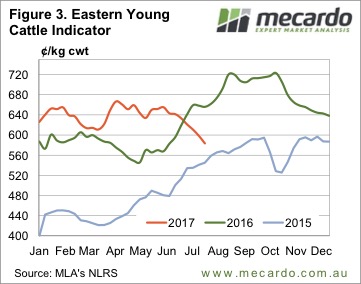

Young cattle prices gained some ground this week, for the first time in some while. The Eastern Young Cattle Indicator (EYCI) has fallen for 12 weeks without any real break. This week the break came, with the EYCI gaining 14¢ to move back to 553¢/kg cwt. Is it a dead cat bounce or a sustainable rally?

Young cattle prices gained some ground this week, for the first time in some while. The Eastern Young Cattle Indicator (EYCI) has fallen for 12 weeks without any real break. This week the break came, with the EYCI gaining 14¢ to move back to 553¢/kg cwt. Is it a dead cat bounce or a sustainable rally?

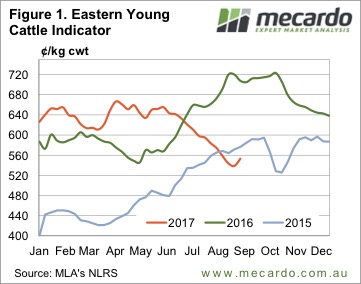

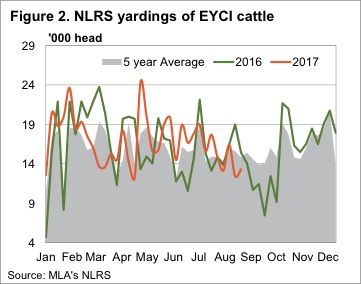

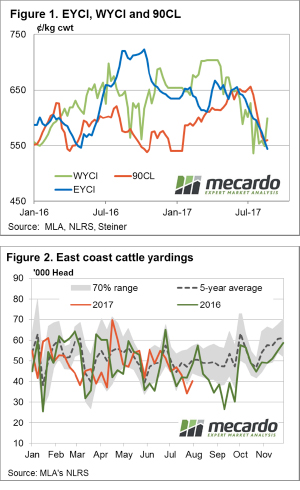

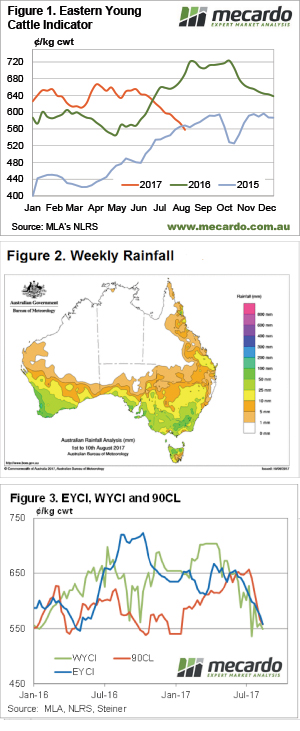

Figure 1 shows the bounce in the EYCI, going back to the level of 3 weeks ago. We can see in figure 2 that EYCI yardings have been low for a couple of weeks in a row, which seems to have been enough to see buyers competing a bit harder and pushing prices higher.

Young cattle weren’t the only category to gain ground. Heavy steers in Queensland and NSW rallied to 480 and 514¢/kg cwt respectively. While Heavy Steer prices in Victoria didn’t rise, they in fact fell 17¢, they remain at a premium to northern states, at 522¢/kg cwt.

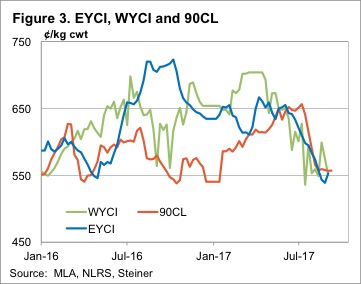

The 90CL Frozen Cow price has tracked sideways for the fourth week in a row and both the EYCI and Western Young Cattle Indicator (WYCI) have met it at around 555¢. Figure 3 suggests it’s hard to argue that falling beef export prices aren’t driving the cattle price.

