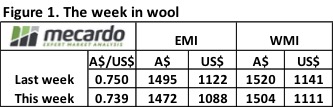

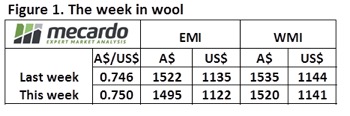

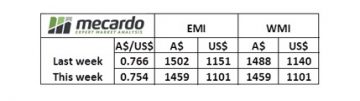

Despite the lower offering this week buyers still happy to cherry pick the broadly softer market with the greatest impact felt by the finer fibres. The benchmark Eastern Market Indicator (EMI) shedding 23¢ to 1472¢/kg clean, although the softer A$ combining with the market downturn to see EMI in US$ terms drop further, down 34¢ to 1088US¢/kg. A lesser fall for the Western market noted with the WMI dropping 16¢ to close 1504¢/kg clean.

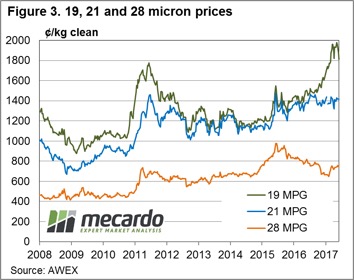

17 to 19-micron fleece registered falls of 55-85¢ across all three selling centres. Melbourne the only auction to offer some finer 16.5-micron wool, but the single source not enough to protect it from registering the largest falls this week closing 113¢ softer to 2135¢/kg clean. Medium wool classes a bit of a mixed bag with 20-25¢ falls in the 20 microns in all centres, 21 microns ranging from a 12¢ loss in Fremantle to a 6¢ gain in the South, while 22-23 mpg wool saw gains from 1-14¢ recorded. Cross bred wool saw Southern 30 mpg shedding 30¢ but the remaining classes posting flat to slight gains of less than 10¢.

17 to 19-micron fleece registered falls of 55-85¢ across all three selling centres. Melbourne the only auction to offer some finer 16.5-micron wool, but the single source not enough to protect it from registering the largest falls this week closing 113¢ softer to 2135¢/kg clean. Medium wool classes a bit of a mixed bag with 20-25¢ falls in the 20 microns in all centres, 21 microns ranging from a 12¢ loss in Fremantle to a 6¢ gain in the South, while 22-23 mpg wool saw gains from 1-14¢ recorded. Cross bred wool saw Southern 30 mpg shedding 30¢ but the remaining classes posting flat to slight gains of less than 10¢.

