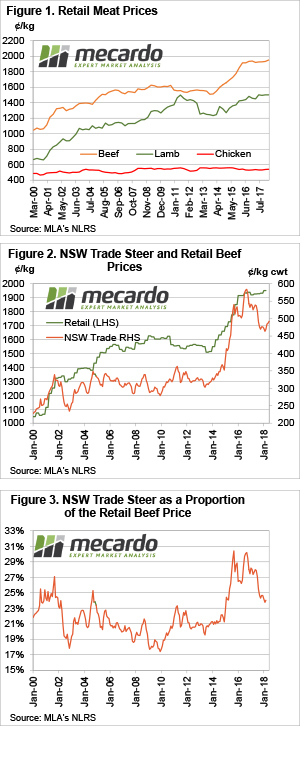

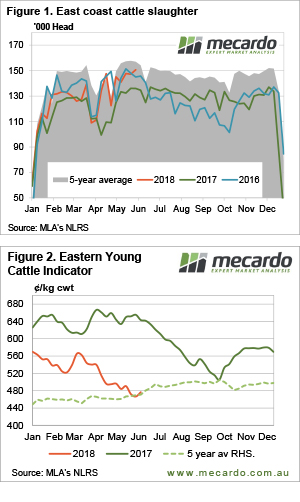

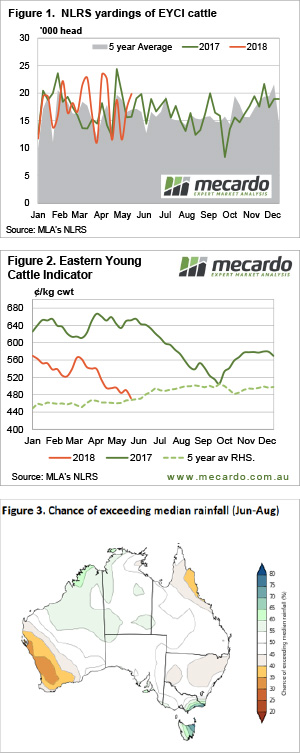

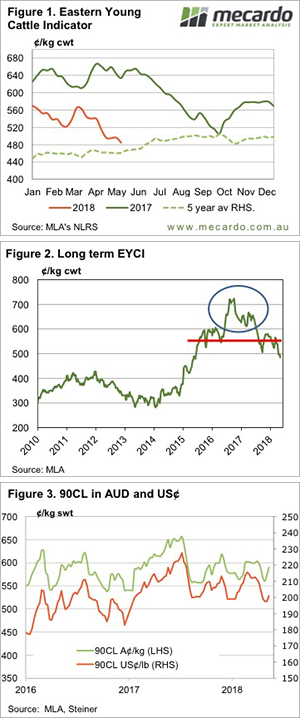

The shortened week due to the Queen’s Birthday holiday saw cattle throughput soften to the lowest weekly level in over a month and a half across the East coast which provided a floor to most categories of cattle. The Eastern States Young Cattle Indicator (EYCI) gained a meagre 0.5% to close at 479.25¢/kg cwt.

The shortened week due to the Queen’s Birthday holiday saw cattle throughput soften to the lowest weekly level in over a month and a half across the East coast which provided a floor to most categories of cattle. The Eastern States Young Cattle Indicator (EYCI) gained a meagre 0.5% to close at 479.25¢/kg cwt.

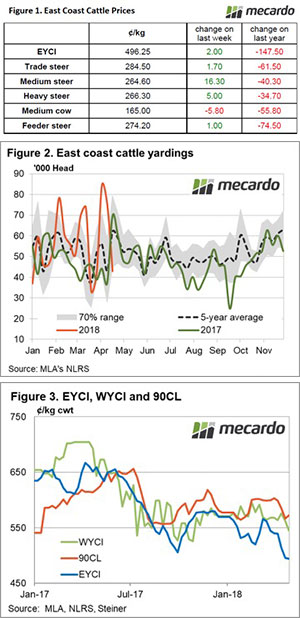

East coast cattle yarding levels were 17% softer week on week to see just over 51,000 head change hands at the sale yard (Figure 2). While this is the lowest cattle throughput in six weeks, it still represents a level that is 25% higher than the seasonal average for this week in the year.

