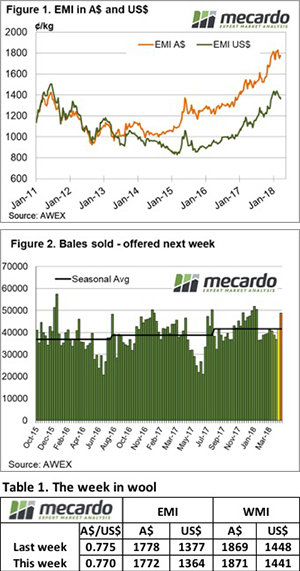

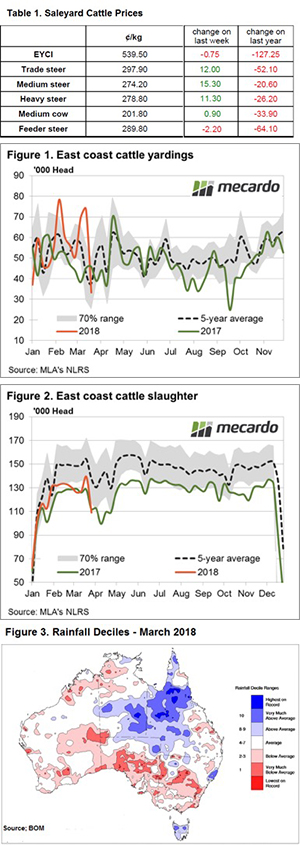

The Eastern Young Cattle Indicator’s (EYCI) decline continued this week. We’re not seeing finished cattle prices being dragged lower, especially not in the south, as the supply of slaughter ready cattle is weakening due to the dry. It’s not great for young cattle producers, but good news for traders.

The EYCI eased another 25¢ this week, heading back through support at the 514.50¢/kg cwt level. No doubt the fact that there has been no real rain in April, in addition to the usual increase in young cattle supply in Northern NSW, is helping drive the EYCI lower.

has been no real rain in April, in addition to the usual increase in young cattle supply in Northern NSW, is helping drive the EYCI lower.

Heavy cattle prices remain relatively strong however. The NSW Heavy Steer Indicator (figure 1) is actually sitting close to a nine-month high, at 512¢/kg cwt. The 2¢ discount for the Heavy Steer is as close as it’s been to the EYCI since spring 2015.

A relatively small spread between finished cattle and young cattle is not unusual for this time of year, but it’s not something we’ve seen during the herd rebuild. It suggests the young cattle supply is approaching normal, but the tight spread is obviously partly driven by the dry summer in NSW, Victoria and South Australia.

The bad news for cattle producers is that seasonality suggests that continued dry conditions are likely to see young cattle prices continue to fall. Figure 3 shows that the fall usually runs until at least May, and this could see the EYCI below 500¢ for the first time since the first half of 2015.

The week ahead

There’s not a lot of precipitation on the forecast, so we might see young cattle prices continue to ease next week.

There is opportunity for restockers to buy at close to 3 year low prices, and the fact that heavy cattle values are holding strong gives an indication that the finished cattle market might find support, making a good trade.

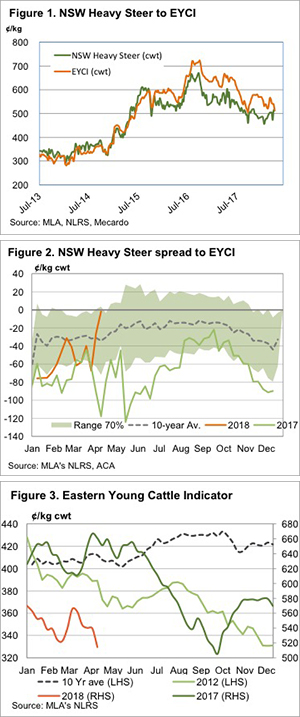

and less on the left through to greater than 30 micron, then cardings and finally total volume on the right. The 20 through 23 micron categories, effectively the merino production on the broad side of the average fibre diameter of 19 micron, stand out as having the largest fall in March. 21 to 23 micron volumes are down by 35-40%, which is a large fall, complicated by the continued high level of vegetable fault in eastern Australia.

and less on the left through to greater than 30 micron, then cardings and finally total volume on the right. The 20 through 23 micron categories, effectively the merino production on the broad side of the average fibre diameter of 19 micron, stand out as having the largest fall in March. 21 to 23 micron volumes are down by 35-40%, which is a large fall, complicated by the continued high level of vegetable fault in eastern Australia.

¢ to close at 289.8¢/kg lwt.

¢ to close at 289.8¢/kg lwt.

