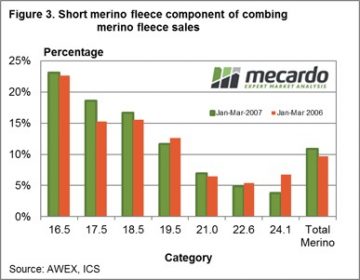

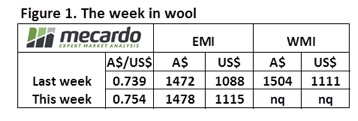

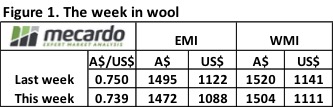

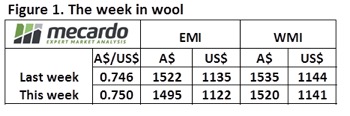

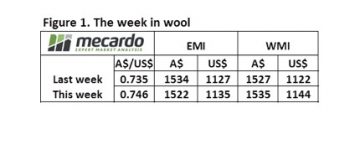

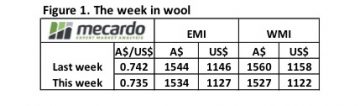

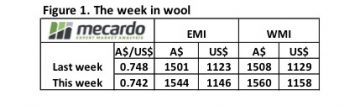

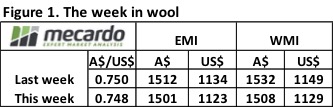

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

Increased demand this week from exporters noted as Chinese buyers resume their activity, undeterred in the face of a higher A$. The EMI creeping back above 1500¢, up 28¢ to 1506¢ and gaining 31US¢ to 1146US¢. The Western markets resumed auctions this week and activity participated in the rally, making up for lost time with a 63¢ rise to see the WMI at 1567¢, up 58¢ in US terms to 1192US¢.

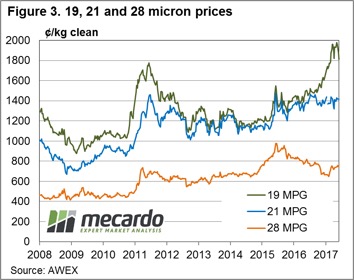

Price gains for most categories of wool noted, although the medium fibres leading the charge higher with gains of 50-65¢ noted for microns between 20 to 23 mpg in the East and 90-110¢ gains for similar wool in the West. The rally in finer wool limited to a 15-50¢ range in all three centres.

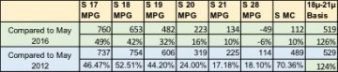

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

Interestingly, the medium fibres displaying a more robust price movement this time around with the 21 micron reaching levels in AUD terms not seen since the middle 1988. Indeed, in May 2016 when the 21-micron hit 1535¢ in the South the 17 mpg was trading above $23 and the 19 mpg was above $19.5. This week with 21 mpg at 1549¢ the 17-micron unable to climb above $22 and 19-micron can’t crack the $19 level.

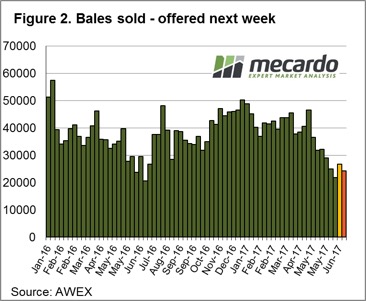

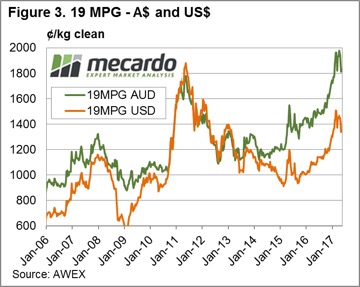

Some whispers around the traps that if the Chinese step away again the fine end could be in for a quick correction. Although, the prospect of higher US interest rates later this year could continue to play into wool grower’s favour. This week the US Federal Reserve lifted rates and because this was highly anticipated it had limited impact on the A$. However, any sign that the US will move to a more tightening bias or indications of more frequent potential future rate rises in the US could see the A$ come under reasonable pressure again, pushing it back toward the 70US¢ level. A relatively softer A$ now compared to back in 2011/12 helping to keep wool prices competitive overseas, despite the high local prices – figure 3.

