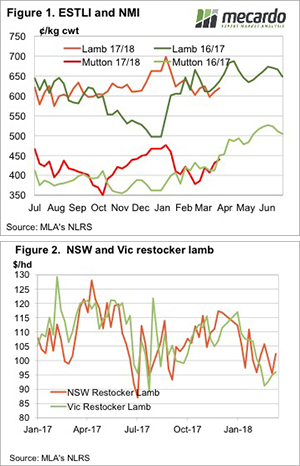

Lamb markets had their usual reaction when prices fall heavily, supply contracted as producers looked for alternatives to selling. Not all prices steadied though, with restocker lambs taking a hit and now looking very cheap.

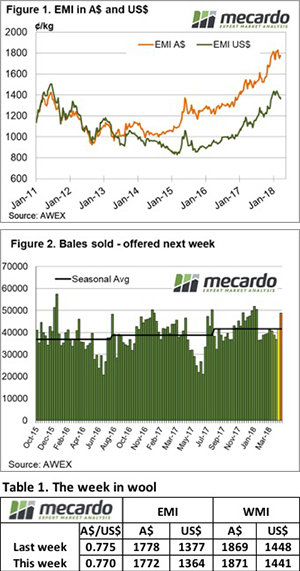

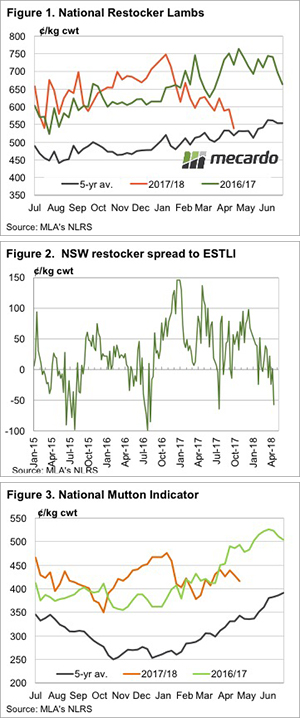

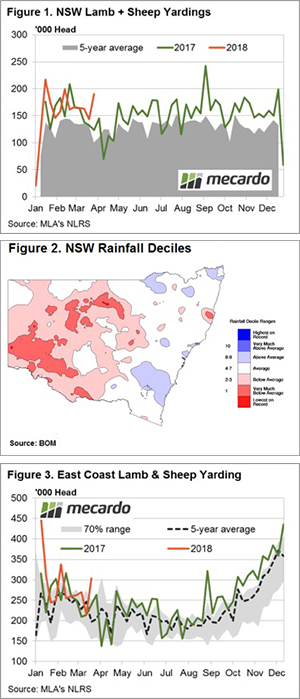

Finished lamb supply tightened, but it seems unfinished lambs kept coming. Figure 1 shows the National Restocker Indicator took a heavy hit this week, moving to a low not seen since August 2016. The difference in seasons this year and last is stark. Restocker lamb prices being 200¢ lower this year is a pretty good reflection of the lack of feed available for lambs.

Figure 2 shows NSW restocker lambs at a 60¢ discount to the Eastern States Trade Lamb Indicator (ESTLI). Even if we expected the ESTLI to stay around the 580¢ mark, we’d say restocker lambs were cheap. At 520¢ a 16kg lamb will cost $85-90. If the ESTLI gets back to 650¢/kg cwt, which it should when it rains, a 20kg lamb will make $135-140 per head. It’s a good margin.

Mutton hasn’t been so caught up in the lamb price fall. Figure 3 shows the National Mutton Indicator has lost 23¢ in the last few weeks, and is 80¢ below the same time last year.

In the West, mutton is around the same price, but WA has the most expensive lambs in the country. The Western Trade Lamb Indicator is at 614¢/kg cwt, down 18¢ on last year but still priced pretty well. There is not a lot of rain forecast for WA, so prices may start to track down towards east coast values.

The week ahead

There is not much rain forecast for anywhere over the next eight days, so it’s hard to see much upside for sheep or lamb prices in general. Don’t be surprised to see restocker prices bounce though, as figure 2 shows, they don’t stay this cheap relative to finished lambs for long.

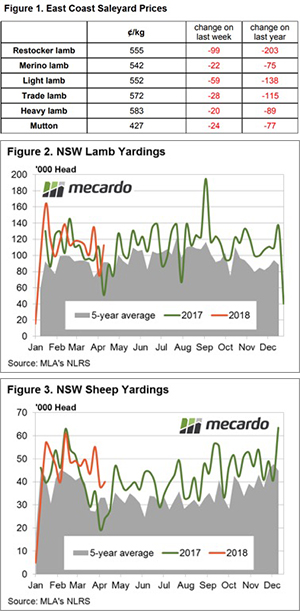

ink. Falls were recorded, ranging in magnitude from 3.5% to 17%, with Restocker Lamb taking the biggest hit, off a dollar on the week and 26.7% softer than this time last season. The Eastern States Trade Lamb Indicator (ESTLI) is mirroring the broader market decline with a 4.6% fall to close at 572¢/kg cwt.

