With generational ties to the land and a degree in Animal science, Tim has lived and breathed agribusiness for all of his working life. Tim has been instrumental in establishing BOQ’s agribusiness team, with a focus on larger, higher quality transactions. In this role Tim has also been responsible for managing BOQ’s funding relationship with StockCo’s Australian business. Tim’s now been appointed as Stockco’s Chief Operating Officer, to continue the growth of Stockco’s business in Australia with specialist focus on enhancing specific distribution channels and targeting new business in the corporate sector.

Welcome to the team Tim!

- You’ve had a successful career in agribusiness, how did you get there and what have been some of the highlights?

My passion for rural Australia is a long-dated affair and thanks to my mother’s side of the family who owned sheep stations in far western Queensland. This passion lead me into a University degree at UQ Gatton studying Animal Science. When social and rugby commitments allowed it, my focus at Uni was the study of animal production systems, pastures and rangelands. During uni, I’d been working part time for a rural merchandiser in Toowoomba who was affiliated with Landmark. Unsure where I was headed after completing my degree they offered me a full-time gig, so I ran with it. It was here I first crossed paths with StockCo’s CEO Richard Brimblecombe who at the time was working for Landmark.

I moved across to work directly for Landmark and was lucky to experience some great opportunities travelling right across north and western QLD. I moved into the rural finance division at Landmark. I had found myself doing something I truly enjoyed and was very passionate about – banking farmers and graziers to achieve their financial, business and personal goals.

As the GFC unfolded, I followed Richard across to CBA and relocated to Roma. Banking has moved me around a lot, and given me the opportunity to meet some fantastic people and business operators. This would have to be a highlight for me. It was on one of these moves where I met my wife – better make that a highlight!

I think a large part of any success has been driven by the people I have been fortunate enough to work with. I’ve had great mentors, colleagues and friends that have supported me through what has been both challenging and rewarding times thus far!

- What role do you see StockCo playing in the agri-finance sector?

StockCo has one purpose – strategic finance solutions for sheep and cattle producers and therefore has a deep understanding of these sectors and their markets. It is with this understanding that StockCo operates in a different manner to traditional financiers or mainstream banks. StockCo becomes an enabler.

This positions StockCo well as the changing tide in capital markets develops. It is becoming more and more prevalent, documented and discussed that the agrifinance sector, and banking in general, is set for change. Ownership models, farming practices, seasonal challenges and technology are forcing people to think differently about how they finance their businesses.

Next generation farmers are proving to be highly productive and successful but often light on capital. StockCo can really assist in this market.

As an agribanker, I have witnessed first-hand instances where StockCo has enabled a grazier to expand their operations by buying the neighbouring property, directing all available capital to the acquisition and/or development, and then utilising StockCo to ramp up livestock numbers immediately to a capacity that creates profitability.

We are witnessing more instances of farmers and graziers choosing to lease instead of own land. A trading bank will then typically struggle to finance these operators working capital or trading accounts. StockCo is a perfect solution in these instances where the grazier is a proven operator.

In the corporate market, StockCo offers a unique off-balance-sheet source of capital that allows a business that is rationing internal sources of capital, to access the capital it needs to fund development or expansion programs on terms that match the business requirements.

- What prompted you to make the move from a senior role in one of Australia’s regional banks to StockCo?

This was both a very difficult, but very easy decision for me….. and I’ll try and explain that complete contradiction! BOQ was a fantastic place to work, with great people, and I had been pivotal in the creation of their Agribusiness division over the last 5 years. BOQ has a similar ethos to StockCo in that they are all about their customer. The customer is at the centre of everything you do. It was an exciting and rewarding place which made leaving difficult. However, it is through BOQ that I was introduced to StockCo as BOQ have a wholesale funding facility with StockCo. So I have a very deep insight into every aspect of StockCo and this made the decision easy.

The points I made earlier around StockCo’s sole purpose being cattle and sheep makes it a very niche and nimble operator. Whilst StockCo has robust systems, procedures and policies, it is a business that is not distracted by a myriad of complex business units, systems, products, compliance and regulation. It really is a very focused business. It truly aims at exceeding the expectations of their clients and I am continually surprised at the depth of knowledge and understanding StockCo has of the livestock industry and how this is then applied to assisting livestock producers.

