Regular readers will know that when we talk about lamb markets, we use the Eastern States Trade Lamb Indicator (ESTLI) as a base for our analysis. The regular reporting and widespread coverage of the ESTLI make it a reliable gauge for the level and direction of the lamb market. However, with the recent launch of MLA’s new market information website, we can now drill down to saleyard level and get some specific regional spreads to help guide buying or selling decisions.

Regular readers will know that when we talk about lamb markets, we use the Eastern States Trade Lamb Indicator (ESTLI) as a base for our analysis. The regular reporting and widespread coverage of the ESTLI make it a reliable gauge for the level and direction of the lamb market. However, with the recent launch of MLA’s new market information website, we can now drill down to saleyard level and get some specific regional spreads to help guide buying or selling decisions.

The ESTLI is a broad indicator, taking in 18-22kg lambs sold at NLRS saleyards on the east coast. MLA’s excellent new market information and pricing tool allows producers to look at individual saleyard lamb weekly prices for a range of weights and buyers. It doesn’t matter what type of sheep or lamb is being sold, MLA’s tool allows you to look at last week’s price and a chart or table of up to 3 years or historical data. Additionally, the data can be exported into excel so it can be further analysed.

To give an example of how helpful this data can be, we have run some comparison of price for 20-22kg lambs, sold to processors, in Hamilton and CTLX. To get a good data, we had to merge the young lamb and old lamb prices series, and this makes it obvious when young lambs arrive in these markets. This analysis will give us an idea of how reliable the ESTLI is as an indicator for these yards at different times of year.

To give an example of how helpful this data can be, we have run some comparison of price for 20-22kg lambs, sold to processors, in Hamilton and CTLX. To get a good data, we had to merge the young lamb and old lamb prices series, and this makes it obvious when young lambs arrive in these markets. This analysis will give us an idea of how reliable the ESTLI is as an indicator for these yards at different times of year.

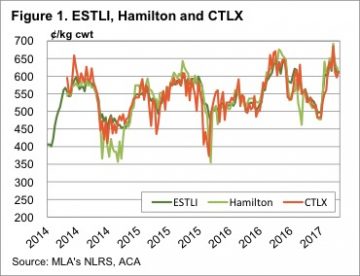

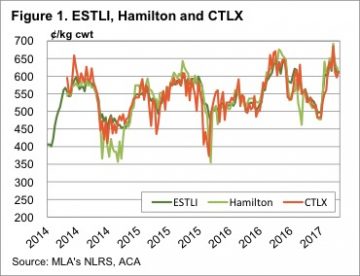

Figure 1 shows weekly prices for the ESTLI, Hamilton and CTLX lambs over the past 3 years. While prices do tend to move together, there are time when lambs Hamilton and CTLX are at significant discounts to the ESTLI. If you are selling in these centres, these times are to be avoided.

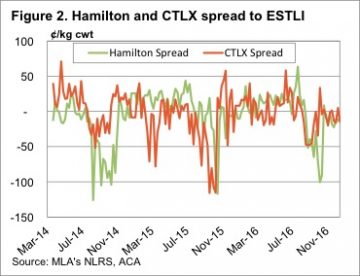

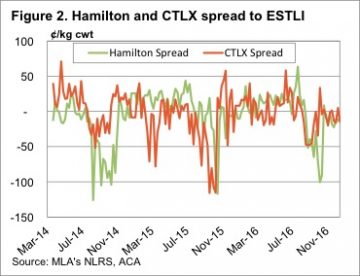

Figure 2 gives a bit clearer picture of the premiums and discounts for lambs at Hamilton and CTLX. Interestingly, both yards have an annual dip in prices relative to the ESTLI in the spring, with Hamilton seeing stronger discounts.

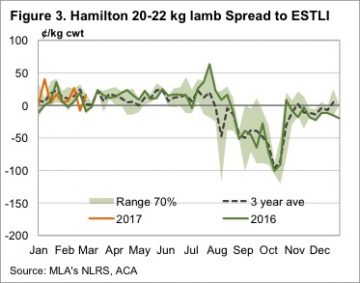

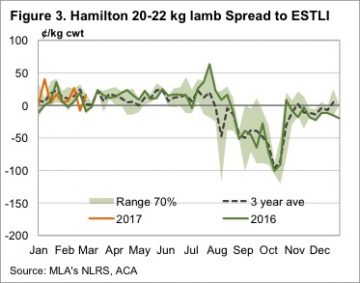

Looking at markets on an annual basis shows a clear strategy for trade lamb producers who use these saleyards. At Hamilton, there is an annual heavy discount for trade lambs to the ESTLI, starting in September and not really correcting until November. This is due to the dearth of lamb numbers, and specifically young lambs, with a critical mass not usually arriving until November, when prices generally run at a small discount to the ESTLI.

