The dry weather through much of NSW continues, and grain prices have risen. There is little good news on the weather forecast, and the impacts on lamb supply could be significant. As such this week we’re having a look back at the impacts of a dry winter and spring on relative lamb prices, and some of the opportunities this could create.

We have been hearing plenty of anecdotal evidence of increasing lamb supplies coming out of NSW, but also that lambs are struggling to put weight on due to a lack of feed. In theory slower weight gains should see increased supply of store lambs, and weaker supply of finished lambs.

We have been hearing plenty of anecdotal evidence of increasing lamb supplies coming out of NSW, but also that lambs are struggling to put weight on due to a lack of feed. In theory slower weight gains should see increased supply of store lambs, and weaker supply of finished lambs.

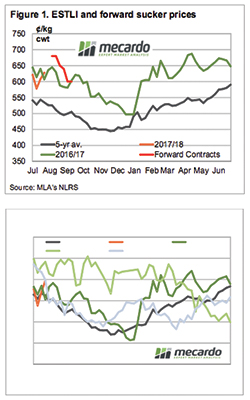

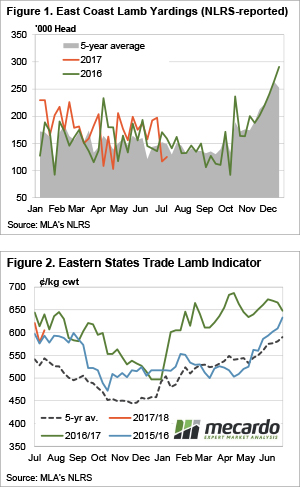

Restocker prices couldn’t be any more expensive relative to trade lambs than they have been in the past twelve months. Figure 1 shows that since the start of September in 2016 restocker lambs in NSW saleyards have been prices as high as a 150¢/kg cwt premium to the Eastern States Trade Lamb Indicator (ESTLI). The average restocker premium over the past 9 months has been 62¢. The average has been higher than almost all of the peaks seen in the restocker premium since the start of 2012.

A dry season will have the impact of increasing supply of light or restocker lambs, while also weakening demand, as grain and grass become more expensive.

The last time restocker lamb prices spent a long time above 50¢ was during the wet years of 2011-2012. During the subsequent dry year’s restockers wound their prices back to a hefty discount as the flock was liquidated, and lambs prices were in the doldrums.

It would likely take a couple of dry years in a row to see restocker lamb prices fall to a discount to the ESTLI. The more likely scenario would be restockers paying a similar premium to that seen during 2014 and 2015. Those years both had ordinary spring and summer rain, and much stronger grain prices than last season.

It would likely take a couple of dry years in a row to see restocker lamb prices fall to a discount to the ESTLI. The more likely scenario would be restockers paying a similar premium to that seen during 2014 and 2015. Those years both had ordinary spring and summer rain, and much stronger grain prices than last season.

Seasonality shows us that the restocker premium usually peaks in the spring, with 50¢ being the level of spring 2014 and 2015, which is a pretty good target for the coming spring.

Key points:

- Dry weather and high grain prices generally increase restocker lamb supply, and decrease demand.

- A return to the restocker premiums over the ESTLI of 2014 and 2015 are likely under current seasonal outlooks.

- Store lamb prices are likely to be $80-90 per head this spring if the dry season eventuates.

What does this mean?

A weaker restocker premium will create issues and opportunities for lamb producers. A likely outcome is the ESTLI falling to 500¢/kg cwt, under a dry season scenario, and restocker lambs are at a 50¢ premium. This puts a 16kg cwt lamb at a respectable $88 plus skin, relative to a 20kg finished lamb at $100 plus skin.

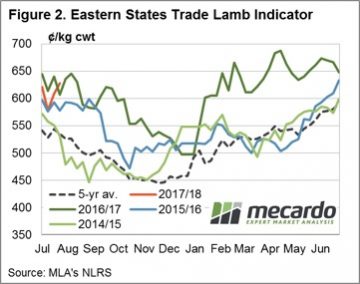

Worst case scenario ESTLI is something like the 450¢ seen in spring 2014 (figure 2), and the 50¢ premium would put a 16kg store lamb at $80 plus skin, versus a trade lamb at $90 plus skin.

