Markets showed some of their traditional (northern hemisphere) spring volatility this week. Rumoured ethanol mandates in the US pushed all markets higher, before some of the sting came out of the rise thanks to increases in South American corn and soybean production forecasts.

There were rumours this week that there might be some form of ‘Executive Order’ regarding the amount of Ethanol to be produced in the US. Without boring you with the details, the market took the view that Trump was going to increase the demand for ethanol, which means more corn and oilseeds will be required in the US to make it.

There were rumours this week that there might be some form of ‘Executive Order’ regarding the amount of Ethanol to be produced in the US. Without boring you with the details, the market took the view that Trump was going to increase the demand for ethanol, which means more corn and oilseeds will be required in the US to make it.

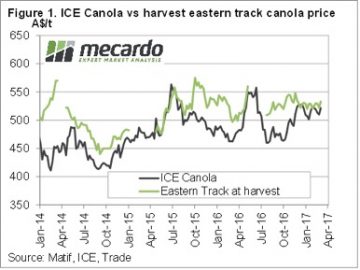

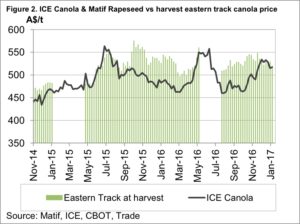

The market was looking for some news, and it jumped higher on Tuesday night. Wheat gained 14¢, Corn 10¢ and Soybeans 16¢. In Canada canola joined in, with the ICE Spot contract gaining $17 to hit a new 3 month high in Canadian terms. In our terms ICE has been bouncing between $500 and $520/t since November, with physical prices in a similar, but slightly higher range (figure 1). This week canola was close to its highest levels since November.

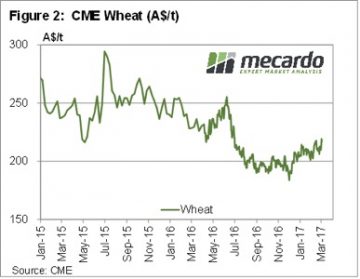

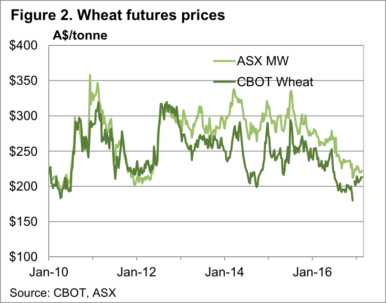

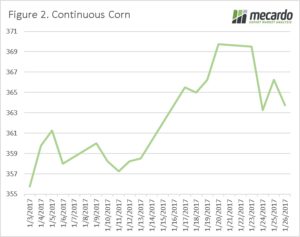

Despite the AUD sitting around 76US¢, CBOT in our terms reached a new 8 month high this week with the May contract hitting $217/t (figure 2). Dec-16 is back above $240/t and looks reasonable selling value. Especially compared to ASX Jan-18, which at $248 is showing weaker than normal basis, although we do have a big crop to carry through.

There was some export demand in markets this week, pushing wheat prices slightly higher. Plenty of APW trades went through on CLEAR at levels $10-15 higher than published bids, but prices were still only in the $210-215 Port range. This is close to parity with CBOT wheat.

The week ahead

The grim weather outlook released last week might add a bit of strength to grain prices. From now on many grower will take the view that grain in store is a good drought hedge, with prices likely to have a lift if the autumn break is late, or worst case, non-existent.

The grim weather outlook released last week might add a bit of strength to grain prices. From now on many grower will take the view that grain in store is a good drought hedge, with prices likely to have a lift if the autumn break is late, or worst case, non-existent.

The problem with this theory is that there is still a lot of grain out there, which will could flood the market at certain times. As usual the key is to watch the basis, as this is a good indication of selling opportunity.

The futures market has improved since the start of harvest, but locally that hasn’t transpired into higher prices. In this week’s comment, we look at the direction of the market since the beginning of November, and where the winners and losers have been.

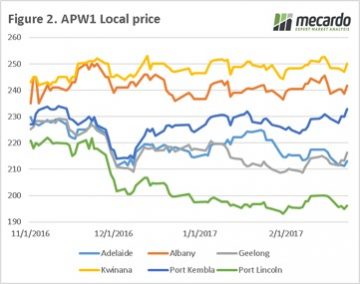

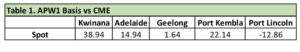

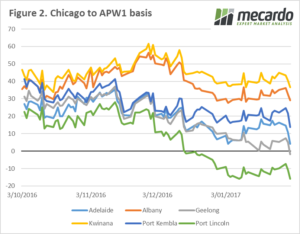

The futures market has improved since the start of harvest, but locally that hasn’t transpired into higher prices. In this week’s comment, we look at the direction of the market since the beginning of November, and where the winners and losers have been. When we look at a local level, at the physical APW1 price (figure 2), the trend across most ports has been for the market to trade in a narrow band and is currently sitting at similar levels to the start of November. The glaring exceptions are Adelaide, Port Lincoln and Geelong which are trading substantially below their start of harvest pricing levels.

