What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

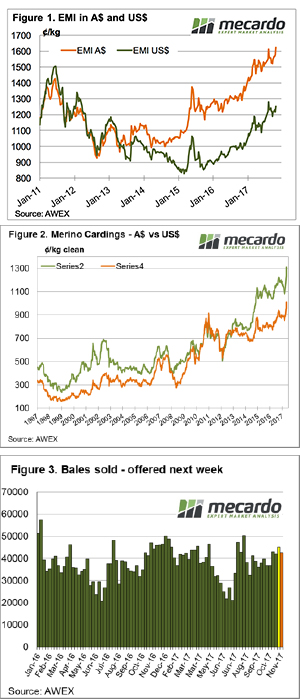

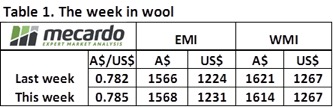

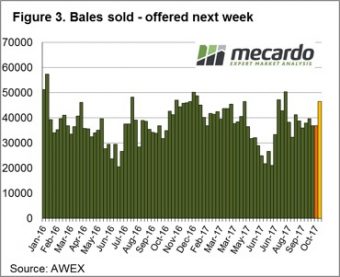

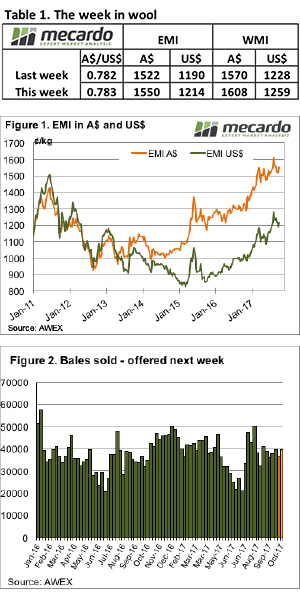

The Eastern Market Indicator (EMI) finished the week at 1,681¢ with AWEX reporting this another new record high in Australian dollar terms. The Australian dollar was slightly lower over the week, with the EMI in US$ terms posting a rise, also of 40¢ to end the week at 1,293¢. The EMI in US$ terms is edging higher, however it is still well off its previous record of 1504 cents set in July 2011.

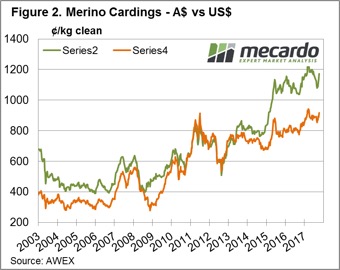

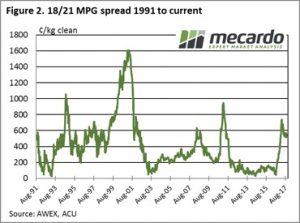

Only 1.3% of the offered bales were passed-in, resulting in 42,846 bales cleared to the trade. Slightly fewer bales were offered compared to last week and therefore fewer sold, however this volume is as expected with the spring deliveries arriving, so all in all this clearance is a good strong market signal.

Looking at the market, demand was excellent with AWEX reporting lots “across the whole Merino spectrum were hotly contested”. It was also noted that discounts for “wools with inferior test results” disappeared as buyers scrambled to secure market share.

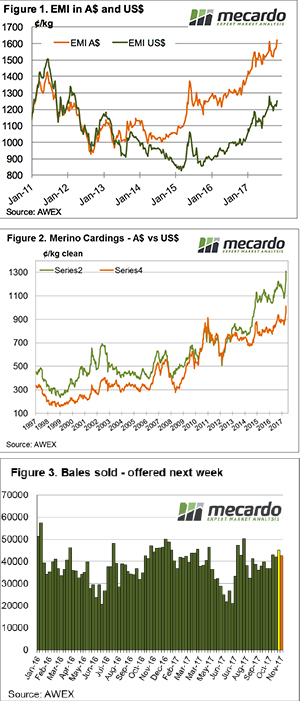

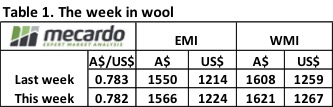

Some of the stand-out performers deserve special mention; the Cardings indicator lifted on average 63 cents across the three selling centres, to post a record level. It’s worth reflecting to compare to the dismal days of 1999 when the Cardings indicator bottomed at 236.

Another sometimes over looked type is the 32 MPG, this week it lifted 81 cents or 20%, an extraordinary move in one week.