As a throwaway comment, I am also excited about the data associated with the Australian Livestock market that StockCo is capturing as part of their standard operations. As this data pool continues to grow, it has the potential to help both StockCo and other industry bodies refine products and processes to benefit numerous industry participants.

- What do hope to achieve in your role as Chief Operating Officer for StockCo?

As COO, I have been tasked to assist the executive team, and in particular, Richard as Australian CEO, to keep growing the Australian business. I will be predominantly focused on enhancing a few specific distribution channels and targeting new business in the corporate sector. My role will also focus on assisting the executive team identify strategic opportunities, product enhancement, new productive development and contributing to the funding strategy and funder relationships.

StockCo is a dynamic business run by dynamic people. It will be all hands-on-deck and I am absolutely certain there will be no dull moments!

Personally, I’d like to be able to look back in 5 years’ time and know I’ve been a pivotal part in building a business that is the leader in its field of Livestock Finance across Australia and New Zealand.

- StockCo has a rather unique approach to distribution of its products and services. Tell us about StockCo’s approach and the rationale behind it.

StockCo definitely is unique in distribution, which is a large contributor to its success. We enjoy a very strong relationship with our key distribution partners Elders and Ruralco, who provide StockCo with access to some 800 locations right across regional Australia. Having worked both in banking and in rural agency, I can attest to the very entrenched relationship a grazier has with livestock agent. StockCo’s product sits very firmly in the toolkit of the livestock managers and agri-finance managers who work for Elders and Ruralco.

StockCo also enjoys formal distribution agreements with other key large successful private agencies and independent service providers, with an important provider being Sprout Ag.

These firms are preferred by StockCo as they share the ethos of the client being at the centre of everything we collectively do. By aligning ourselves with similar firms, we mutually benefit – their clients receive the market leading StockCo product and StockCo gains access to their network of clients. In leveraging these networks via these established distribution partners, StockCo can access a broad network of skilled and knowledgeable relationship managers on the ground whilst continuing to reinvest in our systems, products and infrastructure to maintain our position as market leader in our field. It would be impossible for StockCo to replicate or achieve such a reach without this alignment.

Learn more about the StockCo team here.

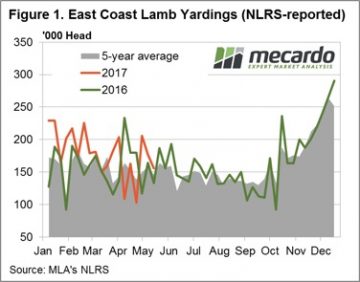

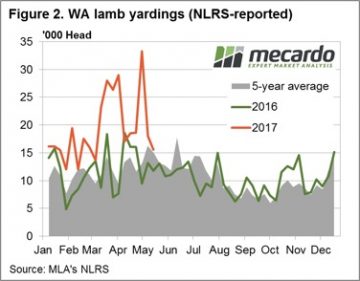

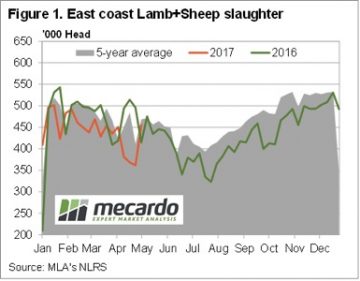

All states, except Tasmania, saw a decline in lamb throughput this week evident in the yarding figures for the East coast (Figure 1) and in Western Australia (Figure 2). East coast lamb yarding down 12% to just under 156,000 head reported through the saleyards, while WA lamb throughput saw a decline of 13.8%.

