It was a brief rally, which came to an abrupt end this week, as lamb markets crashed across the east coast this week, except in the west. It was a supply driven slump, and sheep markets joined in, also tanking. It would seem we have seen the last of prices with a 6 in front for a while, but weather could have a say in the short term.

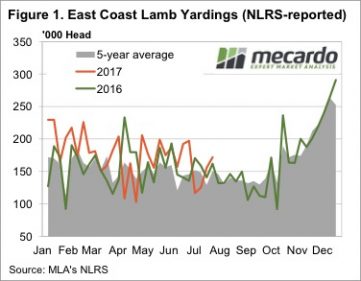

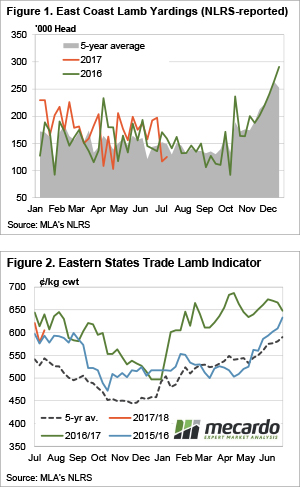

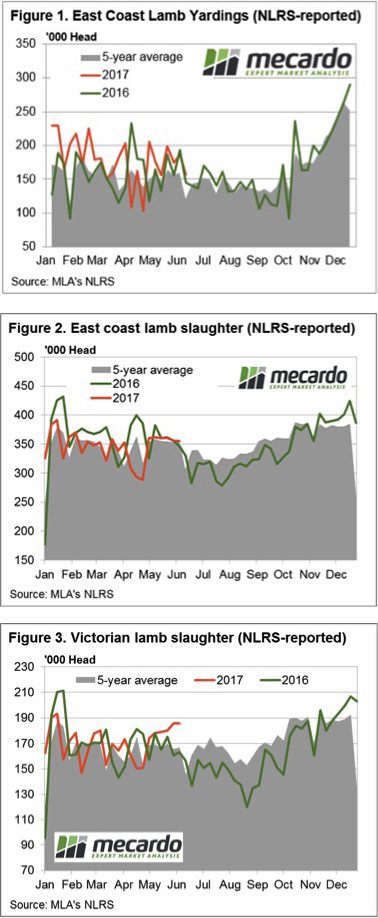

The last of the strong prices for 2017 seems to have drawn out the last of the old season lambs this week. Figure 1 shows a sharp jump in lamb yardings this over the last two weeks, with nearly 172,000 head yarded this week. Given the lower slaughter space on offer at the moment, it was enough to send prices sharply lower.

The last of the strong prices for 2017 seems to have drawn out the last of the old season lambs this week. Figure 1 shows a sharp jump in lamb yardings this over the last two weeks, with nearly 172,000 head yarded this week. Given the lower slaughter space on offer at the moment, it was enough to send prices sharply lower.

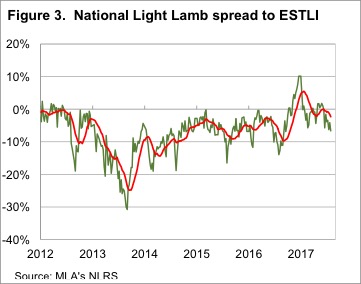

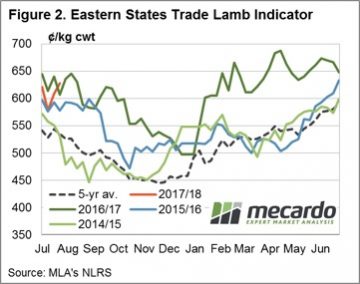

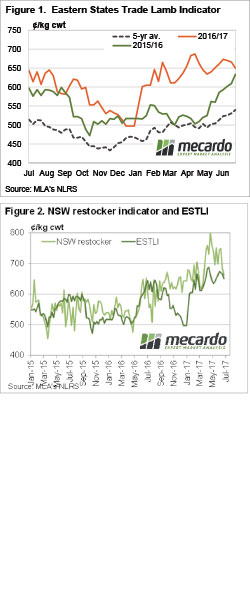

Figure 2 shows the ESTLI falling back to its recent lows, finishing Thursday at 576¢/kg cwt. There was more action in light lambs, with the National Light Lamb Indicator losing 10% and hitting 540¢/kg cwt.

We can see in figure 3 that the light lamb indicator has hit a new low relative to the ESTLI, now at a 6.7% discount, the lowest since last September. It’s normal for light lambs to become more heavily discounted at this time of year, with 10% the lows hit last winter.