In fact, the entire crossbred range lifted by 50 to 80 cents, slightly over shadowing the strong rise in the Merino section in a week of records.

The forward market as expected also kicked into gear, with buyers showing confidence in the near-term outlook by bidding out as far as August 2018; as an example, 19 MPG for July 2018 traded at 1870 cents.

The week ahead

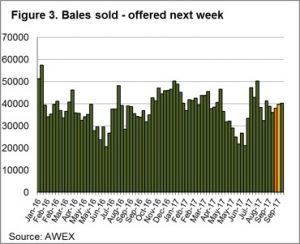

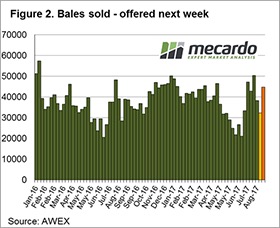

49,486 bales are rostered for sale next week across the three selling centres (Figure 3). The roster lists 41,000 and 44,000 for the following weeks. It’s hard to see that this future offering will have a negative effect on the market following this week’s bull run.

With one of the larger offerings for this year the market performed very strongly this week. Every category posted gains. Records were set with the 19.5 MPG posting its highest level since its 2001 listing, and cardings topping 1300 cents in Melbourne, a record against our records going back to 2002.

With one of the larger offerings for this year the market performed very strongly this week. Every category posted gains. Records were set with the 19.5 MPG posting its highest level since its 2001 listing, and cardings topping 1300 cents in Melbourne, a record against our records going back to 2002. We’ve ticked over the billion-dollar milestone for total value of wool sold this year which is something of an achievement. At this point in the season last year the value was 26% lower than it is today despite the cumulative bales sold being just 10% lower. The wool market hasn’t reached this mark by week 17 since 2002.

We’ve ticked over the billion-dollar milestone for total value of wool sold this year which is something of an achievement. At this point in the season last year the value was 26% lower than it is today despite the cumulative bales sold being just 10% lower. The wool market hasn’t reached this mark by week 17 since 2002. Wool was the hot topic of industry conversation again this week but it wasn’t enough to distract the market from deciding on what fibres it wants to support. Results were particularly mixed with fine fibres attracting premiums whilst the rest of the categories felt losses.

Wool was the hot topic of industry conversation again this week but it wasn’t enough to distract the market from deciding on what fibres it wants to support. Results were particularly mixed with fine fibres attracting premiums whilst the rest of the categories felt losses.  On the other hand, medium to coarse wools of 19.5 to 23 MPG weren’t as readily sought after. Prices fell on average 20 to 30 ¢ by the weeks close. Crossbred wool followed the lead of the medium to coarse Merino fibres, losing ground across the board. The harshest fall was in 28 MPG at an average drop of 30¢ in both Fremantle and Sydney markets.

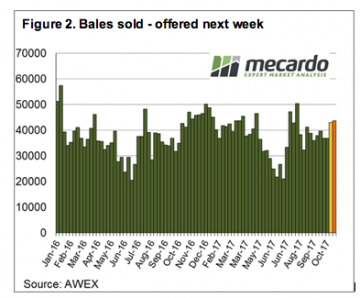

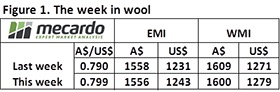

On the other hand, medium to coarse wools of 19.5 to 23 MPG weren’t as readily sought after. Prices fell on average 20 to 30 ¢ by the weeks close. Crossbred wool followed the lead of the medium to coarse Merino fibres, losing ground across the board. The harshest fall was in 28 MPG at an average drop of 30¢ in both Fremantle and Sydney markets. The number of bales on offer next week is expected to drop down to a listing of 43,764 for the three selling centres over Wednesday and Thursday (figure 2). The focus on micron this week might be an indication of where the market is starting to move to. Some strong forward prices in the 18.5 and 19 micron wools where buyers were willing to pay a premium out to next year suggest that preference for the finer wool is likely to grow.

The number of bales on offer next week is expected to drop down to a listing of 43,764 for the three selling centres over Wednesday and Thursday (figure 2). The focus on micron this week might be an indication of where the market is starting to move to. Some strong forward prices in the 18.5 and 19 micron wools where buyers were willing to pay a premium out to next year suggest that preference for the finer wool is likely to grow.

