If you read agricultural news websites, or even listen to the ABC’s country hour, you will be aware of the beef ‘scandal’, which has hit Brazil this week. The reasons behind the scandal have been well documented, so we won’t repeat them here. What we will do is look at what a suspension of Brazilian imports might mean for Australian beef exports.

If you read agricultural news websites, or even listen to the ABC’s country hour, you will be aware of the beef ‘scandal’, which has hit Brazil this week. The reasons behind the scandal have been well documented, so we won’t repeat them here. What we will do is look at what a suspension of Brazilian imports might mean for Australian beef exports.

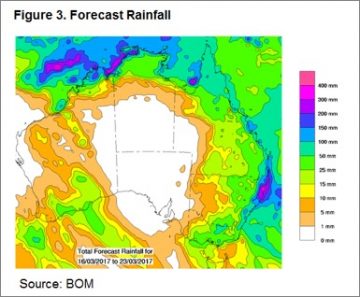

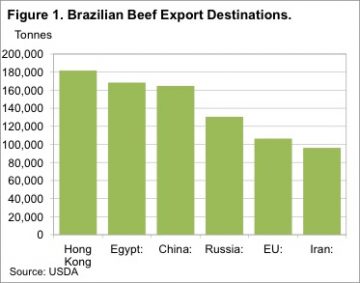

The key outcome of the ‘Brazilian Beef Scandal’ thus far is China and Hong Kong suspending beef imports from Brazil. Figure 1 shows that Hong Kong and China were two of the three biggest markets for Brazilian beef in 2016, accounting for 29% of total exports.

The current suspension of the China/Brazil beef trade will obviously mean that a lot of Brazilian beef will have to find a new home. But how much of a hole does it leave in China’s beef supply? In 2016 Brazil was the largest source of China’s beef imports, accounting for 29%.

If the suspension continues for any significant amount of time, China will be looking to replace Brazilian beef from its other current beef sources, the main ones being Uruguay, Australia and New Zealand.

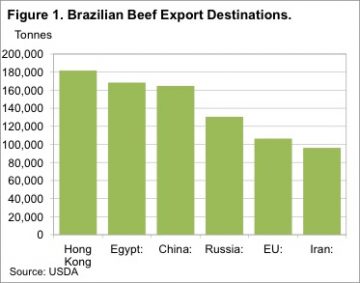

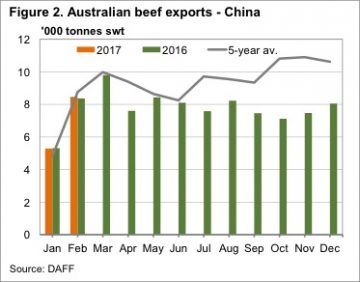

Assuming the Chinese suspension of Brazilian beef lasts a month, China and Hong Kong will have to import around 29,000 tonnes of beef from somewhere else, if it is to maintain supply. If Australia provides a third of this tonnage, it will double our average beef exports to China (figure 2).

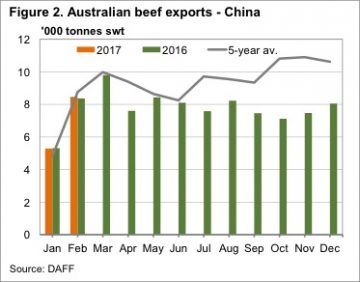

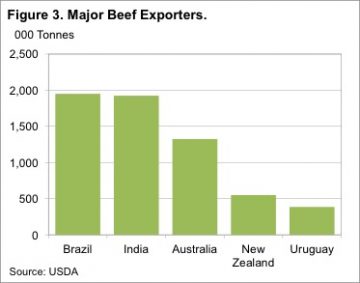

In reality, Uruguay and New Zealand are not really in a position to increase exports to China. Figure 3 shows the Uruguay and New Zealand have much smaller export programs than Australia and Brazil.

In reality, Uruguay and New Zealand are not really in a position to increase exports to China. Figure 3 shows the Uruguay and New Zealand have much smaller export programs than Australia and Brazil.

India can fill some of the void through the ‘grey channel’, but Australia is in a good position to replace Brazilian beef in higher value markets.

Obviously if Australia was to in part fill the Chinese gap, it would have to be diverted from other markets, which would force them into a sort of bidding war with the Chinese, pushing up export prices.