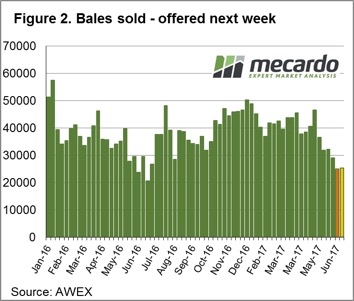

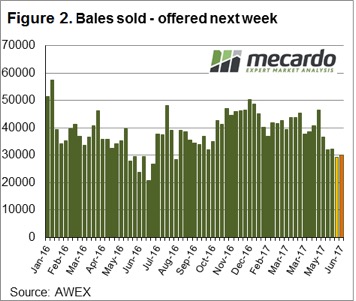

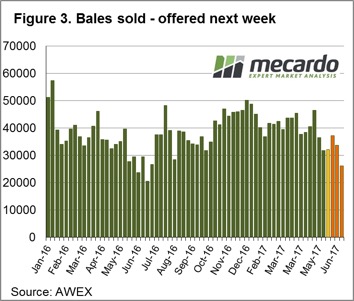

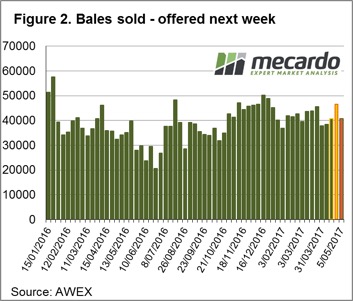

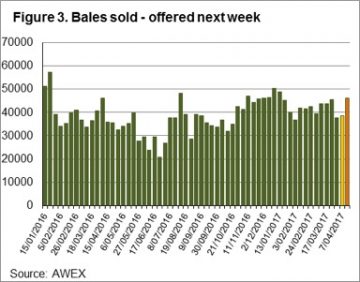

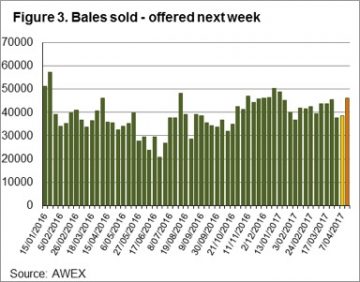

Pass in rates remain higher in the West and the national pass in rate dropping slightly on the week to 12.2% as 24,976 bales were sold out of a possible 28,459. This is the lowest bales sold since late June 2016 although compared to this time last season bales sold this week were 5.4% higher suggesting the relatively higher prices aren’t deterring buyers too much.

Pass in rates remain higher in the West and the national pass in rate dropping slightly on the week to 12.2% as 24,976 bales were sold out of a possible 28,459. This is the lowest bales sold since late June 2016 although compared to this time last season bales sold this week were 5.4% higher suggesting the relatively higher prices aren’t deterring buyers too much.

The week ahead

Supply continues to tighten as we head towards the Winter recess and there are no sales listed in the West next week so bales on offer will drop to 25,278. Melbourne and Sydney are selling on the normal Wednesday Thursday roster. Bales offered set to recover in Week 50 as Fremantle resume selling to reach nearly 33,000 before dropping back sub 25,000 the following week.

Largest magnitude falls were noted for the finer microns with price decreases between 50-100¢ noted. Medium fibres posting declines in the 10-40¢ range, while crossbred fleece just 5-10¢ softer. Southern 28-micron and Cardings in all centres the only categories to record slight gains.

Largest magnitude falls were noted for the finer microns with price decreases between 50-100¢ noted. Medium fibres posting declines in the 10-40¢ range, while crossbred fleece just 5-10¢ softer. Southern 28-micron and Cardings in all centres the only categories to record slight gains. The general view among growers appears to be that supply is tight and mills don’t have much stock in the pipeline so there seems to be a reluctance to chase a falling market. Clearly, in the short term the volume of bales on offer are expected to contract further. However, over the longer term an eye needs to be kept on the trend in demand, as the risk is always there that overseas buyers adjust down their purchasing requirements to reflect the anticipated lower supply.

The general view among growers appears to be that supply is tight and mills don’t have much stock in the pipeline so there seems to be a reluctance to chase a falling market. Clearly, in the short term the volume of bales on offer are expected to contract further. However, over the longer term an eye needs to be kept on the trend in demand, as the risk is always there that overseas buyers adjust down their purchasing requirements to reflect the anticipated lower supply.

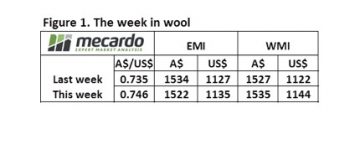

We saw the effect of the Washington/Trump shenanigans which took the confidence out of US markets and resulted in a weaker US$, and by default a stronger A$. The effect on the market was for the EMI to rise in US$ terms (plus 8 cents), but fall in A$ terms (minus 12 cents). The Trump factor causing a 1.5% gain in the A$ over the week to see it finish yesterday at 74.6US¢.

We saw the effect of the Washington/Trump shenanigans which took the confidence out of US markets and resulted in a weaker US$, and by default a stronger A$. The effect on the market was for the EMI to rise in US$ terms (plus 8 cents), but fall in A$ terms (minus 12 cents). The Trump factor causing a 1.5% gain in the A$ over the week to see it finish yesterday at 74.6US¢. At this time of the year we see increased levels of Vegetable Matter; it impacted most on the skirtings market this week with low V.M. wool tending dearer however high V.M. types were irregular and tending cheaper.

At this time of the year we see increased levels of Vegetable Matter; it impacted most on the skirtings market this week with low V.M. wool tending dearer however high V.M. types were irregular and tending cheaper. This tight supply should maintain the market levels, although as we have seen this week currency moves can impact.

This tight supply should maintain the market levels, although as we have seen this week currency moves can impact.

The market opened to solid demand on Wednesday but nervousness crept in on Thursday to see the market in general close below last week’s levels. Eastern prices 5-35¢ softer while the West saw a bit more of a slide, with 15-70¢ falls registered. A reduced offering of bales for sale, just over 38,000 bales came forward this week, however weaker demand saw the pass in rate jump this week to 16.1% with 31,915 bales sold.

