The lamb market seems to have found a level it was happy with this week. With supply disruptions due to the Melbourne Cup, it’s hard to get a gauge on supply, but it appears we might have seen the spring low.

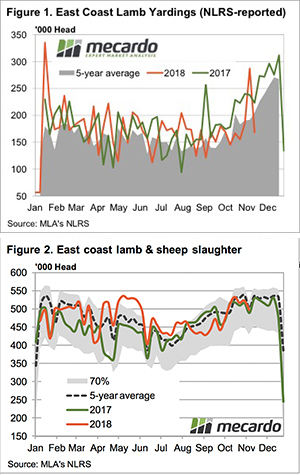

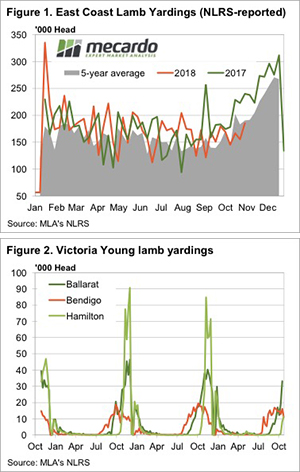

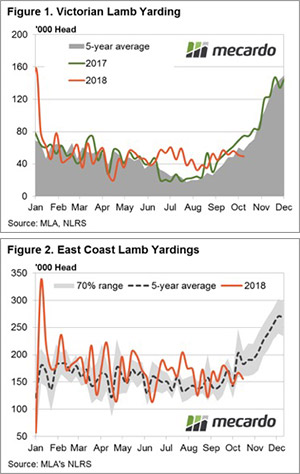

The latest yardings reported by Meat and Livestock Australia (MLA) are to the end of last week. Figure 1 shows that the Melbourne Cup holiday, along with the lower prices, saw a 39.6% decline in yardings. The supply decline saw 119,000 fewer lambs hit the yards across NSW, Victoria and SA.

A quick look at this week’s lamb reports tells us supply has bounced back. Victoria yarded over 100,000 head, which is around normal for this time of year.

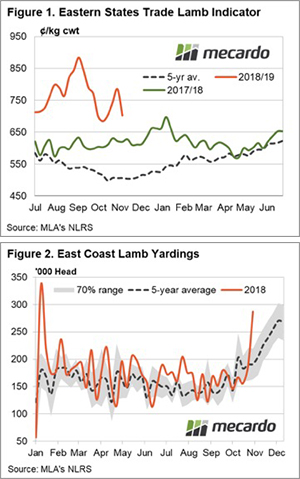

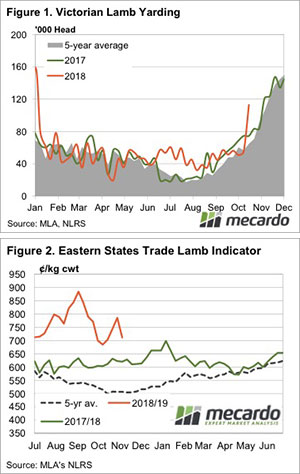

Slaughter numbers also tell an interesting story. Figure 2 shows the total sheep and lamb slaughter for the east coast has been close to last year’s levels. Despite stronger prices than last year, processors still seem to be able to make a margin.

Figure 3 shows the Eastern States Trade Lamb Indicator (ESTLI) has again bounced off 680¢ to this week post a 17¢ gain to hit 695¢/kg cwt. There was, however, a decline in prices at Wagga on Thursday, which dragged the ESTLI back from 700¢.

WA Trade lamb and mutton prices managed to maintain their strong levels this week, at 627¢ and 405¢/kg cwt respectively. It’s interesting, however, to see WA restocker lambs back at 554¢/kg cwt. With cheaper grain in the west, you’d think there should be a narrower spread between restocker and finished lambs than in the east.

What does it mean/next week?:

Growers seem to have shown their cards, with prices under 700¢ now seemingly a hold for many. It shouldn’t be surprising, with forward contracts close to 800¢ a recent memory.

With more rain forecast for the coming week across parts of NSW and key Victorian and South Australian areas, there might be more sheep and lambs held, and higher prices.

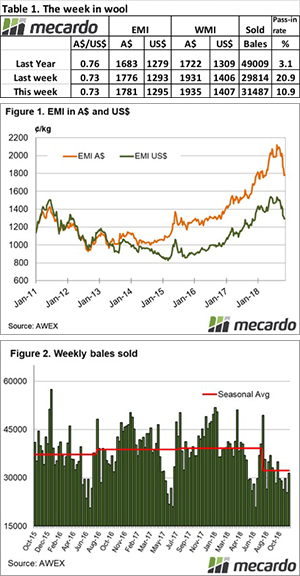

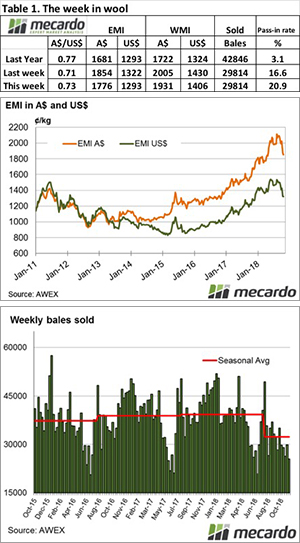

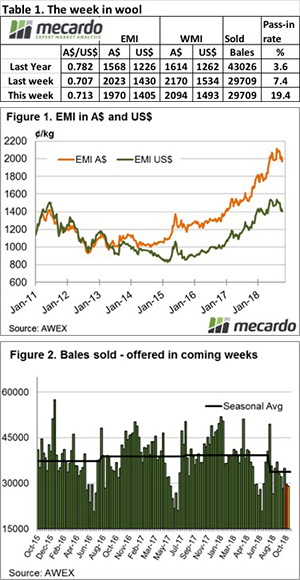

The Eastern Market Indicator (EMI) fell a further 53 cents on top of last week’s 21 cents fall, to end the week at 1,991 cents in AU$. The EMI in US$ terms was cushioned to some degree by a slightly stronger Au$. The EMI dropped 25 cents to end the week at 1,405 US cents (Table 1).

The Eastern Market Indicator (EMI) fell a further 53 cents on top of last week’s 21 cents fall, to end the week at 1,991 cents in AU$. The EMI in US$ terms was cushioned to some degree by a slightly stronger Au$. The EMI dropped 25 cents to end the week at 1,405 US cents (Table 1).