Looking at markets on an annual basis shows a clear strategy for trade lamb producers who use these saleyards. At Hamilton, there is an annual heavy discount for trade lambs to the ESTLI, starting in September and not really correcting until November. This is due to the dearth of lamb numbers, and specifically young lambs, with a critical mass not usually arriving until November, when prices generally run at a small discount to the ESTLI.

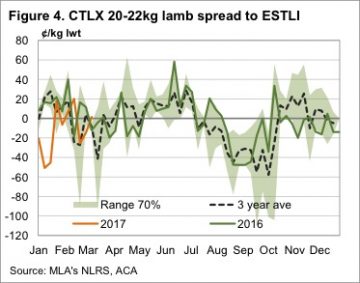

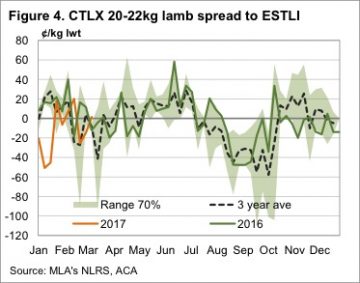

At CTLX (figure 4) the trend is similar, but discounts are not as heavy, while lambs command a premium to the ESTLI in late spring, when a bulk of the ESTLI supply is coming from Victoria.

Key points:

- MLA’s new market information tool allows detailed analysis of individual saleyard prices relative to the ESTLI.

- Both Hamilton and CTLX experience discounts to the ESTLI in early spring, before new season lambs arrive.

- The ESTLI is a reliable price indicator for these yards except for the early spring, when alternative markets should be sought.

What does this mean?

The brief analysis tells us that for most of the year the ESTLI is a good indicator of prices at Hamilton and CTLX. When lamb prices move to heavy discounts to the ESTLI is when there aren’t many lambs being sold. This tells us that if we are going to sell lambs in early spring, these saleyards might not be the best option.

The brief analysis tells us that for most of the year the ESTLI is a good indicator of prices at Hamilton and CTLX. When lamb prices move to heavy discounts to the ESTLI is when there aren’t many lambs being sold. This tells us that if we are going to sell lambs in early spring, these saleyards might not be the best option.

We can also see that strong premiums to the ESTLI don’t last long in either saleyard. Either the rest of the market catches up, or yardings increase to see prices fall the following week. Either way the market corrects.

This data is available for all NLRS reported markets, and can be a valuable took in looking at market trends, and timing sales.