Key points:

- The Brazilian beef scandal has seen China suspend imports of beef from Brazil.

- Australia is in a good position to replace some Brazilian beef in China, pushing up export prices.

- If the suspension on Brazilian beef lasts some time, improved export demand should provide strong support for Australian slaughter cattle prices.

What does this mean?

For a country with such a large export program, being suspended from your biggest market is going to be disastrous for beef and cattle prices. In Australia it would be similar to the US or Japan banning our beef, and we then either need to increase domestic consumption or find another market. Prices would fall very, very quickly.

For a country with such a large export program, being suspended from your biggest market is going to be disastrous for beef and cattle prices. In Australia it would be similar to the US or Japan banning our beef, and we then either need to increase domestic consumption or find another market. Prices would fall very, very quickly.

As with any trade restrictions, the bad news for Brazil could be good news for Australian cattle producers and processors. Increased demand from China will push export prices higher, and given the continued tight supply of cattle, much of this would be passed onto producers.

However, China are not likely to want big increases in beef prices locally, and as such are likely to be working with Brazil to sort out issues. As such there is no way of knowing how long the suspension will last.

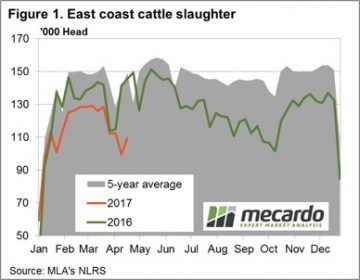

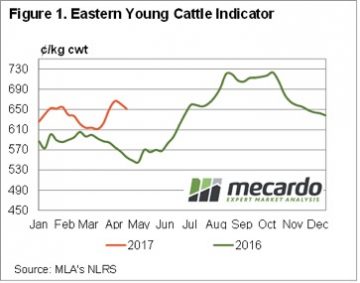

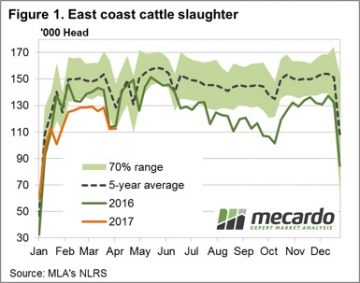

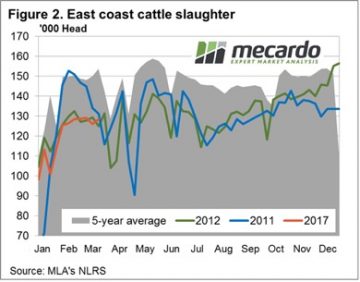

Figure 1 shows the seasonal pattern for East coast slaughter for the week ending 21st April. While the numbers don’t yet represent the shortened ANZAC week it is still clear to see the recovery in supply after the Easter dip. East coast slaughter for the week rising to 109,500 head, a 10% increase from the previous release.

Figure 1 shows the seasonal pattern for East coast slaughter for the week ending 21st April. While the numbers don’t yet represent the shortened ANZAC week it is still clear to see the recovery in supply after the Easter dip. East coast slaughter for the week rising to 109,500 head, a 10% increase from the previous release. A forecast for some light rainfall for parts of Queensland and Victoria over the next week shouldn’t be enough to hamper transport so supply of cattle should continue to improve post Easter. Meanwhile, reduced beef cold storage levels for April in the US as they head into their “grilling season” should see the beef export prices supported in the coming weeks and will provide some encouragement to local processors on any price dips. These two factors set the stage for some price consolidation around the 650¢ level for the EYCI in the short term.

A forecast for some light rainfall for parts of Queensland and Victoria over the next week shouldn’t be enough to hamper transport so supply of cattle should continue to improve post Easter. Meanwhile, reduced beef cold storage levels for April in the US as they head into their “grilling season” should see the beef export prices supported in the coming weeks and will provide some encouragement to local processors on any price dips. These two factors set the stage for some price consolidation around the 650¢ level for the EYCI in the short term.

