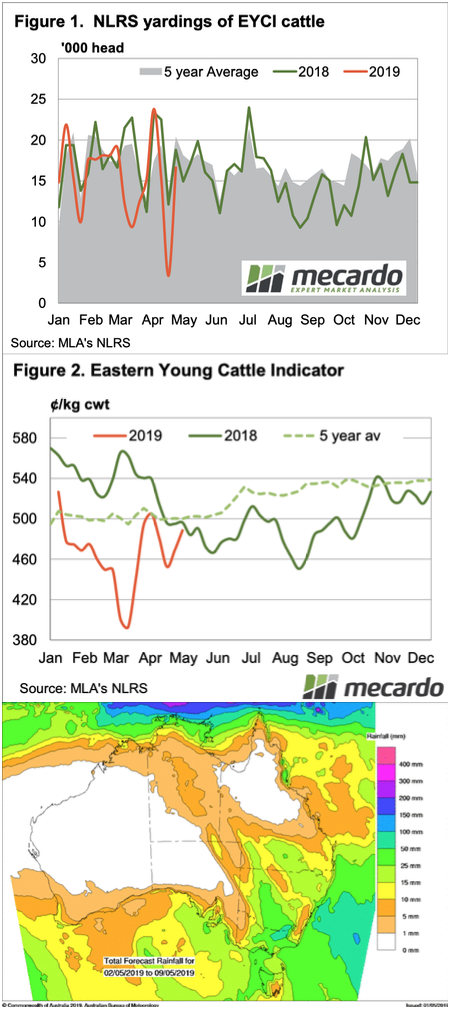

Post drought cattle prices are inherently volatile. This is especially so for young cattle. This week we saw the Eastern Young Cattle Indicator (EYCI) yo yo bounce back up in the first full week of trading for three.

The forecast rain seems to have come to fruition for key cattle areas of NSW and Victoria. Remarkably, so it would seem, parts of Western NSW are getting their second bought of rain within 10 days.

The forecast rain seems to have come to fruition for key cattle areas of NSW and Victoria. Remarkably, so it would seem, parts of Western NSW are getting their second bought of rain within 10 days.

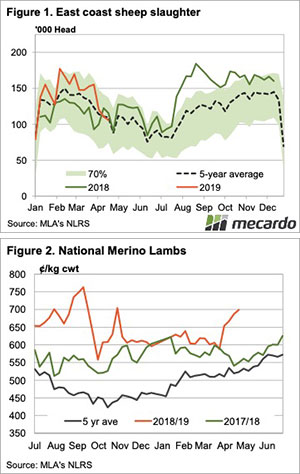

It’s hard to judge how supply is travelling. Usually supply increases after Easter, as pent up cattle from short weeks hits the market. This week EYCI yardings were stronger (figure 1), but well below pre-Easter levels, and below the five year average.

Demand seems to have been stronger this week. Figure 2 shows the EYCI rallying back towards April highs, and last year’s levels. The question will be whether the rally can be sustained.

The most expensive cattle this week were Trade Steers in SA, at the very healthy 571¢/kg cwt, followed by Heavy Steers in Victoria and Trade Steer in NSW, both at 556¢/kg cwt. Heavy steer prices are just 10¢ off a record level for this time of year. Grassfed finished cattle supplies are tightening, and we’re still a month off winter.

Meat and Livestock Australia’s (MLA) industry projection update was released yesterday, and the forecasts are a little scary for processors. MLA expect a 10% fall in cattle slaughter next year, and remain low into 2021. More on this next week.

What does it mean/next week?:

Figure 3 shows the rain forecast for the coming week, which is likely to add to demand and take from supply. Tightening supply of finished cattle will add to upward pressure, so the target might be moving. The 90CL Export price this week hit 690¢, so there seems to be plenty of room for cattle prices to move upwards.

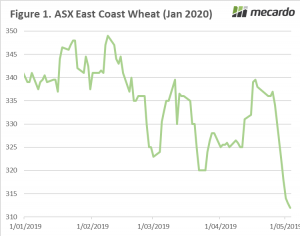

In figure 1, ASX wheat for Jan 2020 is shown since the start of the year. In the past week, the contract has fallen 7% or A$25. The contract is now at its lowest level since April/May last year.

In figure 1, ASX wheat for Jan 2020 is shown since the start of the year. In the past week, the contract has fallen 7% or A$25. The contract is now at its lowest level since April/May last year.

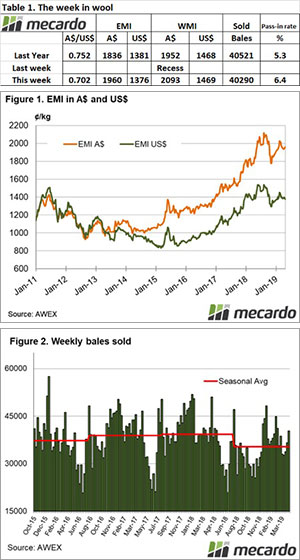

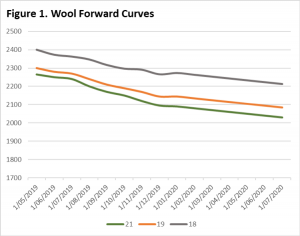

The forwards market has been quiet again the last fortnight. We had the Easter break last week, so that’s not unusual, but we had just as few agreements this week as then.

The forwards market has been quiet again the last fortnight. We had the Easter break last week, so that’s not unusual, but we had just as few agreements this week as then.