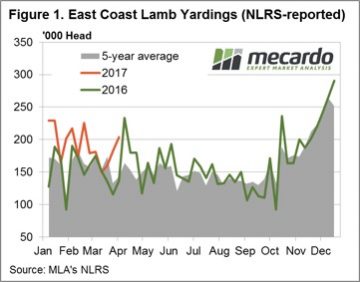

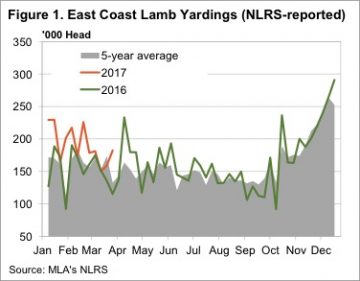

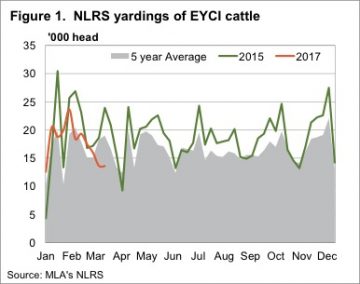

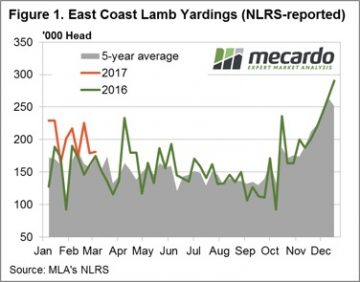

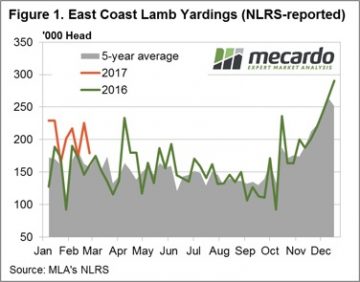

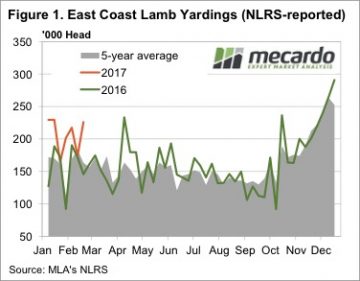

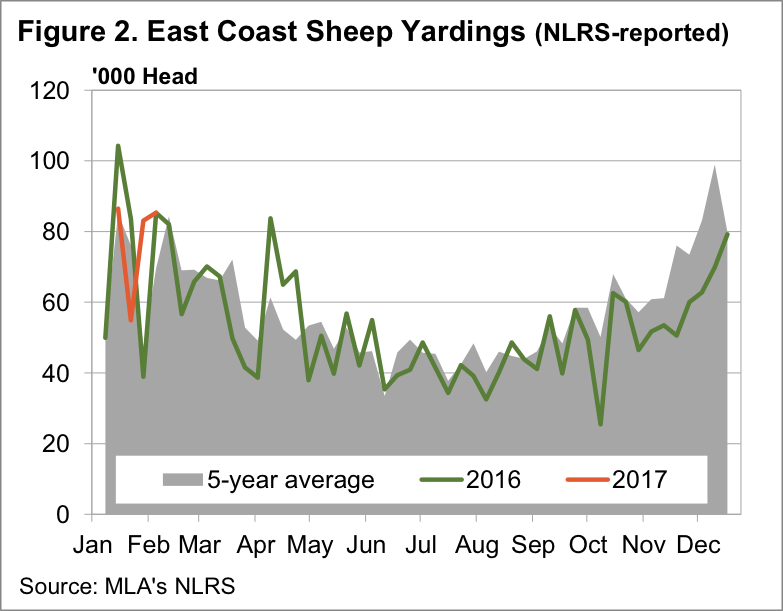

Figure 1. shows the rising trend over the last few weeks in East coast lamb throughput with a further 21,000 head added to yarding numbers this week to reach just short of 204,000 head. Since the recent dip in mid-March, lamb throughput has risen 35.4% in response to the firmer prices on offer at the saleyard.

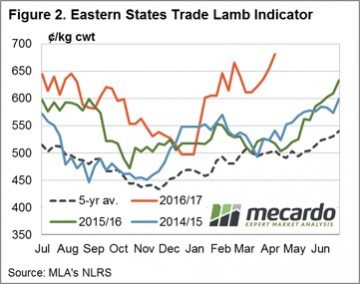

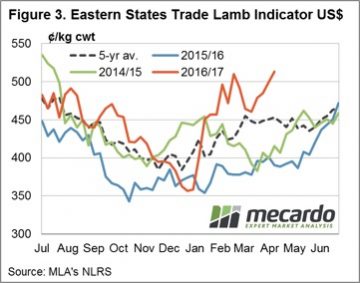

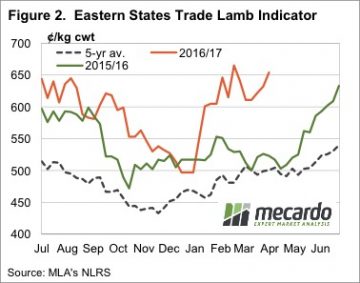

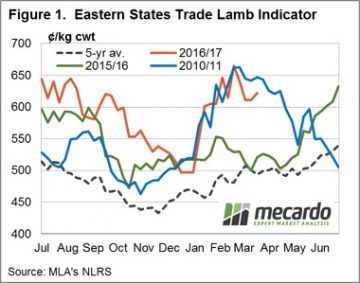

Figure 1. shows the rising trend over the last few weeks in East coast lamb throughput with a further 21,000 head added to yarding numbers this week to reach just short of 204,000 head. Since the recent dip in mid-March, lamb throughput has risen 35.4% in response to the firmer prices on offer at the saleyard. In US$ terms, lamb prices have reached a seasonal peak at 513US¢/kg cwt, this is only the second week it has been above 500US¢ this year – Figure 3. Despite the record local prices for Aussie lamb being received by producers at the moment lamb prices in US terms have been a lot higher. During the 2010/11 season our lamb in US terms reached toward 675US¢/kg cwt so at current levels it is still 24% off its all-time highs.