The week ahead

The week ahead

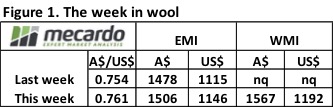

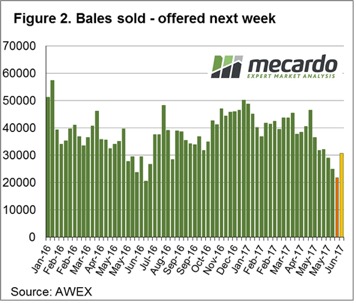

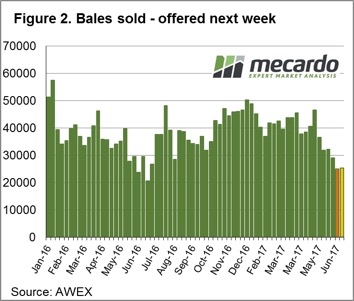

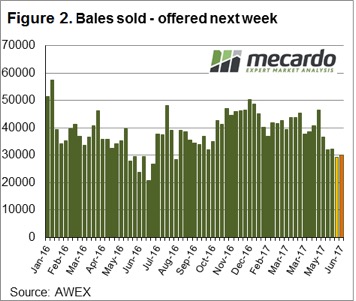

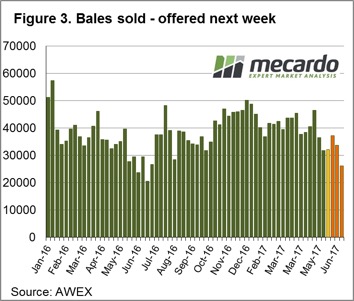

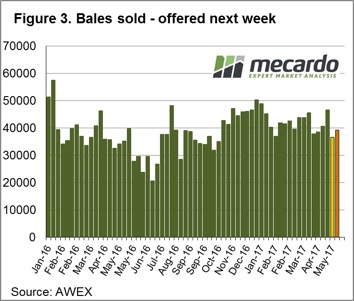

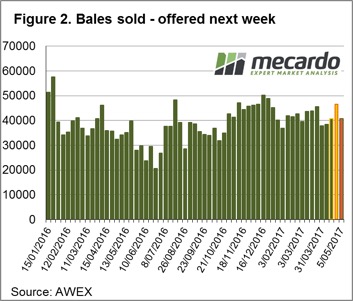

Next week on the Eastern centres have sales are scheduled, with Fremantle taking another recess, to see 24,376 bales on offer – figure 2. Clearly, supply in the favour of the growers at the moment and will continue to support prices in the short term. The key on whether the prices surge or consolidate will be how aggressive the demand is from Chinese buyers.

Australian Wool Innovation has stated it will progress with its Wool Exchange Portal (WEP) beyond the scoping stage and is now moving to the “discovery stage” where the portal is built. Expected industry benefits are $38 million over the first 15 years. In this article Mecardo puts this expected benefit into perspective.

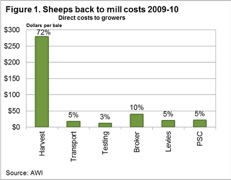

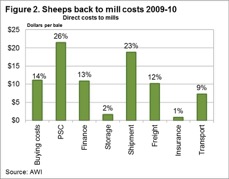

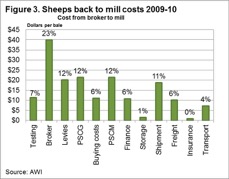

Australian Wool Innovation has stated it will progress with its Wool Exchange Portal (WEP) beyond the scoping stage and is now moving to the “discovery stage” where the portal is built. Expected industry benefits are $38 million over the first 15 years. In this article Mecardo puts this expected benefit into perspective. Costs incurred by growers after the wool has been delivered to store (excluding shearing and delivery to store costs) were $72 per farm bale in 2009-10. Figure 2 shows a breakup of the costs associated with purchasing wool (direct costs to mill) in Australia which totalled $75 per farm bale in 2009-10. In total it cost $175 per farm bale to sell wool in 2009-10, through a system with no counterparty risk.

Costs incurred by growers after the wool has been delivered to store (excluding shearing and delivery to store costs) were $72 per farm bale in 2009-10. Figure 2 shows a breakup of the costs associated with purchasing wool (direct costs to mill) in Australia which totalled $75 per farm bale in 2009-10. In total it cost $175 per farm bale to sell wool in 2009-10, through a system with no counterparty risk. In Australia in 2017, around 1.5 to 1.6 million farm bales will be sold annually through the auction system. In May the average gross value per bale was $1670. For the past three years the average gross value per bale sold has been $1411.