East coast cattle throughput continues to remain elevated due to high numbers of cattle continuing to present themselves at sale yards in NSW. Indeed, every east coast state recorded below average yardings this week except for NSW, which still has cattle throughput running at levels at around 70% above the seasonal average for the last month.

Across the East coast, most cattle price categories posted improvements ranging between 1% to 9%, with East Coast Trade Steers the only category to record a price decline, dropping 4% to 283.9¢/kg lwt (Table 1).

On a side note, our article last Friday made mention of South Australian Restocker Steers that caught our attention posting a 50¢/kg live weight price. The efficient and helpful staff at MLA kindly confirming that this was a valid statistic, albeit somewhat of an outlier as this was based off only a single sale of restocker steers that week in SA.

Further West, young cattle prices eased under the $5 level midweek to see it just 2.5% above the EYCI at 493¢/kg cwt and in offshore markets, the 90CL eased slightly to hold above 570¢/kg CIF (Figure 2).

What does it mean/next week?

With limited rain on the horizon outside of Victoria and coastal WA next week its unlikely to see cattle prices gain too aggressively in the short term. On the flip side, a 90CL beef export price above the 550¢ region and reduced cattle supply as we enter the depths of Winter will continue to provide price support on any dips. Perhaps sideways price consolidation is the order of the day for cattle markets over the coming few weeks.

Another week and another high for slaughter rates. It seems, however, supply may have eased a little this week, as the Eastern Young Cattle Indicator managed to gain ground for the first time in a month and posted its biggest gain since March.

Another week and another high for slaughter rates. It seems, however, supply may have eased a little this week, as the Eastern Young Cattle Indicator managed to gain ground for the first time in a month and posted its biggest gain since March.

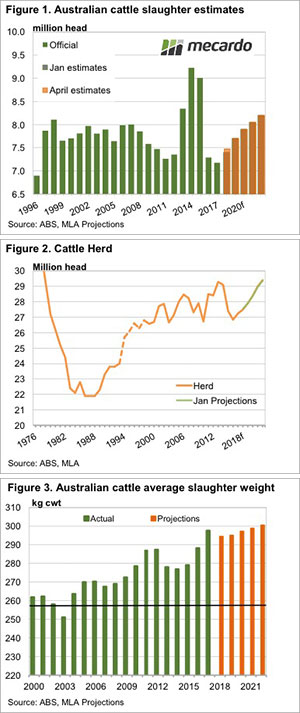

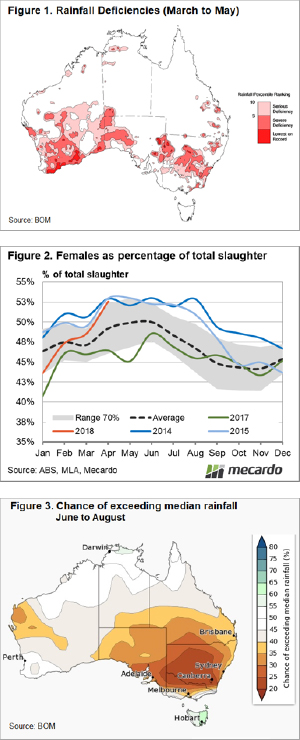

The most recent update to the ABS cattle slaughter data shows a jump in the ratio of female cattle slaughtered as a proportion of the total kill. The average annual ratio now sits at 48% signifying that we are technically in a herd destocking phase.

The most recent update to the ABS cattle slaughter data shows a jump in the ratio of female cattle slaughtered as a proportion of the total kill. The average annual ratio now sits at 48% signifying that we are technically in a herd destocking phase.

