The wool market bubbled along at the higher rates reached last week, however, AWEX reported that this week buyers reverted to a more selective approach, in contrast to the past couple of sales where faults were overlooked.

The wool market bubbled along at the higher rates reached last week, however, AWEX reported that this week buyers reverted to a more selective approach, in contrast to the past couple of sales where faults were overlooked.

Wool that exhibited good measurements & style (high tensile strength & low mid breaks) once again attracted strong bidding albeit on a limited supply.

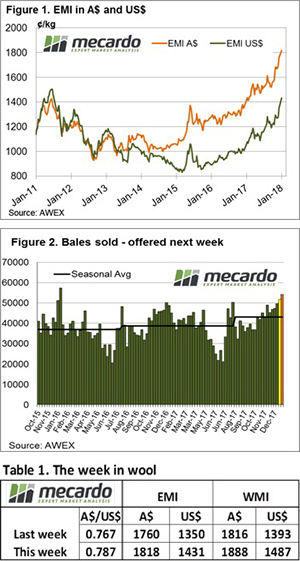

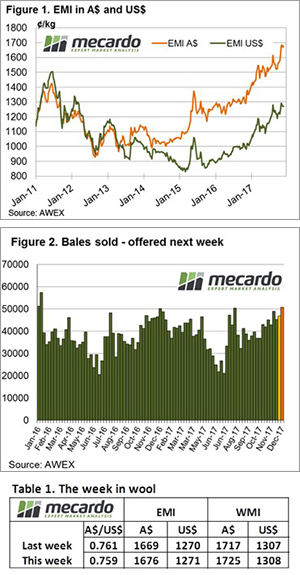

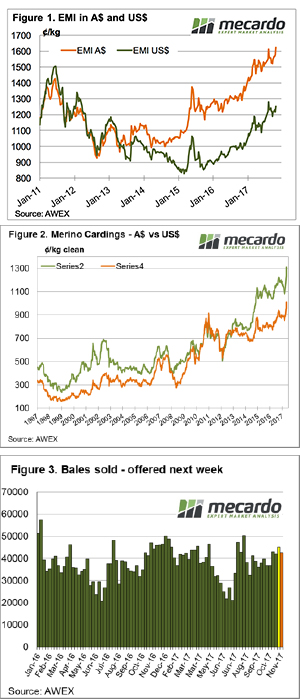

The AU$ improved another US$0.01 over the week, this weighed on the buyer bids with the EMI losing AU$0.17 cents but gaining US$0.03 for the week underpinning the strong market sentiment. W.A. fell also with the WMI giving back 28 cents, closing the week at 1860 cents.

The exception to the general across the board falls were the fine microns, with Sydney & Melbourne for example posting gains for the 17 MPG of 37 & 16 cents respectively.

An interesting note is that in Sydney at the halfway mark of day one of selling, zero fleece lots had been passed in; a recognition by sellers that these are good prices to be taken up.

The Skirtings section tracked a similar path to the fleece, although low VM lots were quoted as stronger, especially for 18.5 micron and finer. This is a continuation of the theme that has been building in recent months; with the market at very high levels the discounts for secondary types such as tender fleece and skirtings fade away. This week the selective approach by buyers returned.

The result was that again best style wool was keenly sought while faulty types were quickly discounted.

As outlined in Mecardo analysis this week, the merino pieces price follows the general story of the faulty type and is some 600 cents above the 2001 levels, while the 18 micron locks price is some 150% up on the 2001 level.

Positive news from the cotton market emerged this week, India is responding to supply concerns by reducing exports which is expected to improve the prospects of US prices. The cotton market has been rising strongly and this week is just shy of its 8-month high point.

This week Mecardo had a look at the wool production estimate on the back of the Australian Wool Production Forecasting Committee report. Sheep offtake rate continues to be supportive of an increase in sheep numbers, with flock modelling pointing to an increase in the flock size in 2018-2019, due to the high wool prices in relation to the wheat price.

