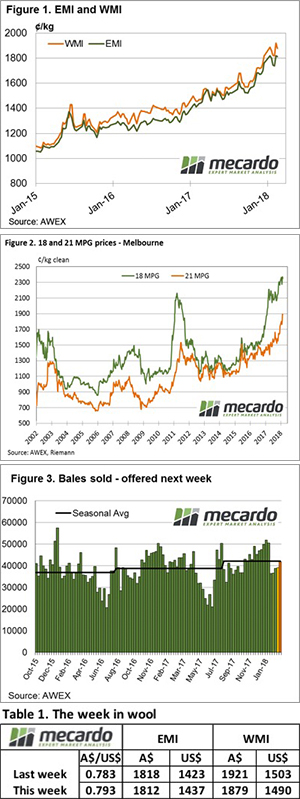

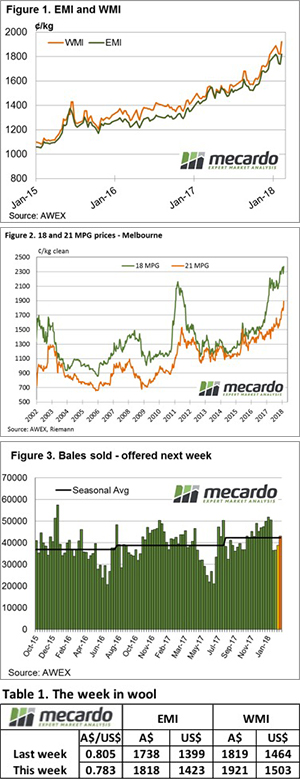

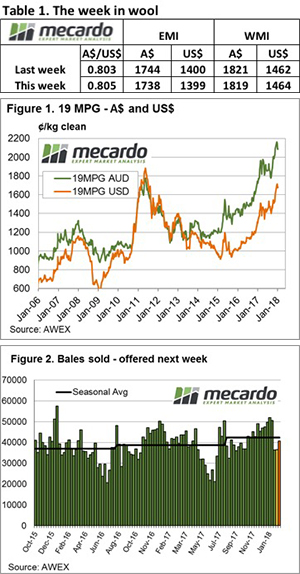

Across the board the Australian wool market Micron Price Guides (MPG’s) were all quoted higher, the only exception on the AWEX Wool Market Report was the Cardings indicators.

The MPG Indicators however failed to provide the whole picture; underneath the headline report is a more complex story.

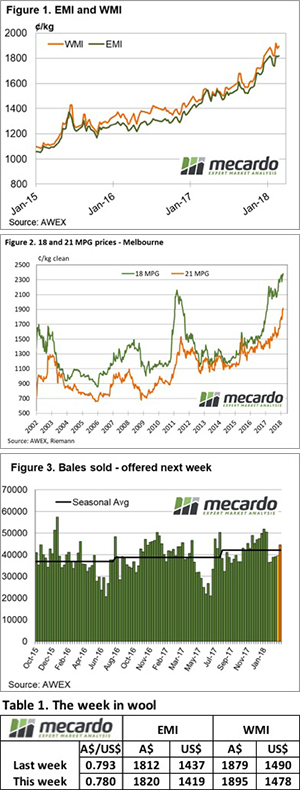

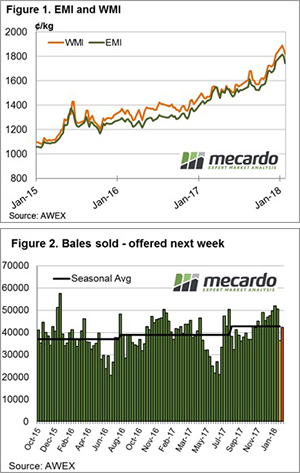

The most significant factor in this week’s market was the Au$; by the end of the week it was quoted down US$0.013, sitting below US$0.78 for the first time in 2018. As a consequence, the Eastern Market Indicator (EMI) rallied by $0.08 for the week to close at 1820¢. This picked up all the fall of last week. As well, the Western Market Indicator (WMI) improved 16 cents to finish at 1895 cents.

To complete the currency story and its influence on this week’s market, the EMI in US$ terms fell 17 cents, this meant a cheaper week on week for buyers, and better prices for wool sellers thanks to an easing Au$.

There is another underlying story, at this time of the year there is more “faulty” wool on offer. Lots with higher VM have been steadily increasing, which results in these types receiving erratic competition. There is another side to this story, and that is that FNF types (wool with less than 1% VM), are increasingly difficult for buyers to source and at times extreme prices are bid for particular lots.

The issue of quality has also permeated into the X Bred section of the market. In the past couple of years, it has been the trend to spend less time preparing X Bred wool in the wool shed, with some producers electing to either not skirt or minimal skirt in their wool preparation. When the market is buoyant or under tight supply this preparation model has little impact on prices, however, when the demand softens or supply increases (both currently the situation with X Bred wool), buyers can overlook less prepared types. This is the case now. Buyers can fil orders with “traditionally” prepared wool; poorly prepared lots are then used as bargain buys to cheapen orders.

Of the 41,815 bales originally offered, 39,429 sold with a Pass-in rate of 5.4% or just 2,240 bales.

