The grain market continues to consolidate over the past week, after the large rise early in the month on the back of the Kansas snow event. There are some small glimmers of hope which are starting to crack through the bearish wall, and lend some support to prices.

The grain market continues to consolidate over the past week, after the large rise early in the month on the back of the Kansas snow event. There are some small glimmers of hope which are starting to crack through the bearish wall, and lend some support to prices.

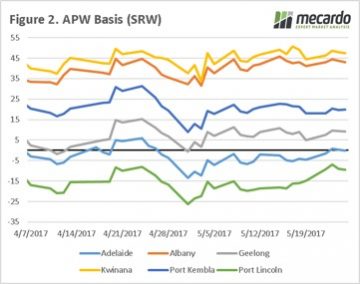

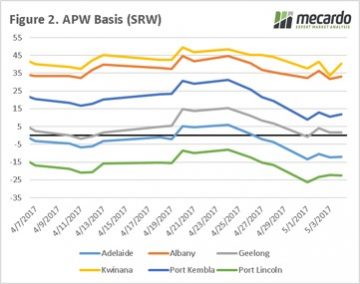

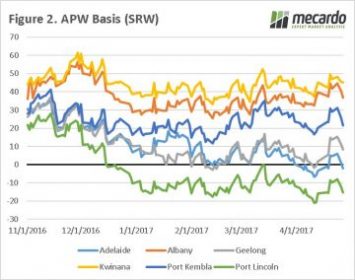

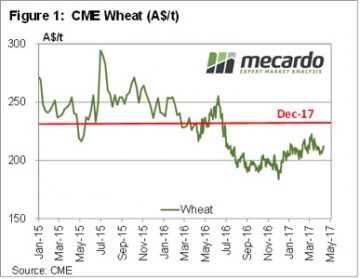

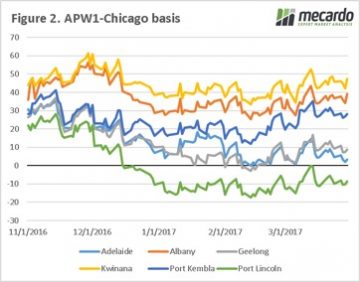

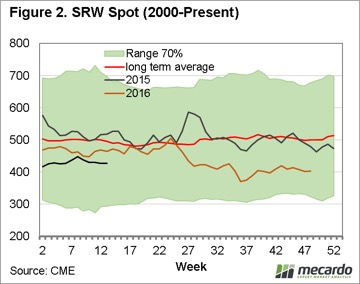

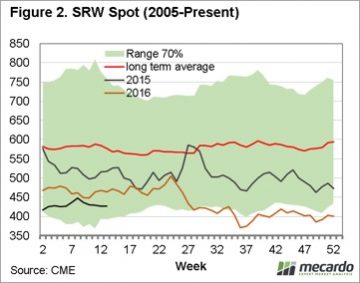

Firstly, let’s have a look at futures. Late last week we saw a 10¢/bu rise (fig 1), however as we moved through the week half the gains were lost. At a local level basis around country moved very little (fig 2), and in the past week there was little grower selling as most farmers are pre-occupied with seeding. All in all, not very exciting in pricing.

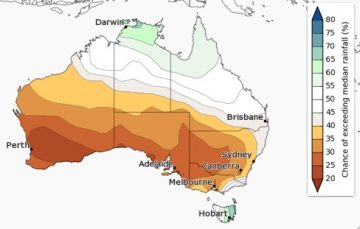

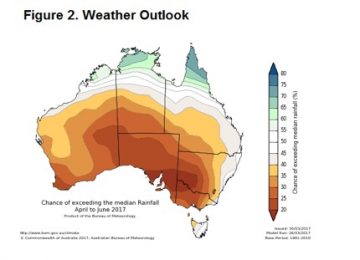

At the moment, we think that we are close to the floor of the market and downside is quite limited. There are a number of weather woes around the world with the possibility of drought across the parts of the northern plains of the US. Locally it is increasingly looking like conditions will be dry over the next three months.