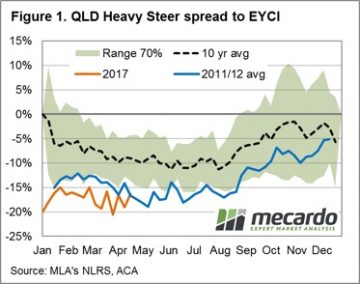

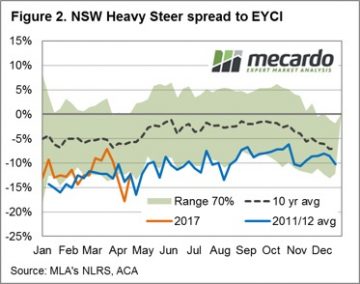

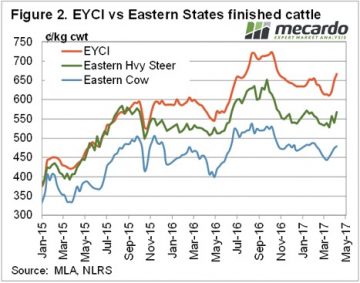

During a favourable season optimism runs high among restockers and opportunistic cattle traders supporting demand and prices for store/young cattle. The added buying competition between the three main purchasing groups (restockers, lot feeders and processors) will often see the Eastern Young Cattle Indicator (EYCI) outperform the price patterns for finished lines, as there is really only one buyer type for fat cattle – the processor. This piece will take a look at what can be expected for the spread pattern between heavy steers and the EYCI along the East coast for the next six months.

During a favourable season optimism runs high among restockers and opportunistic cattle traders supporting demand and prices for store/young cattle. The added buying competition between the three main purchasing groups (restockers, lot feeders and processors) will often see the Eastern Young Cattle Indicator (EYCI) outperform the price patterns for finished lines, as there is really only one buyer type for fat cattle – the processor. This piece will take a look at what can be expected for the spread pattern between heavy steers and the EYCI along the East coast for the next six months. Interestingly, so far for the 2017 season the spread pattern in all three states has been following a similar trajectory to the 2011/12 average pattern. In addition, each state’s spread pattern for this season is trending close to the lower end of the 70% banding, reflecting that the favourable conditions have supported young cattle prices more than the price for finished cattle. Perhaps somewhat unsurprisingly the state that was hit hardest by the most recent cattle turnoff, Queensland, is experiencing the widest spread between young and finished cattle as the requirement to rebuild the herd is likely to be most evident in that region.

Interestingly, so far for the 2017 season the spread pattern in all three states has been following a similar trajectory to the 2011/12 average pattern. In addition, each state’s spread pattern for this season is trending close to the lower end of the 70% banding, reflecting that the favourable conditions have supported young cattle prices more than the price for finished cattle. Perhaps somewhat unsurprisingly the state that was hit hardest by the most recent cattle turnoff, Queensland, is experiencing the widest spread between young and finished cattle as the requirement to rebuild the herd is likely to be most evident in that region. It is likely the spread patterns for each state will continue to trek along the lower end of the 70% band for much of the second half of the year. However, as the confidence level on longer term climate predictions for the 2018 season grows into the later stages of 2017 spreads may begin to return to more normal levels, particularly if the transition from a wetter to drier climate cycle becomes more evident.

It is likely the spread patterns for each state will continue to trek along the lower end of the 70% band for much of the second half of the year. However, as the confidence level on longer term climate predictions for the 2018 season grows into the later stages of 2017 spreads may begin to return to more normal levels, particularly if the transition from a wetter to drier climate cycle becomes more evident.