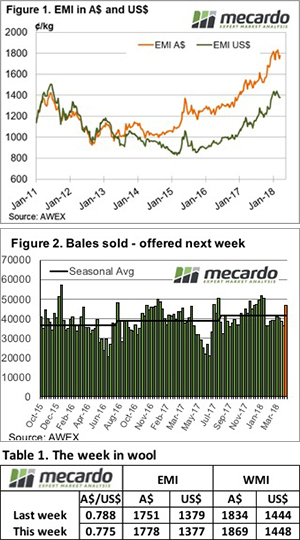

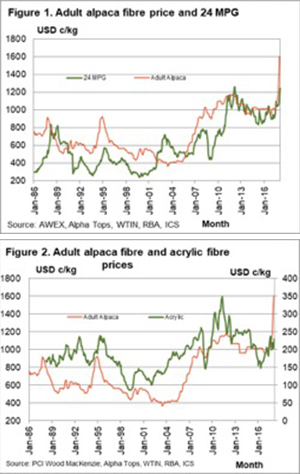

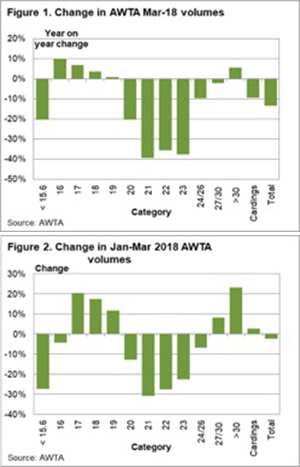

ink. Falls were recorded, ranging in magnitude from 3.5% to 17%, with Restocker Lamb taking the biggest hit, off a dollar on the week and 26.7% softer than this time last season. The Eastern States Trade Lamb Indicator (ESTLI) is mirroring the broader market decline with a 4.6% fall to close at 572¢/kg cwt. and less on the left through to greater than 30 micron, then cardings and finally total volume on the right. The 20 through 23 micron categories, effectively the merino production on the broad side of the average fibre diameter of 19 micron, stand out as having the largest fall in March. 21 to 23 micron volumes are down by 35-40%, which is a large fall, complicated by the continued high level of vegetable fault in eastern Australia.

and less on the left through to greater than 30 micron, then cardings and finally total volume on the right. The 20 through 23 micron categories, effectively the merino production on the broad side of the average fibre diameter of 19 micron, stand out as having the largest fall in March. 21 to 23 micron volumes are down by 35-40%, which is a large fall, complicated by the continued high level of vegetable fault in eastern Australia.

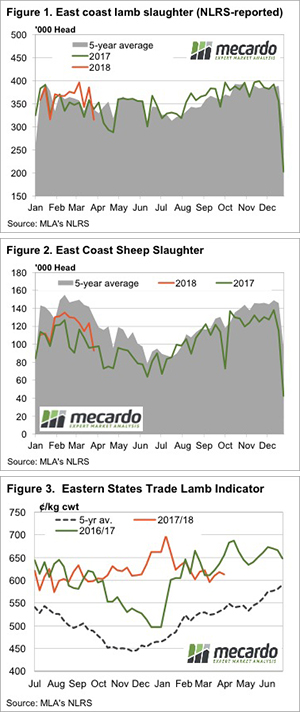

Last week was a day short of a full one, thanks to Good Friday. The short week saw a predictable drop in both sheep and lamb slaughter, but supplies remained much stronger than Easter last year. Prices are starting to fall behind last year levels, so this week we thought it timely to take a look at what price and supply tells us about demand.

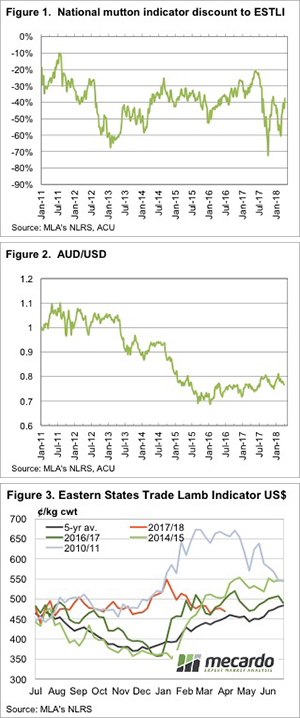

Last week was a day short of a full one, thanks to Good Friday. The short week saw a predictable drop in both sheep and lamb slaughter, but supplies remained much stronger than Easter last year. Prices are starting to fall behind last year levels, so this week we thought it timely to take a look at what price and supply tells us about demand. 437¢.

437¢.