When we look at a local level, at the physical APW1 price (figure 2), the trend across most ports has been for the market to trade in a narrow band and is currently sitting at similar levels to the start of November. The glaring exceptions are Adelaide, Port Lincoln and Geelong which are trading substantially below their start of harvest pricing levels. All eyes on the weather. Locally the BOM point towards it being drier than normal for the next three months, which will start to zap away some of that beneficial subsoil moisture that has been retained from the wet winter and spring.

All eyes on the weather. Locally the BOM point towards it being drier than normal for the next three months, which will start to zap away some of that beneficial subsoil moisture that has been retained from the wet winter and spring.

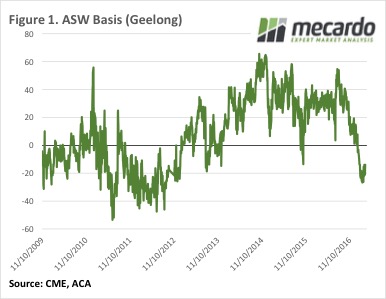

Most of the talk this week has been around ASW, especially in Victoria. With the Shipping Stems showing multiple boats are coming into Melbourne, Geelong and Portland over the coming month, looking for wheat, buyers are having to lift prices to secure supplies.

Most of the talk this week has been around ASW, especially in Victoria. With the Shipping Stems showing multiple boats are coming into Melbourne, Geelong and Portland over the coming month, looking for wheat, buyers are having to lift prices to secure supplies. Plenty of ASW has been bought on CLEAR Grain Exchange, and direct through brokers at around $200/t Port in Geelong and Portland. Port Adelaide has seen action on ASW between $190 and $200/t. In the Melbourne Port Zone ASW had been up to $205/t.

Plenty of ASW has been bought on CLEAR Grain Exchange, and direct through brokers at around $200/t Port in Geelong and Portland. Port Adelaide has seen action on ASW between $190 and $200/t. In the Melbourne Port Zone ASW had been up to $205/t.

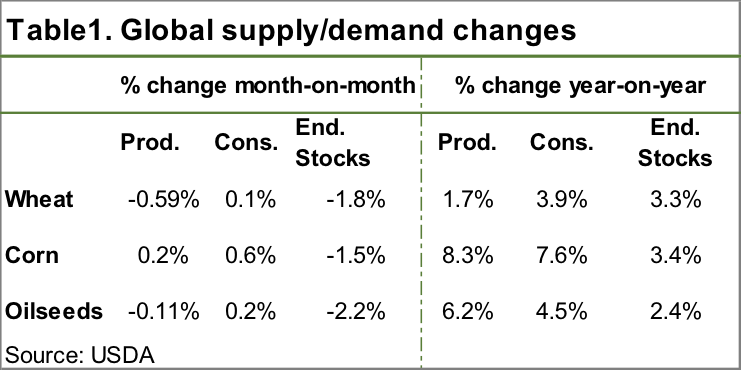

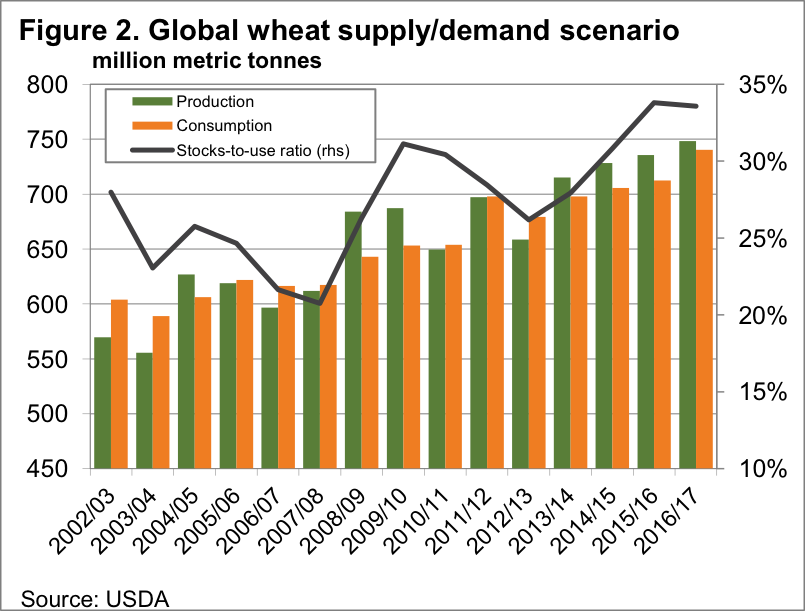

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year.