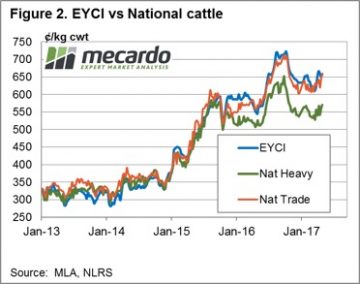

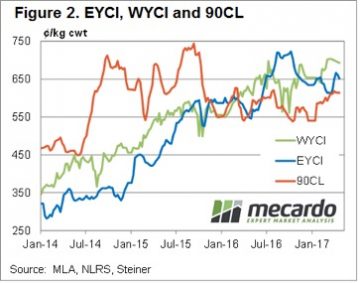

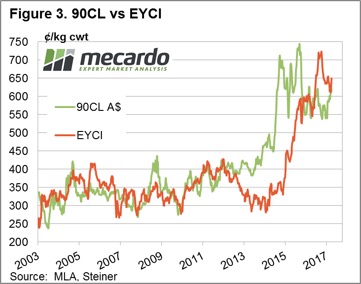

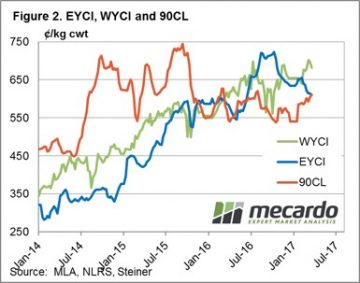

Figure 2 also shows the 90CL export beef indicator holding onto a price around 20 month highs. This week the 90CL sits at 614¢/kg swt, supported by tight supply from Australia and New Zealand.

Figure 2 also shows the 90CL export beef indicator holding onto a price around 20 month highs. This week the 90CL sits at 614¢/kg swt, supported by tight supply from Australia and New Zealand.

Figure 1 shows the pattern for East coast slaughter, with marginal week on week change as just over 112,000 head processed. The Easter dip in slaughter levels seeing numbers processed that were not too dissimilar to this time last season. Although for most of this season slaughter figures have been trending around 10% below the 2016 levels.

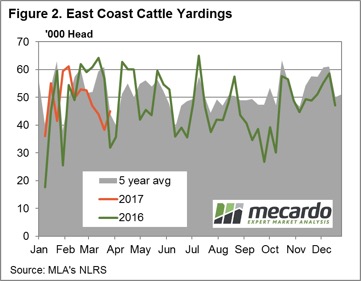

Figure 1 shows the pattern for East coast slaughter, with marginal week on week change as just over 112,000 head processed. The Easter dip in slaughter levels seeing numbers processed that were not too dissimilar to this time last season. Although for most of this season slaughter figures have been trending around 10% below the 2016 levels. February. The increased yardings resulting in a slightly softer EYCI this week – figure 2.

February. The increased yardings resulting in a slightly softer EYCI this week – figure 2.

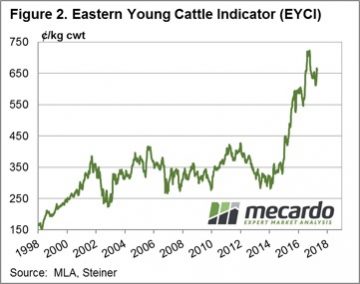

The 2016 season was without doubt the wettest for the nation since the 2010/11 deluge and has been the underlying cause of optimism among restockers, encouraging a rebuild of the herd and supporting young cattle prices to record highs. The recent rains have provided a boost to cattle prices over March – but could the prospect of a dry second quarter in 2017 and 50/50 chance of El Nino developing later in the season signal the beginning of the end for further increasing cattle prices?

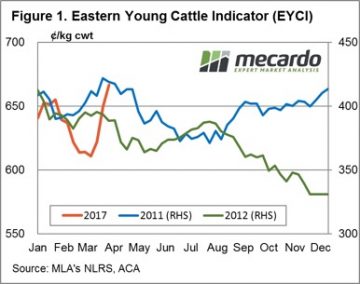

The 2016 season was without doubt the wettest for the nation since the 2010/11 deluge and has been the underlying cause of optimism among restockers, encouraging a rebuild of the herd and supporting young cattle prices to record highs. The recent rains have provided a boost to cattle prices over March – but could the prospect of a dry second quarter in 2017 and 50/50 chance of El Nino developing later in the season signal the beginning of the end for further increasing cattle prices?  Figures 1 and 2 highlight the price and slaughter patterns comparing the current season to the 2011 and 2012 years. Interestingly, all three seasons have seen price increases for the Eastern Young Cattle Indicator (EYCI) over February/March. While the 2017 rally looks impressive, in percentage terms it is not too dissimilar to the gains recorded during 2011. The EYCI rose 8.2% over February/March 2011 compared to the 8.6% gain seen this year, albeit over a shorter timeframe. In terms of the weekly slaughter pattern there was a bit more volatility in the series during the first half of the year in 2011, although the 2012 pattern has been a reasonably good template for the current season, so far.