In US$ terms, lamb prices have reached a seasonal peak at 513US¢/kg cwt, this is only the second week it has been above 500US¢ this year – Figure 3. Despite the record local prices for Aussie lamb being received by producers at the moment lamb prices in US terms have been a lot higher. During the 2010/11 season our lamb in US terms reached toward 675US¢/kg cwt so at current levels it is still 24% off its all-time highs.

Lamb prices continued to charge higher this week, despite stronger yardings. The higher prices are showing no signs of dampening demand, with some categories hitting new highs, while others eased off this week.

Lamb prices continued to charge higher this week, despite stronger yardings. The higher prices are showing no signs of dampening demand, with some categories hitting new highs, while others eased off this week. It was NSW which drove the ESTLI higher this week, as the 25¢ rise saw a new record price of 659¢/kg cwt. Light lambs in NSW saw a 42¢ rise to be the highest indicator in the land, at 673¢/kg cwt. By contrast, light lambs in SA fell 58¢ to sit at a paltry 539¢/kg cwt. For a 17kg cwt lamb that is a $23/head difference.

It was NSW which drove the ESTLI higher this week, as the 25¢ rise saw a new record price of 659¢/kg cwt. Light lambs in NSW saw a 42¢ rise to be the highest indicator in the land, at 673¢/kg cwt. By contrast, light lambs in SA fell 58¢ to sit at a paltry 539¢/kg cwt. For a 17kg cwt lamb that is a $23/head difference. The rain from Cyclone Debbie shouldn’t impact the lamb market too much, but it won’t hurt. Lamb supply out of northern NSW is likely to be disrupted, so we can expect some solid support for lamb markets. Some forward contracts for trade lambs have been floating about this week at 670¢ for May.

The rain from Cyclone Debbie shouldn’t impact the lamb market too much, but it won’t hurt. Lamb supply out of northern NSW is likely to be disrupted, so we can expect some solid support for lamb markets. Some forward contracts for trade lambs have been floating about this week at 670¢ for May. In reality the widespread east coast rainfall would have been enough to halt the gradual slide in cattle markets. Almost all major cattle areas in Victoria and NSW got between 25 and 50mm, while in Queensland it was the far west, and south east which missed out.

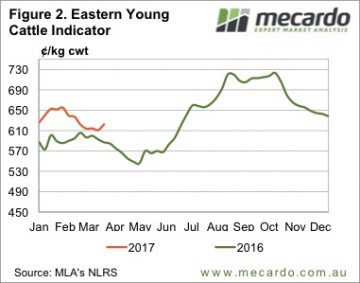

In reality the widespread east coast rainfall would have been enough to halt the gradual slide in cattle markets. Almost all major cattle areas in Victoria and NSW got between 25 and 50mm, while in Queensland it was the far west, and south east which missed out. Young cattle prices rallied, but you might expect a bit more. The EYCI gained 11¢ for the week to reach a five week high of 622¢/kg cwt. NSW and Queensland were the main movers, with feeders and trade steers gaining ground, while in Victoria prices were steady.

Young cattle prices rallied, but you might expect a bit more. The EYCI gained 11¢ for the week to reach a five week high of 622¢/kg cwt. NSW and Queensland were the main movers, with feeders and trade steers gaining ground, while in Victoria prices were steady. The better conditions are not going to go away soon. The improved demand for slaughter cattle could easily dissipate next week, but it’s very uncertain. What we can expect is tempered downside in young cattle from here, as there will be some pressure over the coming months, but improved restocker demand should soak it up.

The better conditions are not going to go away soon. The improved demand for slaughter cattle could easily dissipate next week, but it’s very uncertain. What we can expect is tempered downside in young cattle from here, as there will be some pressure over the coming months, but improved restocker demand should soak it up. Regular readers will know that when we talk about lamb markets, we use the Eastern States Trade Lamb Indicator (ESTLI) as a base for our analysis. The regular reporting and widespread coverage of the ESTLI make it a reliable gauge for the level and direction of the lamb market. However, with the recent launch of MLA’s new market information website, we can now drill down to saleyard level and get some specific regional spreads to help guide buying or selling decisions.

