Elevated sheep slaughter continued to drag on mutton prices this week across the East coast and, while sheep supply in NSW is running at levels similar to what we saw this time last season, it is interesting to note that Victoria has seen a significant lift in sheep slaughter rates since the start of 2019 compared to the first few months of 2018.

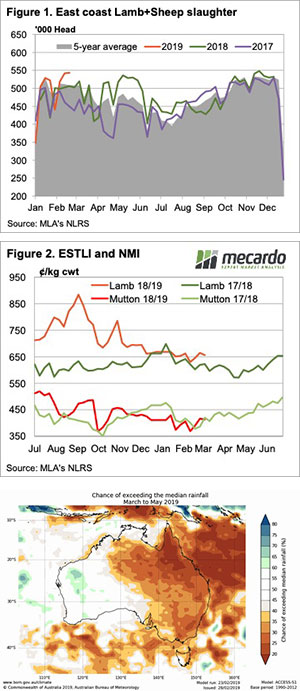

NSW sheep slaughter levels have been averaging close to 57,100 head per week since the start of the season, only marginally ahead of the 55,800 head recorded for the same timeframe during 2018. Although, compared to the five-year seasonal average NSW sheep slaughter has now had two consecutive seasons where weekly slaughter has been running nearly 30% above the five-year trend, representative of the dry conditions facing NSW producers – Figure 1.

In contrast, Victorian sheep slaughter levels began the 2018 season below the five-year average pattern, with slaughter levels not really taking off until the middle of the season. So far in 2019 it has been a robust start to sheep slaughter levels in Victoria with a weekly average of nearly 65,000 head processed. This is 31% higher than the volumes we saw slaughtered during the same timeframe last season and 26% over the five-year average trend – Figure 2.

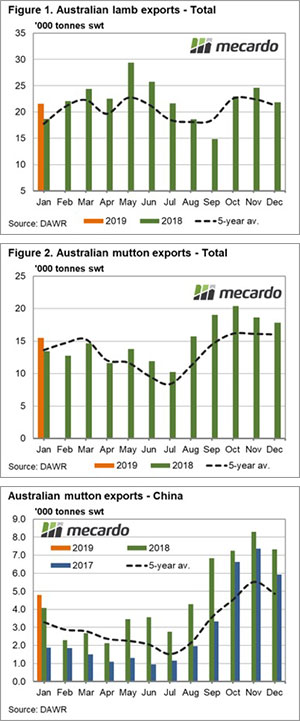

The additional supply of mutton across the East coast weighing on prices with sheep prices 5% lower than where they were this time last year, after staging nearly a 7% decline on the week to close at 385¢.

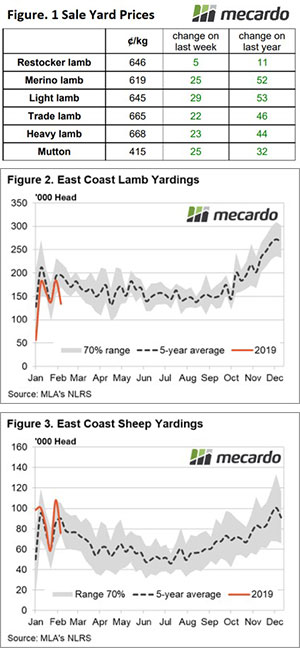

Sheep prices not alone in the price drop this week with all NLRS reported categories experiencing a decline – Figure 3. Although, Restocker Lambs the are the only other category to be lower than this time last season – albeit marginally at 1¢ softer to close at 613¢.

The Eastern States Trade Lamb Indicator (ESTLI) performing best this week out of the NLRS reported lamb categories with only a 2.5% decline to finish at 639¢/kg cwt. Declines ranging between 3%-4% noted for other lamb types.

What does it mean/next week?:

With supply remaining elevated and not much rainfall forecast for sheep country in the coming week there isn’t a lot to inspire a price lift. Although it is worth noting that higher slaughter now will likely mean less available supply when we hit the depths of Winter so there will be plenty of time for price to play catchup then.