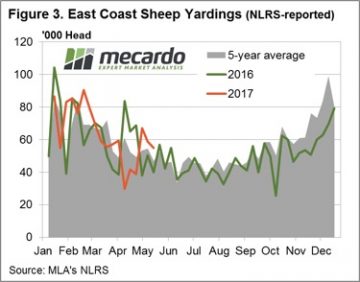

All states, except Tasmania, saw a decline in lamb throughput this week evident in the yarding figures for the East coast (Figure 1) and in Western Australia (Figure 2). East coast lamb yarding down 12% to just under 156,000 head reported through the saleyards, while WA lamb throughput saw a decline of 13.8%. East coast Mutton throughput impacted by soft NSW figures where an 11% fall in NSW flowed through to a price gain of 1.6% for sheep in that state and a broader drop in the East coast throughput for the week – figure 3. Not the case in WA and SA, where increased mutton yardings translated into double digit percentage price falls to see both state mutton prices back below 500¢.

East coast Mutton throughput impacted by soft NSW figures where an 11% fall in NSW flowed through to a price gain of 1.6% for sheep in that state and a broader drop in the East coast throughput for the week – figure 3. Not the case in WA and SA, where increased mutton yardings translated into double digit percentage price falls to see both state mutton prices back below 500¢. A forecast of steady rain for the weekend and early part of next week to much of the sheep producing regions of the country and the prospect of tightening of supply, as the weather cools further, should continue to provide support to lamb and sheep prices.

A forecast of steady rain for the weekend and early part of next week to much of the sheep producing regions of the country and the prospect of tightening of supply, as the weather cools further, should continue to provide support to lamb and sheep prices.

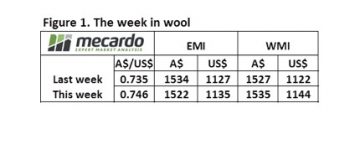

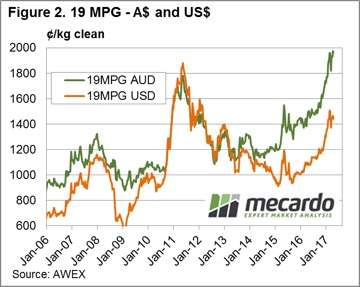

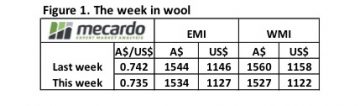

We saw the effect of the Washington/Trump shenanigans which took the confidence out of US markets and resulted in a weaker US$, and by default a stronger A$. The effect on the market was for the EMI to rise in US$ terms (plus 8 cents), but fall in A$ terms (minus 12 cents). The Trump factor causing a 1.5% gain in the A$ over the week to see it finish yesterday at 74.6US¢.

We saw the effect of the Washington/Trump shenanigans which took the confidence out of US markets and resulted in a weaker US$, and by default a stronger A$. The effect on the market was for the EMI to rise in US$ terms (plus 8 cents), but fall in A$ terms (minus 12 cents). The Trump factor causing a 1.5% gain in the A$ over the week to see it finish yesterday at 74.6US¢. At this time of the year we see increased levels of Vegetable Matter; it impacted most on the skirtings market this week with low V.M. wool tending dearer however high V.M. types were irregular and tending cheaper.

At this time of the year we see increased levels of Vegetable Matter; it impacted most on the skirtings market this week with low V.M. wool tending dearer however high V.M. types were irregular and tending cheaper. This tight supply should maintain the market levels, although as we have seen this week currency moves can impact.

This tight supply should maintain the market levels, although as we have seen this week currency moves can impact.

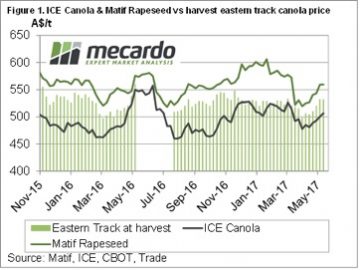

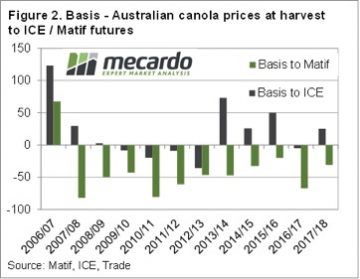

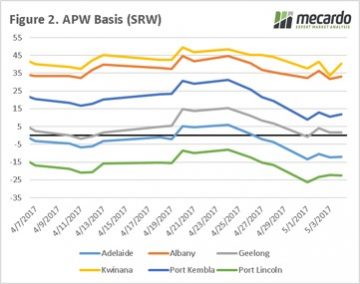

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola.