Regular readers will know that when we talk about lamb markets, we use the Eastern States Trade Lamb Indicator (ESTLI) as a base for our analysis. The regular reporting and widespread coverage of the ESTLI make it a reliable gauge for the level and direction of the lamb market. However, with the recent launch of MLA’s new market information website, we can now drill down to saleyard level and get some specific regional spreads to help guide buying or selling decisions. To give an example of how helpful this data can be, we have run some comparison of price for 20-22kg lambs, sold to processors, in Hamilton and CTLX. To get a good data, we had to merge the young lamb and old lamb prices series, and this makes it obvious when young lambs arrive in these markets. This analysis will give us an idea of how reliable the ESTLI is as an indicator for these yards at different times of year.

To give an example of how helpful this data can be, we have run some comparison of price for 20-22kg lambs, sold to processors, in Hamilton and CTLX. To get a good data, we had to merge the young lamb and old lamb prices series, and this makes it obvious when young lambs arrive in these markets. This analysis will give us an idea of how reliable the ESTLI is as an indicator for these yards at different times of year. Looking at markets on an annual basis shows a clear strategy for trade lamb producers who use these saleyards. At Hamilton, there is an annual heavy discount for trade lambs to the ESTLI, starting in September and not really correcting until November. This is due to the dearth of lamb numbers, and specifically young lambs, with a critical mass not usually arriving until November, when prices generally run at a small discount to the ESTLI.

Looking at markets on an annual basis shows a clear strategy for trade lamb producers who use these saleyards. At Hamilton, there is an annual heavy discount for trade lambs to the ESTLI, starting in September and not really correcting until November. This is due to the dearth of lamb numbers, and specifically young lambs, with a critical mass not usually arriving until November, when prices generally run at a small discount to the ESTLI. The brief analysis tells us that for most of the year the ESTLI is a good indicator of prices at Hamilton and CTLX. When lamb prices move to heavy discounts to the ESTLI is when there aren’t many lambs being sold. This tells us that if we are going to sell lambs in early spring, these saleyards might not be the best option.

The brief analysis tells us that for most of the year the ESTLI is a good indicator of prices at Hamilton and CTLX. When lamb prices move to heavy discounts to the ESTLI is when there aren’t many lambs being sold. This tells us that if we are going to sell lambs in early spring, these saleyards might not be the best option. Supply was back this week on the east coast, as the public holiday in Victoria impacted numbers. It was in NSW and SA where prices rallied however, with their respective trade lamb indicators gaining 10 and 17¢ to 622 (NSW) and 576¢/kg cwt (SA).

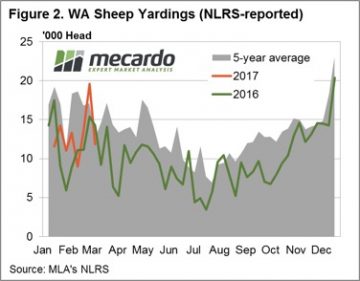

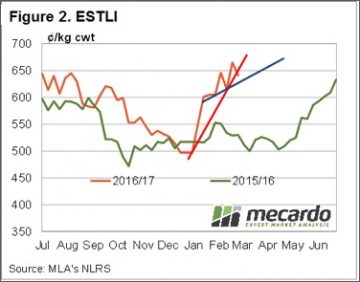

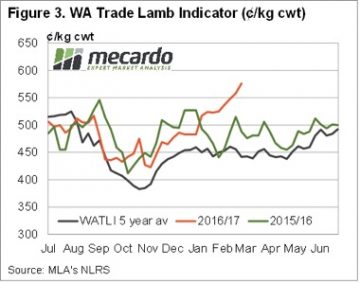

Supply was back this week on the east coast, as the public holiday in Victoria impacted numbers. It was in NSW and SA where prices rallied however, with their respective trade lamb indicators gaining 10 and 17¢ to 622 (NSW) and 576¢/kg cwt (SA). Figure 2 shows the stellar rise of lamb prices in WA, as they move to a premium to the ESTLI for the first time in 15 months. Lamb prices in WA have rallied for four and a half months, and added 200¢, or 44%. This weeks 16¢ rise to 645¢/kg cwt was in spite of a 40% increase in yardings. The lift in yardings might be due to over the hooks quotes running almost 100¢ behind the saleyards.

