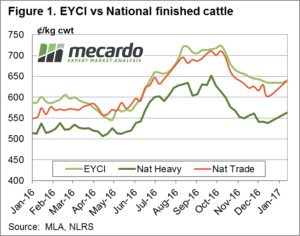

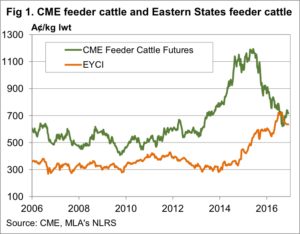

A positive start for 2017 with gains across the board for national

cattle prices, despite the “Black Friday” finish to the first trading

week. The Eastern Young Cattle Indicator (EYCI) up 1% from last

year’s closing price to reach 640.5¢/kg cwt while the National

Medium Steer price, mirroring the percentage EYCI gain, also

1% higher to close at 296.8¢/kg lwt.

Feeder Steers posting the lightest of gains, up a mere 0.8% to

347.6¢/kg lwt. National Heavy Steers back above 300¢ with a

modest 3.4% increase from the 2016 finishing price to test

304¢/kg lwt. Trade Steers the best performers up 6%

to 345.2¢/kg lwt – figure 1.

The positive sentiment has flown through to the annual weaner

sales across the nation with heavier weaners (above 330 kg) fetching

between 350¢ to 400¢/kg lwt and lighter weaners (200-280kg)

going for over 390¢ to 440¢/kg lwt.

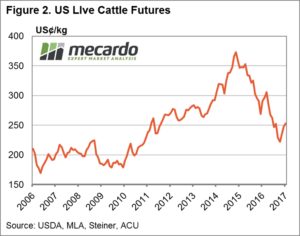

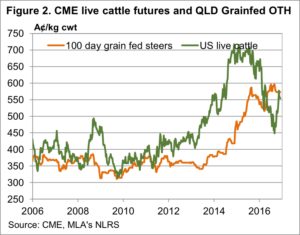

As outlined in our analysis piece this week a rebound in US cattle

futures prices (figure 2) have provided some flow through price

support for local cattle prices, relieving some of the downside price

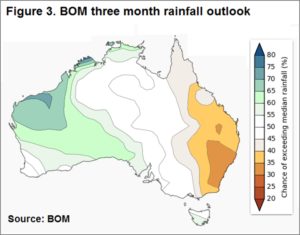

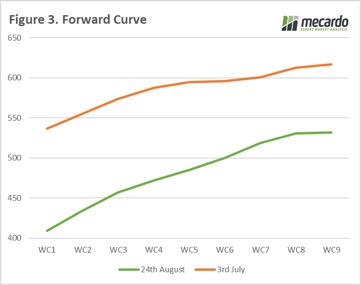

pressure evident into the later months of 2016. Although BOM

three-month outlook to March 2017 suggests somewhat drier

conditions than normal for much of the eastern seaboard which

may give restockers a reason not to chase prices for young cattle

too high into 2017, particularly if pasture growth begins to wane –

figure 3.

The Week Ahead

As we head into 2017 an anticipated tighter supply of available cattle and improved US cattle prices will continue to support local cattle prices.

On the flip side, a dryer start to the season for much of the eastern

seaboard and the prospect of a market correction into the later part

of 2017 or early/mid 2018 should act as a headwind on

prices outperforming the 2016 peaks.

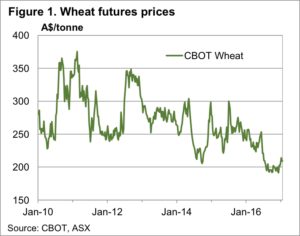

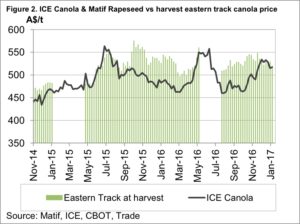

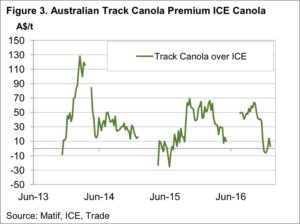

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this.

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this. In early July we recommended the use of a Dec’18 Chicago swap in our article ‘

In early July we recommended the use of a Dec’18 Chicago swap in our article ‘ The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.

The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.