Figures 1 and 2 highlight the price and slaughter patterns comparing the current season to the 2011 and 2012 years. Interestingly, all three seasons have seen price increases for the Eastern Young Cattle Indicator (EYCI) over February/March. While the 2017 rally looks impressive, in percentage terms it is not too dissimilar to the gains recorded during 2011. The EYCI rose 8.2% over February/March 2011 compared to the 8.6% gain seen this year, albeit over a shorter timeframe. In terms of the weekly slaughter pattern there was a bit more volatility in the series during the first half of the year in 2011, although the 2012 pattern has been a reasonably good template for the current season, so far. Figure 3 focuses on data from the last two transitions from a wet to dry period and how the percentage price movement of the EYCI responded over the season. Overlaid on the chart is the percentage price patterns for 2017, 2011, 2012, an average of the 2011 and 2012 pattern and a potential seasonal range (calculated from the most recent five seasons that experienced a shift from wet to dry conditions).

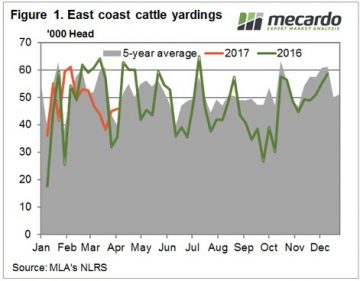

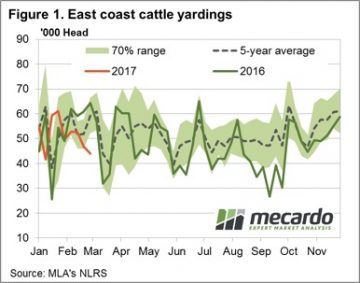

Figure 3 focuses on data from the last two transitions from a wet to dry period and how the percentage price movement of the EYCI responded over the season. Overlaid on the chart is the percentage price patterns for 2017, 2011, 2012, an average of the 2011 and 2012 pattern and a potential seasonal range (calculated from the most recent five seasons that experienced a shift from wet to dry conditions). Figure 1 shows that the strong prices failed to draw out more cattle this week, with East Coast cattle yardings increasing just 1,300 head. Cattle yardings were down 28% on the same week last year. In fact almost every week of autumn (except for Easter) 2016 saw yardings above 60,000 head. Over the last 8 weeks cattle yardings haven’t managed to crack 52,000 head.

Figure 1 shows that the strong prices failed to draw out more cattle this week, with East Coast cattle yardings increasing just 1,300 head. Cattle yardings were down 28% on the same week last year. In fact almost every week of autumn (except for Easter) 2016 saw yardings above 60,000 head. Over the last 8 weeks cattle yardings haven’t managed to crack 52,000 head. Slaughter cattle prices haven’t managed to hit new 2017 highs yet. Heavy steers bounced back this week, gaining 27¢ on the east coast to sit just below the opening price of 2017, at 568¢/kg cwt. It’s s similar story for Cows, with prices sitting a few cents below the February high.

Slaughter cattle prices haven’t managed to hit new 2017 highs yet. Heavy steers bounced back this week, gaining 27¢ on the east coast to sit just below the opening price of 2017, at 568¢/kg cwt. It’s s similar story for Cows, with prices sitting a few cents below the February high. Anecdotal reports of revived restocker activity within the young cattle market suggest that recent rainfall may have given a boost to prices along the Eastern seaboard. But does the underlying data for the Eastern Young Cattle Indicator (EYCI) show this to be the case and if so, is it evenly spread across the Eastern states? Is just a simple glance at the broad restocker activity all that is needed to give a robust picture of the market or is it central to beef analysis to delve a bit deeper into the figures?