The 90CL Frozen Cow price has tracked sideways for the fourth week in a row and both the EYCI and Western Young Cattle Indicator (WYCI) have met it at around 555¢. Figure 3 suggests it’s hard to argue that falling beef export prices aren’t driving the cattle price.

This time last year the 90CL was around 570¢, while the EYCI was at 707¢/kg cwt. This is a good indication of the extraordinary restocker demand we saw last year, which this year has basically returned to normal, seeing cattle prices match the export price again.

The week ahead

It’s going to rain in southern parts of Victoria and South Australia, but nothing to speak of in the north. As such we’re not going to see demand pick up for young cattle. Additionally, the supply of grainfed keeps coming out of the record numbers of cattle on feed, and that’s not going to change in a hurry either. As long as the export price holds, there is a good chance prices have found a base for now, with the next test coming in October.

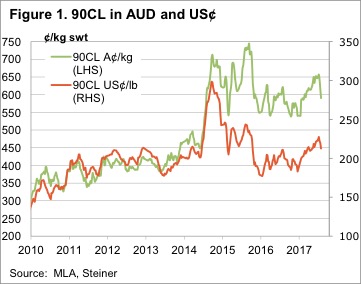

At Mecardo we regularly refer to the 90CL frozen cow indicator as a key beef export price benchmark when undertaking analysis of the domestic market prices in relation to overseas markets. This is because a strong long-term correlation exists between indices like the Eastern Young Cattle Indicator (EYCI) and the 90CL. We often get asked to explain what the 90CL actually is and what influences its movement – this will be addressed in this piece.

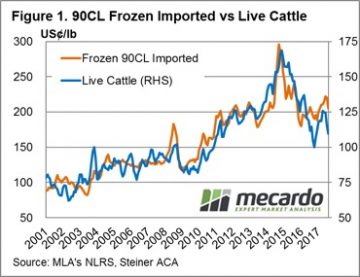

At Mecardo we regularly refer to the 90CL frozen cow indicator as a key beef export price benchmark when undertaking analysis of the domestic market prices in relation to overseas markets. This is because a strong long-term correlation exists between indices like the Eastern Young Cattle Indicator (EYCI) and the 90CL. We often get asked to explain what the 90CL actually is and what influences its movement – this will be addressed in this piece. Therefore, it should come as no surprise that the influence of the broader US cattle market on the price of the 90CL is fairly strong. Indeed, as highlighted in figure 1, the movement of US Live Cattle futures is closely mirrored by the movement in the 90CL. Analysis of the monthly average price of US Live Cattle to the 90CL since 2001 shows a correlation measure of 0.9139 which suggests that nearly all of the movement in the 90CL can be explained by the fluctuations of the US Live Cattle market.

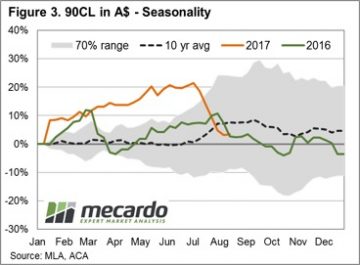

Therefore, it should come as no surprise that the influence of the broader US cattle market on the price of the 90CL is fairly strong. Indeed, as highlighted in figure 1, the movement of US Live Cattle futures is closely mirrored by the movement in the 90CL. Analysis of the monthly average price of US Live Cattle to the 90CL since 2001 shows a correlation measure of 0.9139 which suggests that nearly all of the movement in the 90CL can be explained by the fluctuations of the US Live Cattle market. Compared to current US Live Cattle levels the 90CL in US terms seems a little overvalued, and the normal annual pattern heading into the remainder of the season shows that the 90CL usually begins to decline beyond the US grilling season peak around July/August.