At the moment, we think that we are close to the floor of the market and downside is quite limited. There are a number of weather woes around the world with the possibility of drought across the parts of the northern plains of the US. Locally it is increasingly looking like conditions will be dry over the next three months.

The BOM released their climate outlook summary which points towards a drier SA & WA (see map), which has already been experiencing dry conditions with many dry seeding. After having spoken to a number of farmers and consultants, it seems that the EP is in the worst condition and needs rain soon to get things going.

The International Grain Council released their monthly crop forecasts, reducing global end stocks for 2017/18 down 2mmt. This is largely insignificant; however, corn was reduced by 34mmt on the back of increased demand, which will help with sorghum and barley pricing if forecasts are accurate.

The International Grain Council released their monthly crop forecasts, reducing global end stocks for 2017/18 down 2mmt. This is largely insignificant; however, corn was reduced by 34mmt on the back of increased demand, which will help with sorghum and barley pricing if forecasts are accurate.

What does it mean

The main focus for farmers this week will be keeping an eye on the heavens. We are well into the weather market and although global stocks are still exceptionally high there are still the opportunities for spikes in pricing.

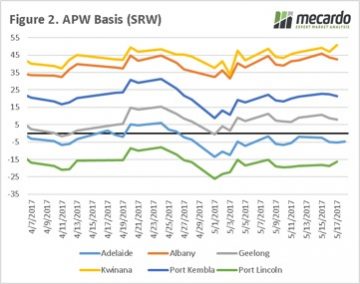

This week the wheat market was largely quiet (figure 1) with a lack of fresh news, there are still continuing concerns in Kansas, however the worries have switched from snow to excess waterlogging. In the coming weeks, we will start to gain more clarity. At a local level basis levels were fairly static with the exception of small increases in Port Lincoln and Kwinana (figure 2). Particularly in Port Lincoln, where there are concerns about lack of moisture for seeding, and with it looking increasingly likely they will miss any falls this weekend.

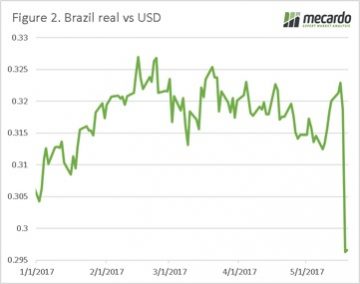

This week the wheat market was largely quiet (figure 1) with a lack of fresh news, there are still continuing concerns in Kansas, however the worries have switched from snow to excess waterlogging. In the coming weeks, we will start to gain more clarity. At a local level basis levels were fairly static with the exception of small increases in Port Lincoln and Kwinana (figure 2). Particularly in Port Lincoln, where there are concerns about lack of moisture for seeding, and with it looking increasingly likely they will miss any falls this weekend. The scandal has reached the top tier of the government with President Michel Temer being placed under investigation for alleged payments of to keep witnesses quiet. All in all, it’s a messy situation which has impacted the Real (figure 3) which plummeted against the US dollar a whopping 7%.

The scandal has reached the top tier of the government with President Michel Temer being placed under investigation for alleged payments of to keep witnesses quiet. All in all, it’s a messy situation which has impacted the Real (figure 3) which plummeted against the US dollar a whopping 7%. What does this mean?

What does this mean?

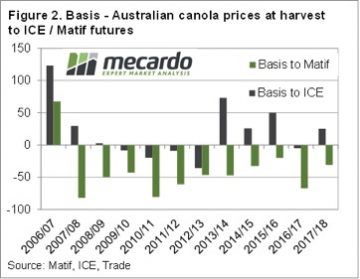

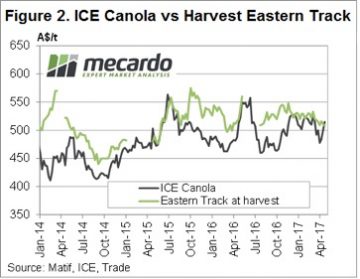

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola.

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola. Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “ This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected.