So where is the opportunity? We see the 50¢ premium as a target sell for store lambs this spring, and lamb producers should be on the lookout for prices above this level as a sell signal, and below as a hold or buy.

The first story states that US herd expansion is continuing. The latest numbers on the US cattle herd from the United States Department of Agriculture (USDA) put the herd at 102.6 million head. This is a 6 year high, and up 7 million head from the 2014 low. The US have added the equivalent of 25% of the Australian herd in just 3 years.

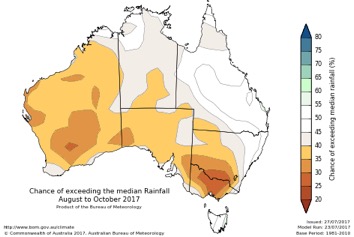

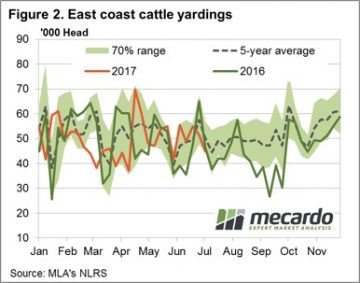

The first story states that US herd expansion is continuing. The latest numbers on the US cattle herd from the United States Department of Agriculture (USDA) put the herd at 102.6 million head. This is a 6 year high, and up 7 million head from the 2014 low. The US have added the equivalent of 25% of the Australian herd in just 3 years. Finally, we come to the fifth story, which is more of the same on the weather forecasting front (Figure 2). While key cattle areas of Queensland and Northern NSW are back at a 50:50 chance of getting more than the median rainfall, the dry is forecast to continue for southern NSW and much of Victoria.

Finally, we come to the fifth story, which is more of the same on the weather forecasting front (Figure 2). While key cattle areas of Queensland and Northern NSW are back at a 50:50 chance of getting more than the median rainfall, the dry is forecast to continue for southern NSW and much of Victoria.

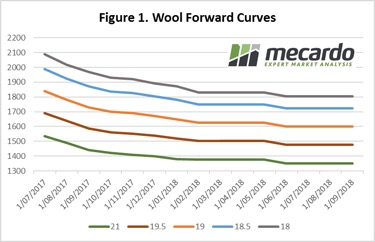

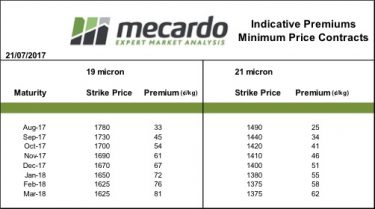

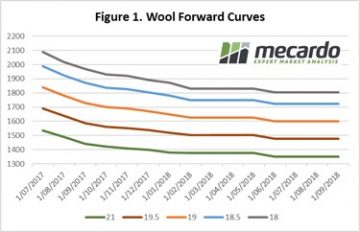

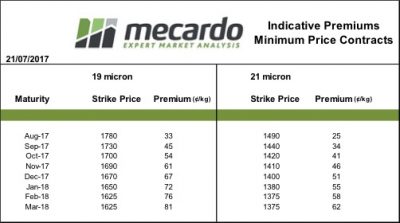

Considering the finale is always the main event, we’ve focused this market review on the last week of the season (July 10th 2017). Table 1 compares the average market price for the last week of the 2016-17 year for Northern, Southern and Western market regions to that of the previous year. The closing market clearly favoured the fine microns this year with a price jump at an average of 34% across the 16.5 to 19 micron range for the Eastern markets and 24% for the West.

Considering the finale is always the main event, we’ve focused this market review on the last week of the season (July 10th 2017). Table 1 compares the average market price for the last week of the 2016-17 year for Northern, Southern and Western market regions to that of the previous year. The closing market clearly favoured the fine microns this year with a price jump at an average of 34% across the 16.5 to 19 micron range for the Eastern markets and 24% for the West. By comparison, the mid and coarse fibre market on the West Coast remained fairly stagnant, landing nearly right back where it ended 12 months ago. The market price was on average just 10c higher than last year for fibres above 19.5 micron.