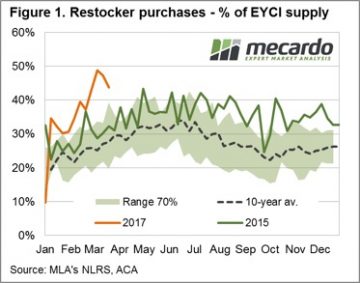

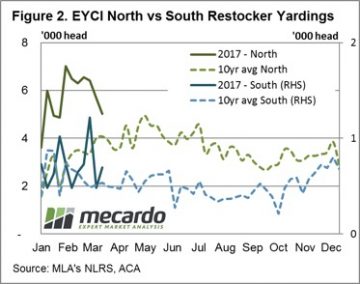

Anecdotal reports of revived restocker activity within the young cattle market suggest that recent rainfall may have given a boost to prices along the Eastern seaboard. But does the underlying data for the Eastern Young Cattle Indicator (EYCI) show this to be the case and if so, is it evenly spread across the Eastern states? Is just a simple glance at the broad restocker activity all that is needed to give a robust picture of the market or is it central to beef analysis to delve a bit deeper into the figures?  Using the underlying EYCI data we are also able to filter and analyse specific components of the broader EYCI market to determine if the robust restocker demand this season is stemming from a particular region. Separating EYCI restocker purchases into northern and southern saleyard groups, with Dubbo saleyard marking the mid-way point between North and South, we can assess how evenly distributed the restocker activity is along the East coast.

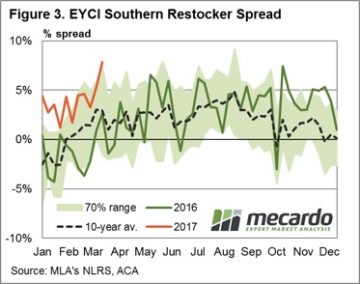

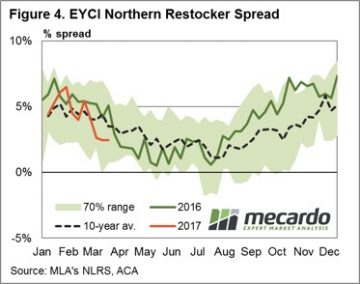

Using the underlying EYCI data we are also able to filter and analyse specific components of the broader EYCI market to determine if the robust restocker demand this season is stemming from a particular region. Separating EYCI restocker purchases into northern and southern saleyard groups, with Dubbo saleyard marking the mid-way point between North and South, we can assess how evenly distributed the restocker activity is along the East coast. Taking a look at the price spread patterns for Southern and Northern sale yards we can see that there are some stark differences between restocker activity in each region. Figure 3 shows that Southern restockers have been happy to pay a premium spread above the EYCI trending along the top of the normal seasonal range and peaking last week at 8%, equivalent to 687¢/kg cwt. In contrast, Northern restockers are paying a premium spread in the lower end of the normal range and below the seasonal average level for this time of year at 2%, equivalent to 649¢/kg cwt – figure 4.

Taking a look at the price spread patterns for Southern and Northern sale yards we can see that there are some stark differences between restocker activity in each region. Figure 3 shows that Southern restockers have been happy to pay a premium spread above the EYCI trending along the top of the normal seasonal range and peaking last week at 8%, equivalent to 687¢/kg cwt. In contrast, Northern restockers are paying a premium spread in the lower end of the normal range and below the seasonal average level for this time of year at 2%, equivalent to 649¢/kg cwt – figure 4. The above average volumes of cattle being purchased by restockers in both the North and South certainly shows the intention to rebuild the herd is evident across the Eastern seaboard. Although, considering the magnitude of destocking experienced in the North during the large turnoff during the 2013-2014 seasons the current volume of cattle going to restockers in Northern saleyards isn’t much dissimilar to levels seen last season.

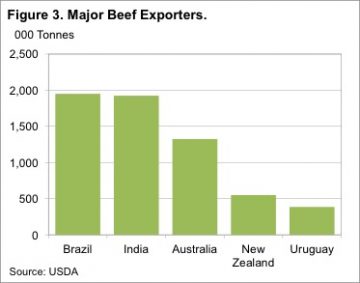

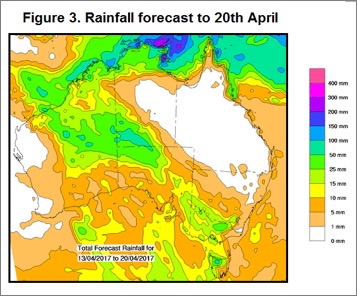

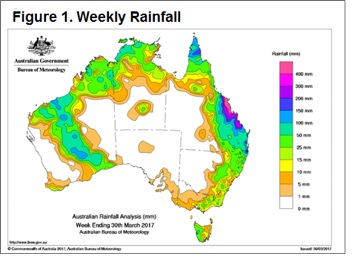

The above average volumes of cattle being purchased by restockers in both the North and South certainly shows the intention to rebuild the herd is evident across the Eastern seaboard. Although, considering the magnitude of destocking experienced in the North during the large turnoff during the 2013-2014 seasons the current volume of cattle going to restockers in Northern saleyards isn’t much dissimilar to levels seen last season. Figure 1 highlights the rainfall pattern across the nation this week with the impact of cyclone Debbie clearly evident. Rainfall further south also present and helping to lift restocker spirits in the southern regions as outlined in the