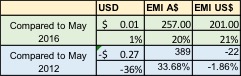

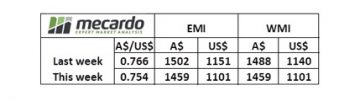

The market opened to solid demand on Wednesday but nervousness crept in on Thursday to see the market in general close below last week’s levels. Eastern prices 5-35¢ softer while the West saw a bit more of a slide, with 15-70¢ falls registered. A reduced offering of bales for sale, just over 38,000 bales came forward this week, however weaker demand saw the pass in rate jump this week to 16.1% with 31,915 bales sold. Firstly currency; while it has hardly moved over the past 12 months, it is 27 cents or 36% lower than five years ago. This is reflected in the EMI levels; in A$ terms the market is higher compared to both periods, while in US$ terms it is still yet to reach the 2012 level while sitting 21% above last years US$EMI.

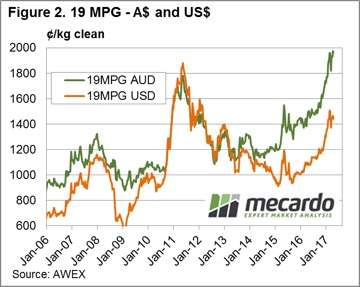

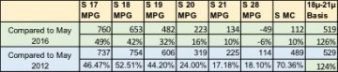

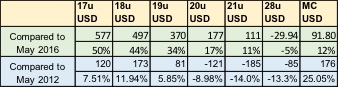

Firstly currency; while it has hardly moved over the past 12 months, it is 27 cents or 36% lower than five years ago. This is reflected in the EMI levels; in A$ terms the market is higher compared to both periods, while in US$ terms it is still yet to reach the 2012 level while sitting 21% above last years US$EMI. Compared to last year, in US$ terms (Fig 4) all bar crossbred types are stronger, particularly the finer types with 17 MPG up 50% year on year. The story is a little more mixed when we compare against 2012 prices in US$’s, and while 19 MPG & finer as well as Cardings are now above 2012 levels, 20 & 21 MPG were higher back then. The A$ in 2012 was trading US$1.01 cents and clearly impacting on the buyers.

Compared to last year, in US$ terms (Fig 4) all bar crossbred types are stronger, particularly the finer types with 17 MPG up 50% year on year. The story is a little more mixed when we compare against 2012 prices in US$’s, and while 19 MPG & finer as well as Cardings are now above 2012 levels, 20 & 21 MPG were higher back then. The A$ in 2012 was trading US$1.01 cents and clearly impacting on the buyers. The good news from this is that while wool grower returns are very good, wool to our customers is not expensive compared to recent history; this is a good thing. In fact, the recent high for 19 MPG in US$ terms was June 2011; the Southern 19 MPG was quoted around 1750, but at that time the A$ was strong at US$1.05 resulting in a US$ 19 MPG price of 1820 – compared to the current US$ price of 1460 which converts to A$19.77 in the market when the current A$ level is applied.

The good news from this is that while wool grower returns are very good, wool to our customers is not expensive compared to recent history; this is a good thing. In fact, the recent high for 19 MPG in US$ terms was June 2011; the Southern 19 MPG was quoted around 1750, but at that time the A$ was strong at US$1.05 resulting in a US$ 19 MPG price of 1820 – compared to the current US$ price of 1460 which converts to A$19.77 in the market when the current A$ level is applied.

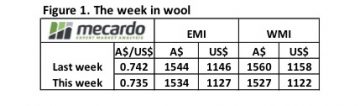

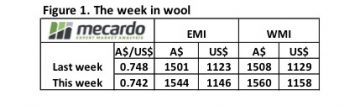

A solid two days trading as exporters re-entered the market this week to see both the Eastern and Western Market Indicators sitting comfortably above 1500¢. The EMI closing the week at 1544¢, a gain of 43¢, and the WMI slightly firmer at 1560¢, up 52¢.