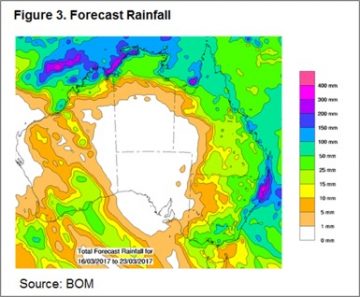

Figure 2 shows the stellar rise of lamb prices in WA, as they move to a premium to the ESTLI for the first time in 15 months. Lamb prices in WA have rallied for four and a half months, and added 200¢, or 44%. This weeks 16¢ rise to 645¢/kg cwt was in spite of a 40% increase in yardings. The lift in yardings might be due to over the hooks quotes running almost 100¢ behind the saleyards. The rain forecast in figure 3 should see solid support for lamb and sheep prices over the coming weeks. It will encourage holding lambs, and sheep as it looks like an autumn break for at least some parts of the country.

The rain forecast in figure 3 should see solid support for lamb and sheep prices over the coming weeks. It will encourage holding lambs, and sheep as it looks like an autumn break for at least some parts of the country. Figure 1 highlights the recent pattern of east coast lamb throughput showing a much more subdued pattern this week, in contrast to the seesaw of the weeks prior. Yarding figures hardly budging with a meagre 1.4% rise to sneak above 181,000 head. The Eastern States Trade Lamb Indicator (ESTLI) responding to the stable throughput settling exactly where is closed this time last week at 611¢/kg cwt. Stability in price the order of the day for most categories of lamb in the national indicators too with 0-1% gains in all classes of lamb, except national restocker lambs, down 3% to $96 per head.