Old crop canola prices have been frustratingly sticky, for those who are still holding onto inventory. The market is stuck around the $520-525 port level, or $540 delivered Melbourne. This is a slight discount on harvest, so not much has been gained or lost through holding Canola. Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

Since Anzac Day delivered wheat and barley prices have gained some ground. With growers busy on seeders, no one is driving the trucks so this market has tightened somewhat. SFW wheat has hit $218/t delivered Melbourne, while F1 Barley is up to $200. These prices are 10-20% better than harvest, and are worth considering.

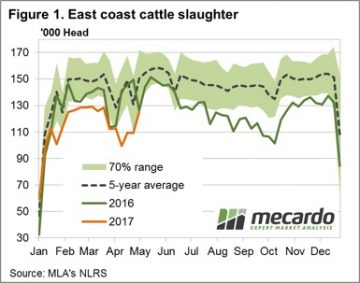

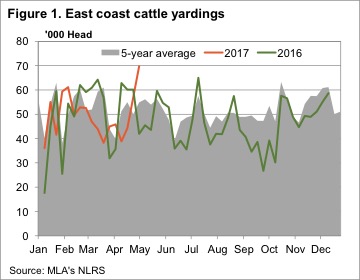

In contrast to the declining throughput and price movements, weekly East coast slaughter for the period ending 5th May still managing an increase from the previous week’s numbers as processors increase activity post the shortened Easter and ANZAC holiday periods – Figure 1. Weekly cattle slaughter rising 14.5% to just over 125,000 head, not far off the peak slaughter levels experienced during March.

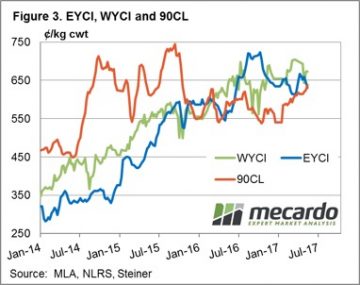

In contrast to the declining throughput and price movements, weekly East coast slaughter for the period ending 5th May still managing an increase from the previous week’s numbers as processors increase activity post the shortened Easter and ANZAC holiday periods – Figure 1. Weekly cattle slaughter rising 14.5% to just over 125,000 head, not far off the peak slaughter levels experienced during March. Indeed, the Western cattle markets were broadly stable, while only marginal declines cited in the East for young/store cattle. The EYCI down a mere 1.5% on the week to 634¢/kg cwt – figure 3. In national markets, trade steers less than 1% softer (345¢/kg lwt), feeder steers declined 1.8% (342¢/kg lwt), while medium cow shed a mere 2.1% (216¢/kg lwt). The more moderate falls reserved for the heavier end with medium steers leading the charge recording a 5% fall at 292¢/kg lwt, while heavy steers (not so heavy it seems) posting a 2.6% drop to 293¢/kg lwt.

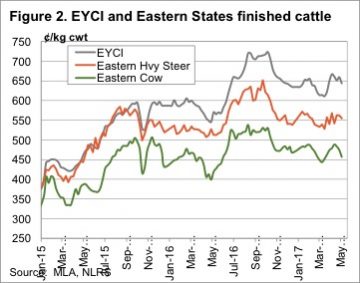

Indeed, the Western cattle markets were broadly stable, while only marginal declines cited in the East for young/store cattle. The EYCI down a mere 1.5% on the week to 634¢/kg cwt – figure 3. In national markets, trade steers less than 1% softer (345¢/kg lwt), feeder steers declined 1.8% (342¢/kg lwt), while medium cow shed a mere 2.1% (216¢/kg lwt). The more moderate falls reserved for the heavier end with medium steers leading the charge recording a 5% fall at 292¢/kg lwt, while heavy steers (not so heavy it seems) posting a 2.6% drop to 293¢/kg lwt.