The week ahead

Sales are scheduled for all three centres next week on Wednesday & Thursday.

A total of 44,506 bales are rostered for next week, slightly more than this week’s offering; the roster drops away over the following 2 weeks with 41,500 and 39,100 anticipated.

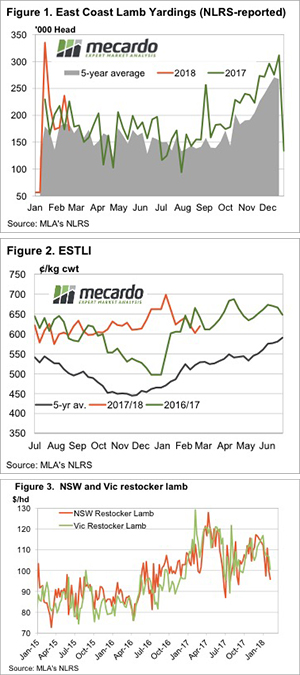

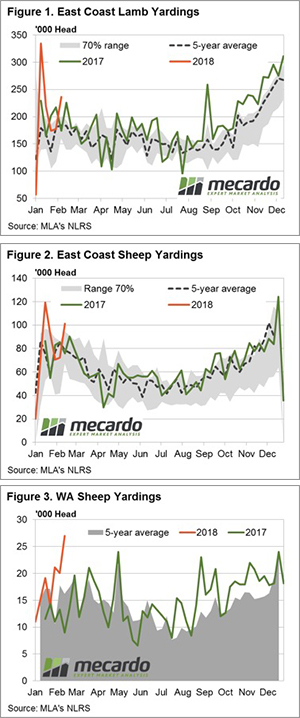

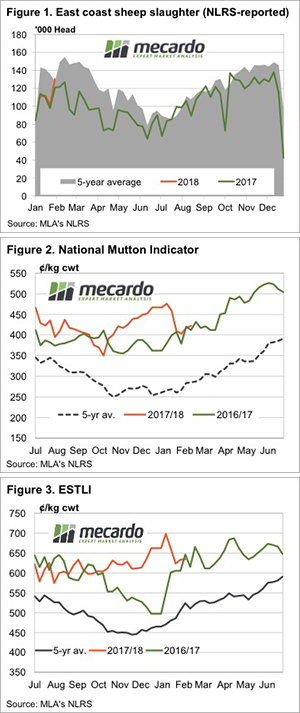

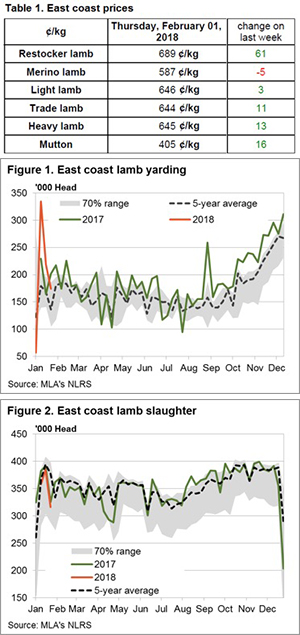

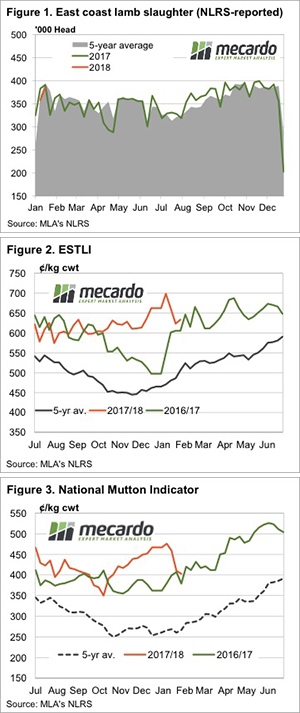

Strong throughput numbers for both lamb and mutton across the nation this week saw falls recorded in all national sale yard indicators, ranging between 3$ to 9 %. The headline Eastern States Trade Lamb Indicator (ESTLI) dropping 9.4% to close at 601/kg, while mutton was equally weak, off 8.8% to 385¢.

Strong throughput numbers for both lamb and mutton across the nation this week saw falls recorded in all national sale yard indicators, ranging between 3$ to 9 %. The headline Eastern States Trade Lamb Indicator (ESTLI) dropping 9.4% to close at 601/kg, while mutton was equally weak, off 8.8% to 385¢.

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume. It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed. This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

The wool market took a bit of a hit this week with most categories losing ground, with the exception of the very fine end. Cardings were hit particularly hard with the combined average fall for all three centres coming off nearly 200¢.

The wool market took a bit of a hit this week with most categories losing ground, with the exception of the very fine end. Cardings were hit particularly hard with the combined average fall for all three centres coming off nearly 200¢. Despite the issues with slaughter capacity in South Australia it seems that we once again managed to achieve a slaughter spike in the middle week of January. In some years the weaker demand in early February has led to weaker prices, but last year it was met with weaker supply, and strong prices.

Despite the issues with slaughter capacity in South Australia it seems that we once again managed to achieve a slaughter spike in the middle week of January. In some years the weaker demand in early February has led to weaker prices, but last year it was met with weaker supply, and strong prices.