In the West lamb prices remained strong. The West Australian Trade Lamb Indicator (WATLI) gained 8¢ to sit at 648¢/kg cwt, now easily the highest priced lambs in the country. Interestingly Mutton in WA is only sitting at 390¢, in line with east coast indicators.

The week ahead

The 8 day forecast is finally showing some decent falls for NSW, which if falls, will bring sheep supply to a bit of a halt. This is assuming a lot of sheep and lambs have already been offloaded during the dry weather, and the rain gives some optimism in terms of feed supply in the early spring.

The could cause a final bounce for sheep and lambs markets, and provide a bit of a boost for those who have suckers which are ready to go.

We have been hearing plenty of anecdotal evidence of increasing lamb supplies coming out of NSW, but also that lambs are struggling to put weight on due to a lack of feed. In theory slower weight gains should see increased supply of store lambs, and weaker supply of finished lambs.

We have been hearing plenty of anecdotal evidence of increasing lamb supplies coming out of NSW, but also that lambs are struggling to put weight on due to a lack of feed. In theory slower weight gains should see increased supply of store lambs, and weaker supply of finished lambs. It would likely take a couple of dry years in a row to see restocker lamb prices fall to a discount to the ESTLI. The more likely scenario would be restockers paying a similar premium to that seen during 2014 and 2015. Those years both had ordinary spring and summer rain, and much stronger grain prices than last season.

It would likely take a couple of dry years in a row to see restocker lamb prices fall to a discount to the ESTLI. The more likely scenario would be restockers paying a similar premium to that seen during 2014 and 2015. Those years both had ordinary spring and summer rain, and much stronger grain prices than last season.

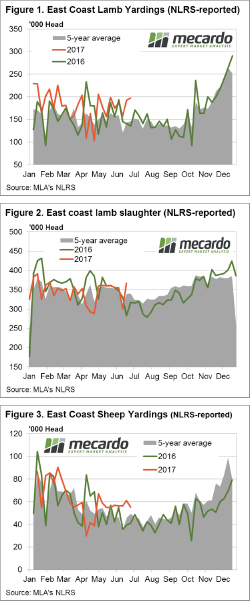

The lamb price bounce continued this week despite a bit of a lift in yardings. The direct to works supply appears to have weakened, with plenty of competition back at the saleyards. All this despite the stronger Aussie dollar which is not doing great things for our export competitiveness.

The lamb price bounce continued this week despite a bit of a lift in yardings. The direct to works supply appears to have weakened, with plenty of competition back at the saleyards. All this despite the stronger Aussie dollar which is not doing great things for our export competitiveness.

It’s nice to be right sometimes, even if it is only for a week. The weekly comment last week suggested the slide in lamb prices was about to halt, and halt it did. The market even bounced back above 600¢ as lamb and sheep yardings recorded another weak week.

It’s nice to be right sometimes, even if it is only for a week. The weekly comment last week suggested the slide in lamb prices was about to halt, and halt it did. The market even bounced back above 600¢ as lamb and sheep yardings recorded another weak week.

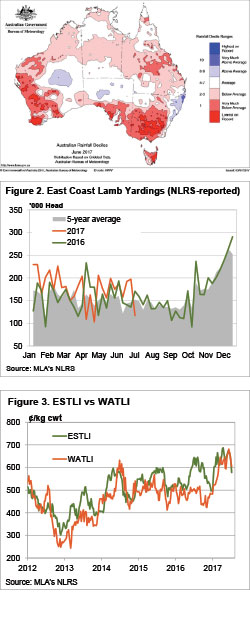

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak.

It doesn’t take a rocket analyst to work out why sheep and lamb prices have been sliding for the last month. The Eastern States Trade Lamb Indicator (ESTLI) this week broke through the 600¢ mark as the supply of stock direct to works appears to be reaching a peak. On the radio in today the weather report included a brief from BOM saying that June has been the driest in Victoria since records began and its taking its toll on the price of lamb and sheep. East coast figures show price falls in all categories other than Restocker lambs on the week and Light, Heavy and Trade lambs are now trading lower than this time last year.

On the radio in today the weather report included a brief from BOM saying that June has been the driest in Victoria since records began and its taking its toll on the price of lamb and sheep. East coast figures show price falls in all categories other than Restocker lambs on the week and Light, Heavy and Trade lambs are now trading lower than this time last year.

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak.