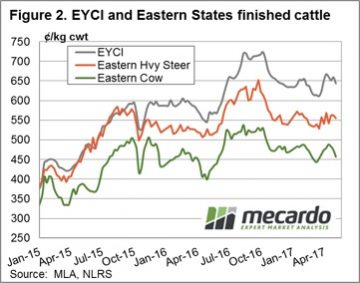

The current margin on cows for processors comes in at negative $34 per head. The margin model is based on a cow weighing 500kgs liveweight, or 260kgs carcase weight. Basically the loss being worn by processors at the moment equates to 13¢/kg cwt.

The current margin on cows for processors comes in at negative $34 per head. The margin model is based on a cow weighing 500kgs liveweight, or 260kgs carcase weight. Basically the loss being worn by processors at the moment equates to 13¢/kg cwt. In fact, prices in Queensland are nearly there, sitting at 446¢/kg cwt last week (figure 1). There is still upside potential for cow prices over the coming months, with the prospect of tight supply sending processor margins toward the $150 losses seen last year. To reach these deeply negative margins under current beef prices, cows would have to make 520¢/kg cwt. Last winter and spring cows were making 540¢, so this is not out of the question.

In fact, prices in Queensland are nearly there, sitting at 446¢/kg cwt last week (figure 1). There is still upside potential for cow prices over the coming months, with the prospect of tight supply sending processor margins toward the $150 losses seen last year. To reach these deeply negative margins under current beef prices, cows would have to make 520¢/kg cwt. Last winter and spring cows were making 540¢, so this is not out of the question.

If you told a sheep grower back in November you’d give them 530¢ for lambs in May, they would have considered it. If you told them you’d give them that for mutton, they’d have laughed at you. But here we are, with the Victorian Mutton Indicator at 530¢/kg cwt.

If you told a sheep grower back in November you’d give them 530¢ for lambs in May, they would have considered it. If you told them you’d give them that for mutton, they’d have laughed at you. But here we are, with the Victorian Mutton Indicator at 530¢/kg cwt. Mutton yardings were also strong relative to last year, but down on last week. The National Mutton Indicator (NMI) reacted by gaining 22¢ to hit a new record of 503¢/kg cwt. This is the first time the NMI has broken 500¢ (figure 2).

Mutton yardings were also strong relative to last year, but down on last week. The National Mutton Indicator (NMI) reacted by gaining 22¢ to hit a new record of 503¢/kg cwt. This is the first time the NMI has broken 500¢ (figure 2). It seems unlikely lamb or sheep supply is going to improve in the short term, with the tap to turn on sometime in August. What happens from there depends on the season, but we can expect to see price decline fairly rapidly once lambs start to hit the market.

It seems unlikely lamb or sheep supply is going to improve in the short term, with the tap to turn on sometime in August. What happens from there depends on the season, but we can expect to see price decline fairly rapidly once lambs start to hit the market.

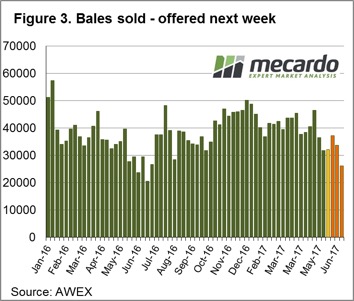

The market opened to solid demand on Wednesday but nervousness crept in on Thursday to see the market in general close below last week’s levels. Eastern prices 5-35¢ softer while the West saw a bit more of a slide, with 15-70¢ falls registered. A reduced offering of bales for sale, just over 38,000 bales came forward this week, however weaker demand saw the pass in rate jump this week to 16.1% with 31,915 bales sold.

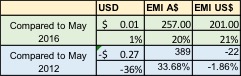

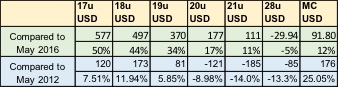

The market opened to solid demand on Wednesday but nervousness crept in on Thursday to see the market in general close below last week’s levels. Eastern prices 5-35¢ softer while the West saw a bit more of a slide, with 15-70¢ falls registered. A reduced offering of bales for sale, just over 38,000 bales came forward this week, however weaker demand saw the pass in rate jump this week to 16.1% with 31,915 bales sold. Firstly currency; while it has hardly moved over the past 12 months, it is 27 cents or 36% lower than five years ago. This is reflected in the EMI levels; in A$ terms the market is higher compared to both periods, while in US$ terms it is still yet to reach the 2012 level while sitting 21% above last years US$EMI.