In Australia in 2017, around 1.5 to 1.6 million farm bales will be sold annually through the auction system. In May the average gross value per bale was $1670. For the past three years the average gross value per bale sold has been $1411.

Normal market drivers and influences were turned on their head this week. On Wednesday, the A$ fell and so did the market, while on Thursday the market rallied with the A$ ending the week up by almost US$0.015 cents.

Normal market drivers and influences were turned on their head this week. On Wednesday, the A$ fell and so did the market, while on Thursday the market rallied with the A$ ending the week up by almost US$0.015 cents.  To compare with the same period last year, wool sales; more specifically “clearance to the trade”, are on average 4,000 bales per week lower.

To compare with the same period last year, wool sales; more specifically “clearance to the trade”, are on average 4,000 bales per week lower. The opportunity for wool growers is to apply a strategic approach to sales; that is use the wool broker to identify types that are selling well as well as types that are over supplied or lacking demand; and then sell or hold back as your situation allows. The recent market activity shows that a weak market one week is quickly replaced by a rally. It is also a time to have any unsold wool listed on Wool Trade where buyers can access if required.

The opportunity for wool growers is to apply a strategic approach to sales; that is use the wool broker to identify types that are selling well as well as types that are over supplied or lacking demand; and then sell or hold back as your situation allows. The recent market activity shows that a weak market one week is quickly replaced by a rally. It is also a time to have any unsold wool listed on Wool Trade where buyers can access if required.

17 to 19-micron fleece registered falls of 55-85¢ across all three selling centres. Melbourne the only auction to offer some finer 16.5-micron wool, but the single source not enough to protect it from registering the largest falls this week closing 113¢ softer to 2135¢/kg clean. Medium wool classes a bit of a mixed bag with 20-25¢ falls in the 20 microns in all centres, 21 microns ranging from a 12¢ loss in Fremantle to a 6¢ gain in the South, while 22-23 mpg wool saw gains from 1-14¢ recorded. Cross bred wool saw Southern 30 mpg shedding 30¢ but the remaining classes posting flat to slight gains of less than 10¢.

17 to 19-micron fleece registered falls of 55-85¢ across all three selling centres. Melbourne the only auction to offer some finer 16.5-micron wool, but the single source not enough to protect it from registering the largest falls this week closing 113¢ softer to 2135¢/kg clean. Medium wool classes a bit of a mixed bag with 20-25¢ falls in the 20 microns in all centres, 21 microns ranging from a 12¢ loss in Fremantle to a 6¢ gain in the South, while 22-23 mpg wool saw gains from 1-14¢ recorded. Cross bred wool saw Southern 30 mpg shedding 30¢ but the remaining classes posting flat to slight gains of less than 10¢. Pass in rates remain higher in the West and the national pass in rate dropping slightly on the week to 12.2% as 24,976 bales were sold out of a possible 28,459. This is the lowest bales sold since late June 2016 although compared to this time last season bales sold this week were 5.4% higher suggesting the relatively higher prices aren’t deterring buyers too much.

Pass in rates remain higher in the West and the national pass in rate dropping slightly on the week to 12.2% as 24,976 bales were sold out of a possible 28,459. This is the lowest bales sold since late June 2016 although compared to this time last season bales sold this week were 5.4% higher suggesting the relatively higher prices aren’t deterring buyers too much.

Largest magnitude falls were noted for the finer microns with price decreases between 50-100¢ noted. Medium fibres posting declines in the 10-40¢ range, while crossbred fleece just 5-10¢ softer. Southern 28-micron and Cardings in all centres the only categories to record slight gains.

Largest magnitude falls were noted for the finer microns with price decreases between 50-100¢ noted. Medium fibres posting declines in the 10-40¢ range, while crossbred fleece just 5-10¢ softer. Southern 28-micron and Cardings in all centres the only categories to record slight gains. The general view among growers appears to be that supply is tight and mills don’t have much stock in the pipeline so there seems to be a reluctance to chase a falling market. Clearly, in the short term the volume of bales on offer are expected to contract further. However, over the longer term an eye needs to be kept on the trend in demand, as the risk is always there that overseas buyers adjust down their purchasing requirements to reflect the anticipated lower supply.

The general view among growers appears to be that supply is tight and mills don’t have much stock in the pipeline so there seems to be a reluctance to chase a falling market. Clearly, in the short term the volume of bales on offer are expected to contract further. However, over the longer term an eye needs to be kept on the trend in demand, as the risk is always there that overseas buyers adjust down their purchasing requirements to reflect the anticipated lower supply.