In general lamb prices were largely steady this week, but trends were mixed depending on category and state. With supply remaining relatively strong as we pass the winter solstice, and new season lamb supply fast approaching, the question is whether we have seen the peak. A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

A reduction in lamb yarding this week along the East coast was met with broadly softer saleyard prices suggesting that buyers took a bit of a spell. The Eastern States Trade Lamb Indicator off a fraction, down 4¢ (or 0.6% lower) to 666¢/kg cwt. National Mutton a little softer, with sheep throughput holding firm, to see a fall of 11¢ (a 2.1% decline) to close at 511¢.

WA doesn’t have the most expensive lambs in the country, but with the Western Australian Trade Lamb Indicator (WATLI) hit a new record this week. The WATLI gained 17¢, to hit 681¢/kg cwt (figure 1), stronger than the ESTLI (670¢) but weaker than Victorian Trade Lambs, which sit at 695¢/kg cwt.

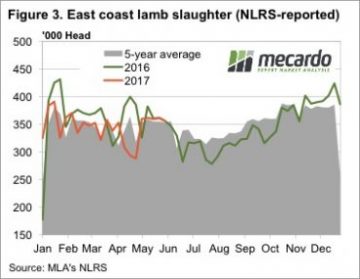

WA doesn’t have the most expensive lambs in the country, but with the Western Australian Trade Lamb Indicator (WATLI) hit a new record this week. The WATLI gained 17¢, to hit 681¢/kg cwt (figure 1), stronger than the ESTLI (670¢) but weaker than Victorian Trade Lambs, which sit at 695¢/kg cwt. It’s interesting to see lamb slaughter remaining relatively steady over the last five weeks (figure 3), at levels similar to last year. As we said a couple of weeks ago, the same supply, and prices 12% higher, suggest demand has strengthened.

It’s interesting to see lamb slaughter remaining relatively steady over the last five weeks (figure 3), at levels similar to last year. As we said a couple of weeks ago, the same supply, and prices 12% higher, suggest demand has strengthened.

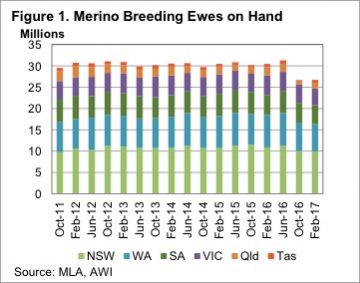

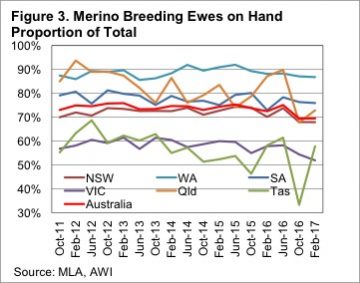

Living in Western Victoria, which is one of the hotspots for the swing to meat breeds, it’s hard to imagine that 69% of the ewe flock is made up of Merinos. Figure 1 in part explains this, with 61% of the nation’s Merinos being in NSW and WA. Just 15% of Australia’s Merino Ewes are now in Victoria.

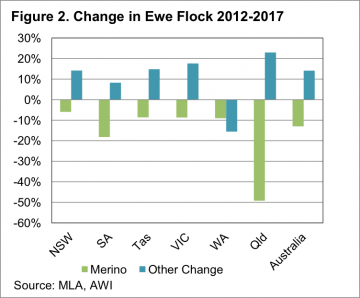

Living in Western Victoria, which is one of the hotspots for the swing to meat breeds, it’s hard to imagine that 69% of the ewe flock is made up of Merinos. Figure 1 in part explains this, with 61% of the nation’s Merinos being in NSW and WA. Just 15% of Australia’s Merino Ewes are now in Victoria. Figure 2 also shows every state except WA has increased their number of ‘other’ breeds since 2012. On a national scale, the decline in Merinos hasn’t been matched by increases in other ewes. However, in NSW and Victoria Merinos have been displaced by other ewes. In WA, SA and Queensland total sheep numbers have fallen.

Figure 2 also shows every state except WA has increased their number of ‘other’ breeds since 2012. On a national scale, the decline in Merinos hasn’t been matched by increases in other ewes. However, in NSW and Victoria Merinos have been displaced by other ewes. In WA, SA and Queensland total sheep numbers have fallen. Perhaps it is due to climatic conditions, or it might be due to the fact that Merino’s are bigger and more suited to lamb production in WA, but the West remains a stronghold of the Merino. The proportion of Merino’s in the west hasn’t really changed over the last five years, fluctuating between 86 and 92% and currently sitting at 87%.

Perhaps it is due to climatic conditions, or it might be due to the fact that Merino’s are bigger and more suited to lamb production in WA, but the West remains a stronghold of the Merino. The proportion of Merino’s in the west hasn’t really changed over the last five years, fluctuating between 86 and 92% and currently sitting at 87%.