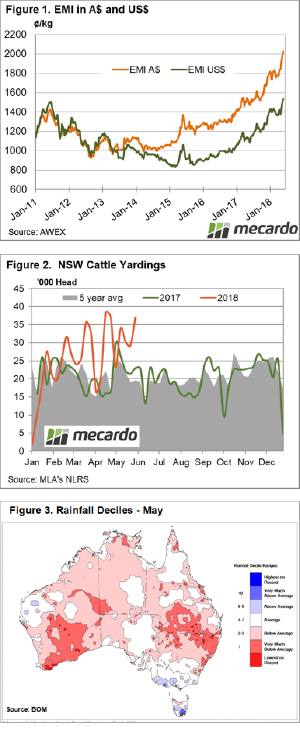

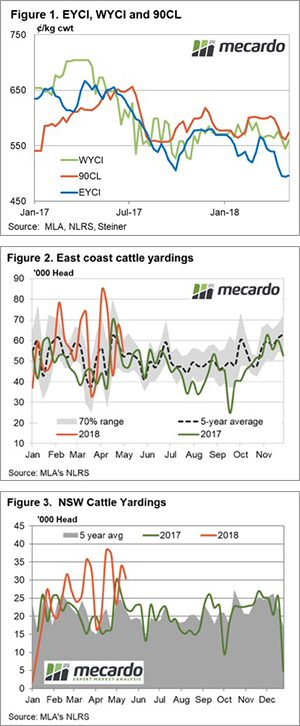

The Eastern Young Cattle Indicator (EYCI) continues to trek lower as cattle yardings reach a five-week peak, underpinned by high NSW cattle throughput. The EYCI closed this week 1.1% lower at 466.5¢/kg cwt, while its Western counterpart shed 3.2%. Despite the bigger fall in WA young cattle prices, producers there are still enjoying an 11% premium over their East coast neighbours, with the Western Young Cattle Indicator (WYCI) closing the week at 523.75¢/kg cwt.

The Eastern Young Cattle Indicator (EYCI) continues to trek lower as cattle yardings reach a five-week peak, underpinned by high NSW cattle throughput. The EYCI closed this week 1.1% lower at 466.5¢/kg cwt, while its Western counterpart shed 3.2%. Despite the bigger fall in WA young cattle prices, producers there are still enjoying an 11% premium over their East coast neighbours, with the Western Young Cattle Indicator (WYCI) closing the week at 523.75¢/kg cwt. After a brief respite in the downward trend, young cattle prices continued their drift lower this week. With grain prices on the up, hay in short supply and more depressing forecasts it is no surprise that sellers are taking advantage of what are relatively strong prices.

After a brief respite in the downward trend, young cattle prices continued their drift lower this week. With grain prices on the up, hay in short supply and more depressing forecasts it is no surprise that sellers are taking advantage of what are relatively strong prices.

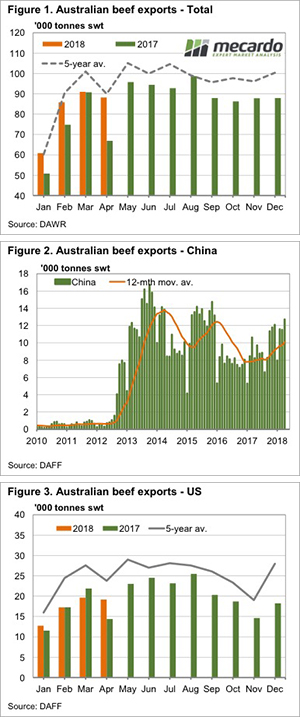

seems to be finding homes in export markets. Demand for Australian beef remains relatively robust. Figure 1 shows April beef exports were down a marginal 3% on March thanks to public holidays. Exports were however, 32% higher than April last year, and at a four year high for the month.

seems to be finding homes in export markets. Demand for Australian beef remains relatively robust. Figure 1 shows April beef exports were down a marginal 3% on March thanks to public holidays. Exports were however, 32% higher than April last year, and at a four year high for the month.