The continued good news regarding the wool market is providing a positive setting for wool producers; with some now locking in prices for future clips and making decisions to expand production. A quick look at relative prices shows the EMI is 248 cents higher year-on-year, while in US$ terms it is up 231 cents.

The continued good news regarding the wool market is providing a positive setting for wool producers; with some now locking in prices for future clips and making decisions to expand production. A quick look at relative prices shows the EMI is 248 cents higher year-on-year, while in US$ terms it is up 231 cents. This week the market opened strongly on Wednesday then settled into a “firm” trend resulting in a good result for sellers; and they responded by only Passing-in 3.3% of the 38,103 bales offered- well below the season average of 7.3%.

This week the market opened strongly on Wednesday then settled into a “firm” trend resulting in a good result for sellers; and they responded by only Passing-in 3.3% of the 38,103 bales offered- well below the season average of 7.3%. The scramble for “low mid break” lots resulted in these types at times posting extreme prices. AWEX report that up to 70 cent premiums are evident for wool with the “right” specifications. This is a response to the

The scramble for “low mid break” lots resulted in these types at times posting extreme prices. AWEX report that up to 70 cent premiums are evident for wool with the “right” specifications. This is a response to the  Despite an increasing offering that is normal as Spring shearing clips arrive, it is difficult to see anything but positive times (at least in the short term) for wool.

Despite an increasing offering that is normal as Spring shearing clips arrive, it is difficult to see anything but positive times (at least in the short term) for wool.

The “steady as she goes” reports on the wool market activity over recent weeks were thrown out the door at this week’s 2 day wool sale, with the market lifting significantly led by the Merino and including Cardings sections.

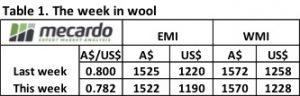

The “steady as she goes” reports on the wool market activity over recent weeks were thrown out the door at this week’s 2 day wool sale, with the market lifting significantly led by the Merino and including Cardings sections.  An overall satisfactory wool sale result this week, however we need to acknowledge that the weaker A$ played a part. Last week the A$ touched out at US$0.80, whereas this week it closed at US$0.782. Causes for currency moves are varied and debatable, and we can’t be sure if the weakness in the A$ is anticipating a Tigers/Crows win or loss in the AFL; or perhaps it is due to the struggle NSW NRL fans are having coming to terms with a Cowboys/Storm final?

An overall satisfactory wool sale result this week, however we need to acknowledge that the weaker A$ played a part. Last week the A$ touched out at US$0.80, whereas this week it closed at US$0.782. Causes for currency moves are varied and debatable, and we can’t be sure if the weakness in the A$ is anticipating a Tigers/Crows win or loss in the AFL; or perhaps it is due to the struggle NSW NRL fans are having coming to terms with a Cowboys/Storm final? A key point of interest in the wool market is the fine wool price, including the fine wool price relative to medium wool.

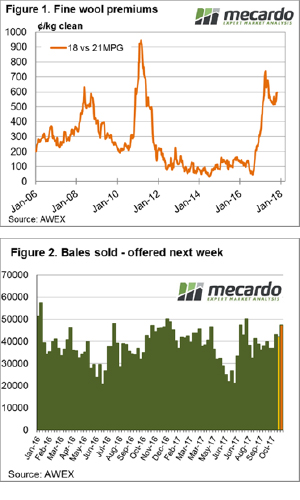

A key point of interest in the wool market is the fine wool price, including the fine wool price relative to medium wool. Of course, this leads to comparisons of relative price levels. Figure 2 shows the basis or spread between the 18 & 21 MPG’s for the Southern selling region. Currently the 18 over 21 MPG premium is sitting nicely at 554, having briefly touched the high level of over 700 cents in March this year.

Of course, this leads to comparisons of relative price levels. Figure 2 shows the basis or spread between the 18 & 21 MPG’s for the Southern selling region. Currently the 18 over 21 MPG premium is sitting nicely at 554, having briefly touched the high level of over 700 cents in March this year. The market looks remarkably stable at present, and providing we don’t see a sudden surge in the A$ this should translate into another good week to be selling (that is providing the footy community can cope with an all Victorian result!!!)

The market looks remarkably stable at present, and providing we don’t see a sudden surge in the A$ this should translate into another good week to be selling (that is providing the footy community can cope with an all Victorian result!!!)