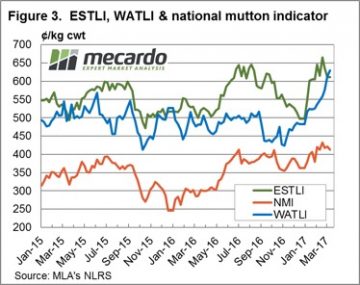

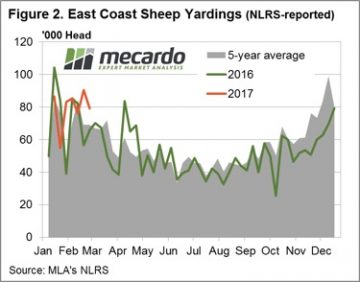

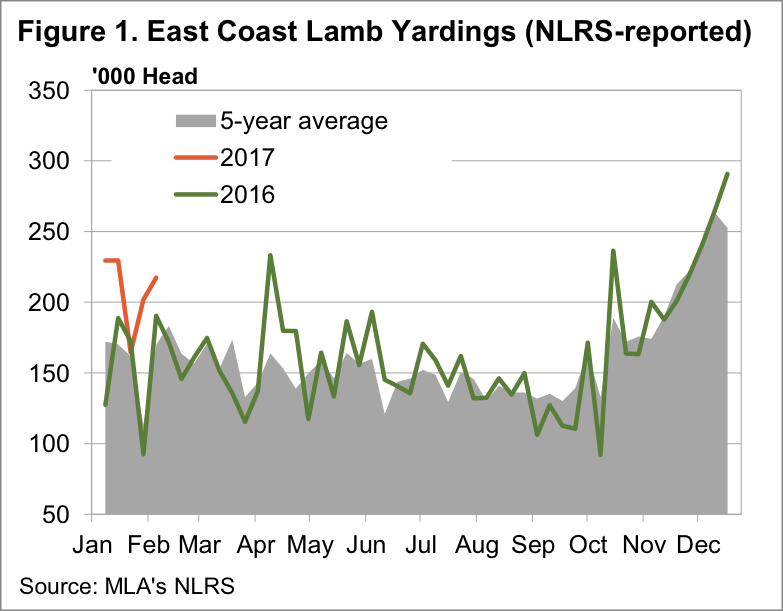

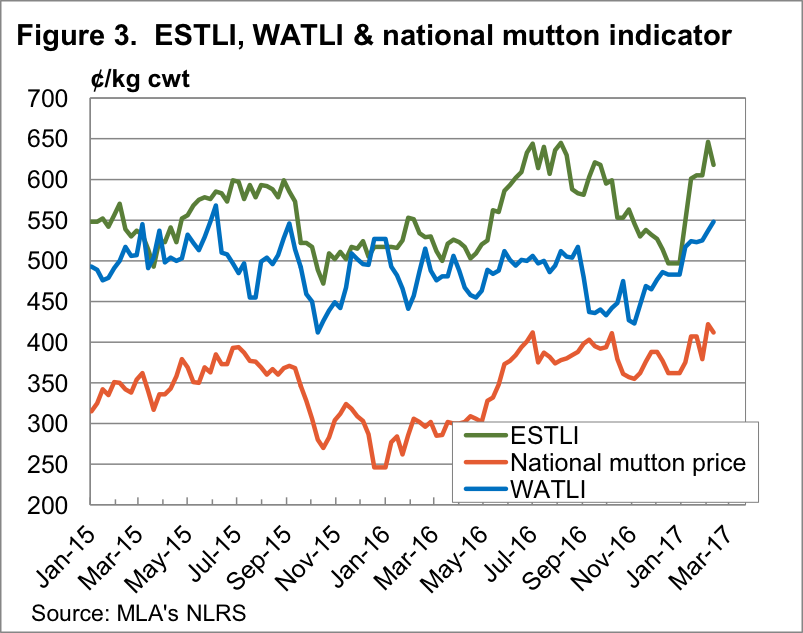

Figure 1 highlights the recent pattern of east coast lamb throughput showing a much more subdued pattern this week, in contrast to the seesaw of the weeks prior. Yarding figures hardly budging with a meagre 1.4% rise to sneak above 181,000 head. The Eastern States Trade Lamb Indicator (ESTLI) responding to the stable throughput settling exactly where is closed this time last week at 611¢/kg cwt. Stability in price the order of the day for most categories of lamb in the national indicators too with 0-1% gains in all classes of lamb, except national restocker lambs, down 3% to $96 per head. In contrast, WA mutton experiencing a stellar performance with an 11% price rise to 478¢/kg cwt. Spurred on by much softer supply (as shown in figure 2) with WA mutton throughput down 39.6%. The impressive performance this season not limited to mutton in the west with the Western Australian Trade Lamb Indicator (WATLI) continuing to press higher this week to close at 629¢ – figure 3. The tighter season and firm export demand helping support WATLI and WA mutton, 31% and 78% higher than this time last year – respectively.

In contrast, WA mutton experiencing a stellar performance with an 11% price rise to 478¢/kg cwt. Spurred on by much softer supply (as shown in figure 2) with WA mutton throughput down 39.6%. The impressive performance this season not limited to mutton in the west with the Western Australian Trade Lamb Indicator (WATLI) continuing to press higher this week to close at 629¢ – figure 3. The tighter season and firm export demand helping support WATLI and WA mutton, 31% and 78% higher than this time last year – respectively. Forecast rainfall between 5-15 mm to much of the sheep bearing regions of the nation next week will give slight relief to the recent dry spell to much of SA and Western Victoria during the last fortnight. This is likely to encourage further price consolidation to continue for the next few weeks for lamb and sheep markets.

Forecast rainfall between 5-15 mm to much of the sheep bearing regions of the nation next week will give slight relief to the recent dry spell to much of SA and Western Victoria during the last fortnight. This is likely to encourage further price consolidation to continue for the next few weeks for lamb and sheep markets.

SA and WA mutton both faring well this week up 11.8% and 13.1%, respectively. NSW and Vic mutton on marginally softer with falls of 0.7% and 2.1%. Figure 2 showing the weekly decline in East coast mutton throughput not as severe as that for East coast lamb, down only 12.2% to just under 80,000 head.

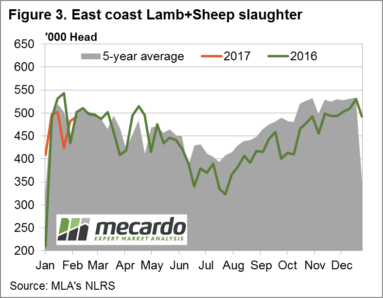

SA and WA mutton both faring well this week up 11.8% and 13.1%, respectively. NSW and Vic mutton on marginally softer with falls of 0.7% and 2.1%. Figure 2 showing the weekly decline in East coast mutton throughput not as severe as that for East coast lamb, down only 12.2% to just under 80,000 head. Just when we thought lamb supply was surely starting to wane, this week saw east coast yardings jump to their second highest level for the year. Figure 1 shows east coast lamb yardings, which were 55% stronger than the same time week last year.