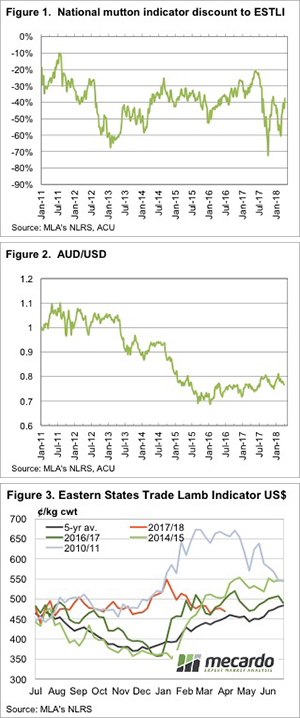

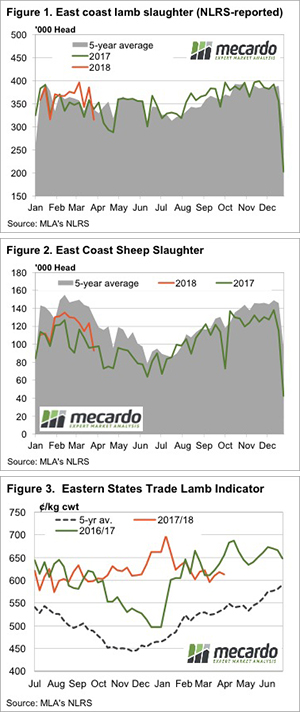

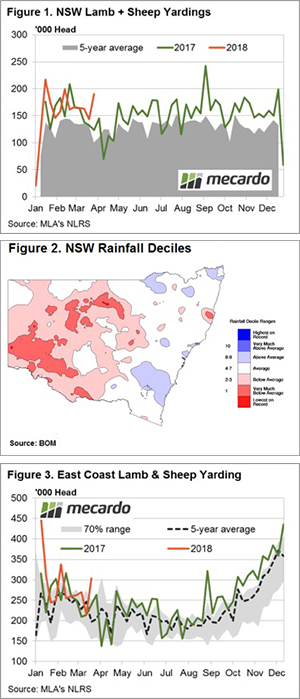

Last week was a day short of a full one, thanks to Good Friday. The short week saw a predictable drop in both sheep and lamb slaughter, but supplies remained much stronger than Easter last year. Prices are starting to fall behind last year levels, so this week we thought it timely to take a look at what price and supply tells us about demand.

Last week was a day short of a full one, thanks to Good Friday. The short week saw a predictable drop in both sheep and lamb slaughter, but supplies remained much stronger than Easter last year. Prices are starting to fall behind last year levels, so this week we thought it timely to take a look at what price and supply tells us about demand.

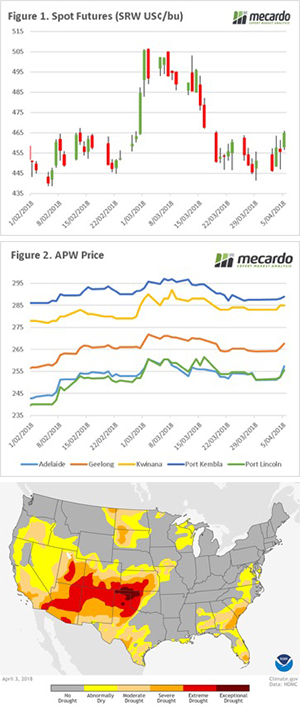

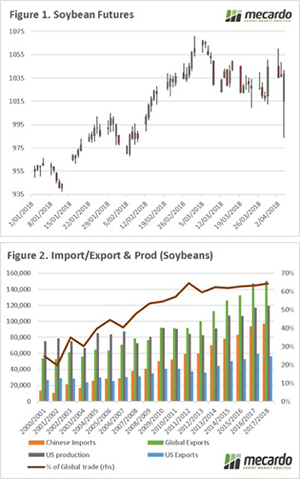

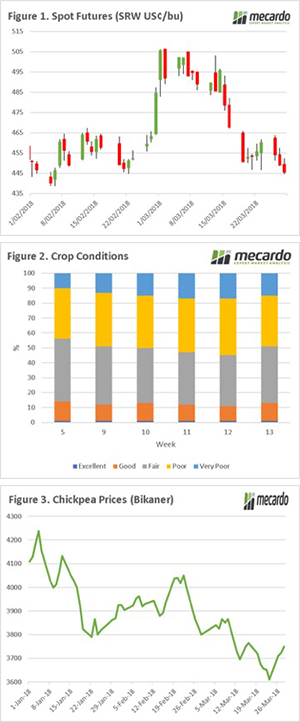

The wheat market has continued to decline, with three sessions in a row the market has accumulated a fall of 3% since the close on Friday last week (figure 1), placing the futures market at 2-month lows. The trade continues to digest the improving weather conditions in the US, and lower than expected exports (leading to higher end stocks).

The wheat market has continued to decline, with three sessions in a row the market has accumulated a fall of 3% since the close on Friday last week (figure 1), placing the futures market at 2-month lows. The trade continues to digest the improving weather conditions in the US, and lower than expected exports (leading to higher end stocks). 437¢.

437¢.