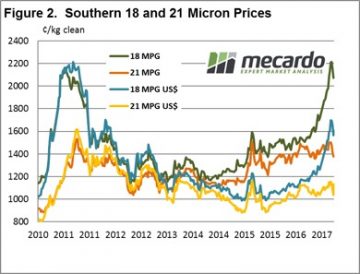

A solid two days trading as exporters re-entered the market this week to see both the Eastern and Western Market Indicators sitting comfortably above 1500¢. The EMI closing the week at 1544¢, a gain of 43¢, and the WMI slightly firmer at 1560¢, up 52¢. Historically the 21 micron class has struggled to hold above 1500¢ for any decent length of time but recently this resistance level has continued to be probed – figure 2. Brokers indicate that there is plenty of space in the wool stores at the moment, so supply remains an ongoing issue. This factor, combined with a continuing softening A$, sets the tone for the chance for further upside in the coming weeks. Clearly, as the chart shows in USD terms overseas buyers have paid higher levels for 21-micron wool in the recent past, so there is the capacity for them to still bid local prices higher.

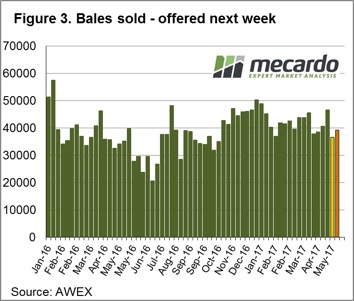

Historically the 21 micron class has struggled to hold above 1500¢ for any decent length of time but recently this resistance level has continued to be probed – figure 2. Brokers indicate that there is plenty of space in the wool stores at the moment, so supply remains an ongoing issue. This factor, combined with a continuing softening A$, sets the tone for the chance for further upside in the coming weeks. Clearly, as the chart shows in USD terms overseas buyers have paid higher levels for 21-micron wool in the recent past, so there is the capacity for them to still bid local prices higher. Offerings over the next few weeks continue to decline, with all of the next three sale weeks listing bales offered under 40,000. Week 45 is operating in all trading centres on Wednesday and Thursday and has 39,253 bales listed. Weeks 46 and 47 will see supply tighten further with 36,100 and 37,650 bales offered, respectively.

Offerings over the next few weeks continue to decline, with all of the next three sale weeks listing bales offered under 40,000. Week 45 is operating in all trading centres on Wednesday and Thursday and has 39,253 bales listed. Weeks 46 and 47 will see supply tighten further with 36,100 and 37,650 bales offered, respectively.

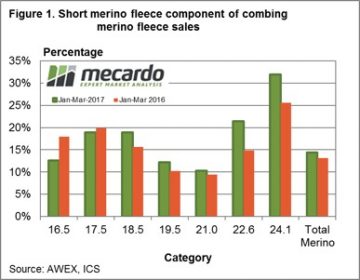

In the earlier analysis (

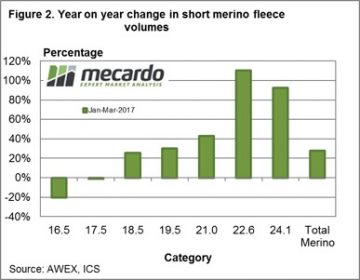

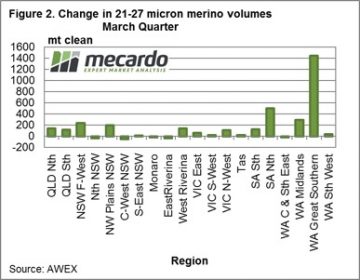

In the earlier analysis ( Figure 2 is where the data becomes interesting. This shows the year on year change in volume for 50-69 mm length merino fleece wool by the micron ranges, for the January to March period. The changes vary widely. There has been a lot broader short staple fleece wool sold in 2017. This fits with the analysis from last week of the broader merino micron volumes. It points to plenty of downward pressure developing in the market as it struggles to absorb increases in the range of 40% to 100% of broad short staple fleece wool. This explains some of the low quotes coming out of the market for wool in these categories.

Figure 2 is where the data becomes interesting. This shows the year on year change in volume for 50-69 mm length merino fleece wool by the micron ranges, for the January to March period. The changes vary widely. There has been a lot broader short staple fleece wool sold in 2017. This fits with the analysis from last week of the broader merino micron volumes. It points to plenty of downward pressure developing in the market as it struggles to absorb increases in the range of 40% to 100% of broad short staple fleece wool. This explains some of the low quotes coming out of the market for wool in these categories.