However, the projected rise in sheep numbers is only a modest 2.6% next season.

The week ahead

Based on previous wool producer responses, any reduction in price levels will see the pass-in rate jump; growers have been bullish over recent times and are prepared to hold wool back in this market of “just in time” supply.

Along with strong demand, the limited supply of fresh wool combined with wool grower’s optimism the market is unlikely to retrace any time soon.

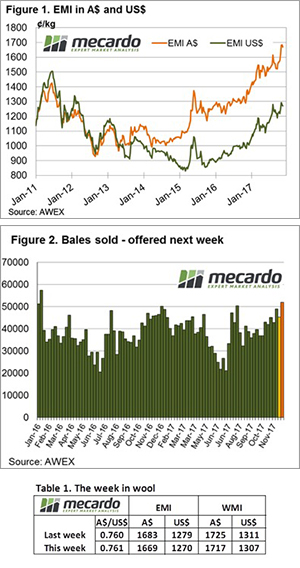

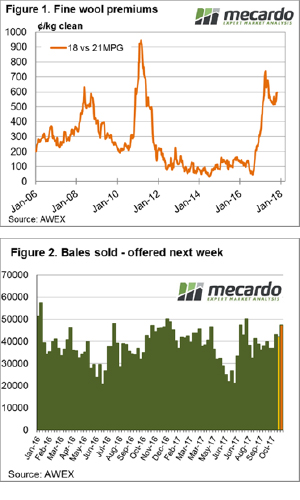

Next week 43,297 bales are rostered for sale across the three selling centres. It is of note that 50,499 bales were cleared to the trade this week.

December Merino volume was down 20% compared to 2017.

December Merino volume was down 20% compared to 2017.

The Christmas spirit continued this week in wool sales with buyers bidding strongly from the Tuesday opening, before becoming slightly more subdued on Thursday. This resulted in strong week-on-week increases across the board, with the 32 MPG in Melbourne the only one to miss out.

The Christmas spirit continued this week in wool sales with buyers bidding strongly from the Tuesday opening, before becoming slightly more subdued on Thursday. This resulted in strong week-on-week increases across the board, with the 32 MPG in Melbourne the only one to miss out.

ng prior to the Christmas recess.

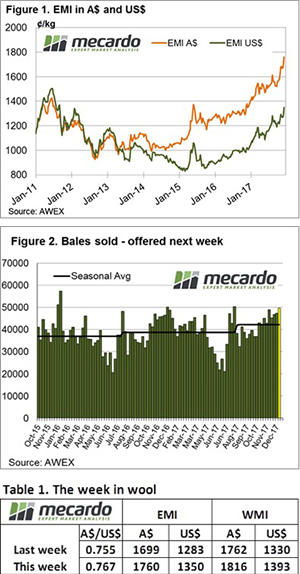

ng prior to the Christmas recess. With the Christmas recess looming the market regained some upward pressure this week as exporters tried to lock in their requirements. Fine and medium fibre prices built up gradually across the sales, while most of the crossbred market moved into negative territory.

With the Christmas recess looming the market regained some upward pressure this week as exporters tried to lock in their requirements. Fine and medium fibre prices built up gradually across the sales, while most of the crossbred market moved into negative territory.

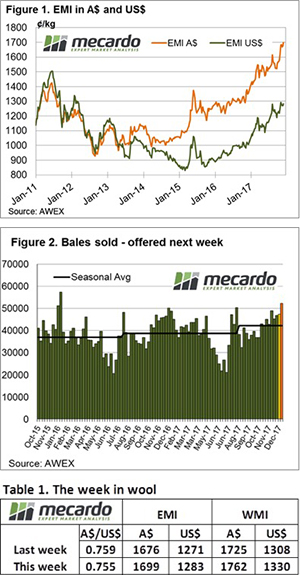

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.  AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced.