By comparison, the mid and coarse fibre market on the West Coast remained fairly stagnant, landing nearly right back where it ended 12 months ago. The market price was on average just 10c higher than last year for fibres above 19.5 micron.

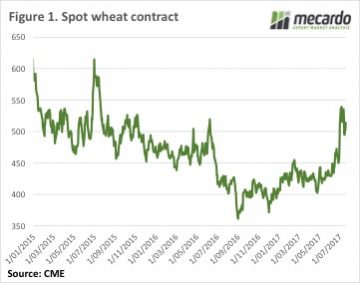

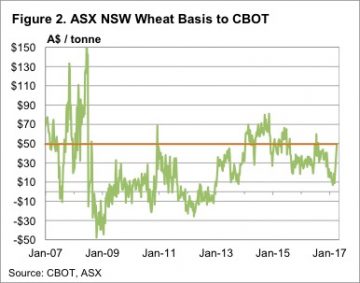

CBOT wheat prices managed to track sideways this week as the market digested the World Agricultural Supply and Demand (WASDE) report and weather outlooks improved. While the spot and Dec-17 CBOT wheat have fallen 50¢ from the peak, the Dec-18 contract is down 35¢. Dec-17 currently sits at 529¢/bu, with Dec-18 at 585¢ and full carry back in the market.

CBOT wheat prices managed to track sideways this week as the market digested the World Agricultural Supply and Demand (WASDE) report and weather outlooks improved. While the spot and Dec-17 CBOT wheat have fallen 50¢ from the peak, the Dec-18 contract is down 35¢. Dec-17 currently sits at 529¢/bu, with Dec-18 at 585¢ and full carry back in the market. After also falling heavily last week, ICE Canola for Jan-18 has steadied at the $515CAD/t level. The Canadian dollar has matched the AUD increases, with the two currencies locked at parity, so swap prices remain around the $515/t value. With local port prices at $530-535/t, the basis value doesn’t look to be there, so swaps would be the way to go at the moment.

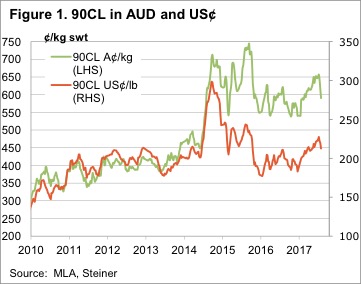

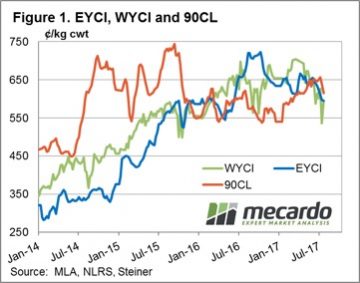

After also falling heavily last week, ICE Canola for Jan-18 has steadied at the $515CAD/t level. The Canadian dollar has matched the AUD increases, with the two currencies locked at parity, so swap prices remain around the $515/t value. With local port prices at $530-535/t, the basis value doesn’t look to be there, so swaps would be the way to go at the moment. The 90CL frozen cow beef export indicator continued to slide this week, dragged down by a reduction in boxed beef forward sales in the US over the last few weeks. US meatworks report an 18% drop in forward bookings so have realigned their pricing to lower levels in order to attract additional forward sales interest. The 90CL settling 3.1% softer to close at 615¢/kg CIF – Figure 1.

The 90CL frozen cow beef export indicator continued to slide this week, dragged down by a reduction in boxed beef forward sales in the US over the last few weeks. US meatworks report an 18% drop in forward bookings so have realigned their pricing to lower levels in order to attract additional forward sales interest. The 90CL settling 3.1% softer to close at 615¢/kg CIF – Figure 1. Despite the fall in the 90CL this week the indicator remains above the EYCI, combined with the steady decline in cattle yardings, this should start to add some support to cattle prices at the current level. Although, the rain forecast for next week shows limited falls to the southern tip of the nation so it’s unlikely that prices will get too much of a kick up. Consolidation at current levels seems the order of the day.

