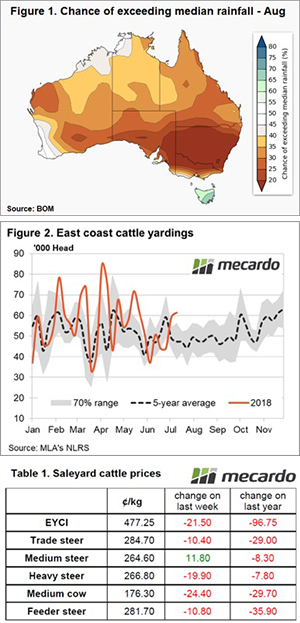

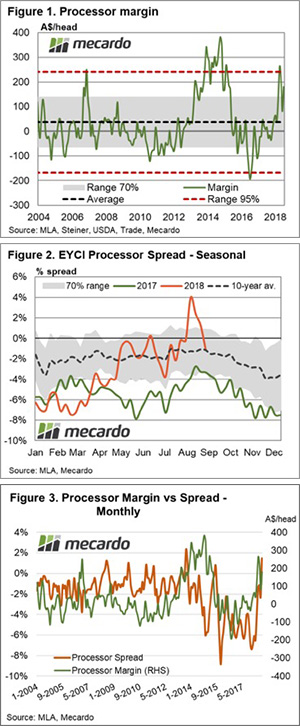

Processor margins remain elevated and have moved back above the upper end of the normal range during August. The healthy margins appear to be encouraging processor optimism at the saleyard according to the behaviour of the spread pattern so far this season. However, is the optimism enough to spark a rally in the EYCI.

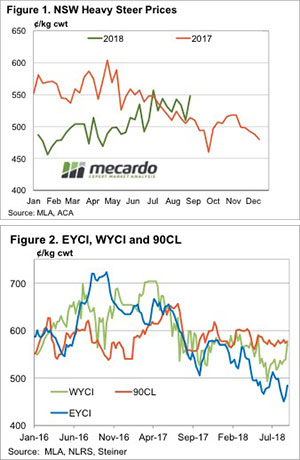

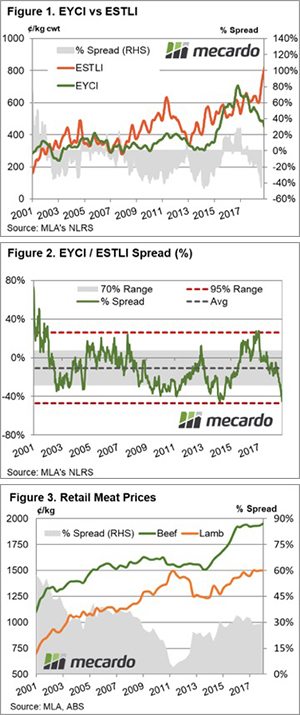

The Mecardo processor cut-out model shows that margins have improved over the month to see the average margin level lift from $81.50 per head in July to $180.65 in August. The rebound in the processor margin places the August figure back above the normal margin range, as identified by the grey shaded region in Figure 1 – which represents where the margin has fluctuated for 70% of the time since 2000.