Compared to current US Live Cattle levels the 90CL in US terms seems a little overvalued, and the normal annual pattern heading into the remainder of the season shows that the 90CL usually begins to decline beyond the US grilling season peak around July/August.

National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support.

National Trade Steers holding up reasonably well this week, supported by price lifts in Queensland, as most other categories of cattle take the lead of the Eastern Young Cattle Indicator (EYCI) and continue to probe lower. Although, prices out West and in Victoria buck the trend as continued rain provides a bit of support. The slide in cattle prices continued this week, with more help from lower export prices, pushing the EYCI back to two year lows for this time of year. Rainfall across NSW and Victoria doesn’t seem to have helped the cause yet, as supply continues to outweigh demand.

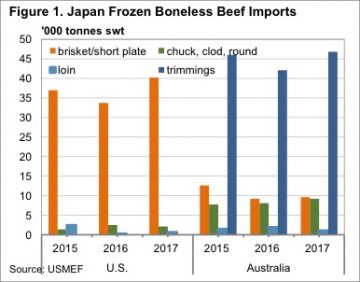

The slide in cattle prices continued this week, with more help from lower export prices, pushing the EYCI back to two year lows for this time of year. Rainfall across NSW and Victoria doesn’t seem to have helped the cause yet, as supply continues to outweigh demand. According to the US Meat Export Federation (USMEF), who have produced an excellent fact sheet, a vast majority of US frozen beef exports to Japan are grainfed brisket and short plate cuts. These cuts are used in gyudon beef bowl chain restaurants.

According to the US Meat Export Federation (USMEF), who have produced an excellent fact sheet, a vast majority of US frozen beef exports to Japan are grainfed brisket and short plate cuts. These cuts are used in gyudon beef bowl chain restaurants. The first story states that US herd expansion is continuing. The latest numbers on the US cattle herd from the United States Department of Agriculture (USDA) put the herd at 102.6 million head. This is a 6 year high, and up 7 million head from the 2014 low. The US have added the equivalent of 25% of the Australian herd in just 3 years.

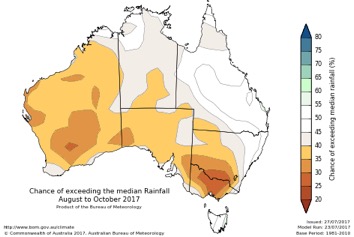

The first story states that US herd expansion is continuing. The latest numbers on the US cattle herd from the United States Department of Agriculture (USDA) put the herd at 102.6 million head. This is a 6 year high, and up 7 million head from the 2014 low. The US have added the equivalent of 25% of the Australian herd in just 3 years. Finally, we come to the fifth story, which is more of the same on the weather forecasting front (Figure 2). While key cattle areas of Queensland and Northern NSW are back at a 50:50 chance of getting more than the median rainfall, the dry is forecast to continue for southern NSW and much of Victoria.

Finally, we come to the fifth story, which is more of the same on the weather forecasting front (Figure 2). While key cattle areas of Queensland and Northern NSW are back at a 50:50 chance of getting more than the median rainfall, the dry is forecast to continue for southern NSW and much of Victoria.

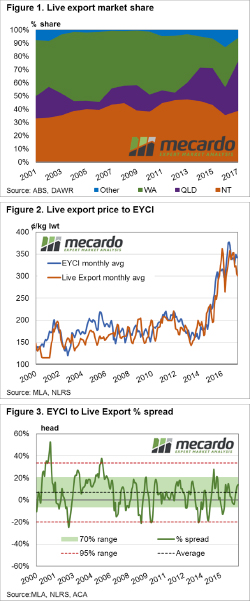

It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle.

It has been some time since we had a look at live cattle exports so we thought it timely to focus in on the changing market share of the live cattle trade among the key export states, along with the price relationships that exist between live cattle and domestic young cattle.