Figure 1 highlights the rainfall pattern across the nation this week with the impact of cyclone Debbie clearly evident. Rainfall further south also present and helping to lift restocker spirits in the southern regions as outlined in the  The national cattle indicators mostly higher this week with 2-4% gains recorded for all categories except heavy steers. The national heavy steer indicator dropping 3.4% on the week to close at 294¢/kg lwt. The Eastern Young Cattle Indicator (EYCI) mirroring the broader market up 4.4% on the week to close at 649.75¢/kg cwt. Young cattle prices continuing to find support from restocker buying and the added benefit of higher beef export prices, with the 90CL frozen cow up slightly – figure 3.

The national cattle indicators mostly higher this week with 2-4% gains recorded for all categories except heavy steers. The national heavy steer indicator dropping 3.4% on the week to close at 294¢/kg lwt. The Eastern Young Cattle Indicator (EYCI) mirroring the broader market up 4.4% on the week to close at 649.75¢/kg cwt. Young cattle prices continuing to find support from restocker buying and the added benefit of higher beef export prices, with the 90CL frozen cow up slightly – figure 3.

If you read agricultural news websites, or even listen to the ABC’s country hour, you will be aware of the beef ‘scandal’, which has hit Brazil this week. The reasons behind the scandal have been well documented, so we won’t repeat them here. What we will do is look at what a suspension of Brazilian imports might mean for Australian beef exports.

If you read agricultural news websites, or even listen to the ABC’s country hour, you will be aware of the beef ‘scandal’, which has hit Brazil this week. The reasons behind the scandal have been well documented, so we won’t repeat them here. What we will do is look at what a suspension of Brazilian imports might mean for Australian beef exports. In reality, Uruguay and New Zealand are not really in a position to increase exports to China. Figure 3 shows the Uruguay and New Zealand have much smaller export programs than Australia and Brazil.

In reality, Uruguay and New Zealand are not really in a position to increase exports to China. Figure 3 shows the Uruguay and New Zealand have much smaller export programs than Australia and Brazil. For a country with such a large export program, being suspended from your biggest market is going to be disastrous for beef and cattle prices. In Australia it would be similar to the US or Japan banning our beef, and we then either need to increase domestic consumption or find another market. Prices would fall very, very quickly.

For a country with such a large export program, being suspended from your biggest market is going to be disastrous for beef and cattle prices. In Australia it would be similar to the US or Japan banning our beef, and we then either need to increase domestic consumption or find another market. Prices would fall very, very quickly.

Figure 1 shows the east coast throughput tracking lower again on the week, despite a lift in Queensland yarding numbers, as the southern states start to restrict supply. The 43,900 head reported marginally softer than last week, but quite a bit lower than the same time in 2016 when just over 64,000 head were going through the east coast sale yards.

Figure 1 shows the east coast throughput tracking lower again on the week, despite a lift in Queensland yarding numbers, as the southern states start to restrict supply. The 43,900 head reported marginally softer than last week, but quite a bit lower than the same time in 2016 when just over 64,000 head were going through the east coast sale yards. Western prices softer across the board with pastoral cows mirroring the SA medium cow falls, down 25.5% to 168¢/kg, while the Western Young Cattle Indicator (WYCI) only marginally lower to 682¢/kg – a 2.3% drop on the week. The Eastern Young Cattle Indicator (EYCI) reasonably stable, with only a 0.5% decline to close at 611¢, exactly where the 90CL beef export prices managed to finish the week – figure 2.

Western prices softer across the board with pastoral cows mirroring the SA medium cow falls, down 25.5% to 168¢/kg, while the Western Young Cattle Indicator (WYCI) only marginally lower to 682¢/kg – a 2.3% drop on the week. The Eastern Young Cattle Indicator (EYCI) reasonably stable, with only a 0.5% decline to close at 611¢, exactly where the 90CL beef export prices managed to finish the week – figure 2.