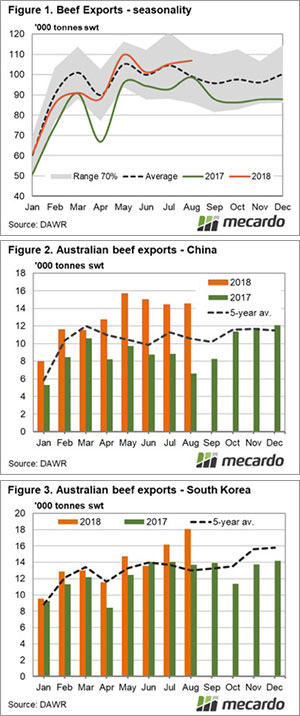

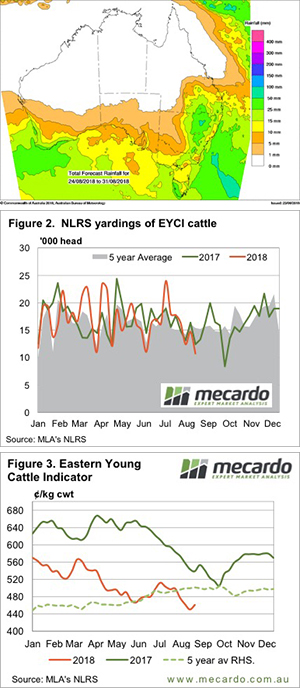

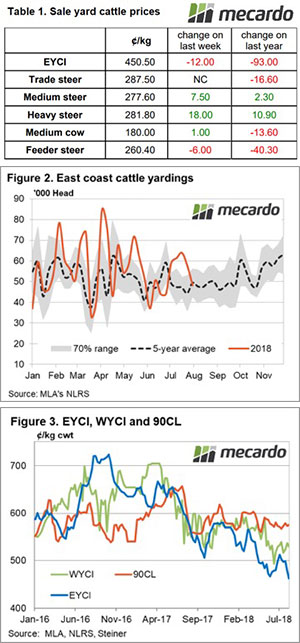

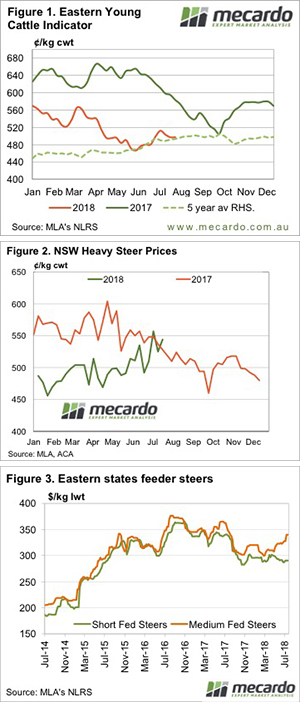

The improvement in processor margins this season began in March and have been recording above-average returns since. Underlying data of buyer behaviour at the saleyard for EYCI eligible cattle shows the weekly spread processors have been prepared to pay above or below the EYCI has been improving since March. It has moved from a discount of 7% in March to a peak of 4% premium in August (Figure 2).

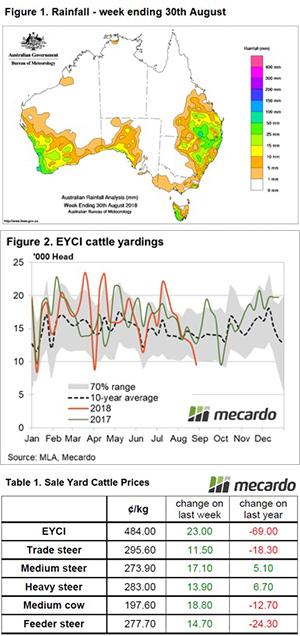

The EYCI processor spread has softened over early September as the EYCI rallied from 444¢ to 490¢. This suggests that processors aren’t inclined to chase the market up despite the good margins being achieved but are more comfortable to provide buying support on dips.

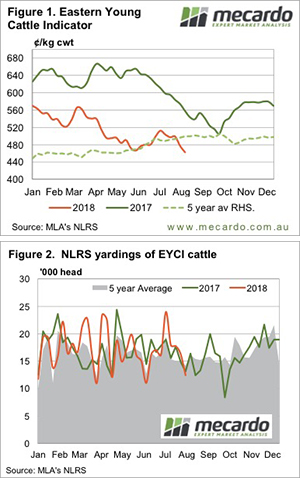

Analysis of the long-term EYCI processor spread pattern, based off the monthly average spread movements since 2004, shows we are nearing all-time highs at a premium spread of 2%. The last time processors were paying average monthly premium spreads in the 2% premium region was during 2014 when offshore demand from the USA was booming and processor margins reached nearly $400 per head monthly (Figure 3).

What does it mean?

It’s hard to see processor activity driving the EYCI higher in any sustained manner, given we are already near extreme historic levels with regard to the spread behaviour. Despite the robust processor margins being achieved at present, they are still a fair way short of the margins that were being made during 2014. Even processor margins over $300 per head weren’t enough to get the processor spread premium extending higher.

A more likely scenario is to continue to see processors actively supporting the young cattle market anytime we see a price dip towards the 420-450¢ level while their margins remain above average.

Key points:

- The monthly processor margin has lifted from $81.50 in July to $180.65 in August, per head of animal processed.

- Improved margins have seen processors more willing to pay up for cattle at the saleyard with the processor spread narrowing from a 7% discount to a 4% premium from March to August.

- Robust processor margins are more likely to provide firm price support on any market dips rather than spark a fresh rally.