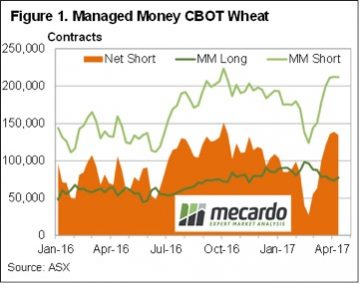

This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected. We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

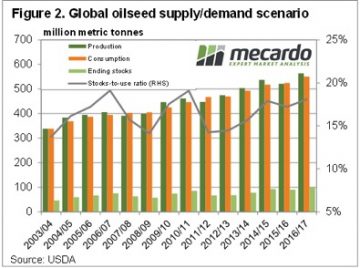

(2.6bn mt) for 2016/17, and old crop end stocks will largely cancel out lower production in the 2017/18 season. Our view still remains the same that a large supply shock is required to put fire under wheat prices to an excitable level.

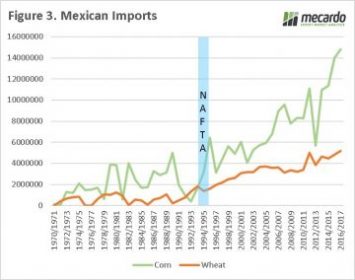

(2.6bn mt) for 2016/17, and old crop end stocks will largely cancel out lower production in the 2017/18 season. Our view still remains the same that a large supply shock is required to put fire under wheat prices to an excitable level. ready to scrap the North America free trade agreement (NAFTA), however it was later announced that there would a ‘renegotiation’. Free trade agreements were at the centre of Trumps campaign, with fears that they negatively impacted on American jobs. The removal of NAFTA would be a worry for American grain growers, as trade with Mexico has drastically increased since 1994 when it was enacted (figure 3). The overwhelming majority of imports are from the US but in recent months it is speculated that Mexican buyers have been examining options from the South (Argentina & Brazil).

ready to scrap the North America free trade agreement (NAFTA), however it was later announced that there would a ‘renegotiation’. Free trade agreements were at the centre of Trumps campaign, with fears that they negatively impacted on American jobs. The removal of NAFTA would be a worry for American grain growers, as trade with Mexico has drastically increased since 1994 when it was enacted (figure 3). The overwhelming majority of imports are from the US but in recent months it is speculated that Mexican buyers have been examining options from the South (Argentina & Brazil). Earlier this week we took a look at some of the production data US wheat markets take note of, and there is also some data which shows how traders react. The CFTC Traders Summary tells us what type of trader holds long or short positions in CBOT wheat.

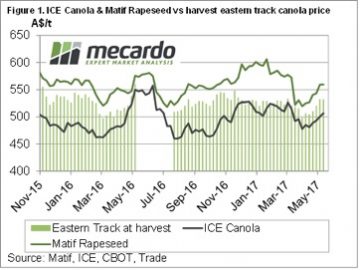

Earlier this week we took a look at some of the production data US wheat markets take note of, and there is also some data which shows how traders react. The CFTC Traders Summary tells us what type of trader holds long or short positions in CBOT wheat. Canola has found some strength in Canada this week as wet weather delays sowing. The spot ICE contract rallied over $30 to $520/t, while Jan-18 gained $15 to sit at $497/t today. With the weather forecast not looking favourable for sowing, there could be some more upside for Canola.

Canola has found some strength in Canada this week as wet weather delays sowing. The spot ICE contract rallied over $30 to $520/t, while Jan-18 gained $15 to sit at $497/t today. With the weather forecast not looking favourable for sowing, there could be some more upside for Canola. In reality, price movements were small in international markets this week. But after months of tracking sideways at low levels, commentators need something to talk about. CBOT wheat gained 9¢ over a few sessions, to hit a two week high of 432¢/bu. In our terms this puts spot wheat at $212/t (figure 1), and December 17 at $235.