In commodities, and particularly in agricultural commodities, a stable market is generally a good sign, especially if the market is at the top of its recent trading range. The wool market can best be described as “steady” this week, however, as usual there were some exceptions with the fine wool and crossbred selections in Melbourne underperforming the market.

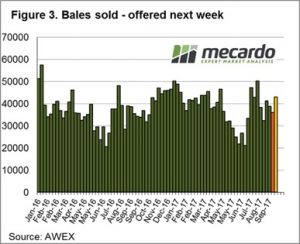

In commodities, and particularly in agricultural commodities, a stable market is generally a good sign, especially if the market is at the top of its recent trading range. The wool market can best be described as “steady” this week, however, as usual there were some exceptions with the fine wool and crossbred selections in Melbourne underperforming the market. A total of 40,699 bales were offered for sale this week. The steady market encouraged growers to more readily meet the market, with the pass-in rate of 6.9% well down from last week’s significant 15.5%. (Figure 3).

A total of 40,699 bales were offered for sale this week. The steady market encouraged growers to more readily meet the market, with the pass-in rate of 6.9% well down from last week’s significant 15.5%. (Figure 3). The market has been a bit “bouncy” up to this week, we wouldn’t predict either stable or unstable for next week, its “one of those times” in the wool market!

The market has been a bit “bouncy” up to this week, we wouldn’t predict either stable or unstable for next week, its “one of those times” in the wool market!

The Eastern Market Indicator dropped down 31 cents to 1,525 cents in A$ terms this week (Figure 1). The market in the west followed a similar path, falling 30 cents out to 1570 cents close (Figure 2). Our dollar is still holding up against the US$, which meant the EMI fared slightly better in US$ terms finishing 22 cents lower on the week at 1221 cents. The A$ traded at 80.5 early and pulled back as the week progressed which was reflected in the market as prices stabilised on the second day of auctions.

The Eastern Market Indicator dropped down 31 cents to 1,525 cents in A$ terms this week (Figure 1). The market in the west followed a similar path, falling 30 cents out to 1570 cents close (Figure 2). Our dollar is still holding up against the US$, which meant the EMI fared slightly better in US$ terms finishing 22 cents lower on the week at 1221 cents. The A$ traded at 80.5 early and pulled back as the week progressed which was reflected in the market as prices stabilised on the second day of auctions. Merino skirtings and crossbred wools also felt a quick early blow in the market before stabilising on day 2. Recovery was slightly better than for Merinos, with losses of 15 to 30 cents for crossbreds and an average of 20 cents on skirtings. Cardings were the only category that managed a positive move by gaining just a few cents on the week.

Merino skirtings and crossbred wools also felt a quick early blow in the market before stabilising on day 2. Recovery was slightly better than for Merinos, with losses of 15 to 30 cents for crossbreds and an average of 20 cents on skirtings. Cardings were the only category that managed a positive move by gaining just a few cents on the week.

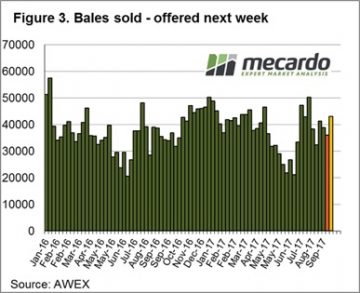

The EMI fell only 2 cents in A$ terms to settle at 1,556 cents, while in US$ terms the market improved 12 cents over the week (figure 1). The WMI was 9 cents lower than the previous close of last week.

The EMI fell only 2 cents in A$ terms to settle at 1,556 cents, while in US$ terms the market improved 12 cents over the week (figure 1). The WMI was 9 cents lower than the previous close of last week. This week was a pretty good result considering a larger offering and a higher A$ could have pushed the market lower following the last couple of weeks of price corrections. It wasn’t the case however, and growers responded by clearing the large offering and only passing in 5.2%.

This week was a pretty good result considering a larger offering and a higher A$ could have pushed the market lower following the last couple of weeks of price corrections. It wasn’t the case however, and growers responded by clearing the large offering and only passing in 5.2%. Through the looking glass into next week, another large offering of 44,281 bales are rostered for sale in all three selling centres (Figure 2). The solid performance this week in the face of a large offering and stronger A$ bodes well for next week.

Through the looking glass into next week, another large offering of 44,281 bales are rostered for sale in all three selling centres (Figure 2). The solid performance this week in the face of a large offering and stronger A$ bodes well for next week.