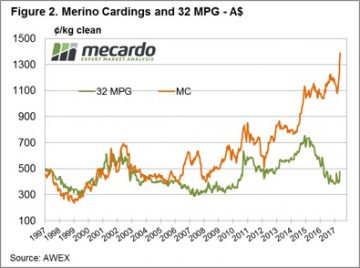

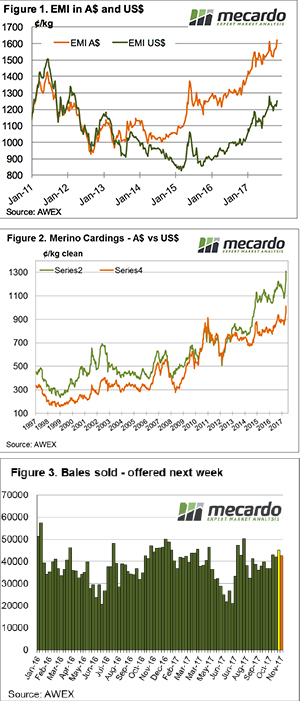

AWEX identified an interesting statistic this week; the turnover of wool sold this week of $96 million was the largest since 2002. The kicker is that while this week it was generated by the sale of 49,000 bales, in 2002 it was on the back of an offering of 74,500 bales. So, a similar $ value heading back to rural Australia but 33% less bales produced. Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week.

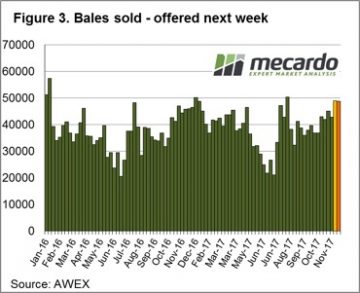

Crossbred wool fell sharply losing as much as 50 cents reflecting the volatile nature of this sector. In contrast, Cardings continue to improve and set new records with all centres showing strong lifts across the week. The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week.

The big offering this week is to be followed by another 48,700 bales rostered for sale next week across the three selling centres (Figure 3). The roster then lists 44,000 for the following two weeks. Of note is the strong report from Fremantle this week, generally a solid market on Thursday in W.A. with the 3-hour time delay to the East Coast is a good lead for next week. What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks.

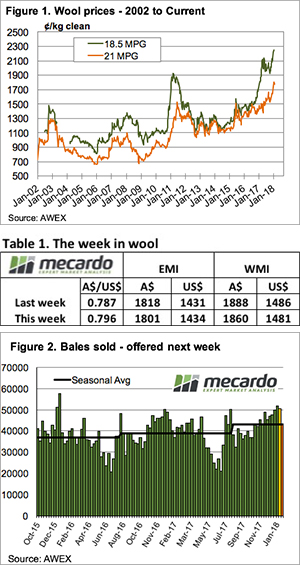

What a week, Rekindling wins the Melbourne Cup while the wool market catches fire! If we thought last week was good when the EMI jumped 45 cents, this week the increase was 58 cents – more than a 6% increase in 2 weeks. With one of the larger offerings for this year the market performed very strongly this week. Every category posted gains. Records were set with the 19.5 MPG posting its highest level since its 2001 listing, and cardings topping 1300 cents in Melbourne, a record against our records going back to 2002.

With one of the larger offerings for this year the market performed very strongly this week. Every category posted gains. Records were set with the 19.5 MPG posting its highest level since its 2001 listing, and cardings topping 1300 cents in Melbourne, a record against our records going back to 2002. We’ve ticked over the billion-dollar milestone for total value of wool sold this year which is something of an achievement. At this point in the season last year the value was 26% lower than it is today despite the cumulative bales sold being just 10% lower. The wool market hasn’t reached this mark by week 17 since 2002.

We’ve ticked over the billion-dollar milestone for total value of wool sold this year which is something of an achievement. At this point in the season last year the value was 26% lower than it is today despite the cumulative bales sold being just 10% lower. The wool market hasn’t reached this mark by week 17 since 2002.