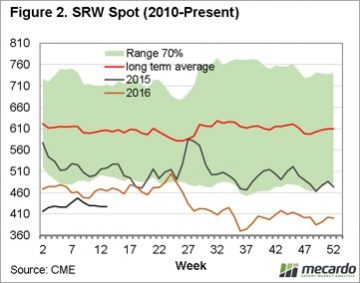

In reality, price movements were small in international markets this week. But after months of tracking sideways at low levels, commentators need something to talk about. CBOT wheat gained 9¢ over a few sessions, to hit a two week high of 432¢/bu. In our terms this puts spot wheat at $212/t (figure 1), and December 17 at $235. The coming month sees the USDA release their first estimate for the 2017/18 growing season, and this can often bring volatility to the market. There is no doubt US wheat production is going to be lower, but whether this can move the market remains to be seen.

The coming month sees the USDA release their first estimate for the 2017/18 growing season, and this can often bring volatility to the market. There is no doubt US wheat production is going to be lower, but whether this can move the market remains to be seen. Figure 1 shows a rather boring CBOT wheat chart. Recent swings in prices have been small on an historical scale. As the volume of supplies dampens any attempts at a real price rally.

Figure 1 shows a rather boring CBOT wheat chart. Recent swings in prices have been small on an historical scale. As the volume of supplies dampens any attempts at a real price rally. There has been intermittent interest in Canola, ASW and Feed Barley in recent weeks, with some growers managing $10-20 premium on published bids when buyers are trying to fill ships. If you’ve got wheat in store it’s worth looking at the shipping stem to see when boats are going and trying your luck with offers on Clear, or by talking to buyers or brokers.

There has been intermittent interest in Canola, ASW and Feed Barley in recent weeks, with some growers managing $10-20 premium on published bids when buyers are trying to fill ships. If you’ve got wheat in store it’s worth looking at the shipping stem to see when boats are going and trying your luck with offers on Clear, or by talking to buyers or brokers. In nautical terms, dead calm is the absence of wind or waves. It feels that way at the moment in the grain trade. The market has largely drifting with little in the way of wind or waves to give momentum in any direction. Will the USDA & IGC report provide some wind behind our sails?

In nautical terms, dead calm is the absence of wind or waves. It feels that way at the moment in the grain trade. The market has largely drifting with little in the way of wind or waves to give momentum in any direction. Will the USDA & IGC report provide some wind behind our sails? Yesterday the International Grain Council (IGC) released their global crop forecasts, and although not particularly positive for prices, does provide some hope for the future. The report indicates that in 2017/18 global wheat production would fall from 745mmt to 735mmt, with end stocks to be around 484mmt versus 513 this year. It has to be tempered that this would still remain the 2nd highest stocks in history. However, it does start to show a depletion in global stocks.

Yesterday the International Grain Council (IGC) released their global crop forecasts, and although not particularly positive for prices, does provide some hope for the future. The report indicates that in 2017/18 global wheat production would fall from 745mmt to 735mmt, with end stocks to be around 484mmt versus 513 this year. It has to be tempered that this would still remain the 2nd highest stocks in history. However, it does start to show a depletion in global stocks.

The futures market has subsided (figure 1) in the past week, as areas of dry concern receive forecasts of substantial rain in the US, and minimal bad news coming out of Europe. The reality is that the trade is concerned about USDA stock reports due next week. This asks the question, what if exports have not been high enough to deplete stocks?

The futures market has subsided (figure 1) in the past week, as areas of dry concern receive forecasts of substantial rain in the US, and minimal bad news coming out of Europe. The reality is that the trade is concerned about USDA stock reports due next week. This asks the question, what if exports have not been high enough to deplete stocks? However at a local level, we have seen basis increase across all port zones (figure 3) at an average increase week on week of $3.50/mt. This is using the public bid, and there are further opportunities out there for non-public sales.

However at a local level, we have seen basis increase across all port zones (figure 3) at an average increase week on week of $3.50/mt. This is using the public bid, and there are further opportunities out there for non-public sales. We will get an insight into inventory levels with next week’s USDA quarterly stock report.

We will get an insight into inventory levels with next week’s USDA quarterly stock report.