We saw the effect of the Washington/Trump shenanigans which took the confidence out of US markets and resulted in a weaker US$, and by default a stronger A$. The effect on the market was for the EMI to rise in US$ terms (plus 8 cents), but fall in A$ terms (minus 12 cents). The Trump factor causing a 1.5% gain in the A$ over the week to see it finish yesterday at 74.6US¢.

We saw the effect of the Washington/Trump shenanigans which took the confidence out of US markets and resulted in a weaker US$, and by default a stronger A$. The effect on the market was for the EMI to rise in US$ terms (plus 8 cents), but fall in A$ terms (minus 12 cents). The Trump factor causing a 1.5% gain in the A$ over the week to see it finish yesterday at 74.6US¢. At this time of the year we see increased levels of Vegetable Matter; it impacted most on the skirtings market this week with low V.M. wool tending dearer however high V.M. types were irregular and tending cheaper.

At this time of the year we see increased levels of Vegetable Matter; it impacted most on the skirtings market this week with low V.M. wool tending dearer however high V.M. types were irregular and tending cheaper. This tight supply should maintain the market levels, although as we have seen this week currency moves can impact.

This tight supply should maintain the market levels, although as we have seen this week currency moves can impact.

The market opened to solid demand on Wednesday but nervousness crept in on Thursday to see the market in general close below last week’s levels. Eastern prices 5-35¢ softer while the West saw a bit more of a slide, with 15-70¢ falls registered. A reduced offering of bales for sale, just over 38,000 bales came forward this week, however weaker demand saw the pass in rate jump this week to 16.1% with 31,915 bales sold.

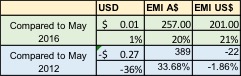

The market opened to solid demand on Wednesday but nervousness crept in on Thursday to see the market in general close below last week’s levels. Eastern prices 5-35¢ softer while the West saw a bit more of a slide, with 15-70¢ falls registered. A reduced offering of bales for sale, just over 38,000 bales came forward this week, however weaker demand saw the pass in rate jump this week to 16.1% with 31,915 bales sold. Firstly currency; while it has hardly moved over the past 12 months, it is 27 cents or 36% lower than five years ago. This is reflected in the EMI levels; in A$ terms the market is higher compared to both periods, while in US$ terms it is still yet to reach the 2012 level while sitting 21% above last years US$EMI.

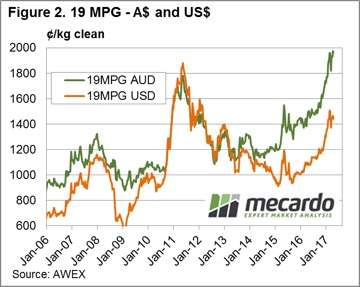

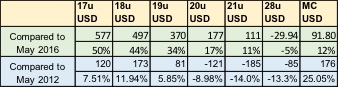

Firstly currency; while it has hardly moved over the past 12 months, it is 27 cents or 36% lower than five years ago. This is reflected in the EMI levels; in A$ terms the market is higher compared to both periods, while in US$ terms it is still yet to reach the 2012 level while sitting 21% above last years US$EMI. Compared to last year, in US$ terms (Fig 4) all bar crossbred types are stronger, particularly the finer types with 17 MPG up 50% year on year. The story is a little more mixed when we compare against 2012 prices in US$’s, and while 19 MPG & finer as well as Cardings are now above 2012 levels, 20 & 21 MPG were higher back then. The A$ in 2012 was trading US$1.01 cents and clearly impacting on the buyers.

Compared to last year, in US$ terms (Fig 4) all bar crossbred types are stronger, particularly the finer types with 17 MPG up 50% year on year. The story is a little more mixed when we compare against 2012 prices in US$’s, and while 19 MPG & finer as well as Cardings are now above 2012 levels, 20 & 21 MPG were higher back then. The A$ in 2012 was trading US$1.01 cents and clearly impacting on the buyers. The good news from this is that while wool grower returns are very good, wool to our customers is not expensive compared to recent history; this is a good thing. In fact, the recent high for 19 MPG in US$ terms was June 2011; the Southern 19 MPG was quoted around 1750, but at that time the A$ was strong at US$1.05 resulting in a US$ 19 MPG price of 1820 – compared to the current US$ price of 1460 which converts to A$19.77 in the market when the current A$ level is applied.

The good news from this is that while wool grower returns are very good, wool to our customers is not expensive compared to recent history; this is a good thing. In fact, the recent high for 19 MPG in US$ terms was June 2011; the Southern 19 MPG was quoted around 1750, but at that time the A$ was strong at US$1.05 resulting in a US$ 19 MPG price of 1820 – compared to the current US$ price of 1460 which converts to A$19.77 in the market when the current A$ level is applied.

A solid two days trading as exporters re-entered the market this week to see both the Eastern and Western Market Indicators sitting comfortably above 1500¢. The EMI closing the week at 1544¢, a gain of 43¢, and the WMI slightly firmer at 1560¢, up 52¢.

A solid two days trading as exporters re-entered the market this week to see both the Eastern and Western Market Indicators sitting comfortably above 1500¢. The EMI closing the week at 1544¢, a gain of 43¢, and the WMI slightly firmer at 1560¢, up 52¢. Historically the 21 micron class has struggled to hold above 1500¢ for any decent length of time but recently this resistance level has continued to be probed – figure 2. Brokers indicate that there is plenty of space in the wool stores at the moment, so supply remains an ongoing issue. This factor, combined with a continuing softening A$, sets the tone for the chance for further upside in the coming weeks. Clearly, as the chart shows in USD terms overseas buyers have paid higher levels for 21-micron wool in the recent past, so there is the capacity for them to still bid local prices higher.

Historically the 21 micron class has struggled to hold above 1500¢ for any decent length of time but recently this resistance level has continued to be probed – figure 2. Brokers indicate that there is plenty of space in the wool stores at the moment, so supply remains an ongoing issue. This factor, combined with a continuing softening A$, sets the tone for the chance for further upside in the coming weeks. Clearly, as the chart shows in USD terms overseas buyers have paid higher levels for 21-micron wool in the recent past, so there is the capacity for them to still bid local prices higher. Offerings over the next few weeks continue to decline, with all of the next three sale weeks listing bales offered under 40,000. Week 45 is operating in all trading centres on Wednesday and Thursday and has 39,253 bales listed. Weeks 46 and 47 will see supply tighten further with 36,100 and 37,650 bales offered, respectively.

Offerings over the next few weeks continue to decline, with all of the next three sale weeks listing bales offered under 40,000. Week 45 is operating in all trading centres on Wednesday and Thursday and has 39,253 bales listed. Weeks 46 and 47 will see supply tighten further with 36,100 and 37,650 bales offered, respectively.

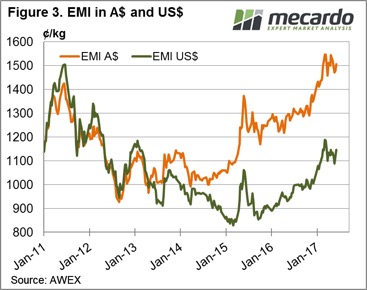

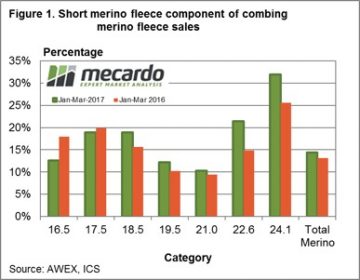

In the earlier analysis (

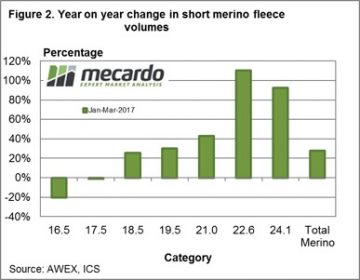

In the earlier analysis ( Figure 2 is where the data becomes interesting. This shows the year on year change in volume for 50-69 mm length merino fleece wool by the micron ranges, for the January to March period. The changes vary widely. There has been a lot broader short staple fleece wool sold in 2017. This fits with the analysis from last week of the broader merino micron volumes. It points to plenty of downward pressure developing in the market as it struggles to absorb increases in the range of 40% to 100% of broad short staple fleece wool. This explains some of the low quotes coming out of the market for wool in these categories.

Figure 2 is where the data becomes interesting. This shows the year on year change in volume for 50-69 mm length merino fleece wool by the micron ranges, for the January to March period. The changes vary widely. There has been a lot broader short staple fleece wool sold in 2017. This fits with the analysis from last week of the broader merino micron volumes. It points to plenty of downward pressure developing in the market as it struggles to absorb increases in the range of 40% to 100% of broad short staple fleece wool. This explains some of the low quotes coming out of the market for wool in these categories.