has further to run, even without further

rain for the next couple of months the path is set; the clip will continue

to move broader. As a result, the fine wool premium is likely to continue

to improve, resulting in higher fine wool prices providing that medium

wool categories can at least hold at these levels (Fig 2).

Crossbred types missed out on the general price rally and continued to

struggle, on the other hand the 30 – 40 cent lift in the Cardings indicator

pushed all 3 centres indicators to record levels.

The Week Ahead

Another big offering of 55,000 bales listed for next week, and based

on this week’s sales we expect that only crossbred producers will be

doubtful of turning up to sale. So, a big offering, however those we

have spoken to in the trade are not seeing this as a temporary spike,

and while not expecting to see the gains of this week repeated note

that the tight pipeline supply is keeping orders flowing at these levels.

The wool trade is also aware that listed bales for sale quickly drop

back to 40,000 per week.