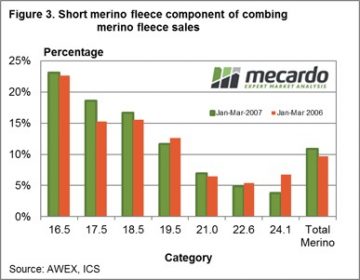

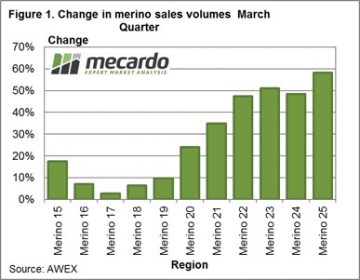

Recent sales volumes and AWTA data have shown strong increases in the supply of broad merino wool in Australia. While the supply was expected to pick up on the back of improved seasonal conditions in 2016, the rise has been faster than anticipated. This article takes a look at where the wool is coming from.

Recent sales volumes and AWTA data have shown strong increases in the supply of broad merino wool in Australia. While the supply was expected to pick up on the back of improved seasonal conditions in 2016, the rise has been faster than anticipated. This article takes a look at where the wool is coming from. The question is where is the extra broad merino wool coming from? As Mecardo showed in an article a couple of weeks ago (

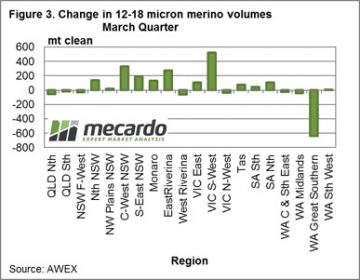

The question is where is the extra broad merino wool coming from? As Mecardo showed in an article a couple of weeks ago ( As a check on this change, Figure 3 shows the year on year change in the volume of 12-18 micron wool sold by each region in the March quarter. The big swing to broader wool in the Great Southern region is matched by a big drop in 12-18 micron volumes. Notice the higher rainfall NSW regions have had increased fine wool sales this year, along with south-west Victoria (which was coming off a drought induced low base). The expected decrease in supply of fine wool from NSW has not eventuated, except for the western Riverina. Good seasonal conditions in 2017 (which has started in the Monaro) will be required to pull the micron broader in the regions, in order to lower the supply of fine merino wool.

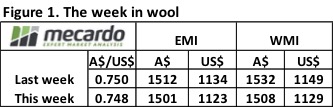

As a check on this change, Figure 3 shows the year on year change in the volume of 12-18 micron wool sold by each region in the March quarter. The big swing to broader wool in the Great Southern region is matched by a big drop in 12-18 micron volumes. Notice the higher rainfall NSW regions have had increased fine wool sales this year, along with south-west Victoria (which was coming off a drought induced low base). The expected decrease in supply of fine wool from NSW has not eventuated, except for the western Riverina. Good seasonal conditions in 2017 (which has started in the Monaro) will be required to pull the micron broader in the regions, in order to lower the supply of fine merino wool. The EMI closed up a whopping 53 cents in A$ terms at 1512¢ while in Fremantle, the strong finish to the last week continued with a A$0.73 rise, the west closing at 1532 – Fig 1.

The EMI closed up a whopping 53 cents in A$ terms at 1512¢ while in Fremantle, the strong finish to the last week continued with a A$0.73 rise, the west closing at 1532 – Fig 1. While the market in general benefited, it was the 21 MPG that was the stand out, with the market in Melbourne actually closing at a higher level than before the correction. This is quite remarkable given the increased supply of medium wool coming forward post the drought conditions of the past couple of years. Fig 2.

While the market in general benefited, it was the 21 MPG that was the stand out, with the market in Melbourne actually closing at a higher level than before the correction. This is quite remarkable given the increased supply of medium wool coming forward post the drought conditions of the past couple of years. Fig 2. Growers are in the driving seat (not often this is the case!!), as the shortage of any buffer stocks means sellers can confidently withdraw wool from the market and have little risk that better prices won’t appear later. When combined with record income from any sheep or lamb sales (

Growers are in the driving seat (not often this is the case!!), as the shortage of any buffer stocks means sellers can confidently withdraw wool from the market and have little risk that better prices won’t appear later. When combined with record income from any sheep or lamb sales ( The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1.

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1. The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne.

The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne. It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day.

It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day. Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied.

Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied.