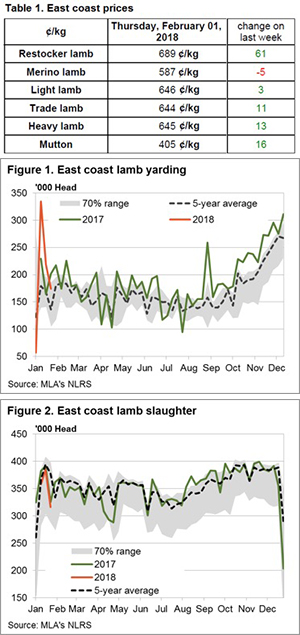

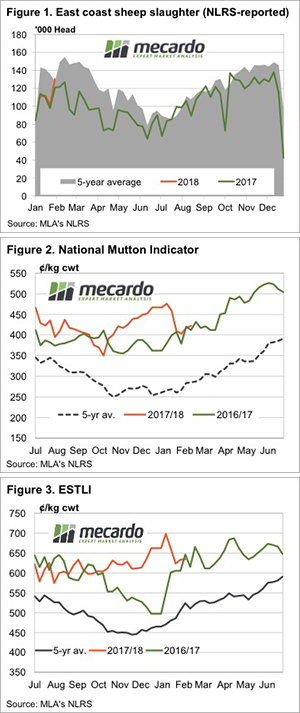

Strong throughput numbers for both lamb and mutton across the nation this week saw falls recorded in all national sale yard indicators, ranging between 3$ to 9 %. The headline Eastern States Trade Lamb Indicator (ESTLI) dropping 9.4% to close at 601/kg, while mutton was equally weak, off 8.8% to 385¢.

Strong throughput numbers for both lamb and mutton across the nation this week saw falls recorded in all national sale yard indicators, ranging between 3$ to 9 %. The headline Eastern States Trade Lamb Indicator (ESTLI) dropping 9.4% to close at 601/kg, while mutton was equally weak, off 8.8% to 385¢.

The East coast sale yard indicators mostly mirroring the national falls, with many categories posting declines between 2% to 12%. In Victoria, Merino Lambs the weakest, falling 9% to 558¢, while in NSW Restockers took the heat with a 12% drop to 598¢.

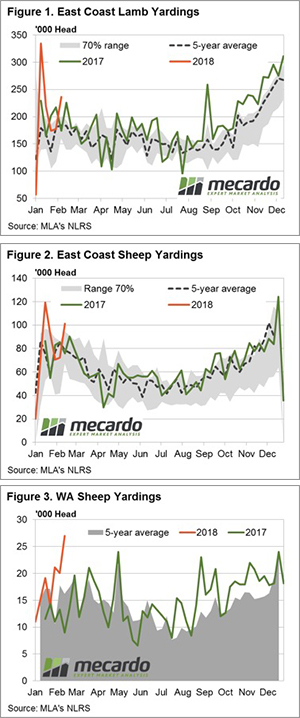

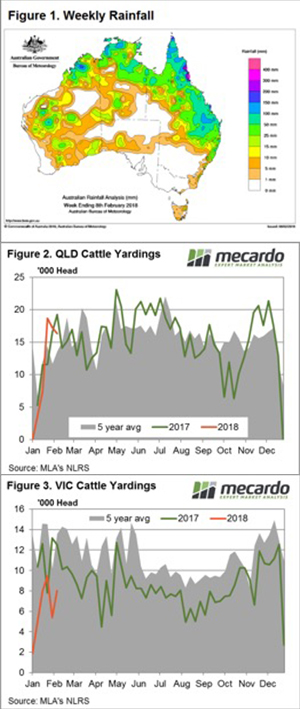

Victorian and NSW lamb yardings shown to be running above average for this time of the year and this saw East coast throughput lift 33% on the week to sit 28% higher than the seasonal average for this time in the year – Figure 1.

Higher NSW mutton yarding the key behind the elevated East coast figures too this week – figure 2. NSW sheep thoughput currently 34.7% over the seasonal average level for this week in the year and the added numbers of mutton has pushed the East coast levels over 100,000 head this week, an 18.7% gain on the seasonal average.

Western Australian indicators for Merino Lamb and Mutton were particularly soft, both off 19% to 509¢ and 370¢, respectively. High throughput the likely culprit there too with WA mutton yarding levels showing a solid surge this week with 27,000 head recorded – an increase over the seasonal average of 66.3% – Figure 3.

What does it mean/next week?:

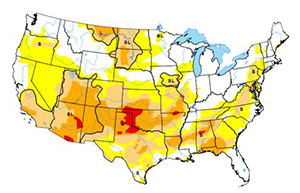

A wetter week is anticipated, particularly in the West, and this should stem some of the price declines experienced by producers this week. The BOM have forecast a higher chance for a wetter than average February and there hasn’t been much for the East coast for the first few weeks of the month – perhaps that means the second half of the month we will be some decent falls… fingers crossed.

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

This was a week of “toing & froing”; in early sales buyers tested the market to see if some of the gains from last week could be taken back. However, by the end of the week, buyers were forced to re-engage to secure volume.

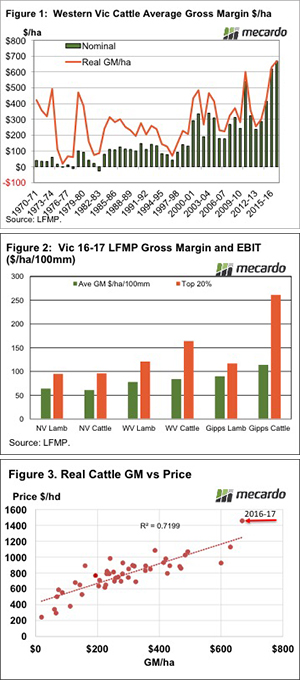

Some very solid rainfall in Queensland this week, yet this was unable to inspire trade cattle prices there as high throughput weighs on the market. In contrast, NSW and Victoria broadly missed out on any rain yet surprisingly throughput was below average and trade cattle prices firmed.

Some very solid rainfall in Queensland this week, yet this was unable to inspire trade cattle prices there as high throughput weighs on the market. In contrast, NSW and Victoria broadly missed out on any rain yet surprisingly throughput was below average and trade cattle prices firmed.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

It was another unusually steady week for lamb prices, as supply seems to be closely matching demand. Mutton prices found some strength however, especially in NSW, but regular readers will know this was not unexpected.

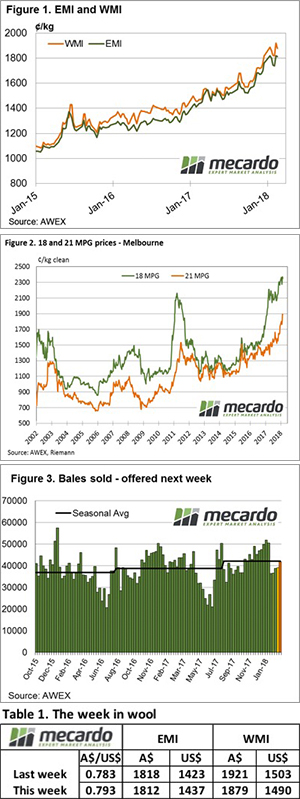

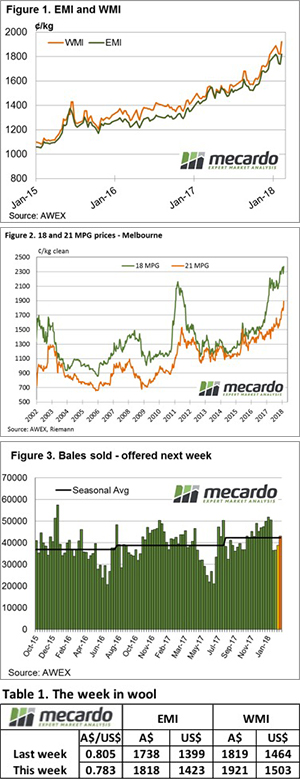

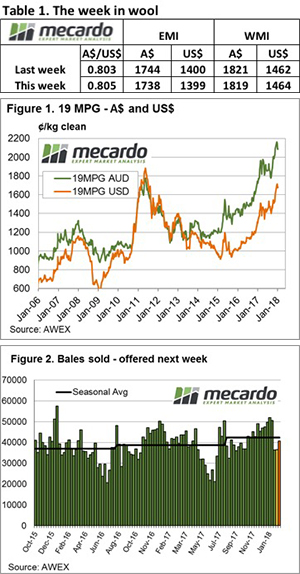

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

This AWEX report probably summed up the sentiment of the wool market this week – “The recent wool market decline halted in stunning fashion”. Every one of the AWEX reported indices posted an improvement, some of the increases had to be seen to be believed.

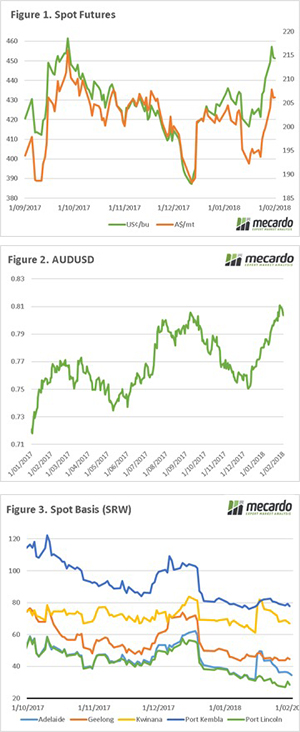

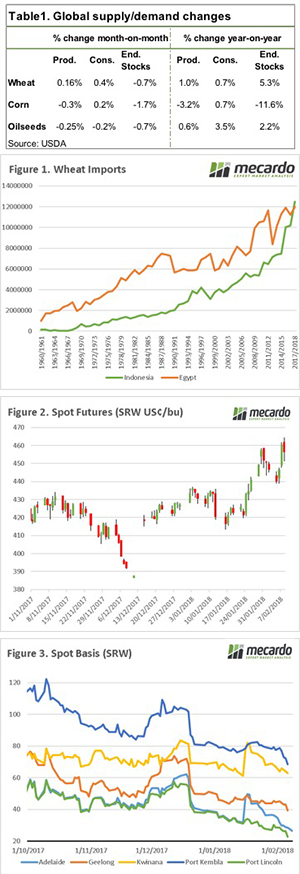

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term.

An exciting week in markets, with volatility across equities and currency. In the past week wheat futures have performed well, but has the benefit been passed onto local growers? Overnight the WASDE was released, and it provides some data that is good for Australian grain in the long term. This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

This week the wool market appeared to draw breathe after the sharp falls of the previous two weeks. It was the fine end that fared the best, and of note was the strong competition for sound wool with low mid-breaks.

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.

Time flows like water down the river rapids, we are now into February and the holiday season is now but a distant memory. January has come to an end, and it’s worth examining how the start of the year has gone.