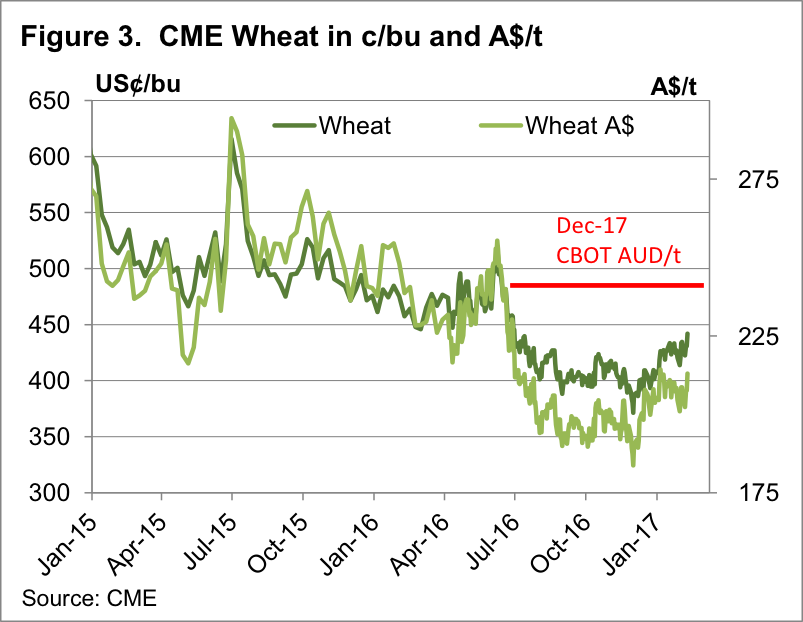

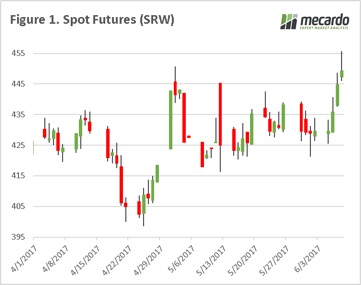

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year. In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016.

In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016. In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market.

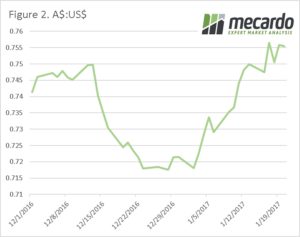

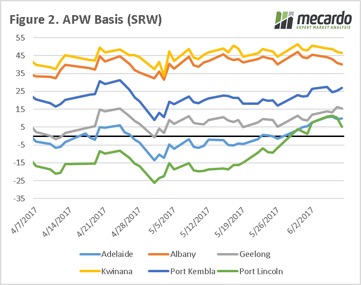

A great week for farmers on the grain markets. The speculators whom many like to chastise for being involved in the grain markets, in combination with worsening weather, have helped put a little fire under the wheat market. East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing.

East coast basis levels have conserved their gains from last week, and continue to be in positive territory across all zones which we regularly monitor (figure 2). Although basis and futures have both risen, unfortunately for growers the A$ has also risen to 75.2¢ which has reduced some of the benefits but still overall positive for pricing. The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

The USDA will release the June WASDE overnight. Will there be any surprises in this month’s report? We have seen issues in Europe, and it wouldn’t be a surprise to see some production downgrades.

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.

At a local level, we continue to see basis come under pressure. In figure 2, we can see that Geelong has now joined Port Lincoln in the negative basis club, with likely Adelaide to follow soon. The weight of harvest could likely keep basis levels depressed for sometime.

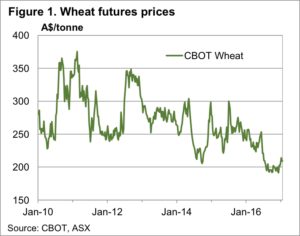

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this.

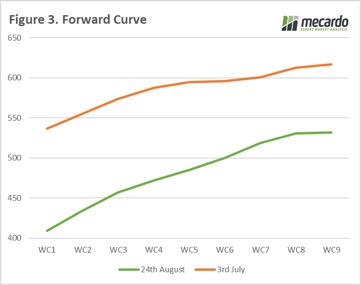

Let’s start globally, by taking a look at futures. In figure 1, I have plotted the spot futures. The market closed at a low of 402¢/bu this week, however overnight has regained some composure to close at 409¢, however ultimately is down 5¢ on the week. This is a fall of around A$2/mt which in the overall scheme of the previous weeks falls is miniscule. The market is treading water whilst we await more data, however with the northern hemisphere weather risk market close to an end the signs are not good, and growers need to make sure their strategy reflects this. In early July we recommended the use of a Dec’18 Chicago swap in our article ‘

In early July we recommended the use of a Dec’18 Chicago swap in our article ‘ The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.

The futures prices seen in July, are unlikely to be seen again this year, and we have to prepare for that.