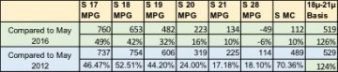

Firstly currency; while it has hardly moved over the past 12 months, it is 27 cents or 36% lower than five years ago. This is reflected in the EMI levels; in A$ terms the market is higher compared to both periods, while in US$ terms it is still yet to reach the 2012 level while sitting 21% above last years US$EMI. Compared to last year, in US$ terms (Fig 4) all bar crossbred types are stronger, particularly the finer types with 17 MPG up 50% year on year. The story is a little more mixed when we compare against 2012 prices in US$’s, and while 19 MPG & finer as well as Cardings are now above 2012 levels, 20 & 21 MPG were higher back then. The A$ in 2012 was trading US$1.01 cents and clearly impacting on the buyers.

Compared to last year, in US$ terms (Fig 4) all bar crossbred types are stronger, particularly the finer types with 17 MPG up 50% year on year. The story is a little more mixed when we compare against 2012 prices in US$’s, and while 19 MPG & finer as well as Cardings are now above 2012 levels, 20 & 21 MPG were higher back then. The A$ in 2012 was trading US$1.01 cents and clearly impacting on the buyers. The good news from this is that while wool grower returns are very good, wool to our customers is not expensive compared to recent history; this is a good thing. In fact, the recent high for 19 MPG in US$ terms was June 2011; the Southern 19 MPG was quoted around 1750, but at that time the A$ was strong at US$1.05 resulting in a US$ 19 MPG price of 1820 – compared to the current US$ price of 1460 which converts to A$19.77 in the market when the current A$ level is applied.

The good news from this is that while wool grower returns are very good, wool to our customers is not expensive compared to recent history; this is a good thing. In fact, the recent high for 19 MPG in US$ terms was June 2011; the Southern 19 MPG was quoted around 1750, but at that time the A$ was strong at US$1.05 resulting in a US$ 19 MPG price of 1820 – compared to the current US$ price of 1460 which converts to A$19.77 in the market when the current A$ level is applied.

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “

The background to the issues at the early part of this week are explained in Tuesdays analysis piece “ This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected.

This yield estimate is therefore based on the fields with the smallest impact by recent weather, and yield/hectare losses will most likely be revised in the coming ten days. This may cause another short rally when the snow-covered fields are estimated, but likely the damage will not be as bad as previously expected. We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

We need to keep a very close eye on the market as it may present selling opportunities over the 1-2 weeks, if (as I expect) the Kansas crop is re-estimated to take into account the snow-covered fields. This may potentially result in speculators with short positions being spooked again. The commitment of trader’s report for this week will be of interest as it will give an indication of whether the funds are still bearish on agricultural commodities or has this week made them reassess.

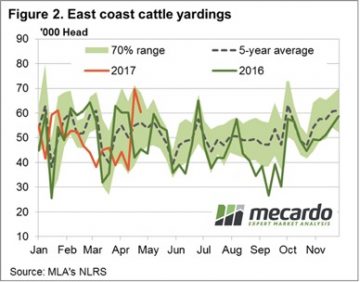

Figure 1 shows east coast cattle yardings rallied an enormous 87% on last week, and 52% on the last full week of sales. With yardings this week hitting 69,737 head, we had to go back to the second week in December 2015 to find larger supply.

Figure 1 shows east coast cattle yardings rallied an enormous 87% on last week, and 52% on the last full week of sales. With yardings this week hitting 69,737 head, we had to go back to the second week in December 2015 to find larger supply. There were no issues with supply hitting prices in WA, where the Western Young Cattle Indicator rallied 30¢ to 673¢/kg cwt. Supply tends to only get tighter in WA at this time of year, which should keep prices at the upper end of the range.

There were no issues with supply hitting prices in WA, where the Western Young Cattle Indicator rallied 30¢ to 673¢/kg cwt. Supply tends to only get tighter in WA at this time of year, which should keep prices at the upper end of the range.