The drought continues to be the main talking point, with this September being officially the driest on record. The areas that were in reasonable condition at the start of the month (Vic, SA & WA) have all seen downgrades to their potential production. However, it’s not all doom and gloom with welcome rainfall in NSW.

The drought continues to be the main talking point, with this September being officially the driest on record. The areas that were in reasonable condition at the start of the month (Vic, SA & WA) have all seen downgrades to their potential production. However, it’s not all doom and gloom with welcome rainfall in NSW.

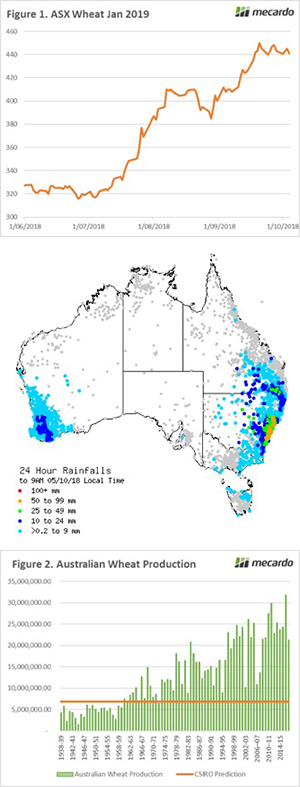

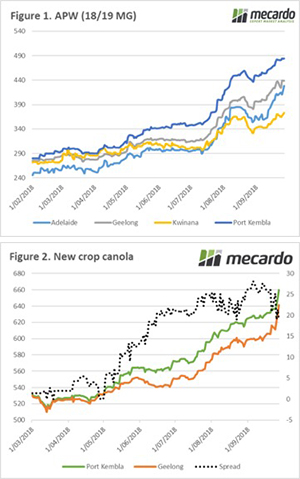

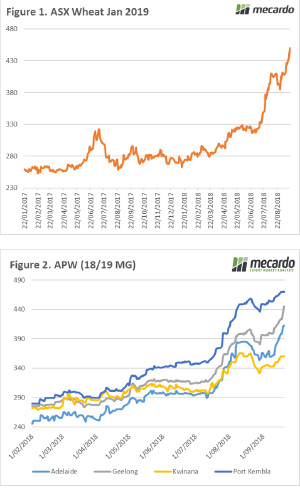

The ASX futures saw strong volume this week, however, is currently marginally lower than the end of last week (Figure 1). Interestingly there was increased interest in delivery periods further on the horizon with trades at $370 for Jan 2020 and $360 for Jan 2021. I wrote on Tuesday about the importance of looking beyond the current harvest (Warning: This isn’t the new level.).

This has been a tough year, however, it is fantastic to see some reports of substantive rainfall in NSW and QLD (see map). It is much too late for many crops, but it will fill some dams and assist with the moisture profile for the coming summer planting. Most of all, it improves everyone’s wellbeing.

The CSIRO has released crop updates based on their Yield Gap model. They currently predict an overall yield of 0.62mt/ha, this equates to 6.8mmt. In comparison, in the last ABARES update a yield of 1.45mt/ha or 16mmt was forecast. This is a bold call from CSIRO, however as we all know a ‘small crop only gets smaller’.

This forecast would place the crop at the lowest level since 1972/3 (Figure 2). They may indeed be correct, but I think that market forecasts of between 12-16mmt are more realistic.

What does it mean/next week?:

In the next week, we will see the WASDE report released, I don’t expect many big surprises in this report as most crops are now a known entity.

There are many in the industry examining the possibility of importing wheat or by-products for feeding purposes, as many consuming industries are unable to remain profitable at these levels.

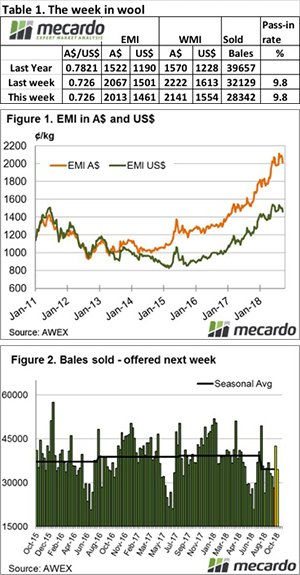

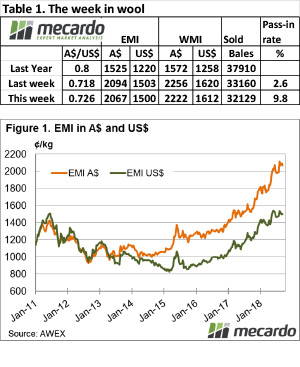

The beginning of the selling week saw the Au$ firm and the wool market ease as a consequence, however on Thursday, it was a different tale as buyers abandoned the poorer quality types but retained focus on well measured good yielding wool.

The beginning of the selling week saw the Au$ firm and the wool market ease as a consequence, however on Thursday, it was a different tale as buyers abandoned the poorer quality types but retained focus on well measured good yielding wool.

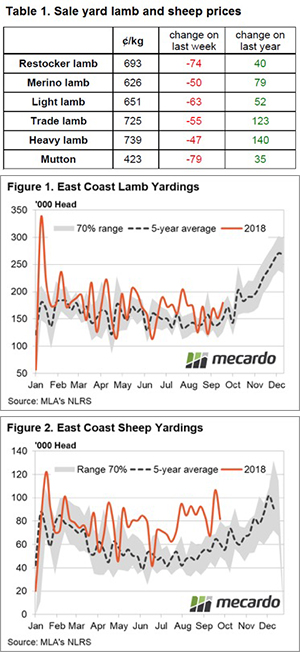

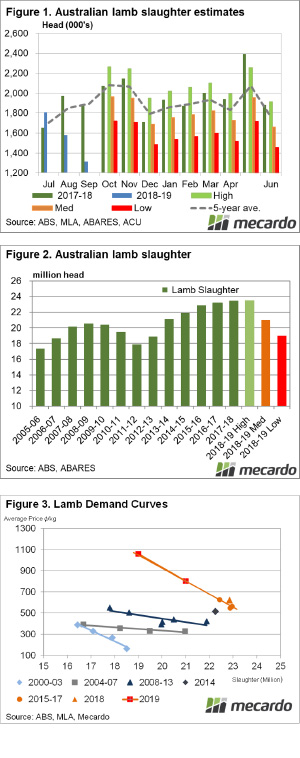

Spring is well and truly here, but the spring lambs are not quite. We usually start to see lamb slaughter show weekly increases from mid-July through to mid-October. This year all we have seen is slaughter declines. August and September are likely to post their weakest slaughter rates since at least 2009. The question is, how is this going to impact supplies for the rest of the year?

Spring is well and truly here, but the spring lambs are not quite. We usually start to see lamb slaughter show weekly increases from mid-July through to mid-October. This year all we have seen is slaughter declines. August and September are likely to post their weakest slaughter rates since at least 2009. The question is, how is this going to impact supplies for the rest of the year? ‘A big crop gets bigger and a small crop gets smaller’. This seems to be an apt statement to apply to this year’s Australian production. Continued concerns in the east coast & now in WA have led to more positive price action in the past week.

‘A big crop gets bigger and a small crop gets smaller’. This seems to be an apt statement to apply to this year’s Australian production. Continued concerns in the east coast & now in WA have led to more positive price action in the past week.