Just when we thought lamb supply was surely starting to wane, this week saw east coast yardings jump to their second highest level for the year. Figure 1 shows east coast lamb yardings, which were 55% stronger than the same time week last year. In WA lamb prices defied the larger yardings, rising 18¢ to 576¢/kg cwt. The WATLI is showing an impressive upward trend, and has hit a 2.5 year high (figure 3).

In WA lamb prices defied the larger yardings, rising 18¢ to 576¢/kg cwt. The WATLI is showing an impressive upward trend, and has hit a 2.5 year high (figure 3).

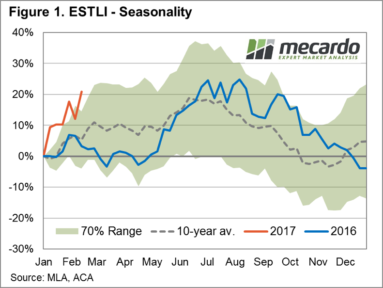

A firm recovery in price across all east coast categories of lamb and mutton reflecting the underlying tight supply anticipated this season to see the Eastern States Trade Lamb Indicator (ESTLI) surge to fresh highs, closing at 664¢/kg cwt yesterday – a gain on the week of 7.4%.

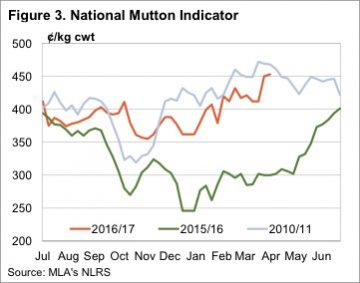

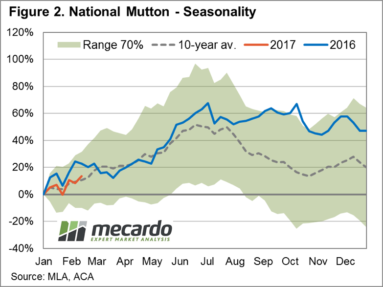

A firm recovery in price across all east coast categories of lamb and mutton reflecting the underlying tight supply anticipated this season to see the Eastern States Trade Lamb Indicator (ESTLI) surge to fresh highs, closing at 664¢/kg cwt yesterday – a gain on the week of 7.4%. East coast mutton also enjoying some upward momentum on the week, reflective of the trade and heavy lamb gains, to see it rise 7.5% to 441¢/kg cwt. Figure 2 showing the seasonal percentage gains for mutton so far this year respectably tracking along the ten-year average pattern. Although the price pattern for mutton not as robust when compared to the ESTLI performance and the pattern set by mutton during the 2016 season.

East coast mutton also enjoying some upward momentum on the week, reflective of the trade and heavy lamb gains, to see it rise 7.5% to 441¢/kg cwt. Figure 2 showing the seasonal percentage gains for mutton so far this year respectably tracking along the ten-year average pattern. Although the price pattern for mutton not as robust when compared to the ESTLI performance and the pattern set by mutton during the 2016 season. To read more about the expected tight supply during 2017 and our ESTLI forecast released in December 2016 click

To read more about the expected tight supply during 2017 and our ESTLI forecast released in December 2016 click  The very high prices seen last week had the desired effect for processors, drawing out very large lamb numbers, and sending prices lower. Sheep are a bit of a different story, especially in Victoria, where yardings waned, and as such prices have largely held their ground.

The very high prices seen last week had the desired effect for processors, drawing out very large lamb numbers, and sending prices lower. Sheep are a bit of a different story, especially in Victoria, where yardings waned, and as such prices have largely held their ground. The fall was strongest in Victoria, where trade lambs lost 45¢, or 7%, and moved back into line with NSW and SA.

The fall was strongest in Victoria, where trade lambs lost 45¢, or 7%, and moved back into line with NSW and SA. In WA lamb prices continued to play catch up to the east coast, with the WA Trade Lamb Indicator (WATLI) hitting a 19 month high of 548¢/kg cwt (figure 3).

In WA lamb prices continued to play catch up to the east coast, with the WA Trade Lamb Indicator (WATLI) hitting a 19 month high of 548¢/kg cwt (figure 3).