Despite the fall in the 90CL this week the indicator remains above the EYCI, combined with the steady decline in cattle yardings, this should start to add some support to cattle prices at the current level. Although, the rain forecast for next week shows limited falls to the southern tip of the nation so it’s unlikely that prices will get too much of a kick up. Consolidation at current levels seems the order of the day.

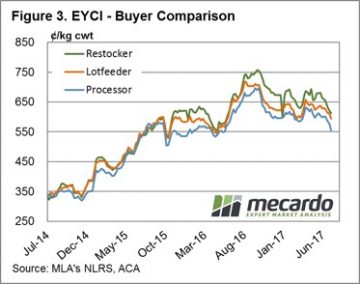

When we set out to write this article, we thought it was going to be about how restocker demand was on the wane, and one of the reasons the cattle market was falling. While restockers are paying less, they are still buying plenty of cattle.

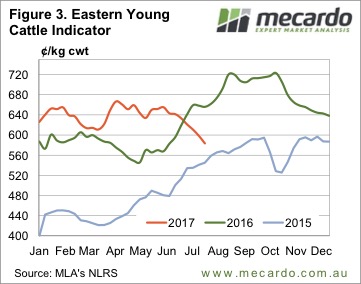

When we set out to write this article, we thought it was going to be about how restocker demand was on the wane, and one of the reasons the cattle market was falling. While restockers are paying less, they are still buying plenty of cattle. This is somewhat confirmed by the smaller fall in the price paid by feeders for EYCI cattle over the last six weeks. Figure 3 shows that feeders are paying 7% less than at the start of June, while restockers are down 10% and processors price have weakened 8%.

This is somewhat confirmed by the smaller fall in the price paid by feeders for EYCI cattle over the last six weeks. Figure 3 shows that feeders are paying 7% less than at the start of June, while restockers are down 10% and processors price have weakened 8%. Stronger supply of light store cattle is not the only reason for the weaker EYCI, but it is contributing. For those lucky enough to have feed on hand, the fact the restocker cattle are now more in line with historical premiums to the EYCI means they are reasonable buying.

Stronger supply of light store cattle is not the only reason for the weaker EYCI, but it is contributing. For those lucky enough to have feed on hand, the fact the restocker cattle are now more in line with historical premiums to the EYCI means they are reasonable buying.

The lamb price bounce continued this week despite a bit of a lift in yardings. The direct to works supply appears to have weakened, with plenty of competition back at the saleyards. All this despite the stronger Aussie dollar which is not doing great things for our export competitiveness.

The lamb price bounce continued this week despite a bit of a lift in yardings. The direct to works supply appears to have weakened, with plenty of competition back at the saleyards. All this despite the stronger Aussie dollar which is not doing great things for our export competitiveness.

It’s nice to be right sometimes, even if it is only for a week. The weekly comment last week suggested the slide in lamb prices was about to halt, and halt it did. The market even bounced back above 600¢ as lamb and sheep yardings recorded another weak week.

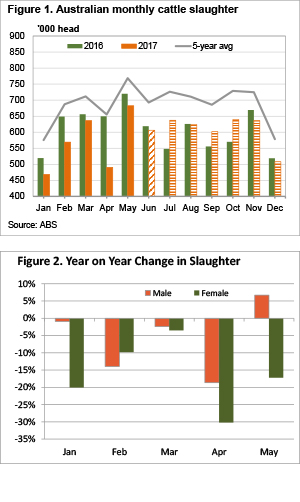

It’s nice to be right sometimes, even if it is only for a week. The weekly comment last week suggested the slide in lamb prices was about to halt, and halt it did. The market even bounced back above 600¢ as lamb and sheep yardings recorded another weak week. As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.

As we move past the half way mark of the year we can start to get an idea of how cattle supply is faring relative to industry forecasts. Those looking to sell cattle in the second half of the year will not only be hoping the weather does the right thing, but also that Meat and Livestock Australia’s (MLA) total cattle slaughter forecasts are an overestimate.